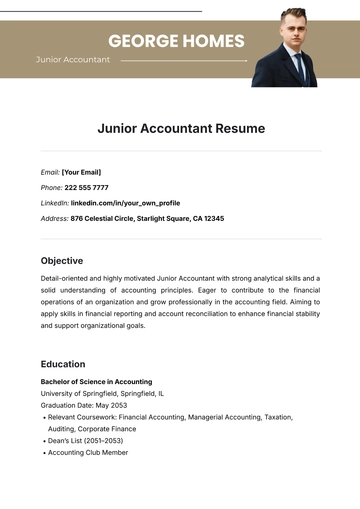

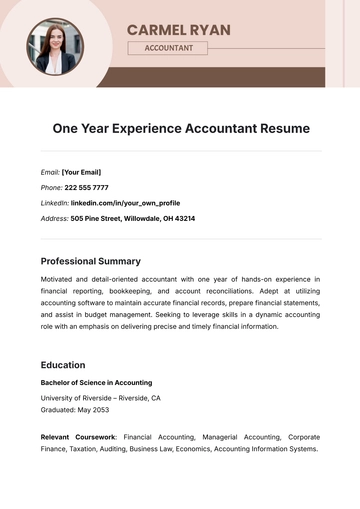

Free Junior Accountant Executive Resume

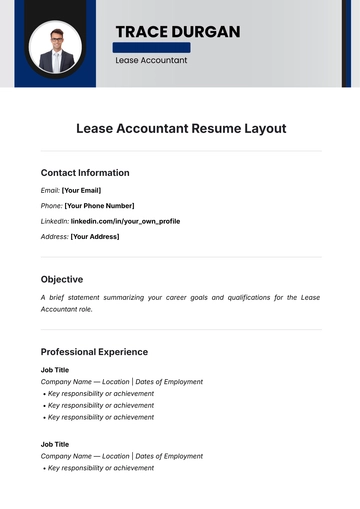

I. Contact Information

Phone Number: | [YOUR PHONE NUMBER] |

Address: | [YOUR ADDRESS] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

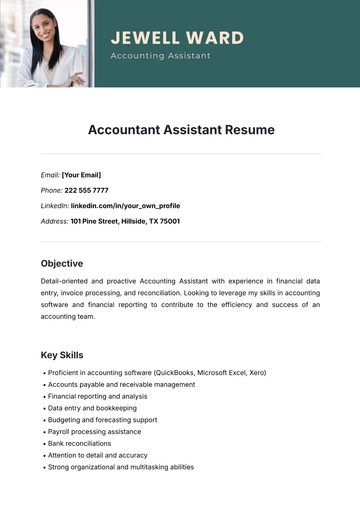

II. Career Objective

A Junior Accountant Executive with [X] years of financial accounting experience demonstrates strong GAAP knowledge and Excel-based financial modeling, delivering exceptional analysis and budgeting within corporate finance teams. Seeking to contribute proven skills to [YOUR COMPANY NAME] by supporting senior accountants and finance managers.

III. Education

Bachelor of Science in Accounting

[UNIVERSITY NAME], [LOCATION]

Graduation: [YEAR]

Relevant Coursework:

Financial Accounting: Covers preparing and analyzing financial statements, recording transactions, and interpreting financial data.

Managerial Accounting: Uses accounting information for internal management, including cost analysis, budgeting, and performance evaluation for decision-making.

Corporate Finance: Explores corporate financial management principles for optimizing shareholder value.

Business Law: Outlines the legal framework for business, ensuring compliance and ethics in contracts, torts, corporate governance, and regulations.

Economics: Covers basic economic principles like supply and demand, market structures, and macroeconomic indicators to analyze their impact on business.

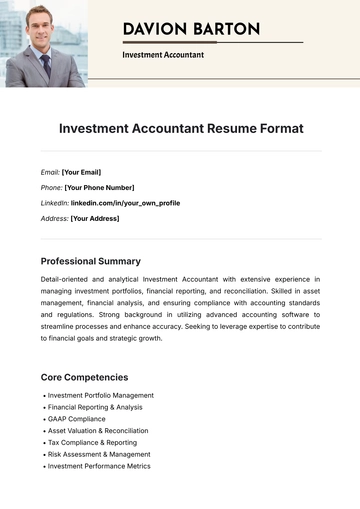

IV. Qualifications

Proficiency in MS Excel, including pivot tables, VLOOKUP, and financial modeling.

Strong understanding of GAAP and financial reporting standards.

Experience with accounting software (e.g., QuickBooks, SAP, Oracle).

Excellent analytical and problem-solving skills.

Attention to detail and high level of accuracy.

Effective communication and teamwork abilities.

V. Key Skills

Financial Analysis: Proficient in analyzing financial data, identifying trends, and interpreting results to support decision-making processes.

Budgeting and Forecasting: Possessing expertise in the areas of budgeting, variance analysis, and financial forecasting.

Financial Reporting: Experience in preparing accurate and timely financial statements in compliance with GAAP and other regulatory requirements.

Auditing and Compliance: Proficient in conducting comprehensive audits, performing thorough risk assessments, and ensuring adherence to financial regulations and compliance standards.

Data Management: Skilled in financial data management, data integrity, and accounting software.

VI. Professional Experience

Junior Accountant Executive

[START DATE] – [END DATE]

Reconciled bank statements and general ledger for accurate records.

Prepared budgets and analyzed variances for strategic decisions.

Conducted audits and risk assessments.

Used advanced Excel for financial models, reports, and forecasts.

Worked with finance to prepare monthly, quarterly, and annual financial statements per GAAP standards.

Financial Analyst at XYZ Corporation

[START DATE] – [END DATE]

Analyzed financial data and prepared reports for senior executives.

Conducted financial analyses to support strategic planning and budgeting.

Streamlined finances and better budget tracking via cross-functional teams.

Installed new accounting software, trained staff, ensured smooth transition.

Participated in regular audits and compliance reviews, ensuring adherence to regulatory requirements and internal controls.

VII. Achievements

Improved budget accuracy and efficiency by 15%

Implemented a new financial reporting system, reducing reporting time by 30%.

Corrected audit discrepancies, saving $50K annually.

Earned CPA, demonstrating accounting expertise and commitment.

Highly rated for reliability, detail, and timely reports.

Awarded "Employee of the Month" for creating a financial model that enhanced forecasting accuracy by 20%.

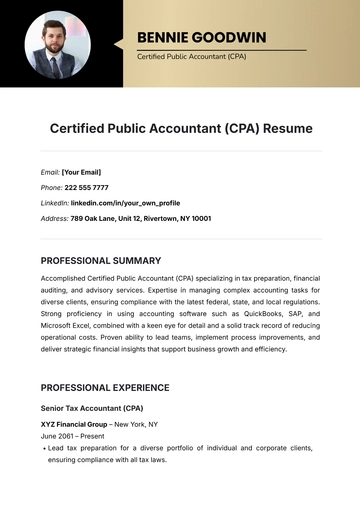

VIII. Certifications

Certified Public Accountant (CPA)

Certified Management Accountant (CMA)

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

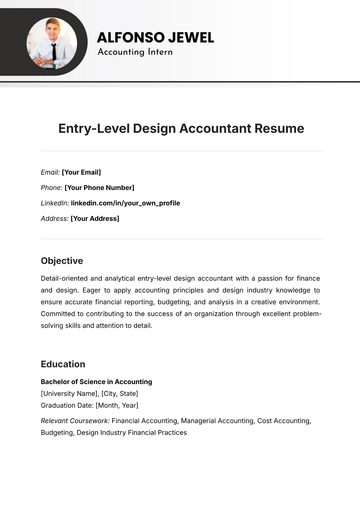

Advance your accounting career with Template.net’s Junior Accountant Executive Resume. This editable and customizable template, designed for our AI Editor Tool, highlights your accounting knowledge and skills. Tailor your resume to showcase your financial expertise and experience, ensuring a professional and appealing presentation. Impress potential employers with a polished, personalized resume.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

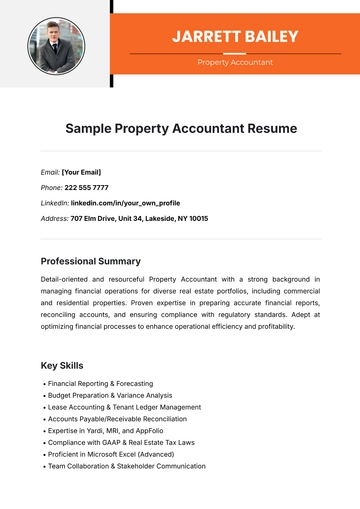

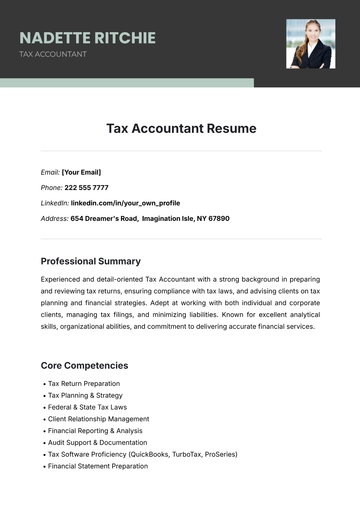

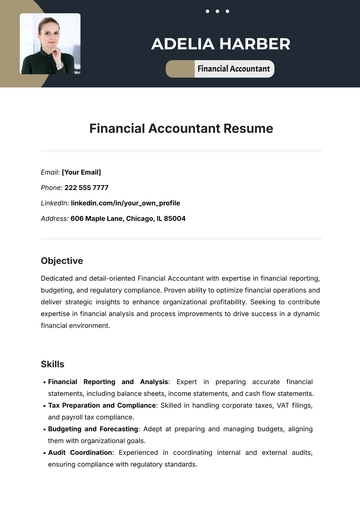

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

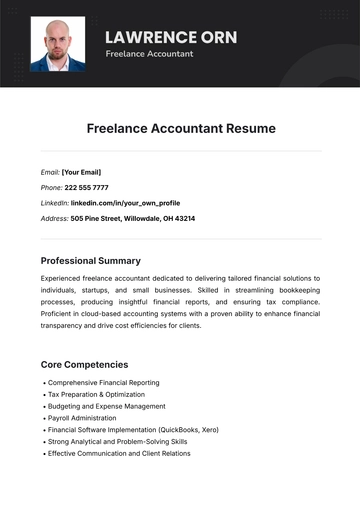

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

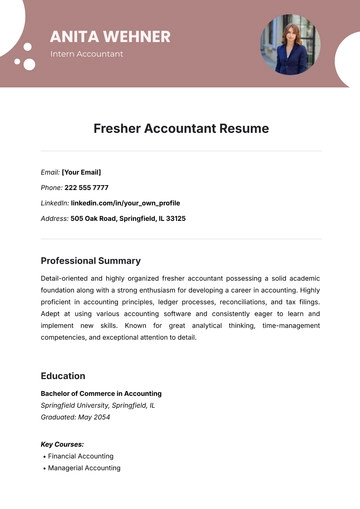

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume