Free Hotel Investment Memo

[Date]

We are pleased to present an investment opportunity in the acquisition and renovation of the [Second Party] located in [Second Party Address]. The hotel, strategically situated in the heart of the business district, presents an attractive investment proposition with potential for significant returns.

Key highlights include a prime location, strong market demand, and a comprehensive renovation plan aimed at enhancing the property's value proposition. With an estimated total investment of $[0] million, the projected internal rate of return (IRR) exceeds [00]%, making it an appealing opportunity for investors seeking exposure to the hospitality sector.

Market Analysis

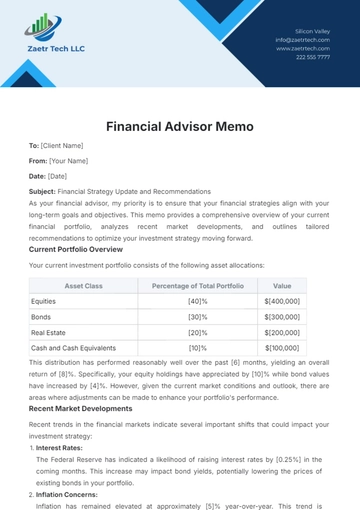

Market Metrics | Data/Analysis |

|---|---|

Market Size | $[000] million annually |

Demand Trends | Steady increase in corporate and leisure travelers |

Supply Trends | Limited new supply in downtown area |

Occupancy Rates | Average occupancy rate of [00]% |

Average Daily Rates (ADR) | $[000] |

RevPAR Trends | Consistent growth of [0]% annually |

Competitor Analysis | Market-leading position with strong brand recognition |

Property Overview

Property Details | Description |

|---|---|

Location | Prime downtown location with proximity to major businesses and attractions |

Size | [000] rooms and suites |

Number of Rooms | [000] |

Amenities | Restaurant, bar, fitness center, meeting rooms |

Unique Features | Skyline views, historic architecture |

Financial Projections

Financial Metrics | Projections |

|---|---|

Revenue | Year 1: $[00] million |

Expenses | Year 1: $[00] million |

Cash Flow | Year 1: $[00] million |

Investment Amount | $[00] million |

Financing Structure | [00]% equity, [00]% debt financing |

Equity and Debt | Equity: $[00] million, Debt: $[00] million |

Potential Returns | Projected IRR: [00]% |

Investment Structure

We propose a structured investment approach with a focus on achieving optimal returns while managing risk effectively. The total investment amount of $20 million will be financed through a combination of equity and debt, with equity investors expected to receive preferred returns and participation in cash flow distributions.

Risks and Mitigants

Market volatility: Mitigated by strong demand fundamentals and limited supply growth in the downtown area.

Economic downturn: Contingency plans in place to adjust pricing and cost structures to maintain profitability during economic downturns.

Operational challenges: Experienced management team in place to oversee renovations and operations, ensuring efficient execution and maximization of returns.

Exit Strategy

The proposed exit strategy includes a potential sale of the renovated property after five years, capitalizing on the increased property value and market demand. Alternative exit options include refinancing the investment to realize additional returns or pursuing a joint venture partnership for further development opportunities.

The [Second Party] investment opportunity offers compelling potential returns with limited downside risk, supported by strong market fundamentals and a comprehensive renovation plan. We recommend proceeding with further due diligence to evaluate the opportunity in detail and consider participation in this promising investment venture.

Prepared by: [Your Name]

Company: [Your Company Name]

Contact Information: [Your Email] | [Your Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your hotel investment process with the Hotel Investment Memo Template from Template.net. This editable and customizable template offers a comprehensive framework for crafting compelling investment memos. Utilize the AI Editor Tool to effortlessly tailor market analyses, financial projections, and investment structures. Maximize efficiency and accuracy in presenting your investment opportunities with this versatile template.