Cafe Cost Benefit Analysis

I. Introduction

The purpose of this cost benefit analysis is to evaluate the financial implications of various initiatives at [Your Company Name]. By systematically comparing the costs and benefits associated with each initiative, we aim to identify the most financially viable options that will contribute to the cafe's growth and profitability.

A. Objectives

Assess Financial Impact: Evaluate the financial impact of proposed initiatives on the cafe’s overall profitability. This involves analyzing both the costs incurred and the benefits gained. A thorough assessment will provide a clear understanding of each initiative's potential return.

Inform Decision-Making: Provide data-driven insights to inform strategic decision-making processes. The analysis will guide which projects should be prioritized based on their cost-effectiveness. This ensures that resources are allocated to the most beneficial initiatives.

Optimize Resource Allocation: Ensure that resources are allocated efficiently to maximize return on investment. This will help in achieving the cafe’s financial goals more effectively. Efficient resource allocation is crucial for sustaining long-term growth.

B. Scope

Scope Definition: The analysis covers all major initiatives planned for the upcoming fiscal year. This includes marketing campaigns, new product launches, and operational improvements. By encompassing a broad range of initiatives, the analysis provides a holistic view of potential investments.

Financial Metrics: Key financial metrics such as return on investment (ROI), net present value (NPV), and payback period will be used to evaluate each initiative. These metrics provide a comprehensive view of financial performance. Using multiple metrics ensures a balanced evaluation of each initiative's viability.

Data Sources: Data will be gathered from internal financial records, market research reports, and industry benchmarks. Accurate and reliable data is critical for a valid analysis. Comprehensive data collection methods enhance the credibility of the analysis.

C. Methodology

Data Collection: Collect data on both direct and indirect costs associated with each initiative. This includes initial capital outlay, ongoing operational expenses, and potential risks. Thorough data collection is essential for an accurate cost assessment.

Benefit Estimation: Estimate the benefits in terms of increased revenues, cost savings, and intangible benefits such as brand enhancement. Both short-term and long-term benefits will be considered. Estimating benefits accurately helps in understanding the full impact of each initiative.

Analytical Techniques: Apply financial analysis techniques such as cost-benefit ratios, sensitivity analysis, and scenario analysis. These techniques help in understanding the financial implications under different conditions. Advanced analytical methods provide a deeper insight into the potential outcomes.

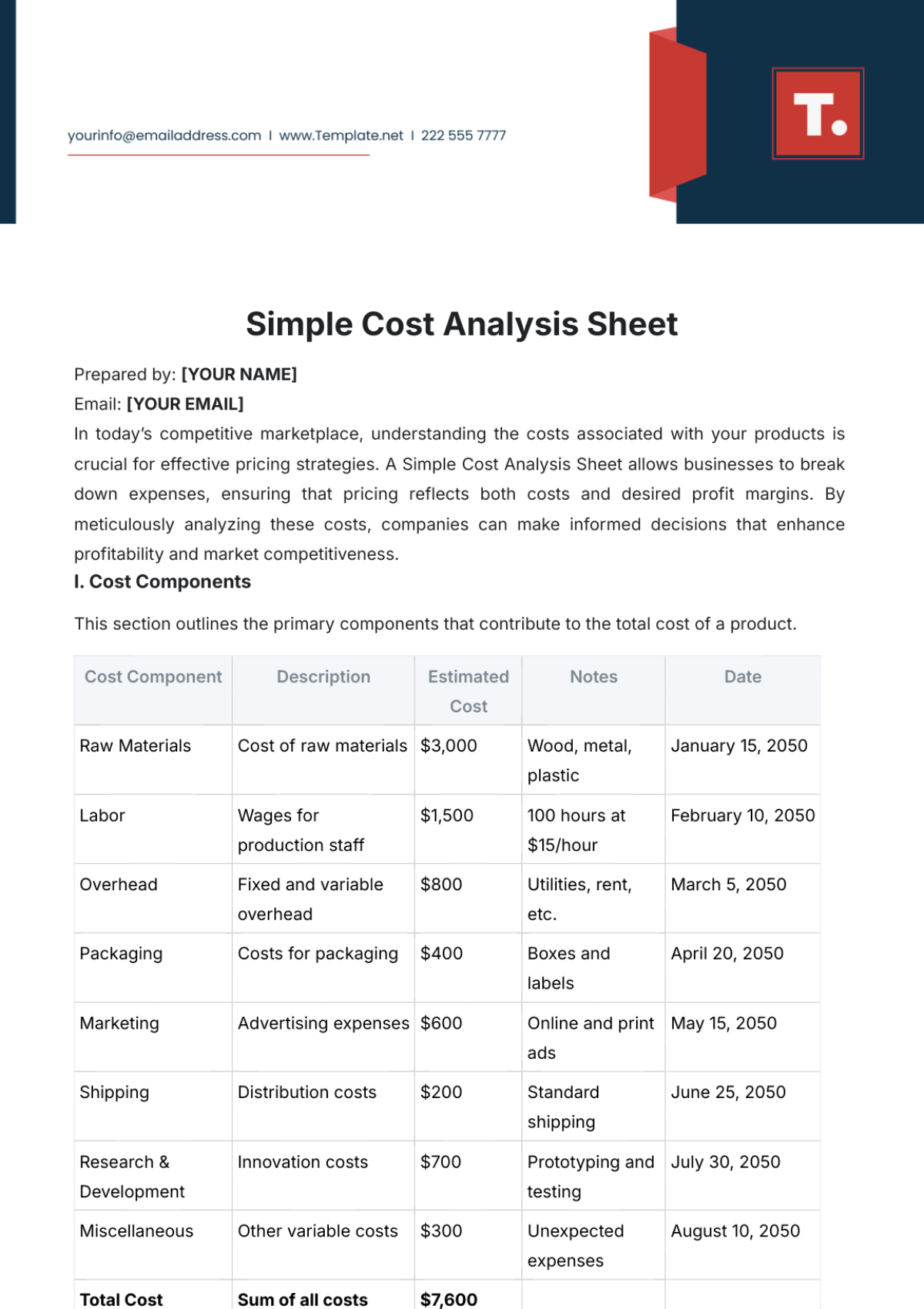

II. Cost Analysis

The following table provides an overview of the costs associated with the proposed initiatives:

Initiative | Initial Cost | Ongoing Cost | Total Cost |

|---|---|---|---|

Marketing Campaign | $10,000 | $2,000/month | $34,000 |

New Product Launch | $15,000 | $3,000/month | $51,000 |

Operational Upgrades | $20,000 | $1,500/month | $38,000 |

A. Marketing Campaign

Initial Investment: The initial cost for the marketing campaign is $10,000. This includes expenses for creative development, media buying, and promotional activities. These initial expenses are crucial for setting up an effective campaign.

Ongoing Costs: The campaign incurs ongoing costs of $2,000 per month for maintenance and optimization. These costs are necessary to sustain the campaign's effectiveness. Regular optimization ensures that the campaign continues to deliver results.

Total Cost: The total cost over the projected period amounts to $34,000. This figure combines both initial and ongoing expenses. A comprehensive understanding of total costs is essential for evaluating the campaign's financial viability.

B. New Product Launch

Initial Investment: Launching a new product requires an initial investment of $15,000. This covers research and development, production, and initial marketing efforts. These initial steps are critical for ensuring a successful product launch.

Ongoing Costs: The ongoing costs are $3,000 per month for continued marketing, distribution, and customer support. These expenses ensure the product gains traction in the market. Sustained marketing efforts are essential for maintaining product momentum.

Total Cost: The cumulative cost of the new product launch over the analysis period is $51,000. This includes all related expenses. Evaluating total costs helps in understanding the overall financial commitment required.

C. Operational Upgrades

Initial Investment: Upgrading the cafe’s operations involves an initial expenditure of $20,000. This includes costs for new equipment, software, and training. These upgrades are necessary for improving operational efficiency.

Ongoing Costs: The ongoing costs for operational upgrades are $1,500 per month. These cover maintenance, support, and additional training. Regular maintenance ensures that the upgrades remain effective over time.

Total Cost: The total cost of operational upgrades over the analysis period is $38,000. This encompasses both initial and recurring expenses. Understanding total costs is essential for evaluating the financial feasibility of the upgrades.

The cost analysis reveals that initial investments often set the stage for long-term gains. For example, the marketing campaign's initial cost covers essential setup activities that drive future revenue. Ongoing costs, while necessary, ensure the continued success of these initiatives by maintaining momentum and adapting to market changes. By understanding the full scope of both initial and ongoing costs, [Your Company Name] can make informed decisions about which initiatives offer the best return on investment. Additionally, the total cost figures provide a clear picture of the financial commitment required, allowing for better budget planning and resource allocation.

III. Benefit Analysis

The following table summarizes the expected benefits from the proposed initiatives:

Initiative | Revenue Increase | Cost Savings | Intangible Benefits |

|---|---|---|---|

Marketing Campaign | $50,000 | $5,000 | Brand Awareness |

New Product Launch | $70,000 | $10,000 | Market Expansion |

Operational Upgrades | $40,000 | $15,000 | Efficiency Gains |

A. Marketing Campaign

Revenue Increase: The marketing campaign is projected to increase revenue by $50,000. This boost is attributed to enhanced brand visibility and customer engagement. Effective marketing strategies can attract new customers and retain existing ones.

Cost Savings: The campaign is also expected to yield cost savings of $5,000 through optimized marketing spend and economies of scale. By targeting the right audience, the campaign can reduce wastage and improve efficiency.

Intangible Benefits: In addition to tangible financial gains, the campaign will significantly enhance brand awareness. This intangible benefit contributes to long-term customer loyalty and market positioning. A strong brand presence can lead to sustained growth and competitive advantage.

B. New Product Launch

Revenue Increase: Launching the new product is estimated to generate an additional $70,000 in revenue. This increase stems from tapping into new customer segments and meeting existing customer demand. A successful product launch can significantly boost sales.

Cost Savings: The new product launch is expected to save $10,000 by leveraging existing distribution channels and marketing infrastructure. Utilizing established channels can reduce costs and increase efficiency.

Intangible Benefits: The initiative will also lead to market expansion, positioning the cafe as an innovator and attracting a broader customer base. Innovation can differentiate the cafe from competitors and drive growth.

C. Operational Upgrades

Revenue Increase: Operational upgrades are projected to increase revenue by $40,000. Enhanced efficiency and service quality drive this growth. Efficient operations can improve customer satisfaction and boost sales.

Cost Savings: The upgrades are expected to save $15,000 through reduced operational costs, such as lower maintenance expenses and improved resource utilization. Efficient resource management can lead to significant cost reductions.

Intangible Benefits: Efficiency gains are a key intangible benefit of the upgrades. Improved operational processes contribute to better customer experiences and increased staff productivity. Enhanced efficiency can lead to long-term competitive advantage.

The insights from the benefit analysis highlights the significant potential gains that [Your Company Name] can achieve through these initiatives. For instance, the revenue increases projected from the marketing campaign, new product launch, and operational upgrades show the positive impact on the cafe’s financial health. Cost savings further enhance the attractiveness of these initiatives, making them not only profitable but also efficient. Intangible benefits, such as brand awareness, market expansion, and efficiency gains, contribute to the long-term success and sustainability of the cafe. These intangible gains, while harder to quantify, play a crucial role in building a strong foundation for future growth and stability. By carefully considering both tangible and intangible benefits, [Your Company Name] can make strategic decisions that align with its long-term objectives.

IV. Cost-Benefit Comparison

The following table presents a comparison of costs and benefits for the proposed initiatives:

Initiative | Total Cost | Total Benefit | Net Benefit | Benefit-Cost Ratio |

|---|---|---|---|---|

Marketing Campaign | $34,000 | $55,000 | $21,000 | 1.62 |

New Product Launch | $51,000 | $80,000 | $29,000 | 1.57 |

Operational Upgrades | $38,000 | $55,000 | $17,000 | 1.45 |

A. Marketing Campaign

Net Benefit: The marketing campaign results in a net benefit of $21,000. This is calculated by subtracting the total cost from the total benefit. The positive net benefit indicates that the campaign is financially viable.

Benefit-Cost Ratio: The benefit-cost ratio of 1.62 demonstrates that for every dollar spent, the campaign returns $1.62. A ratio above 1 indicates a profitable initiative.

Financial Viability: The marketing campaign’s high benefit-cost ratio and significant net benefit make it an attractive option for investment. The quick realization of benefits further supports its feasibility.

B. New Product Launch

Net Benefit: The new product launch yields a net benefit of $29,000. This substantial net benefit highlights the financial potential of the initiative. Positive net benefits signify a profitable venture.

Benefit-Cost Ratio: With a benefit-cost ratio of 1.57, the new product launch promises a return of $1.57 for every dollar invested. This ratio underscores the financial attractiveness of the initiative.

Financial Viability: The new product launch’s strong financial metrics support its viability. The substantial net benefit and favorable benefit-cost ratio justify the initial investment and ongoing costs.

C. Operational Upgrades

Net Benefit: The operational upgrades produce a net benefit of $17,000. This benefit results from the total benefits outweighing the total costs. Positive net benefits indicate that the initiative is worthwhile.

Benefit-Cost Ratio: The benefit-cost ratio of 1.45 signifies that for every dollar spent, the upgrades return $1.45. A ratio above 1 confirms the profitability of the initiative.

Financial Viability: The operational upgrades demonstrate sound financial viability with a reasonable benefit-cost ratio and positive net benefit. These metrics support the feasibility of the initiative.

The cost-benefit comparison reveals that each initiative provides a solid return on investment, making them worthwhile ventures for [Your Company Name]. The marketing campaign, with its high benefit-cost ratio, indicates quick and substantial returns, enhancing brand visibility and customer engagement. The new product launch stands out with the highest net benefit, suggesting significant revenue potential and market expansion opportunities. Operational upgrades, while having the lowest benefit-cost ratio among the three, still offer notable efficiency gains and cost savings, improving overall operational performance. By evaluating these metrics, [Your Company Name] can prioritize initiatives based on financial returns and strategic goals, ensuring that resources are directed towards the most impactful projects.

V. Sensitivity Analysis

The following table outlines the impact of varying key assumptions on the net benefits of the initiatives:

Initiative | Variable | Base Case | +10% | -10% |

|---|---|---|---|---|

Marketing Campaign | Revenue Increase | $21,000 | $23,000 | $19,000 |

New Product Launch | Cost Savings | $29,000 | $32,000 | $26,000 |

Operational Upgrades | Ongoing Costs | $17,000 | $15,000 | $19,000 |

A. Marketing Campaign

Revenue Increase Sensitivity: A 10% increase in revenue increases the net benefit to $23,000, while a 10% decrease reduces it to $19,000. This indicates that the marketing campaign is sensitive to changes in revenue.

Implications: Managing revenue growth is crucial for maximizing the net benefit of the marketing campaign. Effective strategies to boost revenue can significantly enhance financial outcomes. Adjusting revenue expectations helps in preparing for potential fluctuations.

B. New Product Launch

Cost Savings Sensitivity: A 10% increase in cost savings boosts the net benefit to $32,000, whereas a 10% decrease lowers it to $26,000. This shows that cost savings have a significant impact on the initiative's net benefit.

Implications: Achieving and exceeding cost savings targets is essential for the new product launch’s success. Efficient cost management can enhance the financial viability of the initiative. Proactive cost-saving measures can further improve profitability.

C. Operational Upgrades

Ongoing Costs Sensitivity: A 10% increase in ongoing costs decreases the net benefit to $15,000, while a 10% decrease increases it to $19,000. The upgrades show sensitivity to changes in ongoing costs.

Implications: Controlling ongoing costs is crucial for maximizing the net benefit of operational upgrades. Efficient management of these costs can enhance financial outcomes. Monitoring and managing operational expenses is vital for sustaining long-term benefits.

The sensitivity analysis highlights the importance of managing key variables to ensure the success of the initiatives. Variations in revenue, cost savings, and ongoing costs significantly impact the net benefits. For instance, the marketing campaign’s sensitivity to revenue changes underscores the need for robust strategies to drive sales and customer engagement. Similarly, the new product launch’s dependence on cost savings highlights the importance of efficient production and distribution processes. The operational upgrades’ sensitivity to ongoing costs emphasizes the need for careful planning and management of maintenance and support expenses. By understanding these sensitivities, [Your Company Name] can develop contingency plans and strategies to mitigate risks, ensuring the initiatives remain financially viable under different scenarios.

VI. Risk Analysis

The following table outlines the potential risks associated with each initiative and their likelihood and impact:

Initiative | Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|---|

Marketing Campaign | Low Engagement | High | High | Diversify marketing channels |

New Product Launch | Market Acceptance | Medium | High | Conduct market research |

Operational Upgrades | Implementation Delays | Medium | Medium | Develop a detailed plan |

A. Marketing Campaign

Low Engagement Risk: The risk of low customer engagement is high, with significant impact on campaign success. Diversifying marketing channels can mitigate this risk by reaching a broader audience. Ensuring engagement through multiple channels reduces the likelihood of campaign failure.

Mitigation Strategy: By utilizing multiple marketing channels, the cafe can reach a broader audience and increase the likelihood of campaign success. Diversification helps in tapping different customer segments, enhancing overall engagement.

B. New Product Launch

Market Acceptance Risk: The risk of poor market acceptance is medium, with a high impact on the initiative's success. Conducting thorough market research can mitigate this risk by understanding customer preferences. Accurate market insights help in developing products that meet customer needs.

Mitigation Strategy: Market research helps understand customer preferences and tailor the product accordingly, increasing the chances of market acceptance. Well-researched products are more likely to succeed in the market, reducing the risk of failure.

C. Operational Upgrades

Implementation Delays Risk: The risk of implementation delays is medium, with a medium impact on the project. Developing a detailed plan can mitigate this risk by providing clear timelines and responsibilities. Proper planning ensures timely execution.

Mitigation Strategy: A comprehensive implementation plan with clear timelines and responsibilities helps ensure the timely execution of operational upgrades. Detailed planning reduces uncertainties and streamlines the upgrade process.

The risk analysis identifies potential challenges and mitigation strategies for each initiative. Effective risk management is crucial for minimizing negative impacts and ensuring successful outcomes. For example, the high likelihood and impact of low engagement in the marketing campaign emphasize the need for diverse marketing strategies to reach a wider audience. In the case of the new product launch, understanding customer preferences through market research is vital for reducing the risk of poor market acceptance. For operational upgrades, detailed planning and clear timelines are essential to prevent delays and ensure smooth implementation. By proactively addressing these risks, [Your Company Name] can enhance the chances of success for each initiative, ensuring they deliver the expected benefits.

VII. Financial Data Analysis

The following table provides a detailed financial analysis of the initiatives:

Initiative | Total Cost | Total Benefit | Net Benefit | Benefit-Cost Ratio | Payback Period (Months) |

|---|---|---|---|---|---|

Marketing Campaign | $34,000 | $55,000 | $21,000 | 1.62 | 8 |

New Product Launch | $51,000 | $80,000 | $29,000 | 1.57 | 10 |

Operational Upgrades | $38,000 | $55,000 | $17,000 | 1.45 | 12 |

A. Marketing Campaign

Financial Summary: The marketing campaign incurs a total cost of $34,000 and generates a total benefit of $55,000, resulting in a net benefit of $21,000. The benefit-cost ratio is 1.62, and the payback period is 8 months. These metrics indicate that the campaign is financially viable.

Implications: The marketing campaign demonstrates strong financial viability with a high return on investment and a relatively short payback period. This indicates that the benefits are realized quickly, making it an attractive initiative. The quick payback period enhances the initiative’s appeal.

B. New Product Launch

Financial Summary: The new product launch costs $51,000 and yields benefits of $80,000, leading to a net benefit of $29,000. The benefit-cost ratio is 1.57, with a payback period of 10 months. These figures highlight the initiative's financial potential.

Implications: The new product launch offers substantial financial returns with a strong net benefit and favorable benefit-cost ratio. The 10-month payback period is reasonable, ensuring that the investment is recovered within a year. This makes the initiative a worthwhile venture.

C. Operational Upgrades

Financial Summary: The operational upgrades involve a total cost of $38,000 and provide benefits of $55,000, resulting in a net benefit of $17,000. The benefit-cost ratio is 1.45, and the payback period is 12 months. These metrics indicate a viable initiative.

Implications: Operational upgrades show solid financial returns with a positive net benefit and an acceptable benefit-cost ratio. The 12-month payback period is manageable, ensuring that the benefits are realized within a year. This supports the feasibility of the initiative.

The financial data analysis reveals that each initiative offers compelling financial returns, making them viable investments for [Your Company Name]. The marketing campaign's short payback period and high return on investment indicate quick and substantial benefits. The new product launch, with its strong net benefit and favorable financial metrics, highlights significant revenue potential and market growth opportunities. Operational upgrades, while having the longest payback period, still demonstrate solid financial returns, improving operational efficiency and cost savings. By considering these financial metrics, [Your Company Name] can prioritize initiatives that offer the best financial returns and align with strategic goals, ensuring optimal resource allocation and long-term profitability.

VIII. Strategic Recommendations

Based on the comprehensive cost-benefit analysis, the following strategic recommendations are proposed for [Your Company Name]:

A. Prioritize Marketing Campaign

High Return on Investment: The marketing campaign offers a high return on investment with a benefit-cost ratio of 1.62. This indicates that the campaign is likely to yield substantial financial gains.

Short Payback Period: The campaign’s payback period of 8 months ensures that benefits are realized quickly. This short timeframe makes the campaign an attractive option for immediate returns.

Strategic Importance: Enhancing brand awareness and customer engagement through the marketing campaign can drive long-term growth. A strong brand presence can lead to sustained competitive advantage.

B. Launch New Product

Substantial Net Benefit: The new product launch offers a significant net benefit of $29,000, highlighting its financial potential. This substantial benefit justifies the initial investment.

Market Expansion: Introducing a new product can expand the cafe’s market reach and attract new customers. Market expansion is crucial for long-term growth and profitability.

Manageable Payback Period: With a payback period of 10 months, the new product launch ensures that the investment is recovered within a year. This manageable timeframe supports the initiative’s feasibility.

C. Implement Operational Upgrades

Efficiency Gains: Operational upgrades are expected to yield significant efficiency gains and cost savings. Improved efficiency can enhance overall operational performance and customer satisfaction.

Positive Net Benefit: The upgrades offer a positive net benefit of $17,000, indicating financial viability. This benefit supports the feasibility of the initiative.

Long-Term Benefits: Enhancing operational efficiency through upgrades can lead to long-term cost savings and improved service quality. These benefits contribute to sustained growth and profitability.

The strategic recommendations reveal that prioritizing initiatives with the highest financial returns and strategic importance can drive significant growth for [Your Company Name]. The marketing campaign, with its quick payback period and high return on investment, offers immediate financial benefits and enhances brand visibility. The new product launch, with its substantial net benefit and market expansion potential, positions the cafe for long-term growth and increased market share. Operational upgrades, while having the longest payback period, provide essential efficiency gains and cost savings, improving overall operational performance. By strategically focusing on these initiatives, [Your Company Name] can optimize resource allocation, enhance profitability, and achieve sustained growth.

IX. Conclusion

The cost-benefit analysis of [Your Company Name] reveals that the marketing campaign, new product launch, and operational upgrades are all financially viable initiatives. Each initiative offers significant net benefits, favorable benefit-cost ratios, and manageable payback periods, making them attractive options for investment. By carefully evaluating the costs and benefits associated with each initiative, the cafe can make informed strategic decisions that align with its long-term financial goals.

Prioritizing the marketing campaign, new product launch, and operational upgrades will enable [Your Company Name] to maximize its financial returns and achieve sustainable growth. These initiatives, supported by comprehensive financial and strategic analysis, provide a clear path to enhanced profitability and market positioning. By focusing on initiatives with the highest financial and strategic value, [Your Company Name] can ensure optimal resource allocation and long-term success.