Free Printable Online Banker Resume

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

Professional Summary

An accomplished Online Banker with a successful history in providing outstanding online banking services, equipped with extensive knowledge of digital banking platforms and technologies, strong analytical skills for process optimization and customer experience enhancement, and adept at fostering client relationships for satisfaction and loyalty, aims to utilize a Finance Bachelor's degree and three years of online banking experience to add value to a financial institution.

Education

Bachelor of Science in Finance

New Horizons University, 2060

Relevant Coursework:

Financial Technology Innovations: Explored advancements in digital banking and payment systems, focusing on emerging technologies like blockchain and AI.

Investment Analysis and Portfolio Management: Gained expertise in evaluating investment opportunities and constructing diversified portfolios to manage risk and optimize returns.

Corporate Financial Strategy: Studied corporate finance principles, including capital structure decisions, financial planning, and growth strategies.

Work Experience

Online Banking Specialist, VirtualEdge Banking Corp

July 2066 – Present

Developed a new online banking platform, increasing user adoption by 30%.

Teamed up to resolve tech issues, enhancing reliability and performance.

Regularly analyzed online banking metrics to identify trends and opportunities.

Trained and supported colleagues on new online banking technologies.

Delivered personalized online banking support, ensuring client satisfaction and retention.

Digital Banking Manager, Nexus Financial Solutions

January 2063 – November 2066

Led a team of online banking specialists to a 95% customer satisfaction rate.

Researched emerging trends and opportunities in online banking.

Launched new online banking products with marketing and product teams.

Reported to senior management on online banking performance and initiatives.

Increased online banking sales and revenue by 20% annually through strategic initiatives.

Qualifications and Achievements

Boosted customer engagement by 20% with new online banking features.

Launched targeted marketing campaigns, boosting online banking users by 15%.

Streamlined online account opening processes, reducing processing time by 25%.

Earned COBP certification for online banking proficiency.

Launched innovative digital banking solutions with cross-functional teams.

Skills

Technical Skills

Proficient in various digital banking platforms

Knowledgeable in online payment systems such as PayPal, Stripe, and Square

Expert in online banking cybersecurity, encryption, and MFA.

Skilled in data analysis tools such as Microsoft Excel and Tableau

Interpersonal Skills

Excellent communication and interpersonal abilities

Strong problem-solving skills

Customer-focused approach

Ability to work effectively in a team environment

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Boost your online banking career with the Online Banker Resume from Template.net. This fully customizable and editable template allows you to present your skills professionally. Easily tailor your resume using our Ai Editor Tool, ensuring it reflects your unique qualifications. Stand out in the digital banking industry with a resume designed for success.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

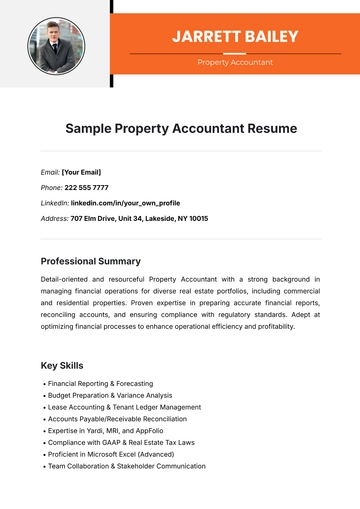

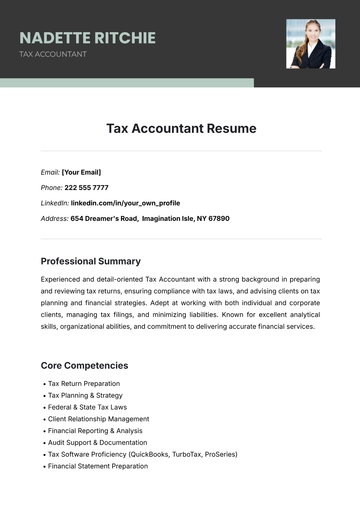

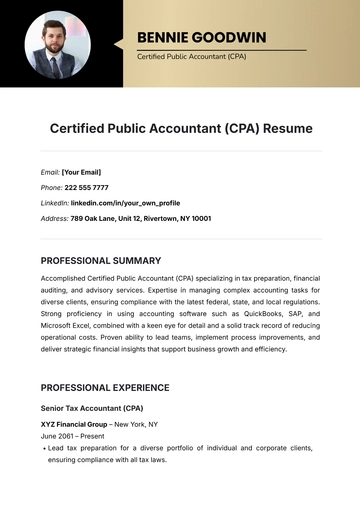

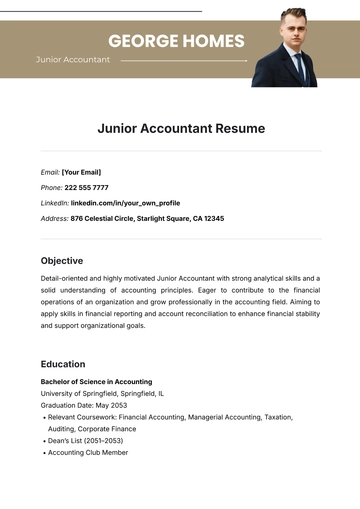

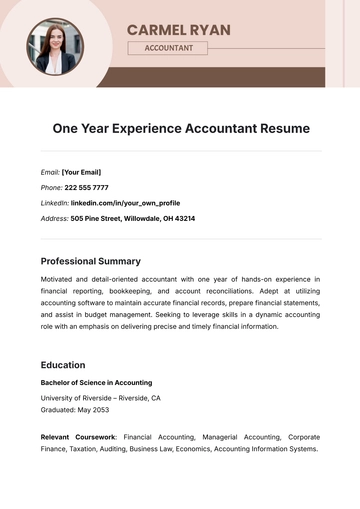

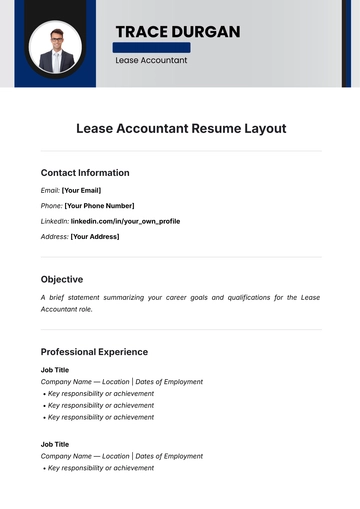

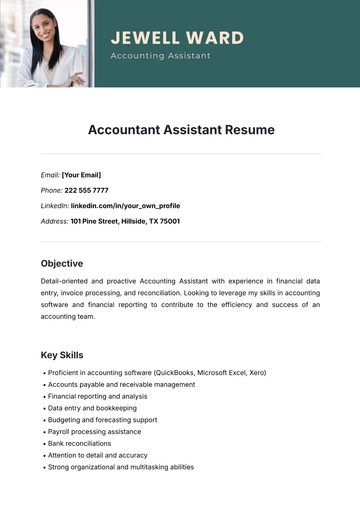

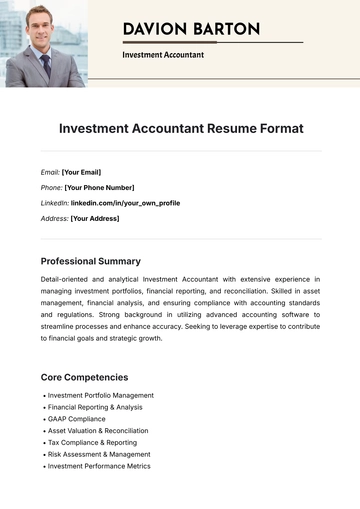

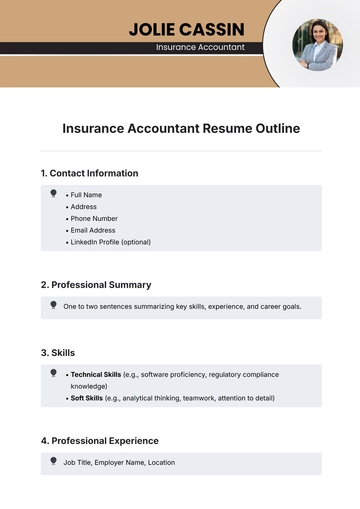

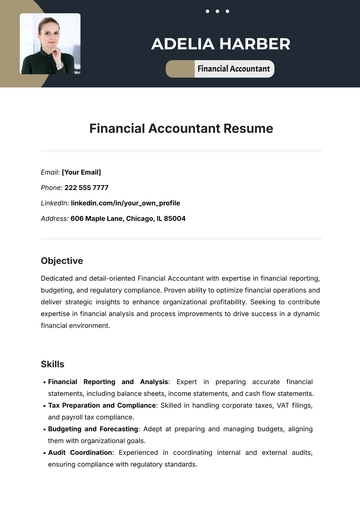

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

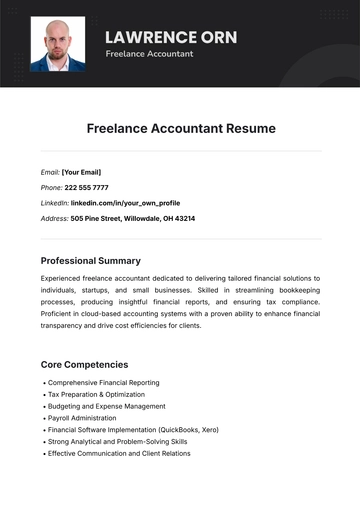

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

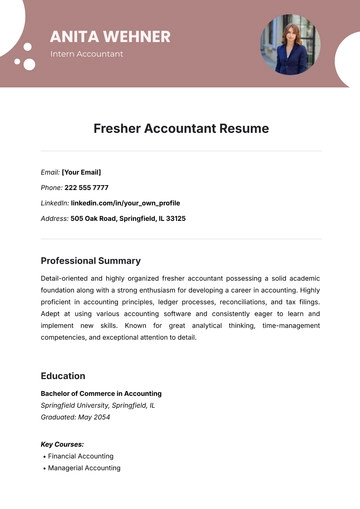

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume