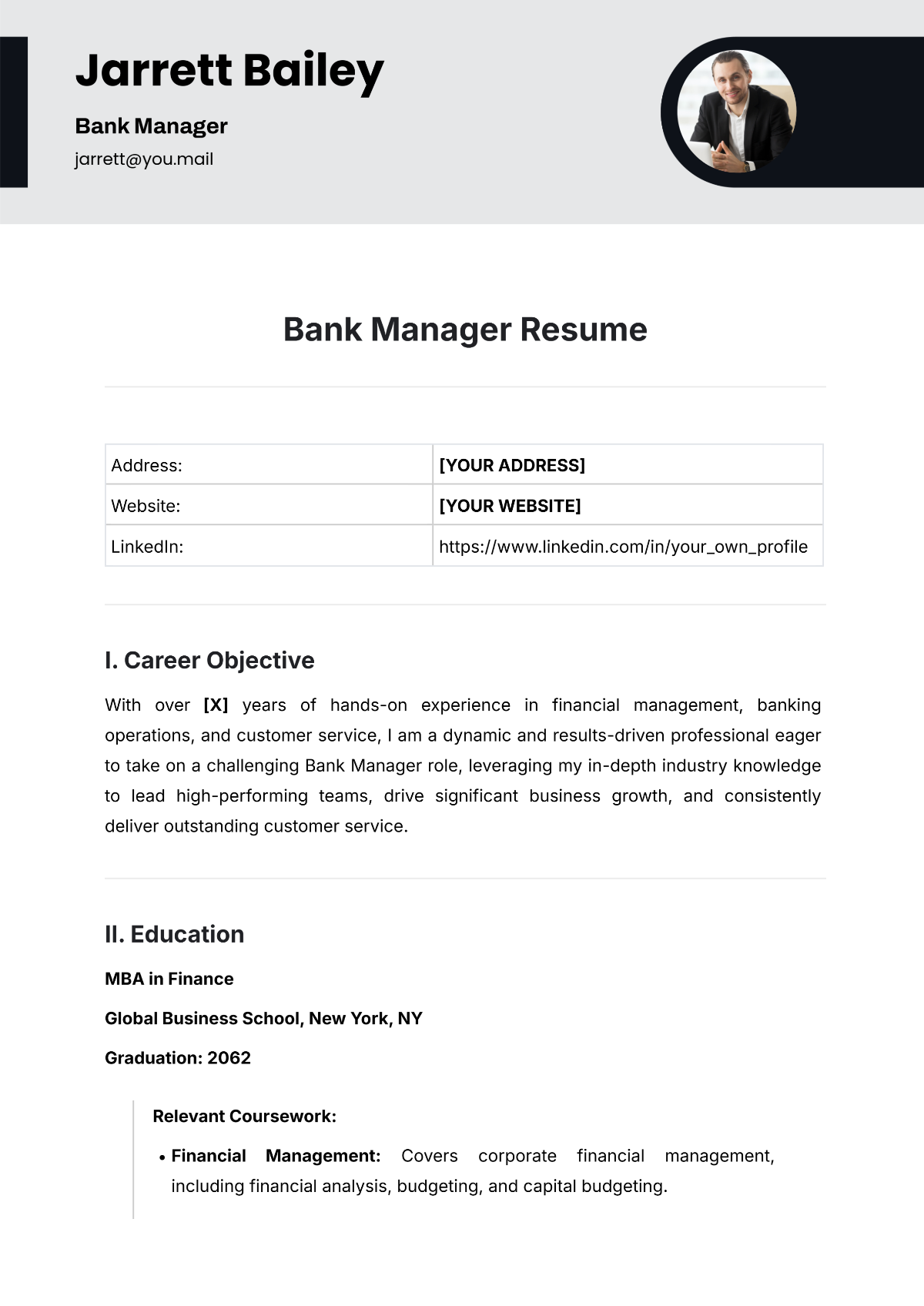

Free Bank Manager Resume

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

I. Career Objective

With over [X] years of hands-on experience in financial management, banking operations, and customer service, I am a dynamic and results-driven professional eager to take on a challenging Bank Manager role, leveraging my in-depth industry knowledge to lead high-performing teams, drive significant business growth, and consistently deliver outstanding customer service.

II. Education

MBA in Finance

Global Business School, New York, NY

Graduation: 2062

Relevant Coursework:

Financial Management: Covers corporate financial management, including financial analysis, budgeting, and capital budgeting.

Investments and Portfolio Management: Focuses on investment strategies, risk management, and portfolio diversification techniques in financial markets.

Corporate Finance: Explores financial strategies for corporations, including capital structure decisions, dividend policy, and mergers and acquisitions.

International Finance: Examines global financial markets, foreign exchange risk management, and international capital budgeting decisions.

Bachelor of Science in Economics

Summit University, Los Angeles, CA

Graduation: 2058

Relevant Coursework:

Microeconomics: Analyzes individual economic behavior, market equilibrium, and decision-making processes of firms and consumers within an economy.

Macroeconomics: Studies economic indicators and policies like GDP, inflation, unemployment, and their impacts.

Econometrics: Introduces statistical methods for analyzing economic data, including regression analysis and hypothesis testing in economic research.

Public Finance: Explores government revenue generation, expenditure policies, taxation systems, and their impact on economic welfare and public goods.

III. Qualification

Proven track record of managing branch operations and achieving sales targets.

Strong understanding of financial products, services, and regulatory requirements.

Excellent communication, leadership, and problem-solving skills.

Strong familiarity with banking regulations and compliance standards, ensuring strict adherence to regulatory requirements to mitigate risks and maintain integrity.

IV. Skills

Financial Analysis

Risk Management

Customer Relationship Management

Team Leadership and Development

Strategic Planning

Sales and Marketing

Regulatory Compliance

Budgeting and Forecasting

V. Professional Experience

Pinnacle Financial Group, New York, NY

March 2065 – Present

Managed daily branch operations, ensuring regulatory compliance.

Implemented training to boost staff performance and customer satisfaction.

Fostered a positive, growth-oriented team spirit.

Boosted branch revenue by 20% using targeted sales strategies and top-notch customer service.

Assistant Branch Manager

Pinnacle Financial Group, New York, NY

July 2062 – February 2065

Assisted in branch operations: staffing, scheduling, and customer service.

Performed regular audits to ensure compliance.

Boosted deposits by 15% through client relationship management.

Coordinated with other departments to optimize branch performance and achieve business objectives

VI. Achievement

Successfully led branch transformation project, reducing operational costs by 15%

Boosted customer retention by 25% with better relationship management.

Recognized as "Top Branch Manager" for three consecutive years for outstanding performance

VII. Certification

Certified Financial Services Auditor (CFSA)

Six Sigma Green Belt

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

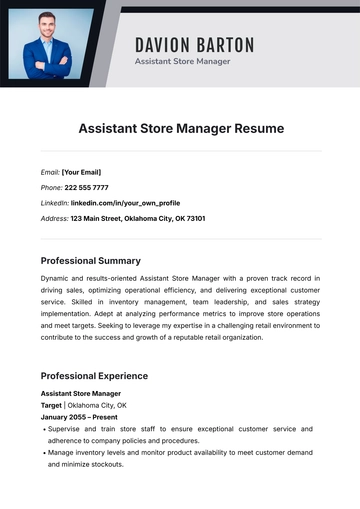

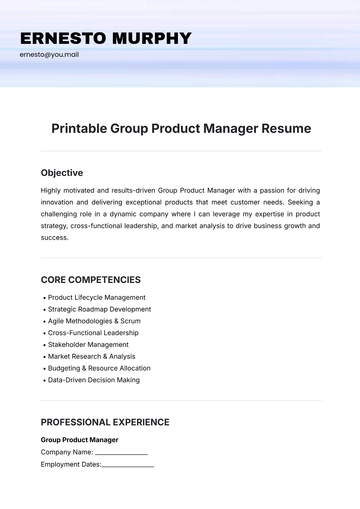

Elevate your career with our Bank Manager Resume from Template.net. This professional template is fully customizable, allowing you to showcase your leadership abilities and banking experience. Editable in our Ai Editor Tool, it ensures you can personalize every aspect to match your career highlights. Impress hiring managers with a standout resume that reflects your managerial expertise.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

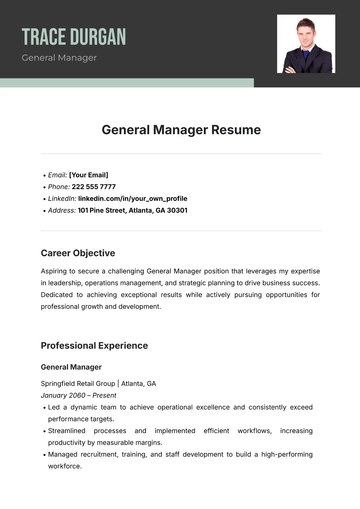

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume