I. Executive Summary

A. Overview

This Architecture Financial Strategy outlines the comprehensive financial planning and management approach for [Your Company Name], aimed at ensuring the company's financial health and long-term sustainability. The strategy encompasses detailed budgeting, cost management, investment planning, and risk management techniques tailored to the unique needs of our organization. By implementing this strategy, [Your Company Name] will be able to align its financial practices with overarching business objectives, paving the way for continuous growth and profitability.

B. Objectives

Maximize Profitability: Enhance revenue streams while minimizing costs through strategic initiatives and operational efficiencies. This objective focuses on identifying and exploiting high-margin opportunities and streamlining processes to eliminate waste.

Ensure Financial Stability: Maintain healthy cash flow and reserves to safeguard against market volatility and unforeseen expenses. This involves meticulous planning, consistent monitoring, and proactive management of financial resources.

Support Strategic Growth: Allocate resources to high-potential projects and initiatives that align with the company’s long-term vision. This includes investing in innovative technologies, expanding market presence, and fostering partnerships that drive growth.

C. Key Financial Metrics

Revenue Growth: Target annual growth of [10%], reflecting a robust strategy to increase sales and market share.

Net Profit Margin: Maintain a net profit margin of [15%] to ensure that the company remains profitable after all expenses are accounted for.

Return on Investment (ROI): Achieve an ROI of [20%], indicating efficient utilization of capital in generating profits.

II. Financial Planning

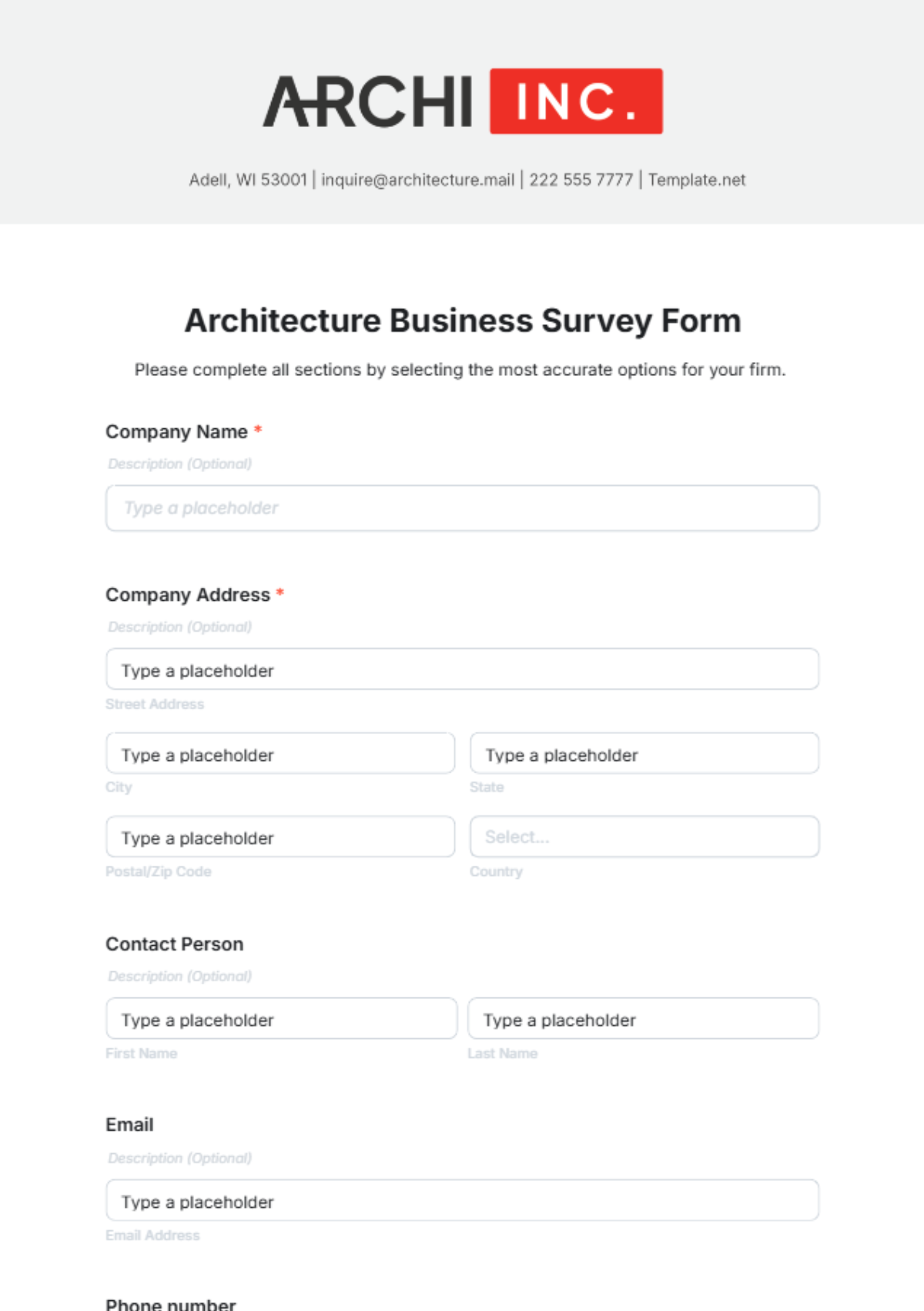

A. Budgeting

Annual Budget: Develop an annual budget that forecasts revenues, expenses, and cash flows. This budget serves as a financial roadmap for the year, guiding spending decisions and helping to align financial resources with strategic priorities.

Revenue Forecasting: Estimate sales based on market trends, historical data, and predictive analytics to create a realistic revenue outlook.

Expense Planning: Itemize fixed and variable costs, including operational and capital expenditures, to manage spending effectively.

Cash Flow Projections: Ensure sufficient liquidity to cover operational needs and investment opportunities by forecasting cash inflows and outflows.

B. Cost Management

Cost Reduction Strategies: Implement initiatives to reduce overhead costs without compromising quality. This includes adopting cost-saving technologies and renegotiating supplier contracts.

Operational Efficiency: Streamline processes to reduce waste and improve productivity, leveraging lean management principles and automation.

Vendor Negotiations: Secure favorable terms with suppliers to lower procurement costs, focusing on long-term partnerships that offer mutual benefits.

Cost Allocation: Accurately assign costs to departments and projects to better understand profitability and improve financial decision-making.

C. Investment Planning

Capital Investments: Identify and evaluate potential investments in technology, infrastructure, and other assets to support growth.

ROI Analysis: Calculate expected returns on proposed investments to prioritize those that offer the highest benefits.

Risk Assessment: Assess potential risks associated with investments and develop strategies to mitigate them, ensuring informed decision-making.

Research and Development (R&D): Allocate funds to R&D to foster innovation and maintain a competitive edge. This includes developing new products, enhancing existing offerings, and exploring emerging technologies.

III. Financial Management

A. Revenue Management

Sales Strategy: Develop and implement strategies to drive sales growth, focusing on market expansion, customer acquisition, and retention.

Market Expansion: Enter new markets and expand product offerings to diversify revenue streams and mitigate risk.

Pricing Strategy: Optimize pricing to balance competitiveness and profitability, using data-driven insights to set prices that attract customers while maximizing margins.

Revenue Streams: Diversify revenue streams to reduce dependency on a single source and enhance financial resilience.

Subscription Services: Introduce subscription-based models to ensure recurring revenue, providing a stable income stream.

Partnerships: Form strategic partnerships to enhance revenue opportunities, leveraging synergies with complementary businesses.

B. Expense Control

Monitoring and Reporting: Regularly review and report on financial performance against budget to identify deviations and take corrective actions.

Variance Analysis: Identify and explain variances between actual and budgeted figures, using insights to improve future planning.

Cost Centers: Establish cost centers for better tracking and management of expenses, ensuring accountability and transparency.

Operational Audits: Conduct periodic audits to identify inefficiencies and areas for improvement, fostering a culture of continuous improvement.

C. Financial Risk Management

Risk Identification: Identify financial risks, including market volatility, credit risk, and operational risks, to proactively manage potential threats.

Mitigation Strategies: Develop and implement strategies to mitigate identified risks, ensuring the company is prepared for adverse scenarios.

Insurance: Secure appropriate insurance coverage to protect against significant losses, providing a safety net for unforeseen events.

Hedging: Use financial instruments to hedge against currency and interest rate fluctuations, stabilizing financial performance.

IV. Funding and Capital Structure

A. Capital Raising

Equity Financing: Raise capital through the issuance of shares to fund growth initiatives and strengthen the balance sheet.

Investor Relations: Maintain strong relationships with existing and potential investors, providing regular updates and transparency.

Valuation: Conduct regular valuations to ensure accurate pricing of shares, reflecting the true value of the company.

Debt Financing: Secure loans or other forms of debt to finance growth, balancing the need for capital with the cost of borrowing.

Interest Rates: Negotiate favorable interest rates to minimize borrowing costs and enhance profitability.

Debt-to-Equity Ratio: Maintain an optimal debt-to-equity ratio to balance leverage and equity, ensuring financial stability.

B. Capital Allocation

Resource Allocation: Allocate financial resources to projects and departments based on strategic priorities, ensuring optimal use of capital.

Project Prioritization: Prioritize projects with the highest potential ROI, focusing on those that align with the company’s long-term goals.

Budget Adjustments: Adjust budgets as necessary to reflect changing priorities and market conditions, maintaining flexibility in financial planning.

C. Dividend Policy

Dividend Distribution: Establish a clear dividend policy that balances reinvestment in the business with shareholder returns, fostering investor confidence.

Payout Ratio: Determine an appropriate payout ratio based on profitability and cash flow, ensuring sustainable distributions.

Reinvestment: Allocate retained earnings to fund growth initiatives and strengthen the balance sheet, supporting long-term success.

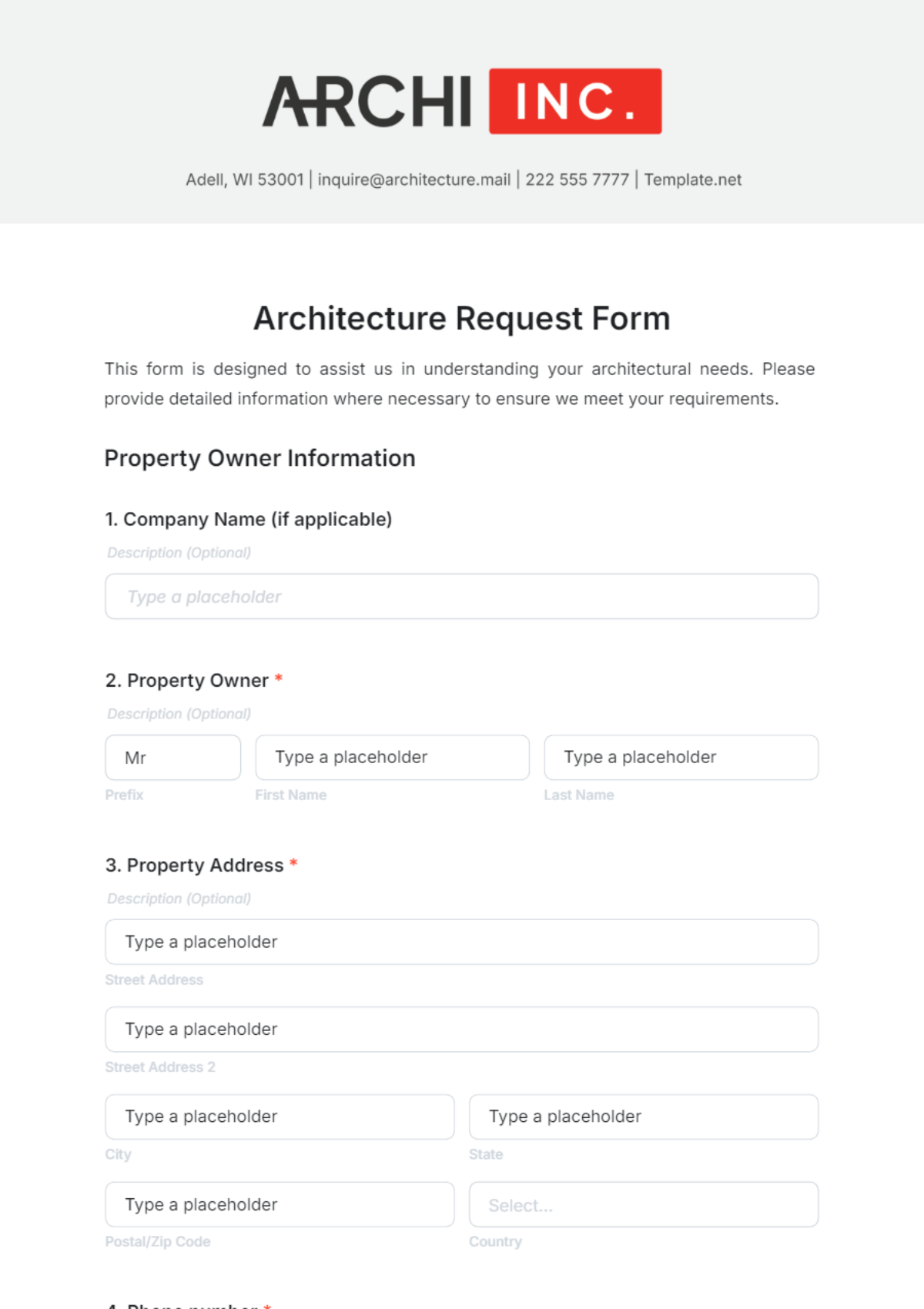

V. Financial Reporting and Compliance

A. Financial Reporting

Financial Statements: Prepare accurate and timely financial statements, including income statements, balance sheets, and cash flow statements, to provide a clear picture of the company's financial health.

Transparency: Ensure transparency in financial reporting to maintain stakeholder trust and comply with regulatory requirements.

Disclosure: Fully disclose financial performance and material events to stakeholders, fostering an environment of openness and accountability.

Accuracy: Implement rigorous controls to ensure the accuracy of financial data, reducing the risk of errors and misstatements.

B. Regulatory Compliance

Regulatory Requirements: Stay abreast of and comply with all relevant financial regulations, minimizing the risk of legal issues and penalties.

Internal Controls: Develop and maintain strong internal controls to ensure compliance, safeguarding the company’s assets and reputation.

Audits: Conduct regular internal and external audits to verify compliance and identify areas for improvement, ensuring adherence to best practices.

C. Governance

Board Oversight: Ensure effective oversight by the board of directors over financial matters, providing strategic guidance and accountability.

Audit Committee: Establish an audit committee to oversee financial reporting and compliance, enhancing governance and transparency.

Ethical Standards: Promote a culture of ethics and integrity in financial practices, ensuring that all employees adhere to high ethical standards.

VI. Performance Evaluation

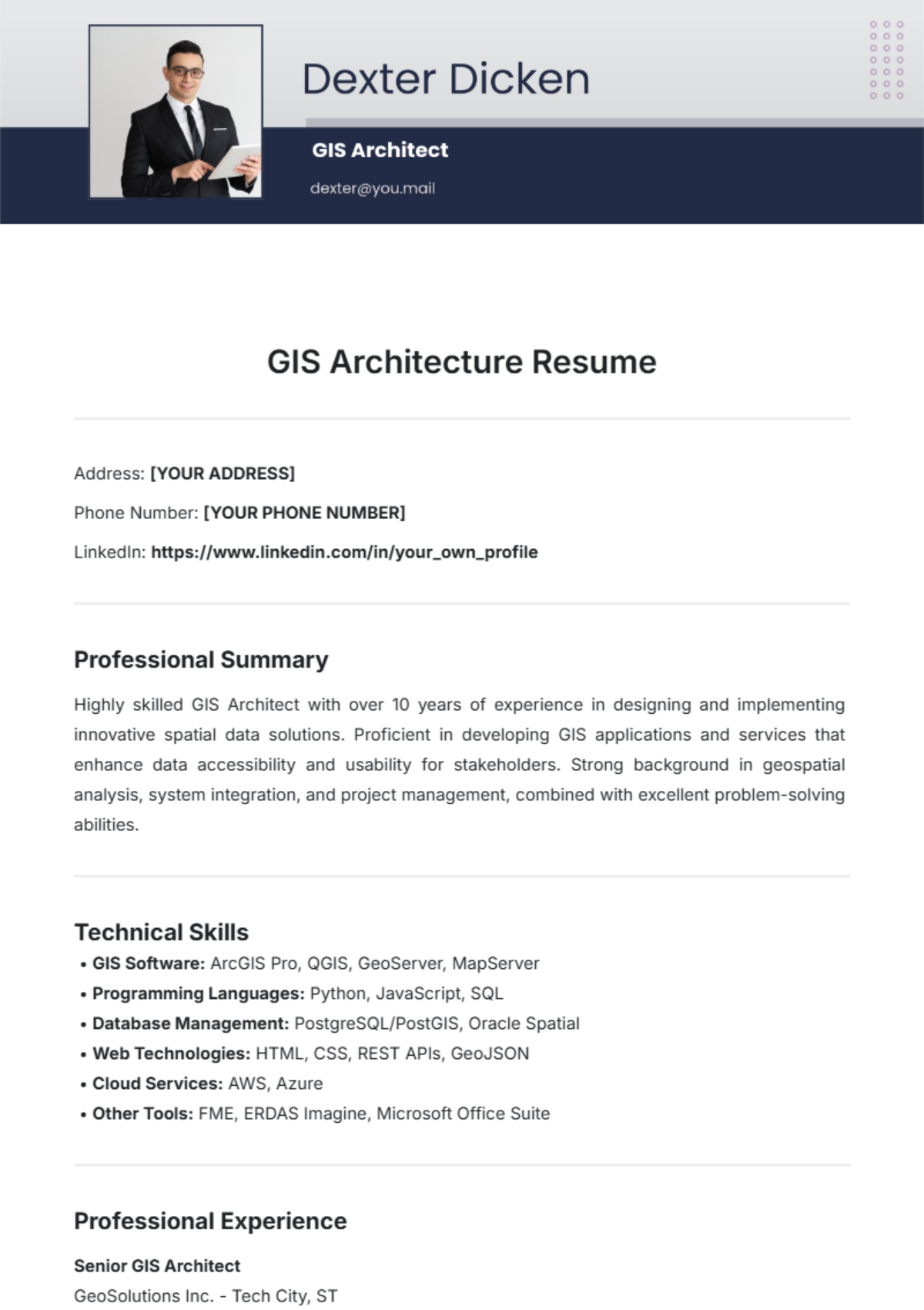

A. Key Performance Indicators (KPIs)

Financial KPIs: Track key financial metrics to evaluate performance and identify areas for improvement.

Gross Profit Margin: Aim for a gross profit margin of [40%], reflecting efficient management of production costs.

Operating Margin: Maintain an operating margin of [20%], indicating the company’s ability to manage operating expenses effectively.

Current Ratio: Ensure a current ratio of [2:1] to indicate good short-term financial health, providing a buffer against liquidity risks.

B. Benchmarking

Industry Benchmarks: Compare financial performance against industry benchmarks to identify areas for improvement and best practices.

Competitor Analysis: Analyze competitors' financials to identify strengths and weaknesses, using insights to enhance competitive positioning.

Market Trends: Monitor market trends to anticipate changes and adapt strategies accordingly, ensuring the company remains agile and responsive.

C. Continuous Improvement

Feedback Mechanisms: Implement feedback mechanisms to gather input from stakeholders and identify areas for improvement, fostering a culture of continuous improvement.

Stakeholder Surveys: Conduct surveys to gauge stakeholder satisfaction and identify concerns, using feedback to drive enhancements.

Performance Reviews: Regularly review financial performance and make adjustments as necessary, ensuring the company remains on track to achieve its goals.

VII. Conclusion

This comprehensive Architecture Financial Strategy serves as a blueprint for [Your Company Name] to achieve financial excellence. By adhering to the outlined strategies and continuously monitoring performance, [Your Company Name] can ensure sustained growth, stability, and profitability in the [Tech Industry]. The strategy emphasizes rigorous planning, proactive management, and continuous improvement, positioning the company to navigate financial challenges and capitalize on opportunities in a dynamic market environment.

VIII. Appendices

A. Financial Statements

Sample Income Statement: Provides a detailed breakdown of revenues, costs, and expenses, highlighting profitability over a specific period.

Sample Balance Sheet: Shows the company’s assets, liabilities, and equity at a specific point in time, providing a snapshot of financial health.

Sample Cash Flow Statement: Details cash inflows and outflows from operating, investing, and financing activities, illustrating liquidity and cash management.

B. Glossary of Terms

Revenue: Income generated from normal business operations, such as sales of goods and services.

Net Profit Margin: Percentage of revenue remaining after all expenses, taxes, and costs have been deducted, indicating overall profitability.

Return on Investment (ROI): Measure of the profitability of an investment relative to its cost, used to evaluate the efficiency of investment decisions.

C. References

Financial Reporting Standards: Refer to the latest guidelines and standards, such as those issued by the Financial Accounting Standards Board (FASB) or International Financial Reporting Standards (IFRS).

Regulatory Bodies: List of relevant regulatory bodies and their requirements, including the Securities and Exchange Commission (SEC) and other industry-specific regulators.

Tables and Charts

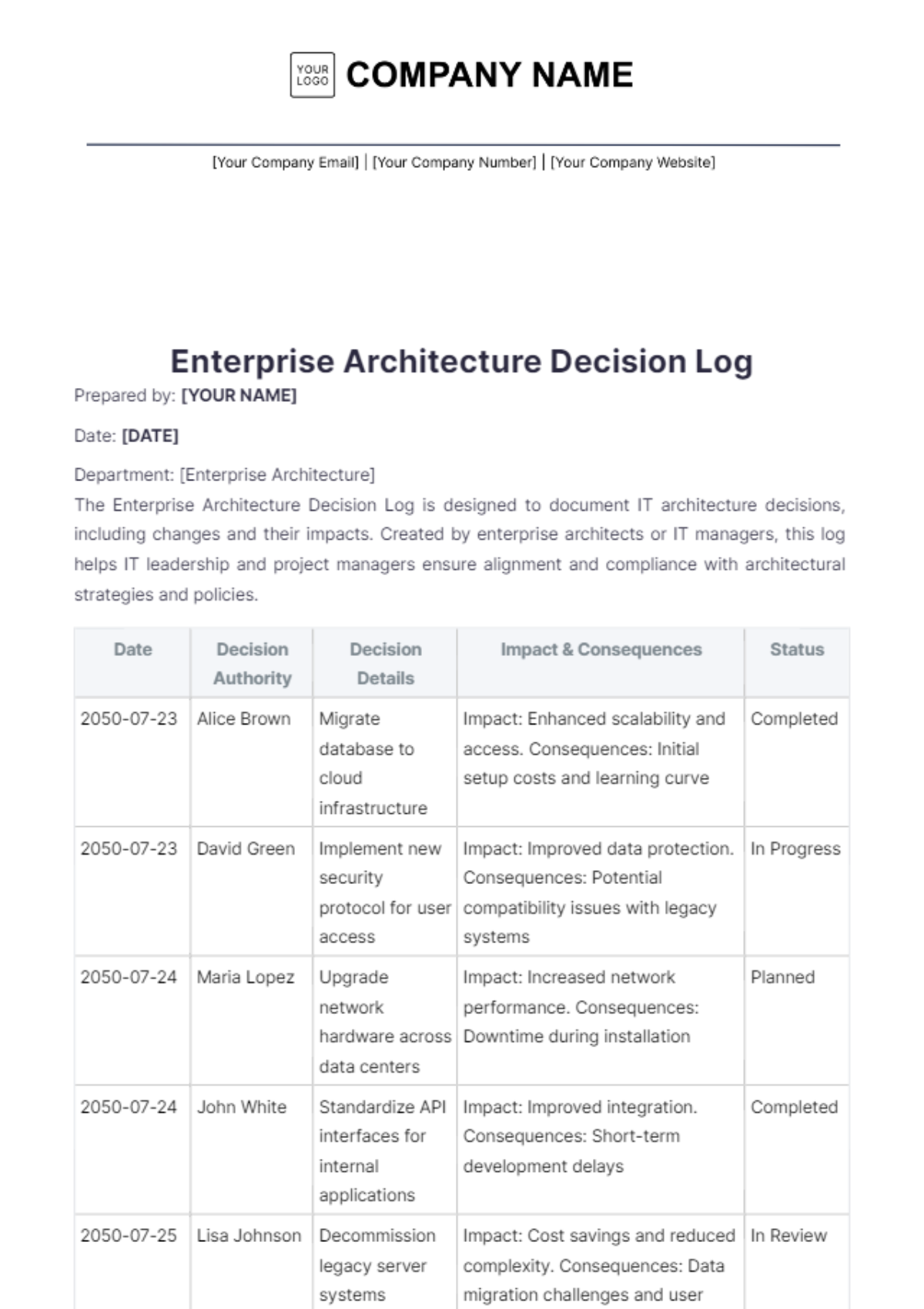

Table 1: Annual Budget Overview

Category | Amount [$] |

|---|---|

Revenue | [0,000,000] |

Fixed Costs | [0,000,000] |

Variable Costs | [0,000,000] |

Capital Expenditures | [0,000,000] |

Net Profit | [0,000,000] |

Table 2: KPI Benchmarks

KPI | Target | Current |

|---|---|---|

Revenue Growth | 10% | [0%] |

Net Profit Margin | 15% | [0%] |

ROI | 20% | [0%] |

Gross Profit Margin | 40% | [0%] |

Operating Margin | 20% | [0%] |

Current Ratio | 2:1 | [0:0] |