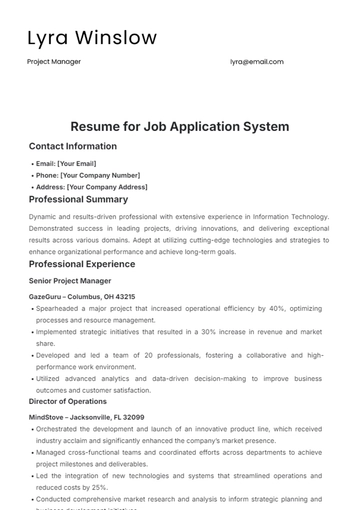

Free Accounting ATS Resume

Phone Number: [YOUR PHONE NUMBER]

Address: [YOUR ADDRESS]

LinkedIn: https://www.linkedin.com/in/your_own_profile

I. Professional Summary

Dedicated and detail-oriented accounting professional with over [X] years of experience in financial analysis, tax preparation, and auditing. Proven track record of improving financial processes, ensuring compliance, and providing accurate financial reporting. Skilled in using accounting software such as QuickBooks, SAP, and Excel.

II. Education

Bachelor of Science in Accounting

[UNIVERSITY NAME], [UNIVERSITY ADDRESS]

Graduated: [YEAR]

Relevant Coursework:

Financial Accounting: Studied financial accounting, including financial statements, transaction analysis, and GAAP compliance.

Managerial Accounting: Investigated cost behavior and budgeting for managerial decisions, emphasizing cost analysis and performance evaluation.

Auditing: Reviewed auditing standards and procedures, focusing on risk assessment, internal controls, and reporting.

Taxation: Examined tax laws and regulations for individuals and businesses, focusing on planning, compliance, and ethics.

III. Professional Experience

Senior Accountant

[START DATE] – [END DATE]

Ensured GAAP compliance for all financial statements.

Conducted financial analysis and provided strategic insights.

Supervised a team of junior accountants, providing training and mentorship.

Filed federal and state tax returns in compliance with regulations.

Automated accounts payable and receivable, cutting processing time by 30%.

Accountant

[START DATE] – [END DATE]

Performed general ledger accounting, reconciliations, and variance analysis.

Assisted in the preparation of the annual budget and monthly forecasts.

Supported external audits and prepared audit schedules and documentation.

Processed payroll and accurate tax withholdings for 200 employees.

Enhanced financial report accuracy with new accounting procedures.

IV. Qualifications

Proficient in analyzing financial statements and reports to assess financial performance, identify trends, and provide strategic recommendations.

Experienced in preparing federal and state tax returns for individuals and businesses, ensuring compliance with relevant tax laws and regulations.

Skilled in conducting audits, including risk assessment, testing internal controls, and preparing audit findings and recommendations.

Proven ability to develop and manage budgets, forecast financial performance and monitor variances to achieve financial goals.

Proficient in using accounting software such as QuickBooks, SAP, and Microsoft Excel to streamline financial processes and enhance reporting accuracy.

Knowledgeable about GAAP and regulatory requirements, with a strong focus on maintaining compliance and integrity in financial reporting.

V. Skills

Financial Analysis

Tax Preparation

Auditing

Budgeting and Forecasting

Accounts Payable/Receivable

Financial Reporting

General Ledger Accounting

QuickBooks, SAP, Excel

VI. Achievements

Implemented Process Improvements: Streamlined accounts payable and receivable processes, reducing processing time by 30%.

Financial Reporting Accuracy: Improved the accuracy of monthly financial reports by implementing new accounting procedures and reconciliation techniques.

Cost Savings: Identified and implemented cost-saving measures, resulting in annual savings of $50,000 in operational expenses.

Recognition: Awarded "Employee of the Year" for outstanding performance and dedication in maintaining high standards of financial integrity and compliance.

VII. Certifications

Certified Public Accountant (CPA)

Certified Management Accountant (CMA)

QuickBooks Certified User

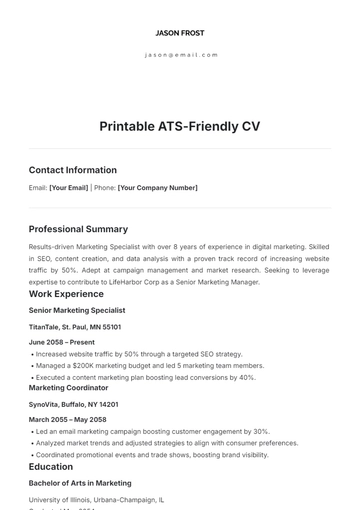

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Crafted exclusively for accountants, our Accounting ATS Resume template from Template.net offers a seamless blend of professionalism and innovation. With its editable and customizable features, tailored specifically for the accounting field, you can effortlessly showcase your expertise and achievements. Editable in our AI Tool, it ensures precision and efficiency in your job hunt.