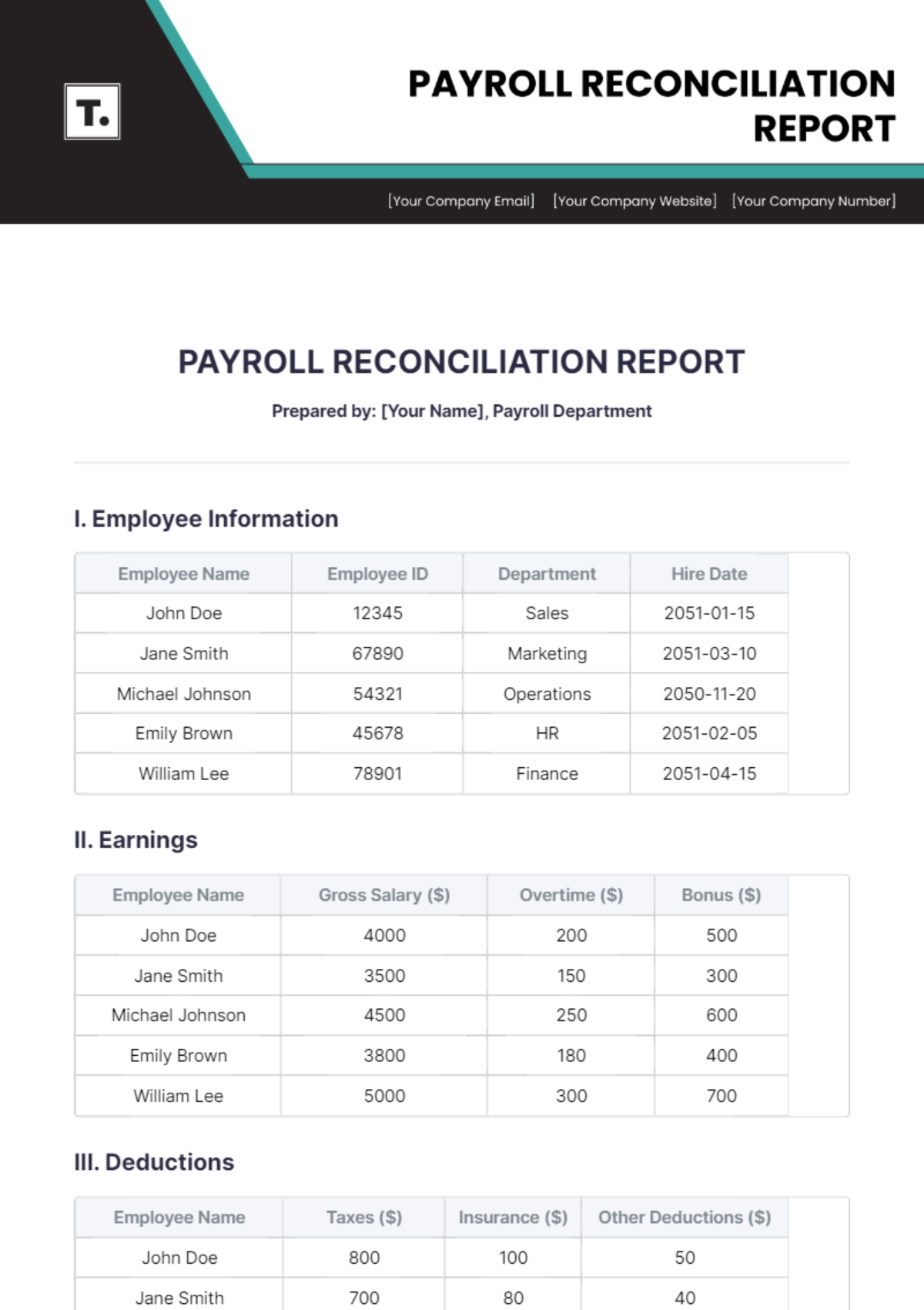

PAYROLL RECONCILIATION REPORT

Prepared by: [Your Name], Payroll Department

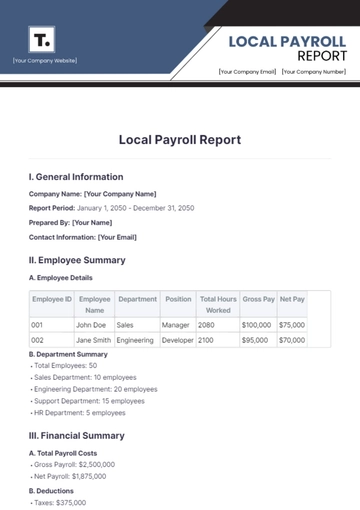

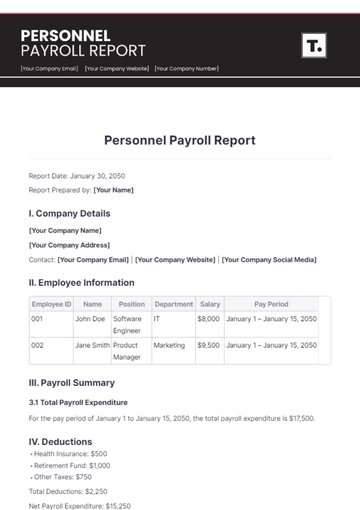

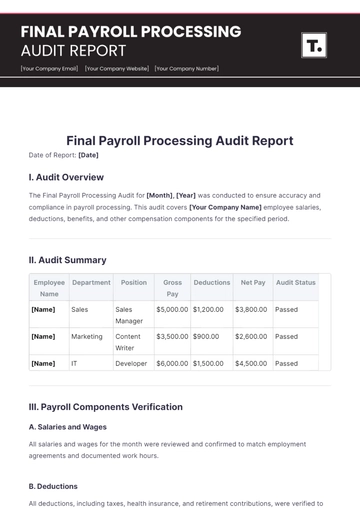

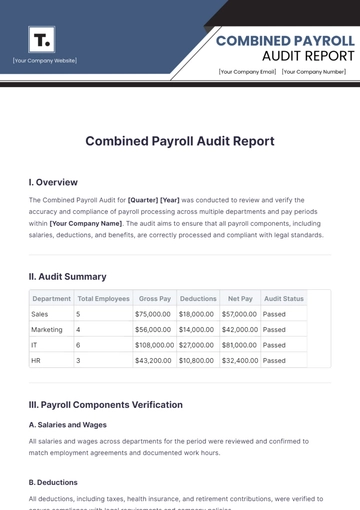

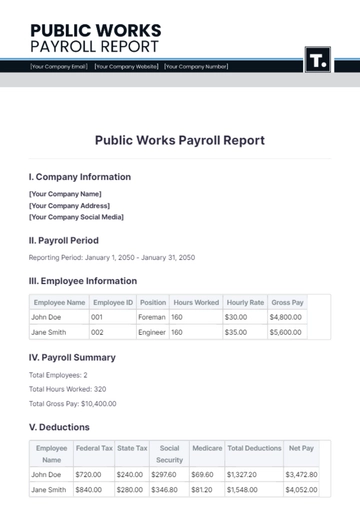

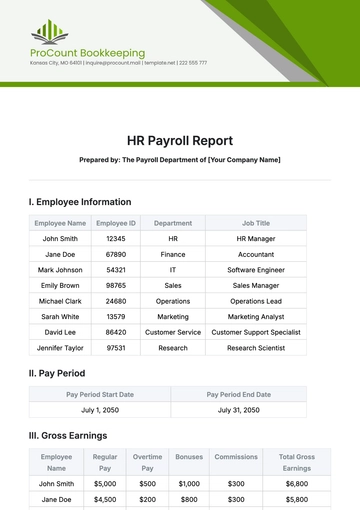

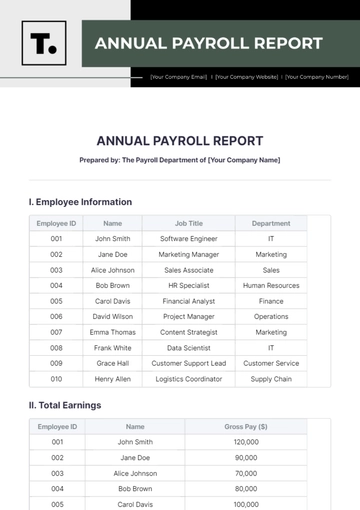

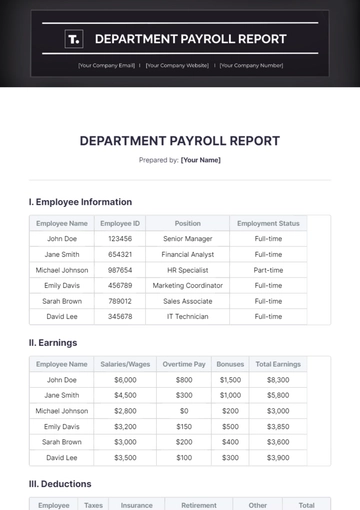

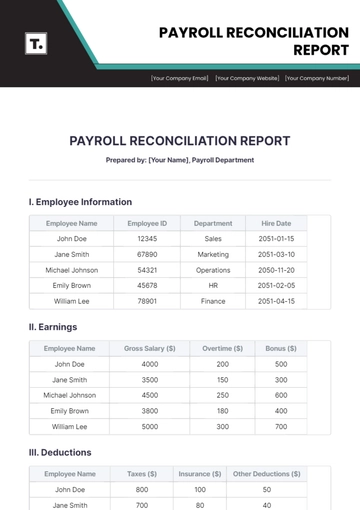

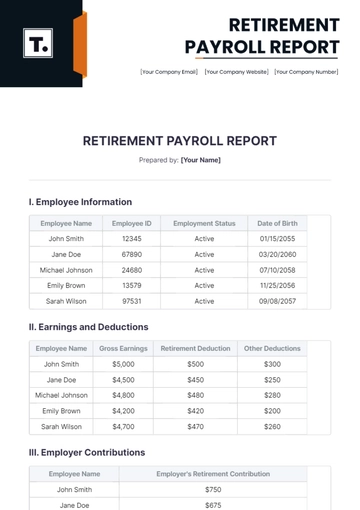

I. Employee Information

Employee Name | Employee ID | Department | Hire Date |

|---|

John Doe | 12345 | Sales | 2051-01-15 |

Jane Smith | 67890 | Marketing | 2051-03-10 |

Michael Johnson | 54321 | Operations | 2050-11-20 |

Emily Brown | 45678 | HR | 2051-02-05 |

William Lee | 78901 | Finance | 2051-04-15 |

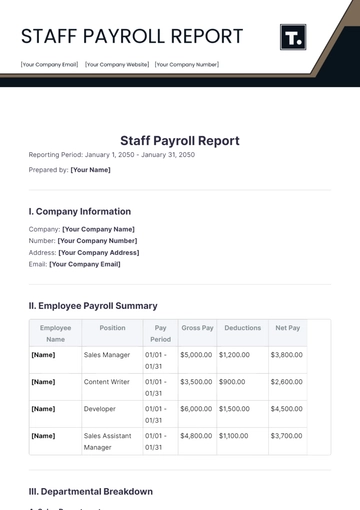

II. Earnings

Employee Name | Gross Salary ($) | Overtime ($) | Bonus ($) |

|---|

John Doe | 4000 | 200 | 500 |

Jane Smith | 3500 | 150 | 300 |

Michael Johnson | 4500 | 250 | 600 |

Emily Brown | 3800 | 180 | 400 |

William Lee | 5000 | 300 | 700 |

III. Deductions

Employee Name | Taxes ($) | Insurance ($) | Other Deductions ($) |

|---|

John Doe | 800 | 100 | 50 |

Jane Smith | 700 | 80 | 40 |

Michael Johnson | 900 | 120 | 60 |

Emily Brown | 750 | 90 | 30 |

William Lee | 1000 | 150 | 70 |

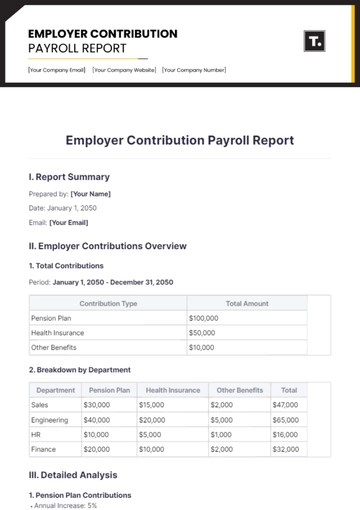

IV. Employer Contributions

Employer Contribution Type | Amount ($) |

|---|

Retirement Plan | 300 |

Health Insurance Premiums | 400 |

Social Security | 600 |

Pension Fund | 250 |

Employee Training Fund | 150 |

V. Adjustments

A. Corrections

B. Revisions

Revision 2: Corrected bonus allocation for Jane Smith due to an error in bonus distribution for the March incentive.

Revision 3: Adjusted gross salary for William Lee after a salary review effective April.

C. Rectifications

VI. Reconciliation Summary

A. Payroll Totals

Total Earnings: $65,800

Total Deductions: $10,830

Net Payroll Expenses: $54,970

B. Accounting Records Comparison

C. Compliance Review

Report Templates @ Template.net