Free Cafe Expense Report

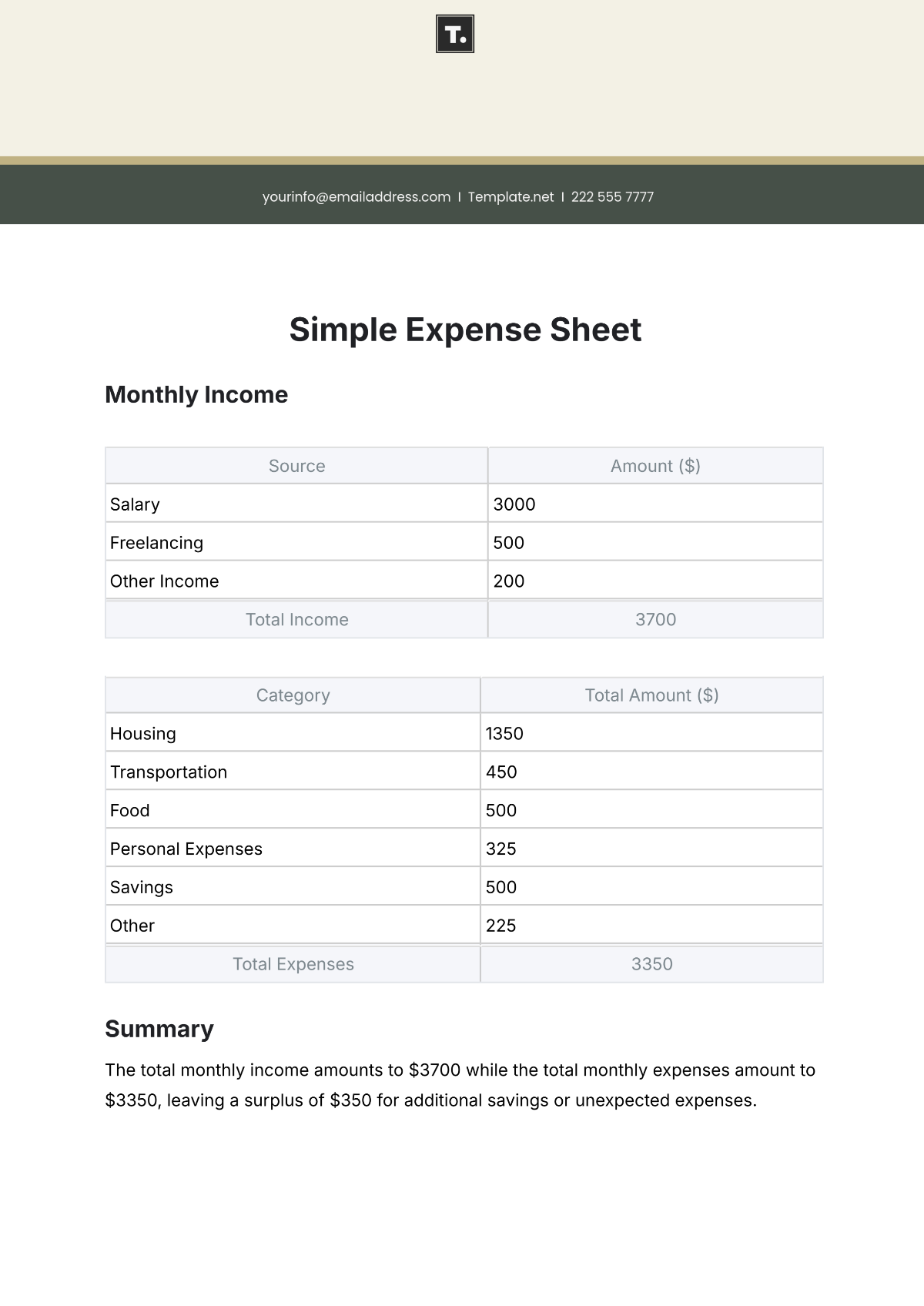

Discover efficiency with the Cafe Expense Report Template from Template.net. This editable and customizable tool streamlines financial tracking for cafes. With its intuitive AI Editor Tool, effortlessly monitor expenses, from COGS to operating costs. Maximize profitability and make informed decisions with this comprehensive template. Simplify cafe management today and unlock success with Template.net's innovative solution.