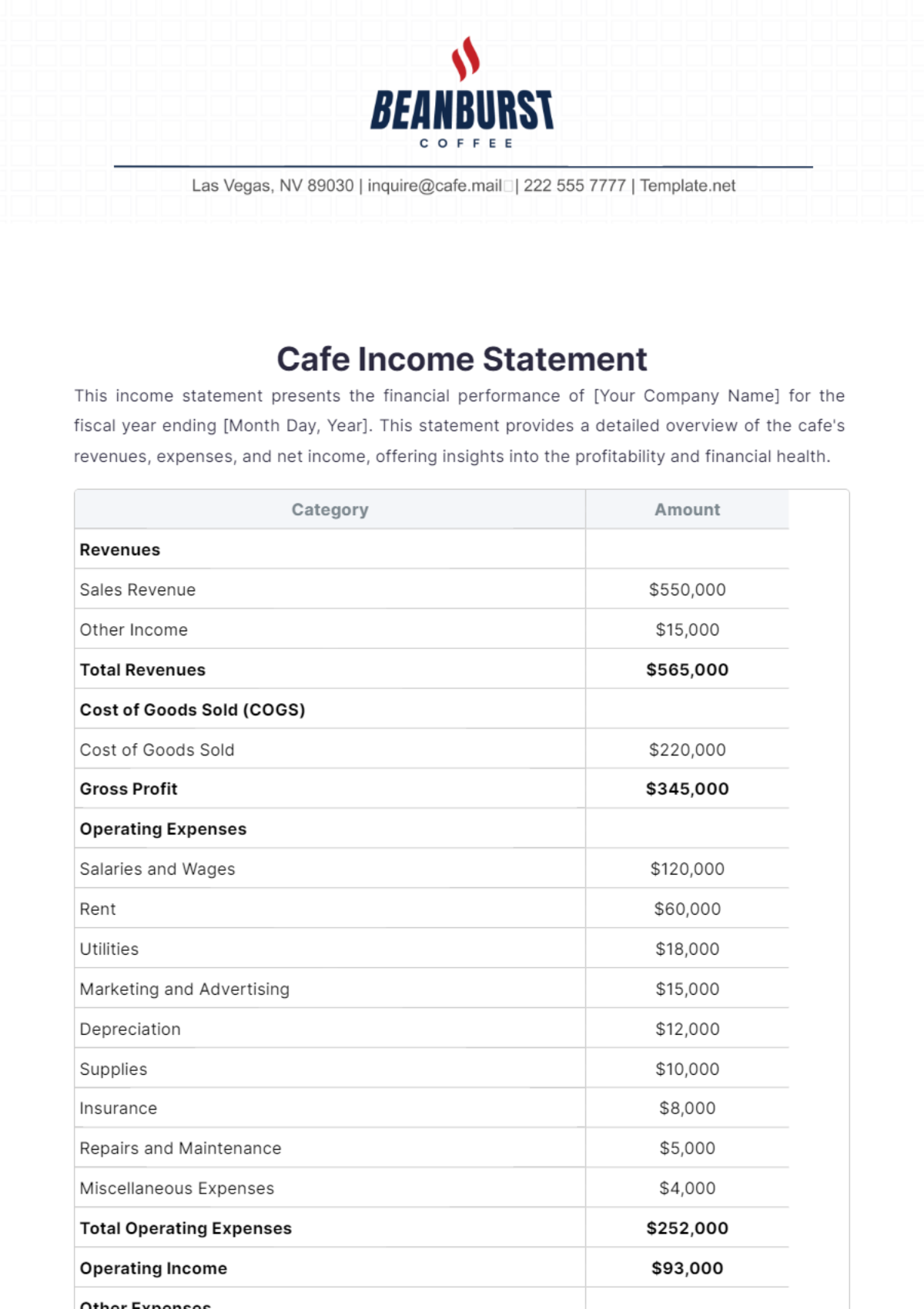

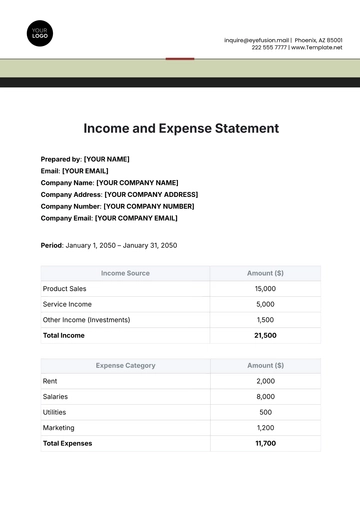

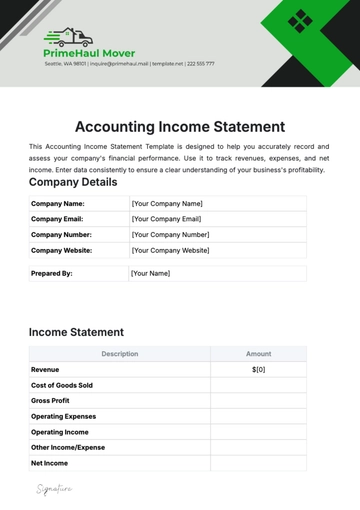

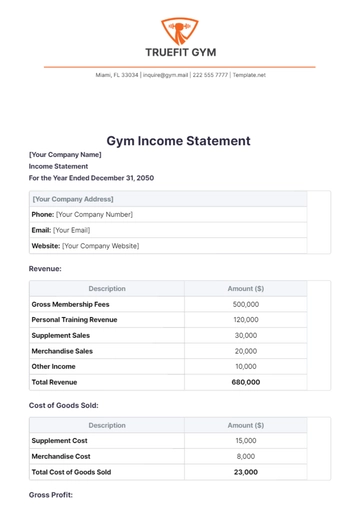

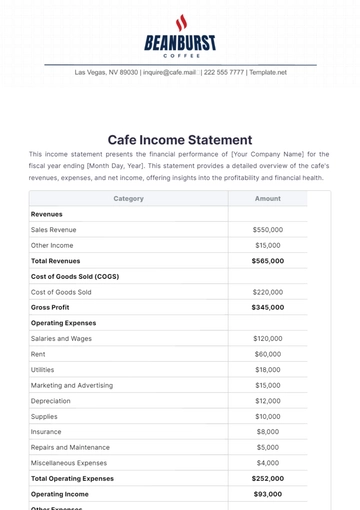

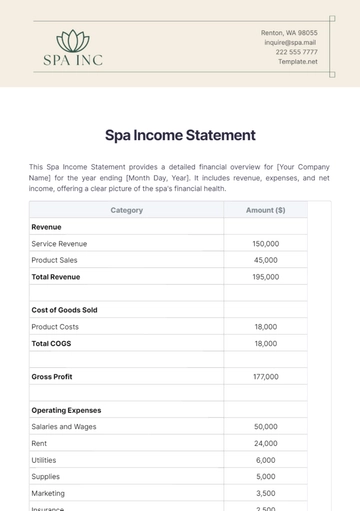

Cafe Income Statement

This income statement presents the financial performance of [Your Company Name] for the fiscal year ending [Month Day, Year]. This statement provides a detailed overview of the cafe's revenues, expenses, and net income, offering insights into the profitability and financial health.

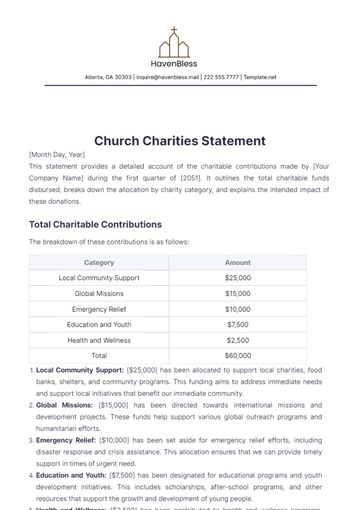

Category | Amount |

|---|

Revenues | |

Sales Revenue | $550,000 |

Other Income | $15,000 |

Total Revenues | $565,000 |

Cost of Goods Sold (COGS) | |

Cost of Goods Sold | $220,000 |

Gross Profit | $345,000 |

Operating Expenses | |

Salaries and Wages | $120,000 |

Rent | $60,000 |

Utilities | $18,000 |

Marketing and Advertising | $15,000 |

Depreciation | $12,000 |

Supplies | $10,000 |

Insurance | $8,000 |

Repairs and Maintenance | $5,000 |

Miscellaneous Expenses | $4,000 |

Total Operating Expenses | $252,000 |

Operating Income | $93,000 |

Other Expenses | |

Interest Expense | $7,000 |

Total Other Expenses | $7,000 |

Net Income Before Taxes | $86,000 |

Income Tax Expense | $25,800 |

Net Income | $60,200 |

The income statement of [Your Company Name] for the fiscal year ending [Month Day, Year], demonstrates a solid financial performance with total revenues amounting to [$565,000] and a net income of [$60,200]. The cafe's gross profit of [$345,000] highlights effective cost management in goods sold, while the operating expenses are well-controlled, ensuring sustainable operational profitability. The net income before taxes stands at [$86,000], showcasing the cafe's ability to generate a healthy profit before accounting for tax liabilities. The final net income after taxes, amounting to [$60,200], reflects the overall successful financial management and operational efficiency of [Your Company Name]. This positive financial outcome positions [Your Company Name] favorably for future growth and expansion.

Cafe Templates @ Template.net