Free Printable Business Analysis Report

I. Executive Summary

This report analyzes [Your Company Name] current business environment, performance metrics, and market position. The findings indicate that while [Your Company Name] benefits from strong brand recognition and innovative product offerings, it faces challenges with high operational costs and limited online presence. Key recommendations include reducing costs, enhancing digital marketing efforts, and diversifying products to tap into new markets.

Key Points:

Strong brand reputation and customer loyalty

High operational costs impacting profitability

Significant opportunities in digital marketing and market expansion

Recommendations for strategic cost management and online growth

II. Introduction and Objectives

The purpose of this business analysis report is to evaluate the performance of [Your Company Name], identify internal strengths and weaknesses, and provide actionable insights for strategic improvement.

Objectives:

Assess the current financial and operational performance of [Your Company Name].

Analyze the competitive market landscape and industry trends

Provide strategic recommendations for growth and profitability

III. Methodology

The analysis was conducted using a combination of qualitative and quantitative data sources. Data was collected from company financial reports, industry publications, and stakeholder interviews.

Methodology Used:

Data Collection: Financial statements, market research, customer feedback

Analysis Tools: SWOT analysis, financial ratio analysis, trend analysis

Time Frame: Data collected from January 2051 to October 2051

IV. Business Overview

[Your Company Name] is a leading technology company specializing in software solutions and digital transformation services for businesses across various industries.

Company Overview:

Name: [Your Company Name]

Industry: Information Technology

Location: [Your Company Address]

Products/Services: Cloud software solutions, IT consulting, cybersecurity services

Mission Statement: "To empower businesses through innovative technology solutions and exceptional customer service."

V. SWOT Analysis

A. Strengths | B. Weaknesses |

|

|

C. Opportunities: | D. Threats: |

|

|

VI. Market and Industry Analysis

The information technology industry is experiencing rapid growth driven by increased demand for digital solutions and cybersecurity services. [Your Company Name] holds a strong position in its niche market but must adapt to evolving industry trends to stay competitive.

A. Market Trends:

Rise in demand for cloud-based software solutions

Increasing focus on data privacy and cybersecurity

Growing use of artificial intelligence in business operations

B. Competitor Analysis

Main Competitors: Duofort, BeansBee, SmithBrand

Market Share: [Your Company Name] holds an estimated 12% market share in the U.S. software solutions market.

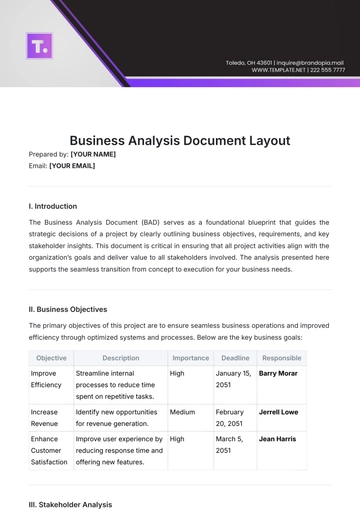

VII. Financial Analysis

The financial analysis highlights strong revenue growth but also points out areas where expenses are high, affecting the profit margin.

A. Key Financial Metrics:

Revenue Growth: $10 million (2050) to $14 million (2051), a 40% increase

Profit Margin: 18%, slightly below the industry average of 20%

Return on Investment (ROI): 12% for 2051

Debt-to-Equity Ratio: 1.5, indicating a moderate level of debt

B. Financial Overview:

The company’s revenue has shown steady growth, but profitability is hindered by high operational costs.

Investments in product development have increased, which may pay off in future revenue.

VIII. Key Findings and Insights

The analysis of [Your Company Name] reveals that the company is well-regarded for its innovative products and customer service. However, there are significant opportunities to enhance profitability through better cost management and increased digital marketing efforts.

A. Key Findings

High-quality products are a core strength, driving customer loyalty.

Operational inefficiencies are impacting profit margins.

There is a growing market demand for cloud and cybersecurity services.

B. Insights

Streamlining operations can lead to better cost control.

Investing in digital marketing could expand customer reach and revenue potential.

The company should explore partnerships to enhance product offerings and market presence.

IX. Recommendations

Based on the analysis, the following recommendations are made to improve business performance:

Optimize Operational Costs: Implement cost-saving measures, including automation and renegotiating vendor contracts, to enhance profitability.

Increase Digital Marketing Efforts: Invest in social media, search engine optimization (SEO), and online advertising to improve brand visibility and attract new customers.

Diversify Product Offerings: Introduce new services tailored to the growing demand for cybersecurity and AI-driven solutions.

X. Conclusion

[Your Company Name] has a strong foundation in the technology industry, with innovative products and loyal customers. However, addressing its operational inefficiencies and expanding its digital presence is critical for sustaining growth and increasing profitability. By following the recommendations provided, [Your Company Name] can enhance its market position and achieve long-term success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your reporting with the Printable Business Analysis Report Template from Template.net. This fully editable and customizable template is designed for presenting in-depth business analyses, data insights, and performance reviews. Easily personalize the content using our AI Editor Tool, and print the finalized report for a polished presentation. Ideal for business analysts, this template ensures that your analysis is communicated clearly and effectively.