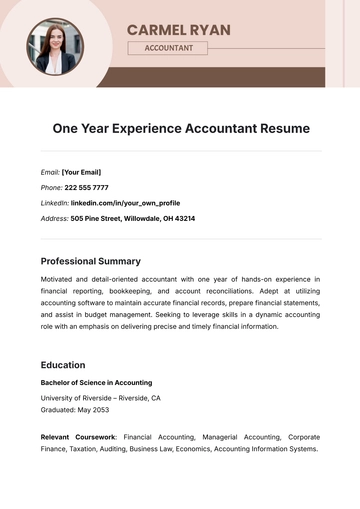

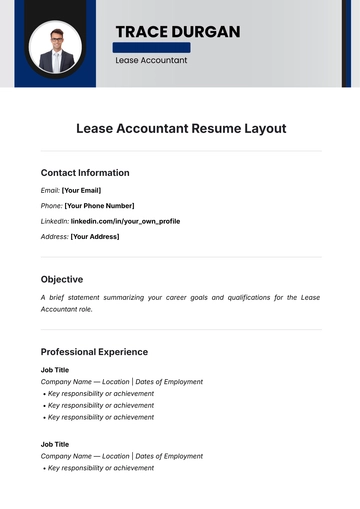

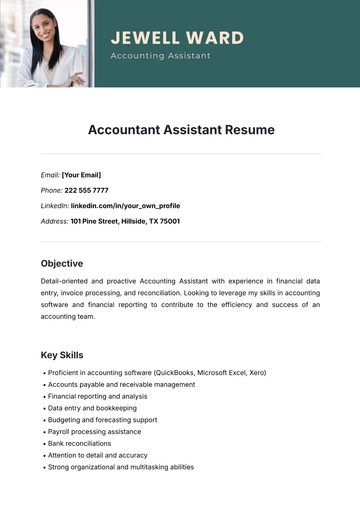

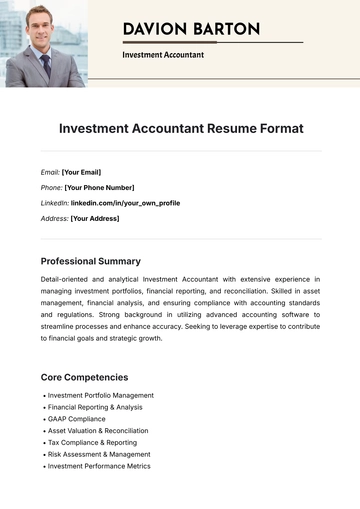

ATS Bold Accounting Resume

_____________________________________________________________________________________

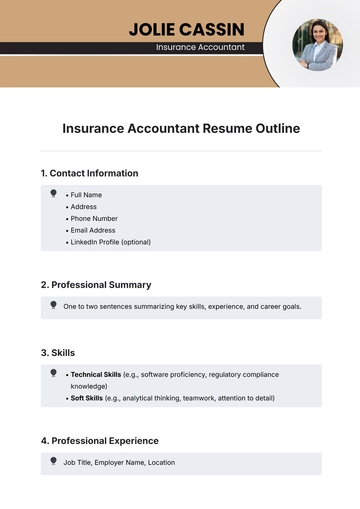

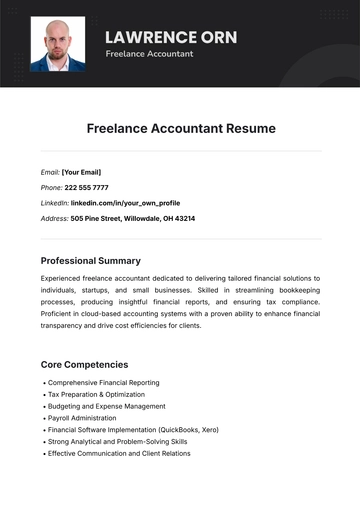

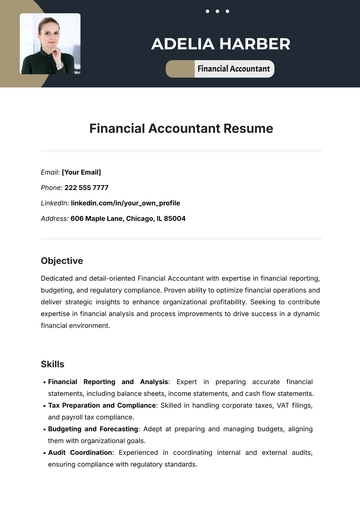

Phone Number: [YOUR PHONE NUMBER]

Address: [YOUR ADDRESS]

LinkedIn: https://www.linkedin.com/in/your_own_profile

_____________________________________________________________________________________

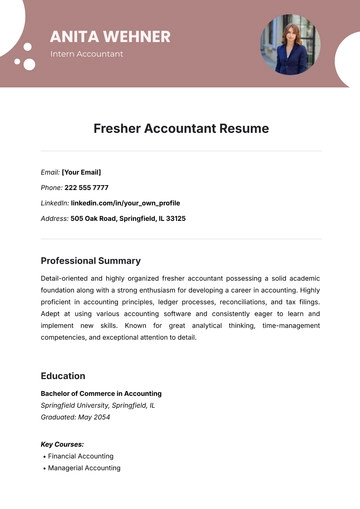

I. Professional Summary

With [X] years of experience, I am a committed accountant adept in financial reporting, budget preparation, and auditing, possessing strong analytical skills that ensure precise financial data and proficiency in multiple accounting software, enhancing process efficiency for dependable decision-making.

II. Education

Bachelor of Science in Accounting

[UNIVERSITY NAME], [UNIVERSITY ADDRESS]

Graduated: [YEAR]

Relevant coursework:

III. Professional Experience

Senior Accountant

[START DATE] – [END DATE]

Prepared monthly, quarterly, and annual financial statements and reports, reducing reporting errors by 20%.

Staff Accountant

[START DATE] – [END DATE]

IV. Qualifications

V. Skills

VI. Achievements

VII. Certifications

_____________________________________________________________________________________

Resume Templates @ Template.net