Free Revenue Tax Accountant Resume

Email: [Your Email]

Phone: 222 555 7777

LinkedIn: linkedin.com/in/your_own_profile

Address: 321 Blissful Avenue, Euphoria Springs, NY 01234

PROFESSIONAL SUMMARY

A highly motivated and detail-oriented Revenue Tax Accountant with extensive experience in tax preparation, financial analysis, and compliance. Proven track record in optimizing tax strategies, ensuring adherence to tax regulations, and providing exceptional support to both individuals and businesses. Skilled in tax filings, audits, and financial reporting. Adept at using accounting software and collaborating with cross-functional teams to deliver accurate financial data.

KEY SKILLS

Tax Preparation and Planning

Financial Statement Analysis

Federal and State Tax Compliance

Tax Audits and Reviews

Accounting Software (e.g., QuickBooks, Xero, TaxSlayer, ProSeries)

IRS Reporting and Documentation

Client Consultation and Advisory

Budgeting and Forecasting

Risk Management and Legal Compliance

Tax Law Updates and Interpretations

Data Analysis and Financial Reporting

Strong Written and Verbal Communication

PROFESSIONAL EXPERIENCE

Senior Revenue Tax Accountant

Tax Strategies Group — New York, NY

June 2061 – Present

Prepare and file tax returns for individuals, corporations, and non-profits, ensuring compliance with federal and state tax regulations.

Conduct tax research, provide recommendations, and oversee quarterly tax projections.

Coordinate tax audits and advise clients on tax planning strategies to minimize liabilities.

Mentored junior accountants and managed updates to accounting systems.

Key Achievements:

Resolved complex audit issues, reducing tax liabilities by 15%.

Increased tax filing efficiency by 20% through new software solutions.

Helped clients reduce tax burden by 10% through tax-efficient planning.

Revenue Tax Accountant

Bright Future Accounting Services — Chicago, IL

July 2058 – May 2061

Prepared tax returns for individuals, partnerships, and corporate clients.

Advised clients on tax deductions, credits, and financial matters.

Assisted in financial statement preparation and tax compliance.

Supported clients through IRS audits and provided ongoing tax guidance.

Key Achievements:

Reduced audit exposure by ensuring full compliance.

Streamlined filing processes, improving client satisfaction by 30%.

Saved clients an average of $5,000 annually through tax-saving strategies.

EDUCATION

Bachelor of Science in Accounting

University of New York — New York, NY

Graduation Date: May 2058

CERTIFICATIONS

Certified Public Accountant (CPA) — New York, 2060

Enrolled Agent (EA) — IRS, 2059

Tax Preparation Certification — National Association of Tax Professionals, 2058

TECHNICAL SKILLS

Tax Preparation Software: ProSeries, Drake Tax, TurboTax, H&R Block, TaxSlayer

Accounting Software: QuickBooks, Xero, Sage, Microsoft Dynamics GP

Microsoft Office Suite: Excel (Advanced), Word, PowerPoint

Data Analytics Tools: Tableau, Power BI (optional)

PROFESSIONAL DEVELOPMENT

Attended National Tax Conference, 2052, focusing on advanced tax law changes and compliance strategies.

Completed 40 hours of Continuing Professional Education (CPE) courses annually, with a focus on federal and state tax law updates and emerging tax technologies.

PROFESSIONAL AFFILIATIONS

Member, American Institute of Certified Public Accountants (AICPA)

Member, National Association of Tax Professionals (NATP)

Member, New York State CPA Society

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your career with the Revenue Tax Accountant Resume Template from Template.net. This fully customizable and editable template is designed to highlight your expertise. Easily tailored to your unique qualifications, it is editable in our AI Editor Tool for a seamless, professional finish. Stand out and secure your dream job today!

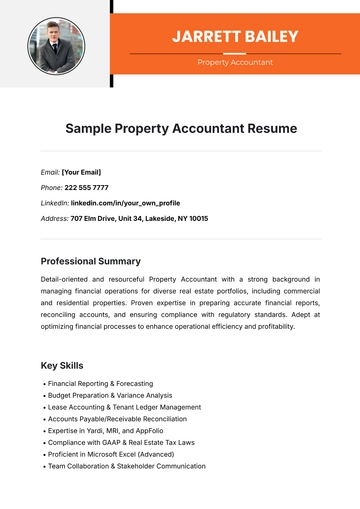

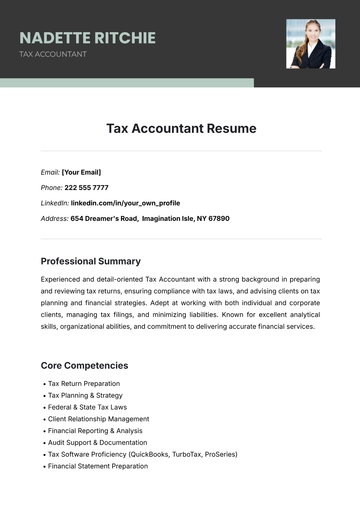

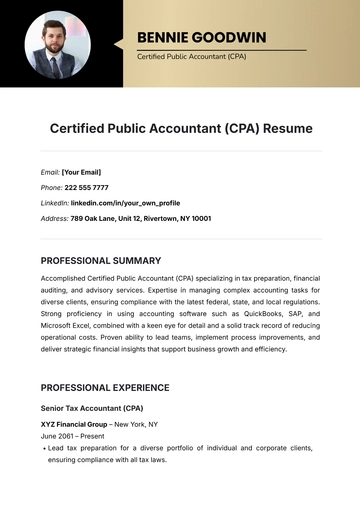

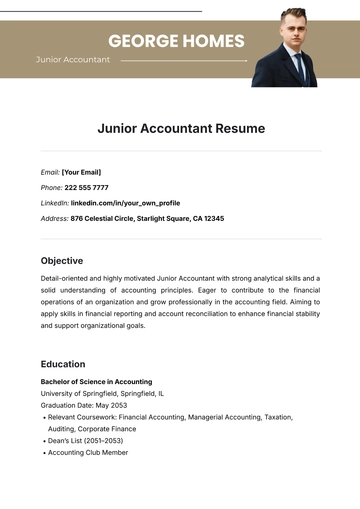

You may also like

- Simple Resume

- High School Resume

- Actor Resume

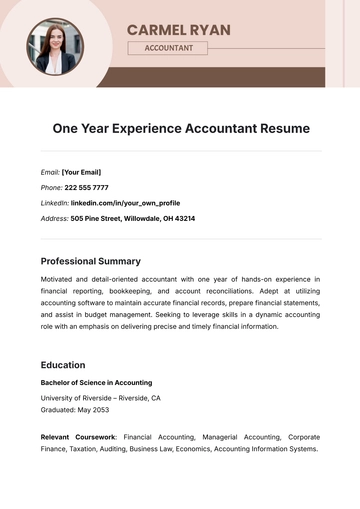

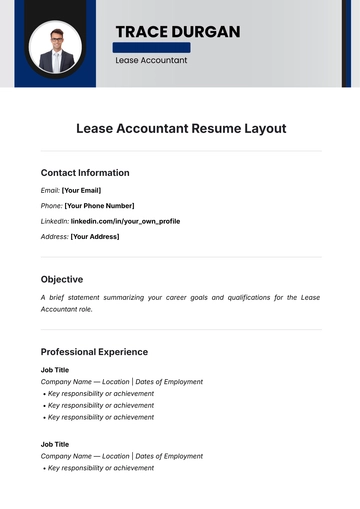

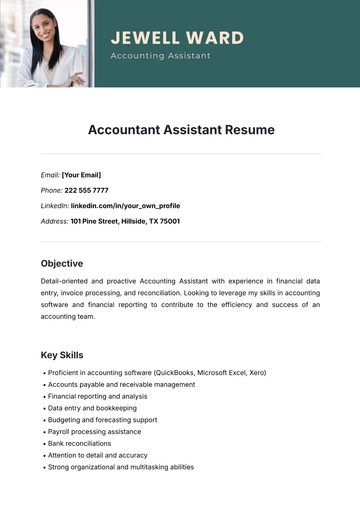

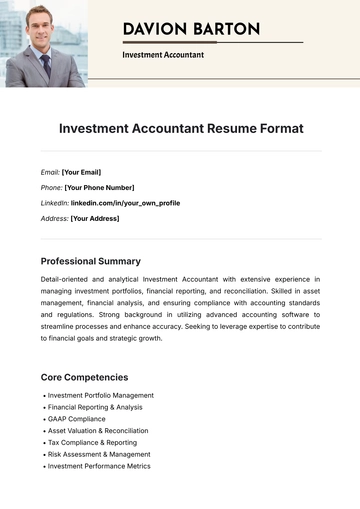

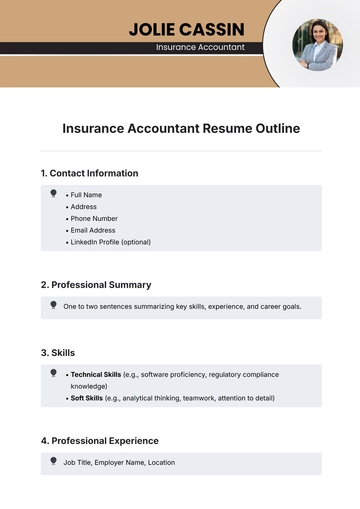

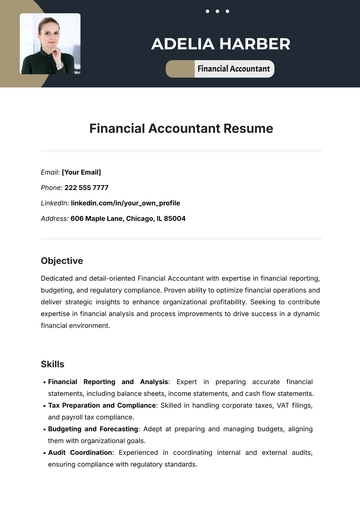

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

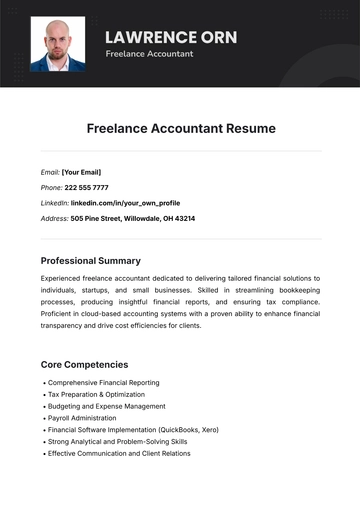

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

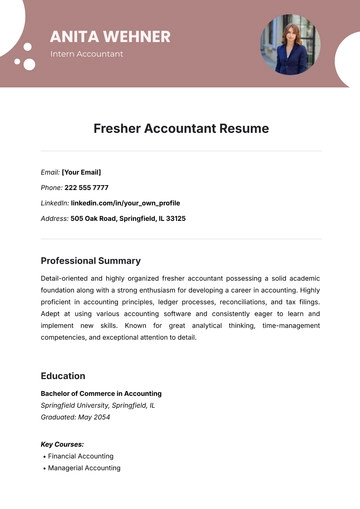

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume