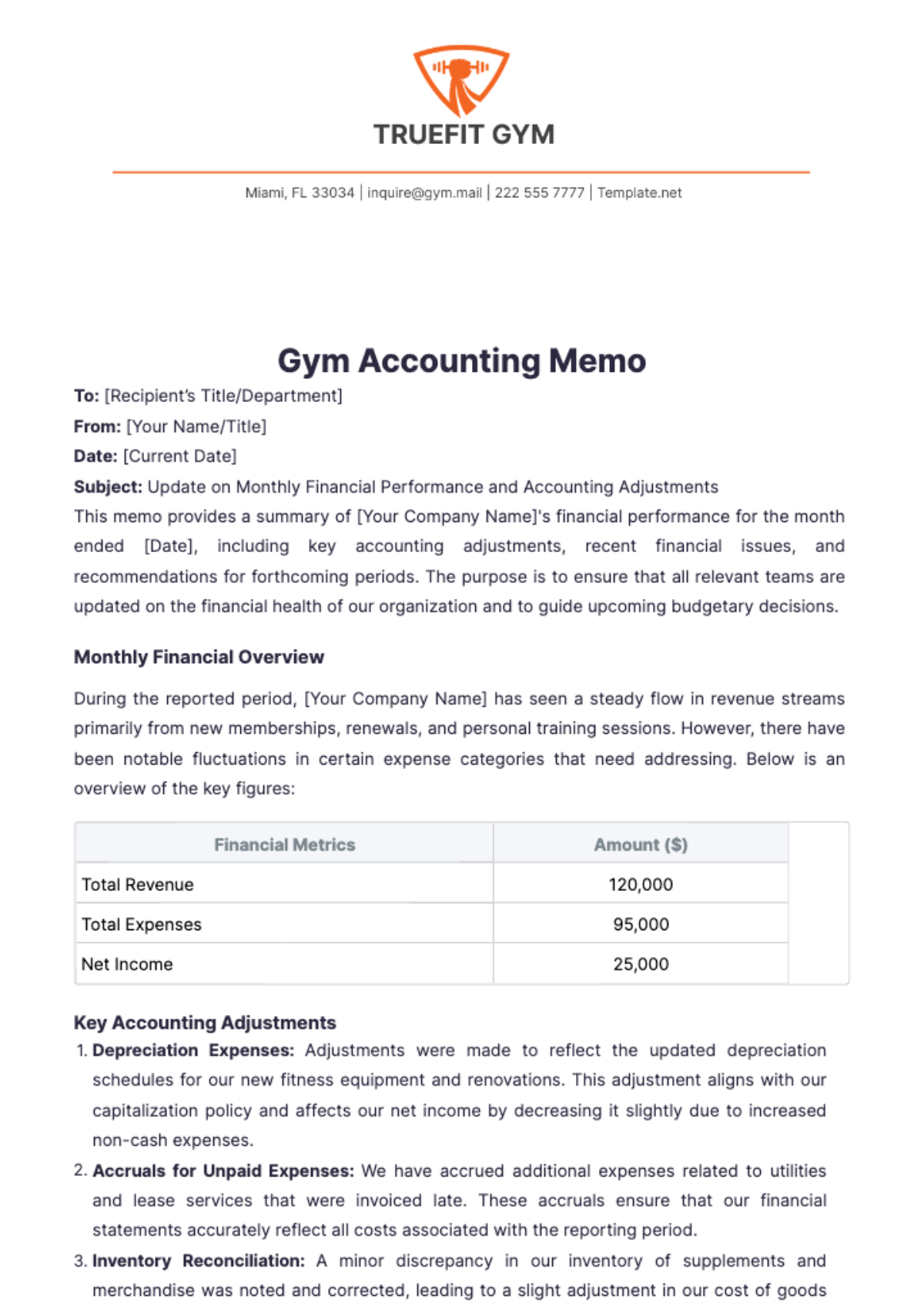

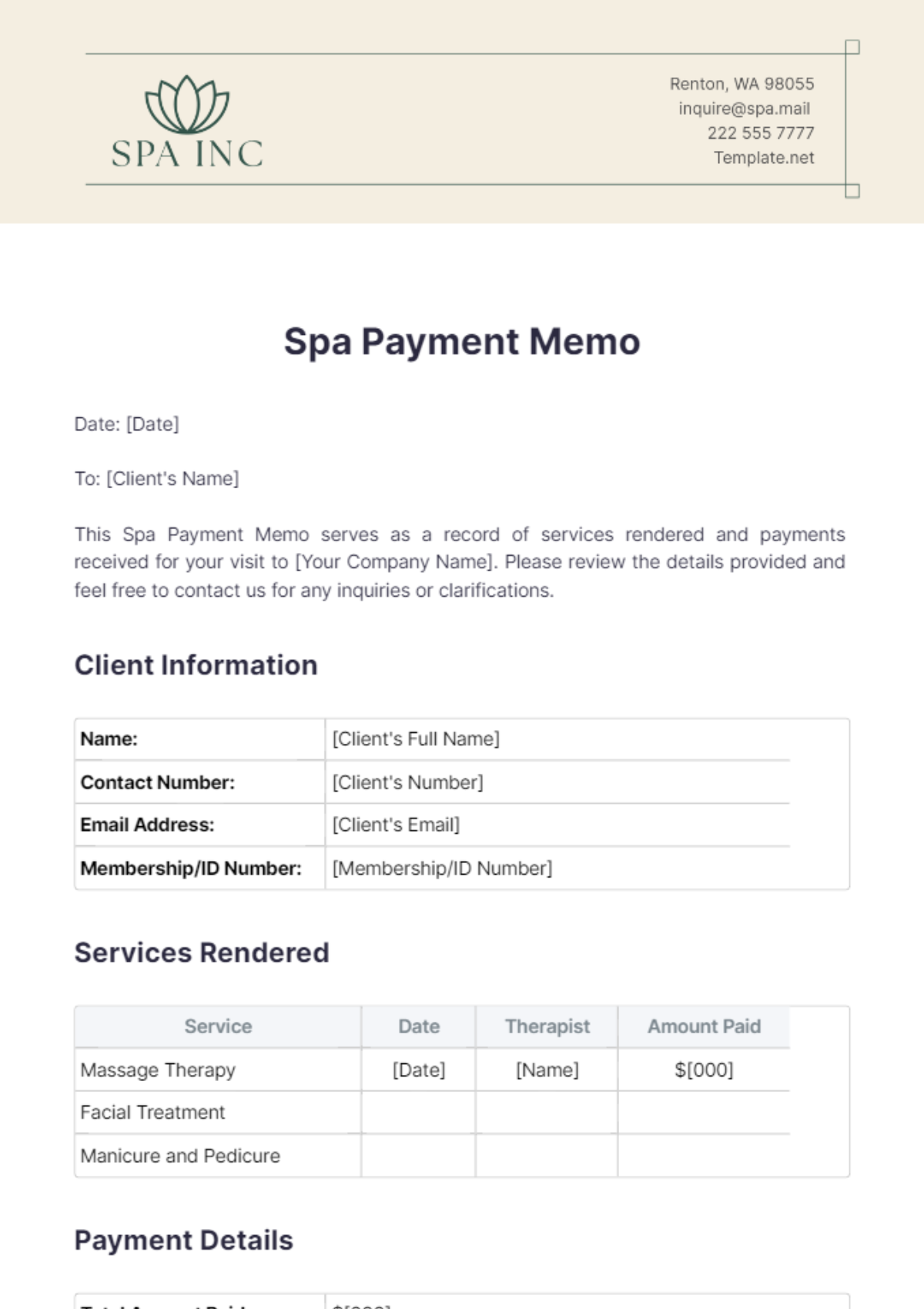

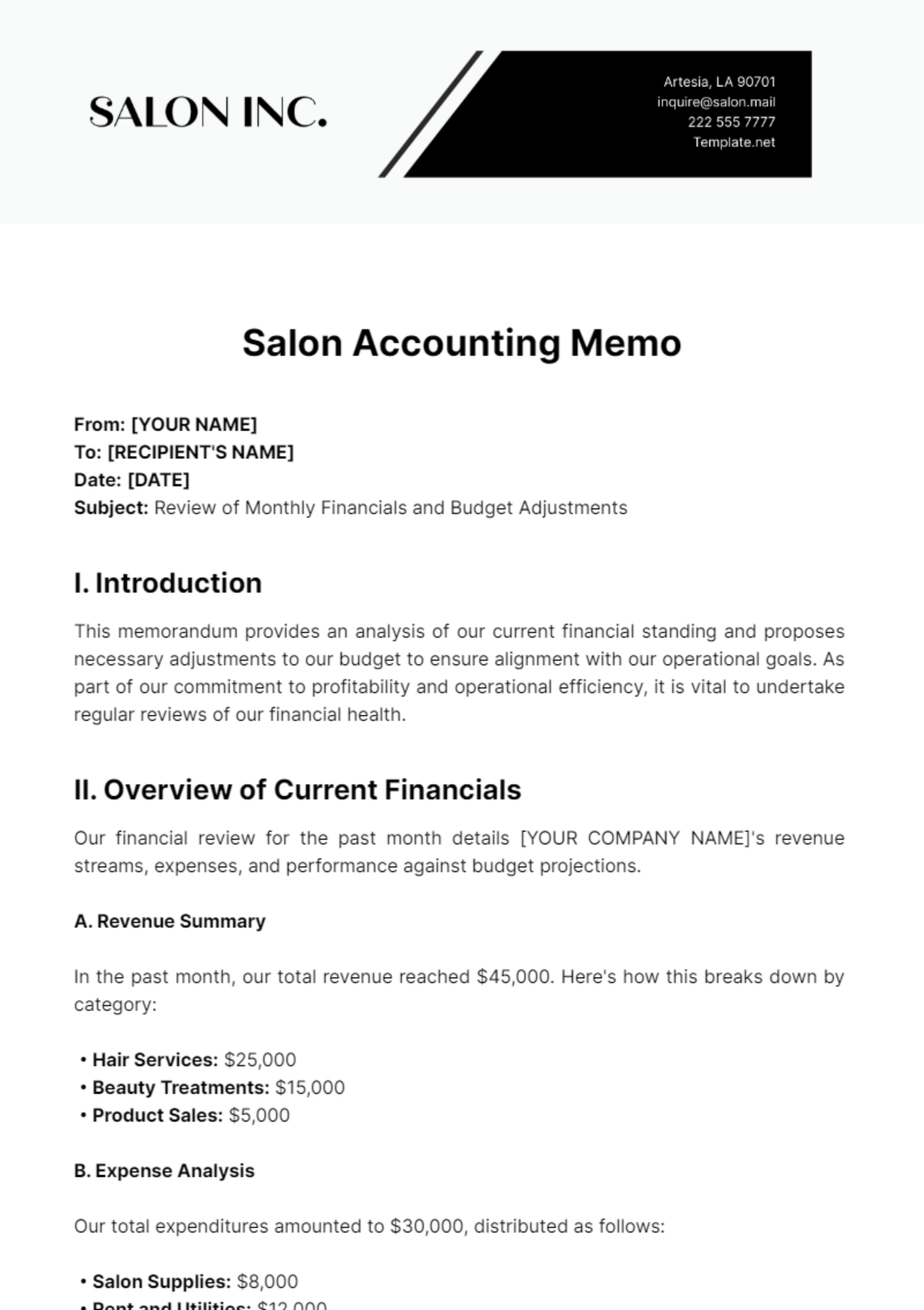

Free Spa Financial Memo

Discover Template.net's Spa Financial Memo Template, a comprehensive solution for your spa business. This editable and customizable template is designed to streamline your financial communication, offering clarity and professionalism. Editable in our Ai Editor Tool, it ensures a seamless experience in creating and managing your financial memos.