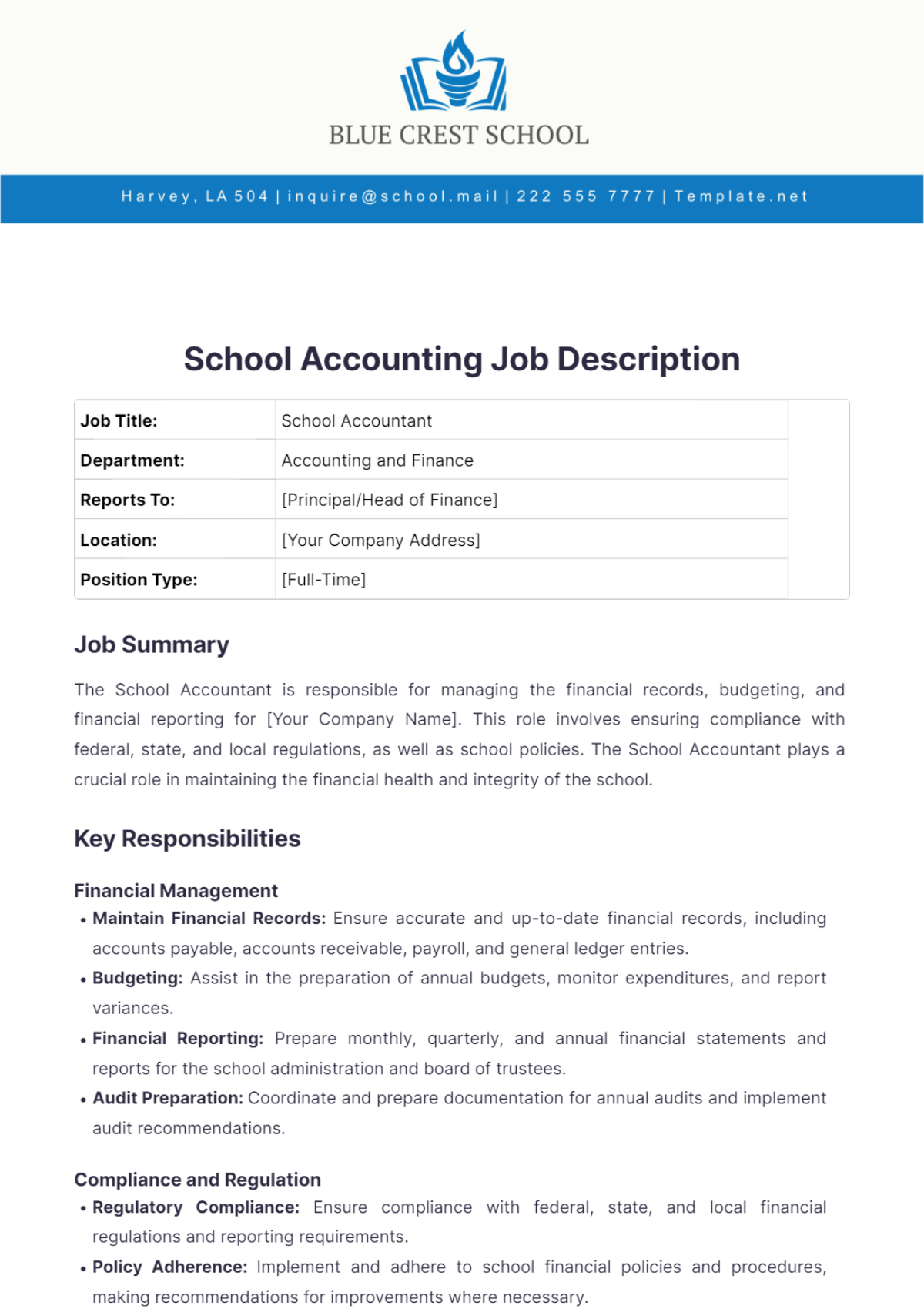

Free School Accounting Job Description

Job Title: | School Accountant |

Department: | Accounting and Finance |

Reports To: | [Principal/Head of Finance] |

Location: | [Your Company Address] |

Position Type: | [Full-Time] |

Job Summary

The School Accountant is responsible for managing the financial records, budgeting, and financial reporting for [Your Company Name]. This role involves ensuring compliance with federal, state, and local regulations, as well as school policies. The School Accountant plays a crucial role in maintaining the financial health and integrity of the school.

Key Responsibilities

Financial Management

Maintain Financial Records: Ensure accurate and up-to-date financial records, including accounts payable, accounts receivable, payroll, and general ledger entries.

Budgeting: Assist in the preparation of annual budgets, monitor expenditures, and report variances.

Financial Reporting: Prepare monthly, quarterly, and annual financial statements and reports for the school administration and board of trustees.

Audit Preparation: Coordinate and prepare documentation for annual audits and implement audit recommendations.

Compliance and Regulation

Regulatory Compliance: Ensure compliance with federal, state, and local financial regulations and reporting requirements.

Policy Adherence: Implement and adhere to school financial policies and procedures, making recommendations for improvements where necessary.

Payroll and Benefits

Payroll Processing: Manage payroll processes, ensuring timely and accurate payment of salaries and benefits to school staff.

Benefits Administration: Oversee employee benefits administration, including health insurance, retirement plans, and other benefits.

Accounts Management

Accounts Payable/Receivable: Manage the school's accounts payable and receivable, ensuring timely payments and collections.

Reconciliation: Perform monthly reconciliations of all school bank accounts and financial records.

Financial Planning and Analysis

Financial Analysis: Conduct financial analysis to support decision-making processes, including cost-benefit analysis and financial forecasting.

Grant Management: Manage financial aspects of grants, including budgeting, reporting, and compliance with grant requirements.

Qualifications

Education and Experience

Education: Bachelor’s degree in Accounting, Finance, or a related field. CPA certification preferred.

Experience: Minimum of [3-5] years of accounting experience, preferably in an educational setting or nonprofit organization.

Skills and Competencies

Technical Proficiency: Proficiency in accounting software (e.g., QuickBooks, Sage) and Microsoft Office Suite, particularly Excel.

Analytical Skills: Strong analytical and problem-solving skills, with attention to detail and accuracy.

Communication: Excellent verbal and written communication skills, with the ability to explain complex financial information clearly.

Organizational Skills: Strong organizational and time management skills, with the ability to manage multiple priorities and meet deadlines.

Ethical Standards: High level of integrity and commitment to ethical standards and confidentiality.

Physical Requirements

Mobility: Ability to sit for extended periods and use a computer for most of the workday.

Lifting: Occasionally lift and/or move up to [10] pounds.

Equal Opportunity Employer

[Your Company Name] is an Equal Opportunity Employer. We do not discriminate on the basis of race, religion, color, sex, age, national origin, disability, or any other legally protected characteristic.

How to Apply

Interested candidates should submit their resume, cover letter, and references to:

Email: [Your Company Email]

Address: [Your Company Address]

Deadline: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Hire top financial talent with the School Accounting Job Description Template from Template.net. This editable and customizable template helps you create clear and detailed job descriptions for accounting positions. Editable in our Ai Editor Tool, it offers a user-friendly experience, making it easy to tailor to your specific needs. Enhance your recruitment process with this essential job description template.