Free Nonprofit Audit Report

I. Introduction

Item | Details |

|---|---|

Prepared for | [NONPROFIT ORG NAME] |

Prepared by | [YOUR NAME], [YOUR COMPANY NAME] |

Address | [YOUR COMPANY ADDRESS] |

[YOUR EMAIL] | |

Website | [YOUR COMPANY WEBSITE] |

Date | January 15, 2050 |

Period Covered | Fiscal Year ending December 31, 2049 |

II. Executive Summary

The audit of [NONPROFIT ORG NAME] for the fiscal year ending December 31, 2049, has been completed. This report provides a comprehensive analysis of the organization's financial statements, internal controls, and compliance with relevant regulations. The audit was conducted in accordance with Generally Accepted Auditing Standards (GAAS).

Key Findings:

The financial statements present fairly the financial position of [NONPROFIT ORG NAME] as of December 31, 2049.

Internal controls are generally effective but require improvements in cash handling and expense authorization.

The organization complies with federal and state regulations, without significant non-compliance issues identified.

III. Objectives

The primary objectives of this audit were to:

Provide an independent assessment of the financial statements.

Evaluate the effectiveness of internal controls.

Ensure compliance with applicable laws and regulations.

Assist the board of directors in strategic decision-making.

These objectives help ensure the financial integrity of the organization, provide confidence to stakeholders, and support effective governance.

IV. Scope of Audit

The audit covered the following areas:

Area | Description |

|---|---|

Examination of Financial Statements | Review of Balance Sheet, Statement of Activities, Statement of Cash Flows, and Statement of Functional Expenses. |

Review of Internal Control Systems | Evaluation of cash handling procedures, expense authorization processes, and segregation of duties. |

Compliance with Federal and State Regulations | Verification of IRS Form 990 compliance, adherence to grant agreements, and compliance with state charitable solicitation laws. |

Assessment of Financial Management Practices | Analysis of budgeting processes, financial planning, and financial reporting. |

V. Audit Findings

A. Financial Statements

The financial statements of [NONPROFIT ORG NAME] for the fiscal year ending December 31, 2049, were found to be accurate and in accordance with Generally Accepted Accounting Principles (GAAP). Key financial metrics include:

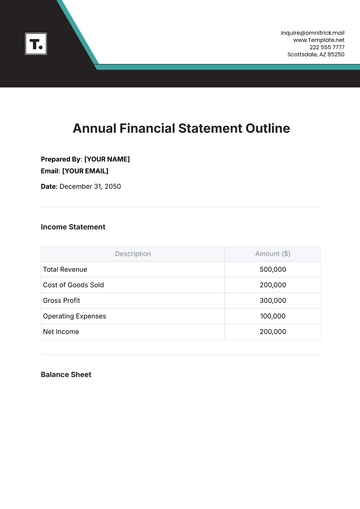

Table 1: Financial Summary

Item | Amount |

|---|---|

Total Revenue | $5,000,000 |

Total Expenses | $4,750,000 |

Net Assets | $3,200,000 |

Current Assets | $1,500,000 |

Current Liabilities | $300,000 |

Long-term Liabilities | $200,000 |

B. Internal Controls

Internal controls were evaluated to ensure the safeguarding of assets and the reliability of financial reporting. While effective overall, the following areas require improvement:

Table 2: Internal Control Issues

Area | Finding | Recommendation |

|---|---|---|

Cash Handling Procedures | Procedures not sufficiently documented, lack of reconciliation | Implement a comprehensive policy and periodic reconciliation |

Expense Authorization | Inadequate oversight, potential misuse of funds | Establish stricter approval processes for high-value expenses |

C. Compliance

The audit confirmed that [NONPROFIT ORG NAME] is in compliance with all relevant federal and state regulations. Specific areas reviewed include:

Table 3: Compliance Review

Area | Finding | Recommendation |

|---|---|---|

IRS Form 990 Compliance | Timely filed with accurate information | Continue adhering to filing deadlines, maintain accurate records |

Grant Agreements | Complies with terms and conditions | Maintain detailed records and regular communication with grantors |

VI. Recommendations

Based on our findings, we recommend the following actions to enhance the financial management and operational effectiveness of [NONPROFIT ORG NAME]:

Table 4: Recommendations

Area | Recommendation |

|---|---|

Cash Handling Procedures | Develop and implement comprehensive policy, periodic reconciliation, and segregation of duties |

Expense Authorization Controls | Introduce a multi-level approval process, regular policy reviews, periodic audits |

Training and Development | Ongoing staff training, workshops on best practices, clear roles and responsibilities |

Regular Internal Audits | Conduct regular audits, develop internal audit plan covering key risk areas |

Enhanced Financial Reporting | Improve timeliness and accuracy of reports, utilize financial software, and provide regular updates to the board |

VII. Conclusion

The audit of [NONPROFIT ORG NAME] has provided valuable insights into the financial health and operational effectiveness of the organization. The recommendations outlined in this report aim to strengthen internal controls, ensure regulatory compliance, and support the organization's strategic decision-making processes. We commend the management and staff for their cooperation and dedication to maintaining high standards of financial accountability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Get your Nonprofit Audit Report Template from Template.net today! This fully customizable and editable template is designed to meet the needs of your nonprofit organization. Easily adapt it to your specific requirements using the AI Editor Tool, ensuring accuracy and professionalism. Simplify your audit process and present a polished report every time.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report