Free Architecture Financial Evaluation Template

Architecture Financial Evaluation

[YOUR COMPANY NAME]

Date: [Date]

Introduction

This evaluation document is designed to provide a structured assessment of the financial aspects of architectural projects within [Your Company Name]. Its primary aim is to ensure financial stability and feasibility across all projects by systematically analyzing various financial criteria.

Overview

The evaluation covers multiple financial criteria to provide a comprehensive financial analysis of our architectural projects. Each criterion is rated on a standardized scale to assist in decision-making and to identify areas for improvement. This process is crucial for maintaining financial discipline and enhancing the profitability and sustainability of our projects.

Evaluation Criteria

Cost Estimation Accuracy: Evaluates the precision of cost estimations compared to actual costs. This criterion checks the accuracy of initial project cost forecasts against actual expenses incurred.

Budget Allocation: Assesses the appropriateness of budget distribution across various project components. It examines whether funds are allocated efficiently and effectively to meet project needs without overspending.

Financial Viability: Measures the overall financial soundness and profitability of the project. This involves analyzing the project’s potential to generate financial benefits relative to its costs.

Return on Investment (ROI): Calculates the expected financial returns versus the investment made. This ratio is crucial for assessing the economic success of a project.

Expense Management: Checks how well the project manages its expenses and adheres to the budget. Effective expense management is key to avoiding cost overruns and maintaining profitability.

Funding and Cash Flow: Assesses the stability and sufficiency of funding and cash flow through the project's lifecycle. It ensures there are adequate funds available at all times to support project activities.

Risk Management: Evaluates the effectiveness of identifying and mitigating financial risks. This includes the ability to foresee financial uncertainties and implement strategies to mitigate their impact.

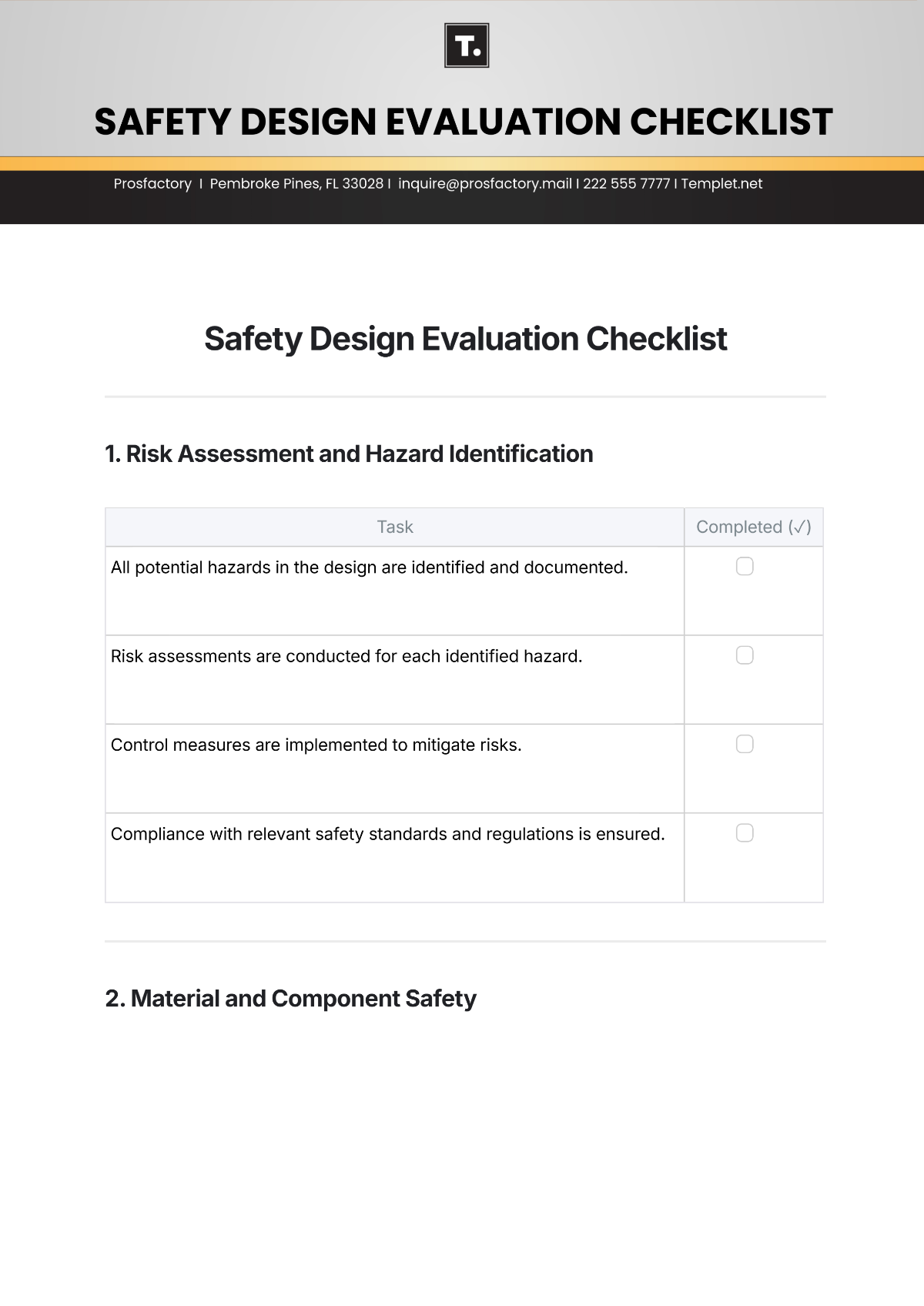

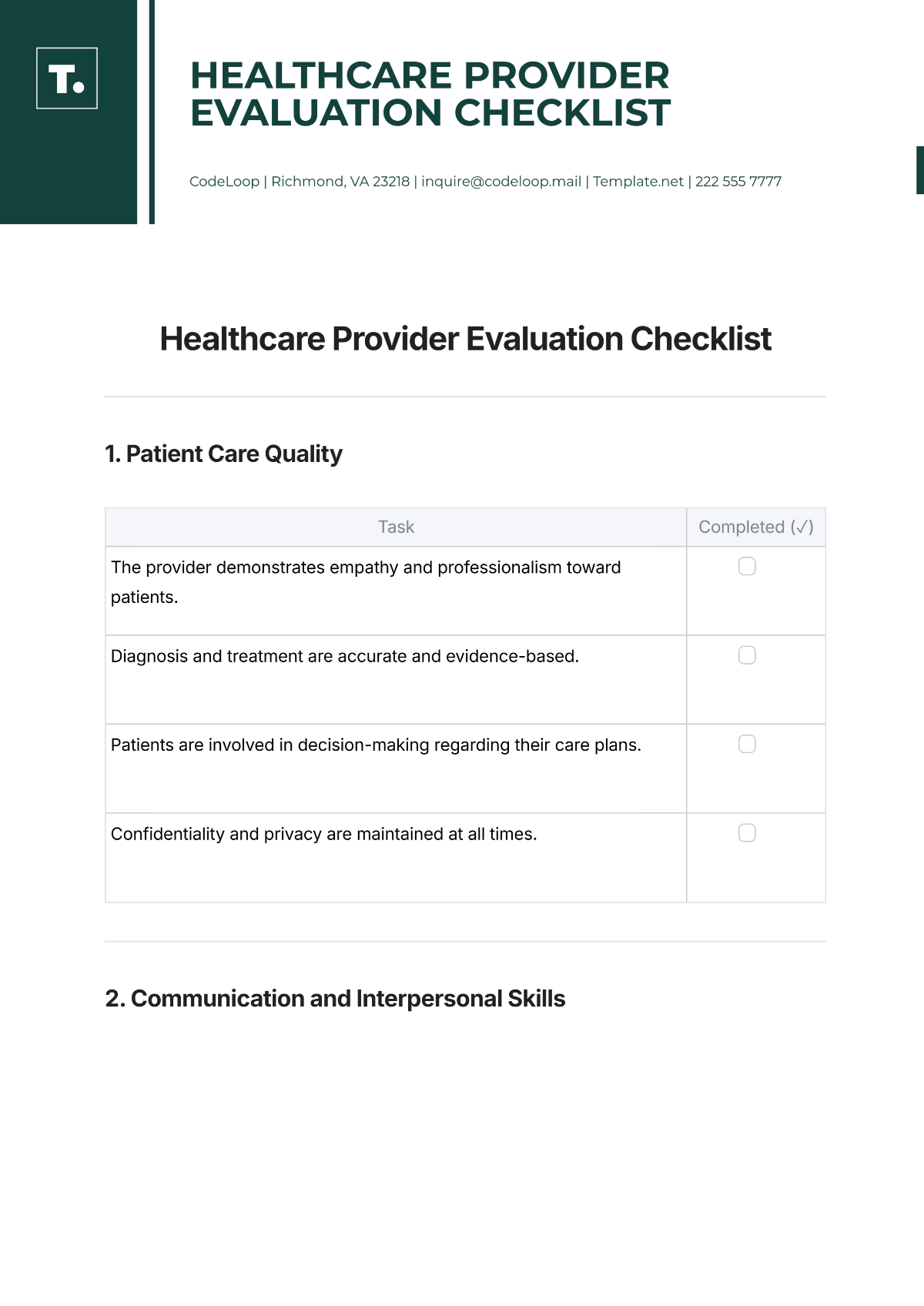

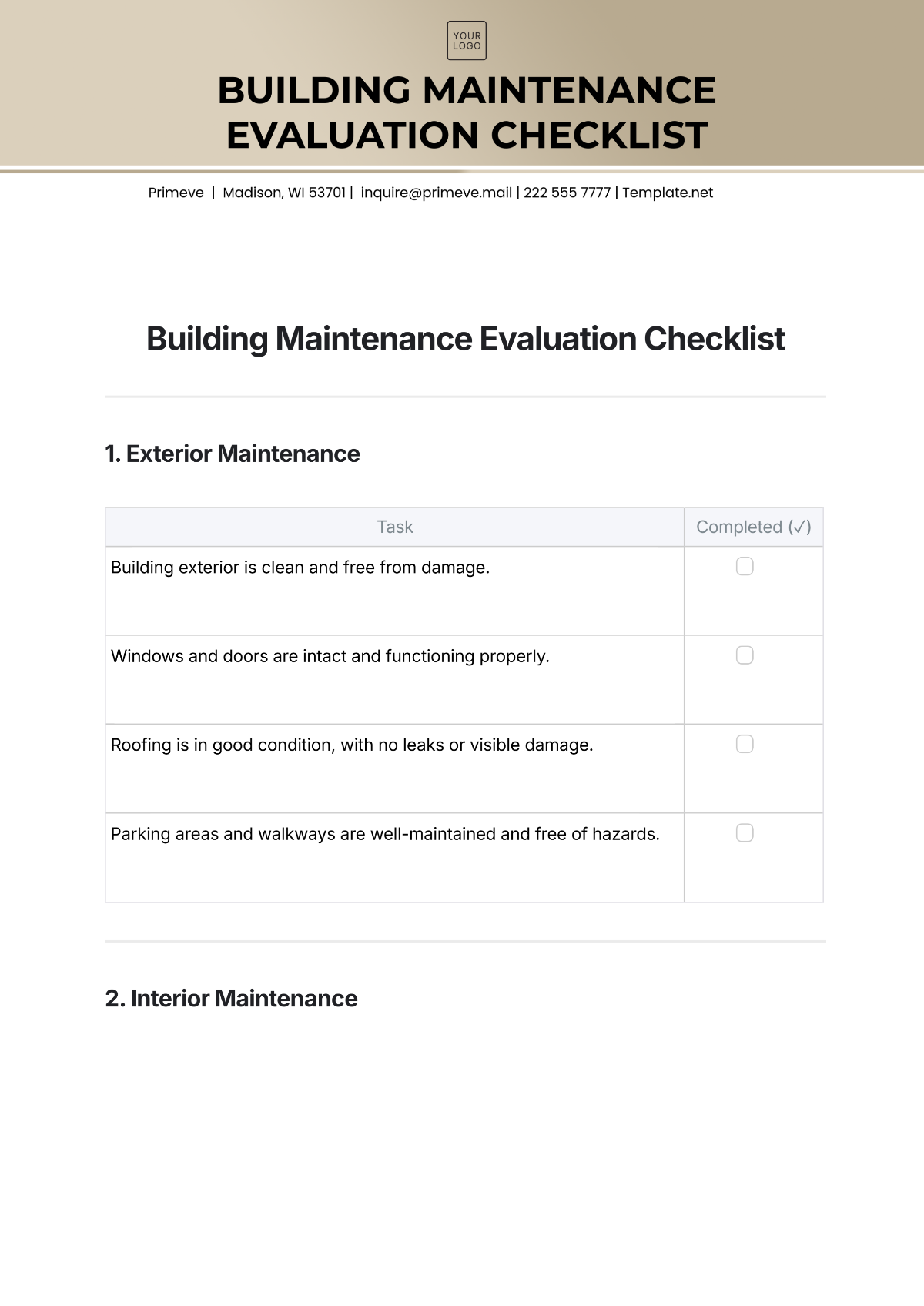

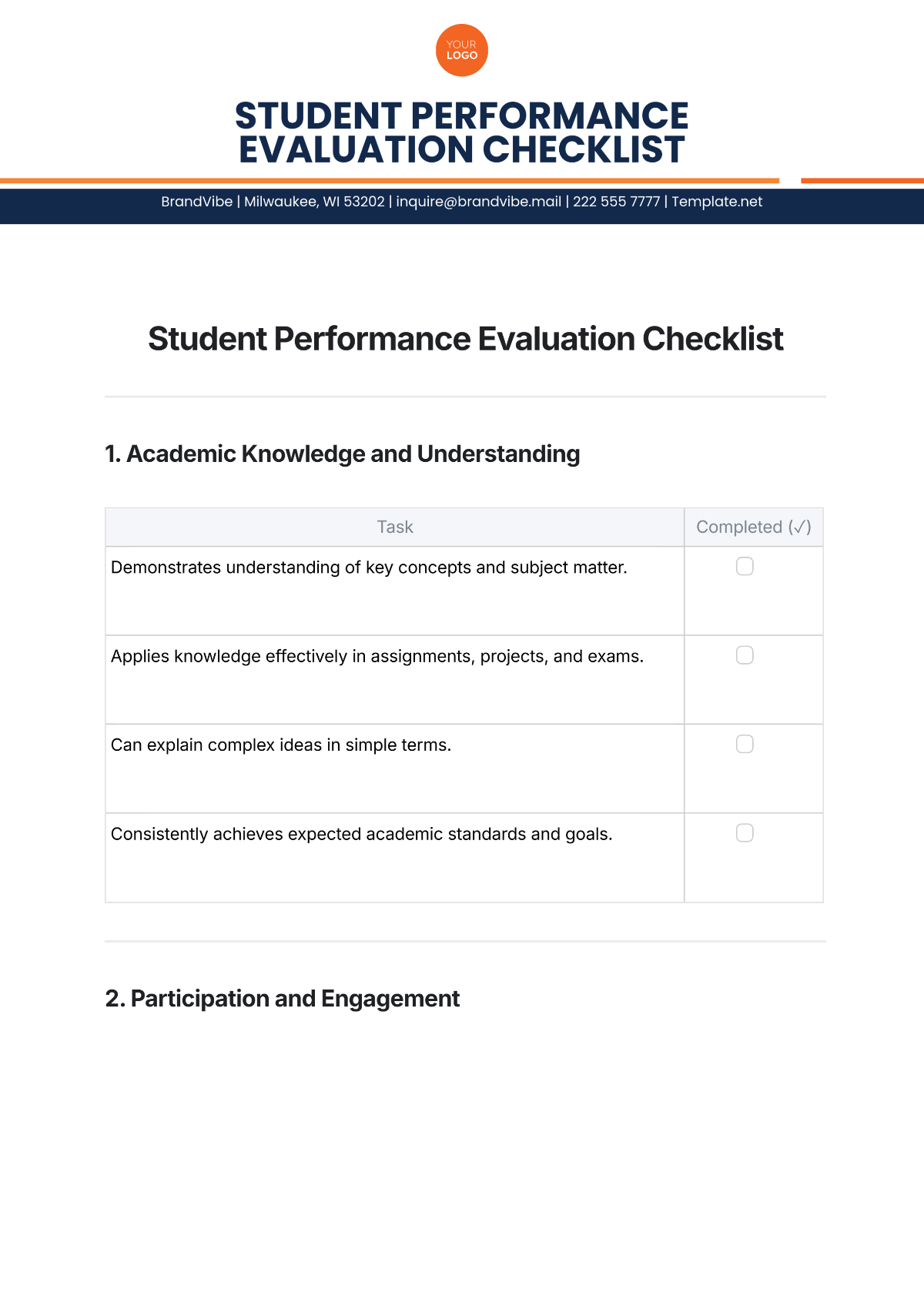

Detailed Evaluation Table

Criteria | Description | Rating (1-5) | Comments |

|---|---|---|---|

Cost Estimation Accuracy | Precision of cost estimations compared to actual costs. | ||

Budget Allocation | Appropriateness of budget distribution across various project components. | ||

Financial Viability | Overall financial soundness and profitability of the project. | ||

Return on Investment (ROI) | Expected financial returns versus the investment made. | ||

Expense Management | Management of project expenses and adherence to the budget. | ||

Funding and Cash Flow | Stability and sufficiency of funding and cash flow throughout the project's lifecycle. | ||

Risk Management | Effectiveness in identifying and mitigating financial risks. |