Free Corporate Banking Executive Resume

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

I. Career Objective

Experienced Corporate Banking Executive with expertise in managing corporate banking operations, driving financial growth and fostering strong client relationships. Seeking to leverage my extensive background in financial products, strategic initiatives, and team leadership to contribute to the success of [YOUR COMPANY NAME] as a Corporate Banking Executive.

II. Education

Master of Business Administration in Finance

University of Global Excellence, New York, NY

Graduation: 2062

Relevant Coursework:

Financial Management: Comprehensive study of financial decision-making, including capital budgeting, risk management, and financial planning.

Corporate Finance: Analysis of corporate financial policies, capital structure decisions, and valuation techniques.

Investment Analysis: Examination of investment strategies, portfolio management, and asset pricing models.

Financial Markets and Institutions: Exploration of financial markets, banking systems, and regulatory frameworks impacting global finance.

Bachelor of Science in Economics

Metropolitan State University, Chicago, IL

Graduation: 2060

Relevant Coursework:

Microeconomic Theory: Analysis of individual economic behavior, market equilibrium, and decision-making under constraints.

Macroeconomic Analysis: Study of national economic performance, including growth, inflation, unemployment, and monetary policy.

Econometrics: Application of statistical methods to economic data for testing hypotheses and forecasting economic variables.

International Economics: Examination of trade theories, exchange rate determination, and policies influencing global economic interactions.

III. Qualifications

Proven track record of managing multi-million-dollar corporate accounts

Extensive knowledge of financial products and banking regulations

Strong leadership and team-building capabilities

Excellent communication and client relationship management skills

IV. Skills

Financial Analysis and Modeling

Corporate Banking Operations

Client Relationship Management

Risk Management

Strategic Planning

Team Leadership

Regulatory Compliance

V. Professional Experience

Senior Corporate Banking Manager

Global Capital Solutions, New York, NY

January 2062 – Present

Managed a portfolio of corporate accounts worth over $500 million

Led a team of 10 banking professionals to achieve annual revenue targets

Improved service delivery and customer satisfaction with strategic plans.

Collaborated with regulators to ensure banking compliance.

Identified and mitigated financial risks, resulting in a 15% reduction in risk exposure

Corporate Banking Officer

Metropolitan Financial Group, Chicago, IL

July 2060 – December 2061

Trained and mentored junior banking staff

Analyzed finances and assessed risks for corporate loan applications.

Worked with senior management to launch new financial products

Fostered and maintained relationships with corporate clients, achieving a 20% increase in client retention

VI. Achievements

Awarded “Top Performer” for three consecutive years

Increased corporate account portfolio by 30% within the first year

Successfully led a team that achieved a $10 million revenue growth in one fiscal year

VII. Certifications

Chartered Financial Analyst (CFA)

Certified Corporate Banker (CCB)

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

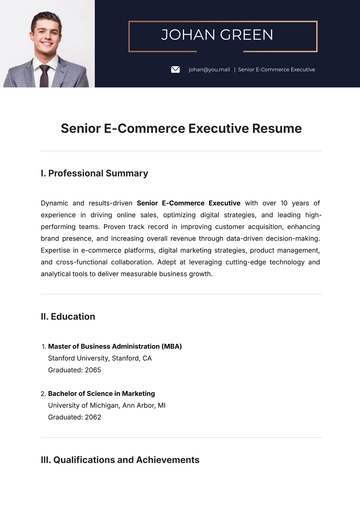

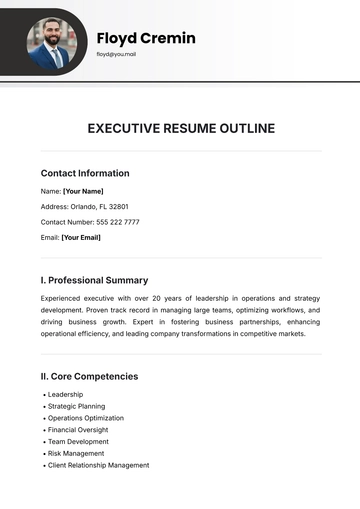

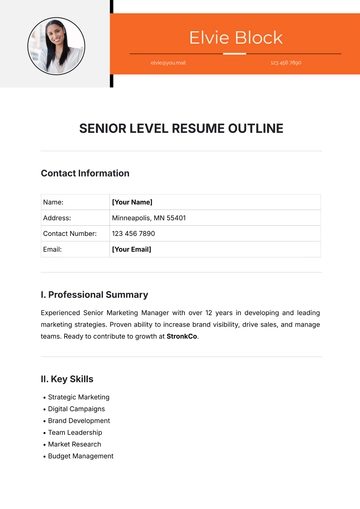

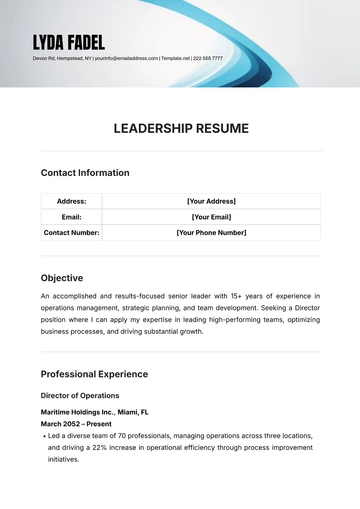

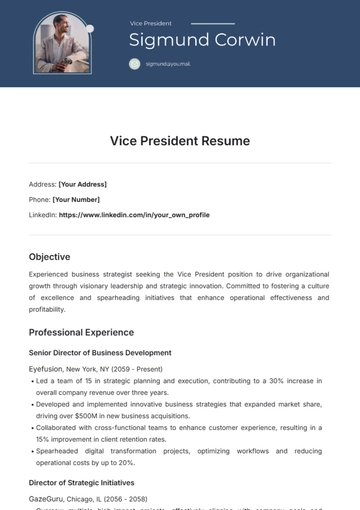

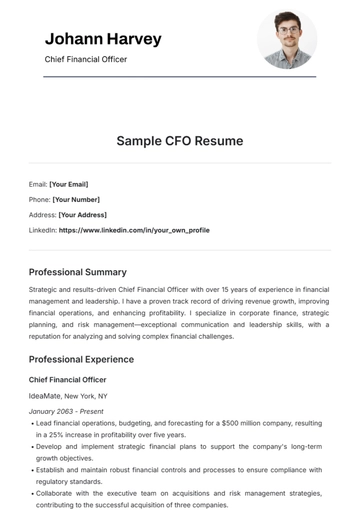

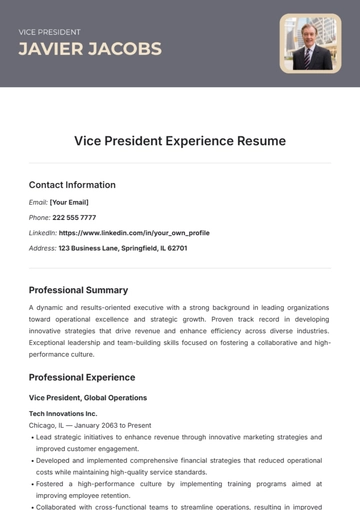

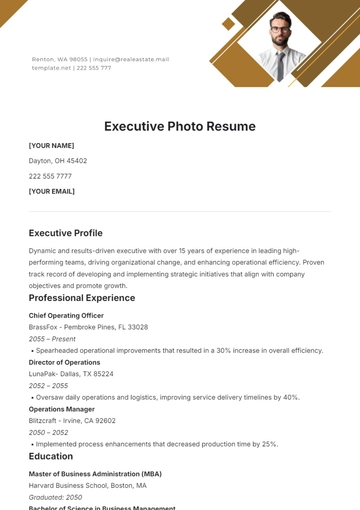

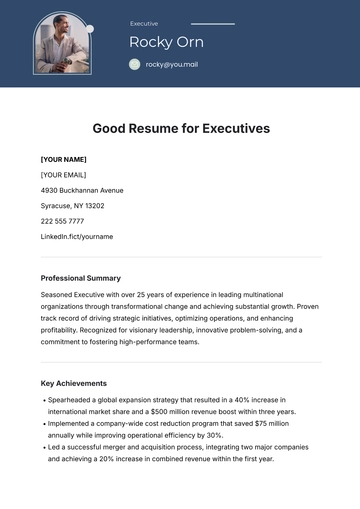

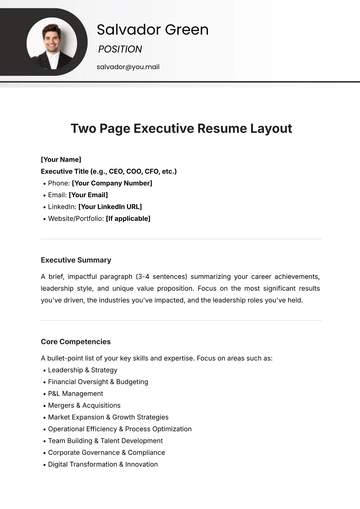

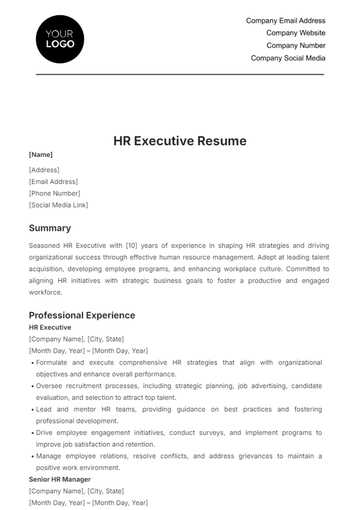

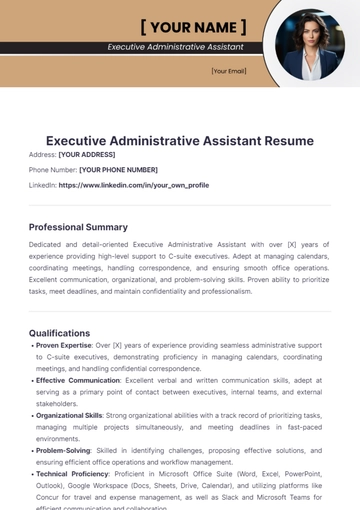

Climb the corporate ladder with our Corporate Banking Executive Resume from Template.net. This professional and customizable template is designed to highlight your executive experience and banking expertise. Editable in our Ai Editor Tool, it offers flexibility to tailor your resume to your career achievements. Impress top firms with a resume that reflects your leadership and strategic abilities.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume