Cafe Break Even Analysis

I. Introduction

A. Purpose of the Analysis

Determine Break-Even Point: The primary purpose of this analysis is to determine the break-even point for [Your Company Name]. Understanding this point helps in identifying the minimum sales required to cover all fixed and variable costs.

Financial Planning: This analysis aids in financial planning by providing insights into cost structures and profitability. It helps in setting realistic sales targets and budgeting effectively.

B. Scope of the Analysis

Fixed and Variable Costs: The analysis covers both fixed and variable costs associated with the cafe's operations. It includes expenses such as rent, utilities, salaries, ingredients, and other operational costs.

Revenue Streams: The analysis examines different revenue streams, including sales of coffee, pastries, and other menu items. It considers average selling prices and sales volume.

Profitability Metrics: The analysis focuses on key profitability metrics, such as contribution margin and break-even sales volume. These metrics help in evaluating the cafe's financial health.

C. Methodology

Data Collection: The methodology involves collecting financial data from the cafe's accounting records. This data includes monthly fixed and variable costs, as well as revenue figures.

Break-Even Calculation: The break-even point is calculated using the formula: Break-Even Point (in units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit). This calculation helps in understanding the sales volume required to cover all costs.

Sensitivity Analysis: A sensitivity analysis is conducted to examine how changes in key variables, such as costs and prices, affect the break-even point. This analysis helps in identifying potential risks and opportunities.

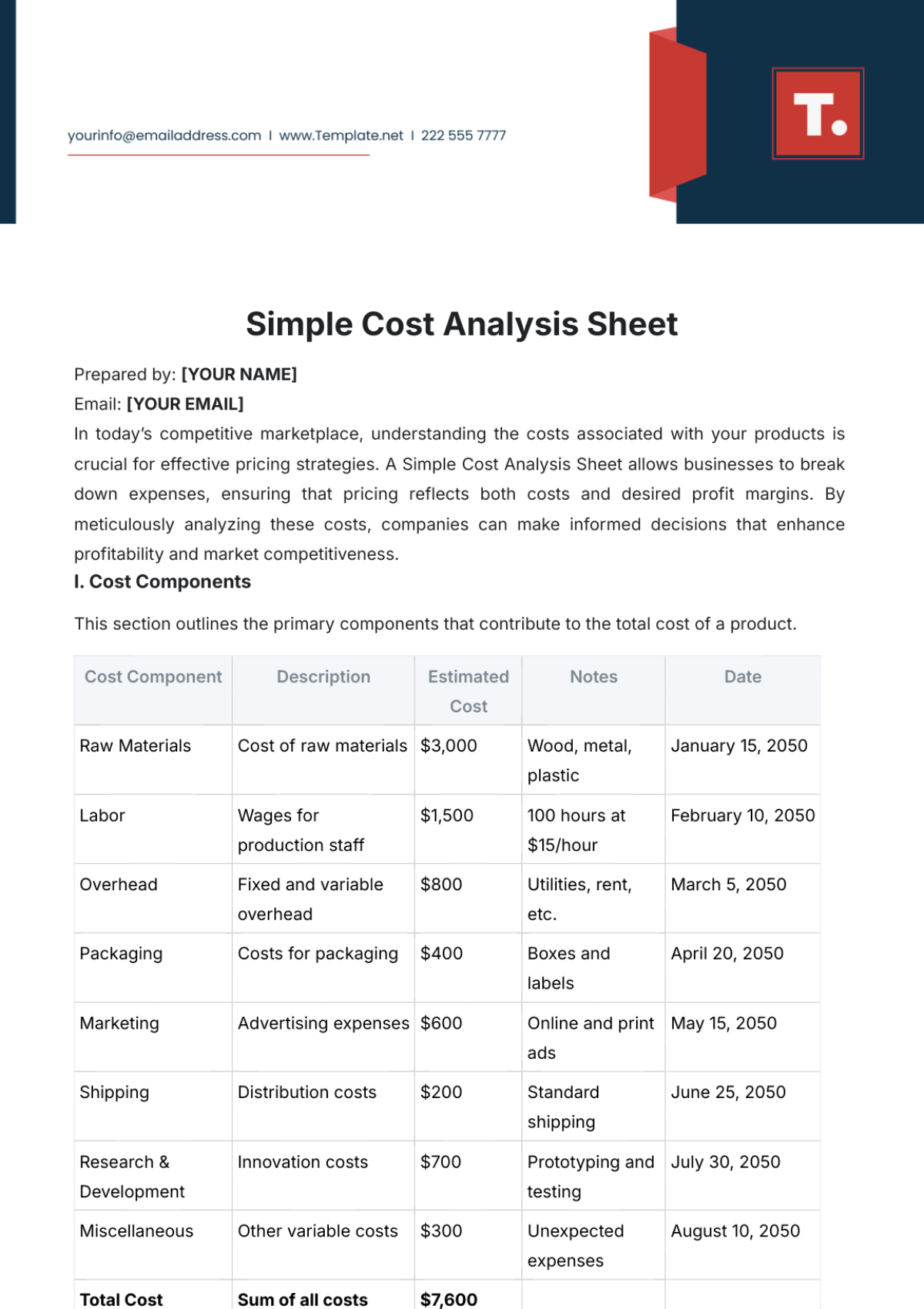

II. Cost Structure Analysis

The following table provides an overview of the fixed and variable costs for [Your Company Name]:

Cost Type | Description | Monthly Cost |

|---|---|---|

Fixed Costs | Rent | $3,000 |

Utilities | $500 | |

Salaries | $7,000 | |

Insurance | $300 | |

Marketing | $200 | |

Variable Costs | Coffee Beans | $1.50 per unit |

Pastry Ingredients | $2.00 per unit | |

Packaging | $0.50 per unit | |

Other Supplies | $0.30 per unit |

A. Fixed Costs

Rent: The cafe incurs a monthly rent of $3,000. This is a significant fixed cost that does not change with sales volume. Managing rent expenses is crucial for maintaining financial stability.

Utilities: Utilities cost $500 per month and include expenses for electricity, water, and other essential services. These costs are relatively stable and necessary for operations.

Salaries: Monthly salaries total $7,000, covering wages for baristas, kitchen staff, and other employees. Salary expenses are fixed and critical for maintaining a skilled workforce.

Insurance: The cafe spends $300 monthly on insurance to cover potential risks and liabilities. This fixed cost ensures financial protection and compliance with regulations.

Marketing: Monthly marketing expenses are $200, aimed at promoting the cafe and attracting customers. Effective marketing is essential for driving sales and brand awareness.

B. Variable Costs

Coffee Beans: The cost of coffee beans is $1.50 per unit. This variable cost fluctuates with the volume of coffee sold, impacting the overall cost structure.

Pastry Ingredients: Pastry ingredients cost $2.00 per unit. These costs vary based on the number of pastries sold, influencing profitability.

Packaging: Packaging costs $0.50 per unit and includes expenses for cups, lids, and bags. These variable costs change with sales volume.

Other Supplies: Other supplies, such as napkins and stirrers, cost $0.30 per unit. These variable costs are necessary for daily operations.

The cost structure reveals the importance of managing both fixed and variable costs. Fixed costs, such as rent and salaries, are essential for maintaining operations but require careful budgeting to avoid financial strain. Variable costs, including coffee beans and pastry ingredients, directly impact profitability as they fluctuate with sales volume. By understanding the cost structure, [Your Company Name] can implement strategies to control expenses, optimize pricing, and improve overall financial performance.

III. Revenue Analysis

The following table provides an overview of the average selling prices and monthly sales volumes for the cafe's main products:

Product | Average Selling Price | Monthly Sales Volume (Units) |

|---|---|---|

Coffee | $4.00 | 3,000 |

Pastries | $3.00 | 2,000 |

Other Beverages | $3.50 | 1,500 |

Snacks | $2.50 | 1,000 |

A. Coffee Sales

Revenue Contribution: Coffee sales contribute significantly to the cafe’s revenue, with an average selling price of $4.00 and a monthly sales volume of 3,000 units. This highlights coffee as a key product for driving revenue.

Profit Margin: With a selling price of $4.00 and variable cost of $1.50 per unit, the contribution margin for coffee is $2.50 per unit. High profit margins on coffee sales enhance overall profitability.

Market Demand: The high sales volume of 3,000 units per month indicates strong market demand for coffee. Meeting this demand consistently is crucial for sustaining revenue.

Product Quality: Maintaining high product quality is essential for retaining customers and driving repeat sales. Quality control measures ensure consistency and customer satisfaction.

B. Pastry Sales

Revenue Contribution: Pastries generate significant revenue, with an average selling price of $3.00 and a monthly sales volume of 2,000 units. Pastries are a popular item, contributing to overall sales.

Profit Margin: With a selling price of $3.00 and variable cost of $2.00 per unit, the contribution margin for pastries is $1.00 per unit. While lower than coffee, pastries still provide a positive contribution margin.

Product Variety: Offering a variety of pastries can attract diverse customer preferences and increase sales. Regularly updating the menu with new items can boost customer interest.

Quality and Freshness: Ensuring the quality and freshness of pastries is vital for customer satisfaction. High-quality ingredients and proper storage practices are essential.

C. Other Beverages Sales

Revenue Contribution: Other beverages, such as teas and smoothies, contribute to revenue with an average selling price of $3.50 and a monthly sales volume of 1,500 units. These beverages diversify the product offering.

Profit Margin: With a selling price of $3.50 and variable cost comparable to coffee, the contribution margin is substantial. Other beverages enhance overall profitability.

Product Diversification: Diversifying the beverage menu can attract different customer segments and increase sales. Offering seasonal beverages can boost interest and revenue.

Customer Preferences: Understanding and catering to customer preferences for beverages can drive sales. Regular customer feedback can guide menu adjustments.

D. Snacks Sales

Revenue Contribution: Snacks contribute to revenue with an average selling price of $2.50 and a monthly sales volume of 1,000 units. Snacks complement beverage sales and enhance the customer experience.

Profit Margin: With a selling price of $2.50 and variable cost of $0.80 per unit, the contribution margin for snacks is $1.70 per unit. Snacks provide a healthy profit margin.

Impulse Purchases: Snacks often drive impulse purchases, increasing overall sales. Strategically placing snacks near the counter can encourage additional purchases.

Product Offering: Offering a variety of snacks can cater to different customer tastes and increase sales. Healthy snack options can appeal to health-conscious customers.

The revenue analysis highlights the importance of understanding product performance and customer preferences. Coffee remains the top revenue driver, with high sales volume and profit margins. Pastries and other beverages also contribute significantly, offering opportunities for menu diversification and customer engagement. Snacks, while generating lower sales volumes, provide substantial profit margins and complement the main products. By analyzing revenue contributions and margins, [Your Company Name] can optimize its product mix, pricing strategies, and marketing efforts to maximize profitability.

IV. Break-Even Analysis

The following table provides the break-even analysis for [Your Company Name], including fixed costs, variable costs per unit, and the break-even point in units and dollars:

Cost Type | Amount |

|---|---|

Fixed Costs | $11,000 |

Variable Costs | $4.30 per unit |

Average Selling Price | $3.80 per unit |

Break-Even Point (Units) | 2,750 units |

Break-Even Point (Dollars) | $10,450 |

A. Fixed Costs

Total Fixed Costs: The total fixed costs for the cafe amount to $11,000 per month. These costs include rent, utilities, salaries, insurance, and marketing. Managing fixed costs is crucial for maintaining financial stability.

Implications for Break-Even: High fixed costs mean that the cafe must generate significant sales to cover these expenses. Effective cost management strategies are essential for reducing financial pressure.

B. Variable Costs

Variable Cost per Unit: The variable cost per unit is $4.30, which includes costs for coffee beans, pastry ingredients, packaging, and other supplies. Variable costs fluctuate with sales volume, impacting profitability.

Implications for Break-Even: Lowering variable costs through efficient sourcing and waste reduction can improve profitability. Controlling variable costs is key to achieving a lower break-even point.

C. Average Selling Price

Average Selling Price per Unit: The average selling price per unit is $3.80, calculated based on the weighted average of all products sold. Pricing strategies influence the break-even point and overall profitability.

Implications for Break-Even: Setting optimal prices that balance customer demand and profitability is essential. Competitive pricing strategies can attract more customers and increase sales volume.

D. Break-Even Point

Break-Even Point in Units: The break-even point is 2,750 units per month. This is the sales volume required to cover all fixed and variable costs. Reaching this sales volume ensures that the cafe operates without losses.

Break-Even Point in Dollars: The break-even point in dollars is $10,450 per month. This is the revenue required to cover all costs. Achieving this revenue ensures financial stability and operational sustainability.

The break-even analysis reveals that managing both fixed and variable costs is crucial for achieving profitability. High fixed costs necessitate significant sales volume to break even, emphasizing the importance of cost control measures. Lowering variable costs through efficient sourcing and waste reduction can improve profit margins and reduce the break-even point. Setting optimal prices that balance customer demand and profitability is essential for maximizing revenue. By understanding and managing these key factors, [Your Company Name] can achieve financial stability and sustainable growth.

V. Sensitivity Analysis

The following table presents a sensitivity analysis for [Your Company Name], examining how changes in key variables affect the break-even point:

Variable | Current Value | Adjusted Value | Break-Even Point (Units) | Change in Break-Even Point |

|---|---|---|---|---|

Fixed Costs | $11,000 | $12,000 | 2,895 | +145 units |

Variable Costs | $4.30 per unit | $4.50 per unit | 3,056 | +306 units |

Selling Price | $3.80 per unit | $4.00 per unit | 2,500 | -250 units |

A. Impact of Increased Fixed Costs

Adjusted Fixed Costs: Increasing fixed costs to $12,000 raises the break-even point to 2,895 units. This highlights the sensitivity of the break-even point to fixed cost changes.

Financial Implications: Higher fixed costs necessitate higher sales volumes to break even. Effective cost management and revenue generation strategies are essential to offset increased fixed costs.

B. Impact of Increased Variable Costs

Adjusted Variable Costs: Raising variable costs to $4.50 per unit increases the break-even point to 3,056 units. This underscores the impact of variable cost fluctuations on profitability.

Financial Implications: Higher variable costs reduce profit margins, requiring higher sales volumes to achieve break-even. Efficient sourcing and cost control measures are crucial to manage variable costs.

C. Impact of Increased Selling Price

Adjusted Selling Price: Increasing the average selling price to $4.00 per unit lowers the break-even point to 2,500 units. This demonstrates how pricing strategies can influence the break-even point.

Financial Implications: Higher selling prices improve profit margins and reduce the required sales volume to break even. However, price increases must consider customer demand and competitive positioning.

The sensitivity analysis reveals that managing fixed and variable costs and setting optimal prices are critical for achieving financial stability. Increases in fixed or variable costs significantly impact the break-even point, highlighting the importance of cost control measures. Efficient sourcing and waste reduction can help manage variable costs, while effective budgeting and expense management can control fixed costs. Pricing strategies that improve profit margins without adversely affecting customer demand can lower the break-even point, enhancing profitability. By understanding and managing these key variables, [Your Company Name] can achieve sustainable growth and financial stability.

VI. Risk Assessment

A. Market Risks

Competitive Pressure: The cafe industry is highly competitive, with numerous players vying for market share. Competitive pressure can impact pricing strategies and sales volumes.

Consumer Preferences: Changes in consumer preferences and trends can affect demand for the cafe's products. Staying attuned to market trends and customer feedback is essential for adapting the product offering.

Economic Conditions: Economic downturns can reduce consumer spending, impacting sales volumes and profitability. Diversifying revenue streams and maintaining a strong value proposition can mitigate economic risks.

Regulatory Changes: Changes in regulations, such as health and safety standards, can impact operational costs and compliance requirements. Staying informed and compliant with regulations is crucial for avoiding penalties and disruptions.

B. Operational Risks

Supply Chain Disruptions: Disruptions in the supply chain can impact the availability and cost of ingredients and supplies. Developing strong supplier relationships and contingency plans can mitigate supply chain risks.

Employee Turnover: High employee turnover can lead to increased recruitment and training costs, impacting operational efficiency. Implementing employee retention strategies and fostering a positive work environment are essential.

Operational Efficiency: Inefficiencies in operations can lead to increased costs and reduced profitability. Regular process reviews and continuous improvement initiatives can enhance operational efficiency.

Equipment Maintenance: Regular maintenance of equipment is essential to avoid breakdowns and disruptions. Implementing a preventive maintenance program can ensure operational continuity.

The risk assessment reveals the importance of proactive risk management strategies for maintaining financial stability and operational efficiency. Market risks, such as competitive pressure and changing consumer preferences, necessitate adaptive strategies and continuous market monitoring. Economic conditions and regulatory changes require a resilient business model and compliance measures. Operational risks, including supply chain disruptions and employee turnover, highlight the need for strong supplier relationships, employee retention strategies, and operational efficiency initiatives. By identifying and managing these risks, [Your Company Name] can achieve sustainable growth and profitability.

VII. Strategic Recommendations

Based on the break-even and sensitivity analysis, the following strategic recommendations are proposed for [Your Company Name]:

A. Cost Management

Fixed Cost Control: Implementing measures to control fixed costs, such as negotiating favorable lease terms and optimizing utility usage, can reduce financial pressure. Effective budgeting and expense management are essential for maintaining financial stability.

Variable Cost Control: Efficient sourcing, waste reduction, and inventory management can help control variable costs. Developing strong supplier relationships and implementing cost-saving initiatives are crucial for managing variable expenses.

Process Improvements: Regular process reviews and continuous improvement initiatives can enhance operational efficiency and reduce costs. Investing in technology and training can support process optimization.

B. Pricing Strategies

Optimal Pricing: Setting optimal prices that balance customer demand and profitability is essential. Regularly reviewing and adjusting prices based on market conditions and cost structures can improve profit margins.

Value Proposition: Enhancing the value proposition through quality products, exceptional service, and unique offerings can justify higher prices. Differentiating the cafe from competitors can attract and retain customers.

Promotional Offers: Implementing promotional offers and loyalty programs can drive sales and customer retention. Targeted promotions can attract new customers and boost repeat business.

C. Revenue Diversification

Product Diversification: Expanding the product offering to include seasonal items, specialty beverages, and healthy options can attract diverse customer segments and increase sales.

New Revenue Streams: Exploring new revenue streams, such as catering services and online sales, can diversify income and reduce reliance on in-store sales. Leveraging digital platforms can expand market reach.

Partnerships: Forming partnerships with local businesses and organizations can create new opportunities for revenue generation and brand exposure. Collaborative initiatives can drive customer traffic and sales.

The strategic recommendations highlight the importance of cost management, optimal pricing, and revenue diversification for achieving financial stability and growth. Controlling fixed and variable costs through efficient sourcing, process improvements, and effective budgeting can reduce financial pressure and enhance profitability. Setting optimal prices that balance customer demand and profit margins is essential for maximizing revenue. Diversifying the product offering and exploring new revenue streams can attract diverse customer segments and reduce reliance on in-store sales. By implementing these strategic recommendations, [Your Company Name] can achieve sustainable growth and long-term profitability.

VIII. Implementation Plan

A. Cost Management Initiatives

Fixed Cost Reduction: Implementing measures to control fixed costs, such as negotiating lease terms and optimizing utility usage, can reduce financial pressure. Regular expense reviews and budget adjustments are essential for maintaining financial stability.

Variable Cost Control: Efficient sourcing, waste reduction, and inventory management can help control variable costs. Developing strong supplier relationships and implementing cost-saving initiatives are crucial for managing variable expenses.

Process Improvements: Regular process reviews and continuous improvement initiatives can enhance operational efficiency and reduce costs. Investing in technology and training can support process optimization.

B. Pricing Strategy Adjustments

Price Optimization: Regularly reviewing and adjusting prices based on market conditions and cost structures can improve profit margins. Implementing dynamic pricing strategies can optimize revenue.

Value Enhancement: Enhancing the value proposition through quality products, exceptional service, and unique offerings can justify higher prices. Differentiating the cafe from competitors can attract and retain customers.

Promotional Campaigns: Implementing targeted promotional campaigns and loyalty programs can drive sales and customer retention. Regularly evaluating the effectiveness of promotions can optimize marketing efforts.

C. Revenue Diversification Efforts

Product Expansion: Expanding the product offering to include seasonal items, specialty beverages, and healthy options can attract diverse customer segments and increase sales. Regularly updating the menu can maintain customer interest.

New Income Streams: Exploring new revenue streams, such as catering services and online sales, can diversify income and reduce reliance on in-store sales. Leveraging digital platforms can expand market reach.

Partnership Initiatives: Forming partnerships with local businesses and organizations can create new opportunities for revenue generation and brand exposure. Collaborative initiatives can drive customer traffic and sales.

The implementation plan emphasizes the importance of proactive measures for achieving strategic goals. Cost management initiatives, such as controlling fixed and variable costs, are essential for maintaining financial stability. Pricing strategy adjustments that optimize revenue and enhance value can improve profit margins and customer satisfaction. Revenue diversification efforts, including product expansion and exploring new income streams, can attract diverse customer segments and reduce reliance on in-store sales. By implementing these initiatives, [Your Company Name] can achieve sustainable growth and long-term profitability.

IX. Conclusion

The break-even analysis of [Your Company Name] highlights the importance of managing fixed and variable costs, setting optimal prices, and diversifying revenue streams for achieving financial stability and growth. By understanding the break-even point and conducting sensitivity analyses, the cafe can make informed decisions to optimize profitability and mitigate risks.

Effective cost management, strategic pricing, and revenue diversification efforts are crucial for sustaining operations and driving long-term success. Implementing the recommended strategies and initiatives will enable [Your Company Name] to navigate market challenges, enhance customer satisfaction, and achieve sustainable growth in the competitive cafe industry.