Free Annual Shareholder Report

I. Introduction

Welcome to the Annual Shareholder Report for [YOUR COMPANY NAME] for the fiscal year ending December 31, 2050. This report provides a comprehensive overview of our financial performance, strategic initiatives, and future outlook. We aim to equip our stakeholders with the necessary information to make informed investment decisions.

II. Message from the CEO

Dear Shareholders,

I am pleased to report another year of robust performance and strategic growth at [YOUR COMPANY NAME]. Despite global economic challenges, our commitment to innovation and operational excellence has driven significant advancements across all business units. Our focus on sustainability, technological innovation, and market expansion has positioned us well for future growth.

Thank you for your continued trust and support.

Sincerely,

[YOUR NAME]

Chief Executive Officer

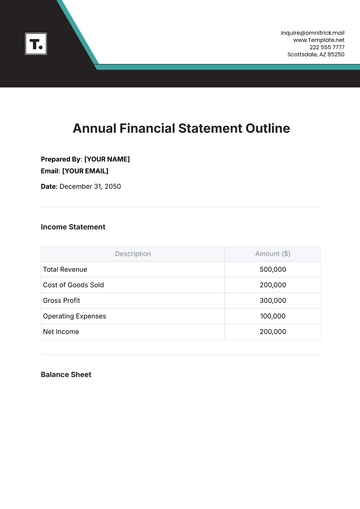

III. Financial Highlights

Key Financial Metrics

Metric | 2050 | 2049 | Change |

|---|---|---|---|

Revenue | $10.5 billion | $9.7 billion | +8% |

Net Income | $1.2 billion | $1.1 billion | +10% |

Earnings per Share (EPS) | $3.45 | $3.15 | +9.5% |

Dividend per Share | $1.50 | $1.50 | 0% |

Balance Sheet Summary

Item | 2050 | 2049 | Change |

|---|---|---|---|

Total Assets | $50 billion | $48 billion | +4.2% |

Total Liabilities | $30 billion | $29 billion | +3.4% |

Shareholders' Equity | $20 billion | $19 billion | +5.3% |

Cash Flow Statement

Cash Flow Activity | 2050 | 2049 | Change |

|---|---|---|---|

Net Cash from Operating Activities | $2 billion | $1.8 billion | +11.1% |

Net Cash for Investing Activities | $1 billion | $1.2 billion | -16.7% |

Net Cash from Financing Activities | $0.5 billion | $0.4 billion | +25% |

Financial Commentary

The year 2050 marked a period of significant financial achievement for [YOUR COMPANY NAME]. We successfully increased our revenue by 8% compared to 2049, driven by strong performance in our Technology Solutions and Industrial Systems divisions. Our net income rose by 10%, reflecting improved operational efficiencies and strategic cost management. The steady dividend of $1.50 per share underscores our commitment to returning value to our shareholders.

IV. Management's Discussion and Analysis (MD&A)

Market Overview

In 2050, the global market experienced unprecedented volatility due to geopolitical tensions and rapid technological changes. Despite these challenges, [YOUR COMPANY NAME] successfully navigated the landscape, leveraging our innovative product pipeline and strategic partnerships.

Business Performance

Division | Revenue Growth | Key Drivers |

|---|---|---|

Technology Solutions | +12% | Strong demand in emerging markets for AI and IoT |

Consumer Products | -3% | Supply chain disruptions, increased competition |

Industrial Systems | +7% | Introduction of new sustainable energy solutions |

Strategic Initiatives

Our strategic focus in 2050 included:

Innovation: We invested $500 million in R&D to foster next-generation technologies, particularly in the fields of artificial intelligence, machine learning, and renewable energy solutions. Our new AI-driven analytics platform, launched in Q3 2050, has already shown promising market uptake.

Sustainability: Implemented new sustainability initiatives, reducing carbon emissions by 15%. Our "Green Future" project focuses on integrating eco-friendly practices across our manufacturing processes and supply chain.

Global Expansion: Entered three new international markets, enhancing our global footprint. We successfully launched operations in India, Brazil, and South Africa, which are expected to contribute significantly to our revenue in the coming years.

V. Corporate Governance

Board of Directors

Position | Name | Background |

|---|---|---|

Chairman | [CHAIRMAN'S NAME] | Financial services expert, 20+ years |

Board Member | [MEMBER'S NAME] | Technology sector executive |

Board Member | [MEMBER'S NAME] | Sustainability and corporate responsibility leader |

Executive Compensation

Executive Position | Total Compensation | Breakdown |

|---|---|---|

CEO | $5 million | Salary, bonuses, stock options |

CFO | $3 million | Salary, bonuses, stock options |

Other Key Executives | $2 million each | Salary, bonuses, stock options |

Our compensation philosophy aims to attract and retain top talent while aligning executive rewards with the company's performance and shareholder interests.

Shareholder Engagement

We value our shareholders' perspectives and encourage ongoing dialogue. Throughout 2050, we hosted several virtual and in-person investor meetings, webinars, and Q&A sessions. Please reach out to our investor relations team at [YOUR COMPANY EMAIL] for any inquiries.

VI. Auditor's Report

Our independent auditor, [AUDITOR NAME], has issued an unqualified opinion on our financial statements for the year ended December 31, 2050. The auditor's report confirms that our financial statements present a true and fair view of the company's financial position and comply with all relevant accounting standards. The full auditor's report can be found in the appendix of this document.

VII. Future Outlook

Market Opportunities

We anticipate significant growth opportunities in the following areas:

Opportunity | Description |

|---|---|

Technology Innovation | Continued investment in AI and machine learning. We plan to launch several new AI-driven products in the next fiscal year. |

Sustainability Solutions | Expanding our eco-friendly product lines. We are committed to developing products that help our customers achieve their sustainability goals. |

Global Market Expansion | Targeting high-growth regions in Asia and Africa. Our recent market entries are just the beginning of a broader global expansion strategy. |

Strategic Goals

Goal | Target |

|---|---|

Revenue Target | Achieve a revenue target of $12 billion by 2051. |

Shareholder Value | Enhance shareholder value through strategic acquisitions and partnerships. |

Dividend Policy | Maintain a dividend payout ratio of 40% to ensure steady returns to our shareholders. |

VIII. Conclusion

Thank you for your unwavering support and trust in [YOUR COMPANY NAME]. We are committed to driving sustainable growth and creating long-term value for our shareholders. As we move into 2051, we remain focused on innovation, sustainability, and strategic expansion to continue delivering strong performance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Boost your corporate communications with this Annual Shareholder Report Template from Template.net. This fully customizable and editable template ensures a professional presentation of your company's financial health. Designed for convenience, the template integrates seamlessly with our AI Editor Tool, allowing you to tailor every detail to your specific needs effortlessly.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report