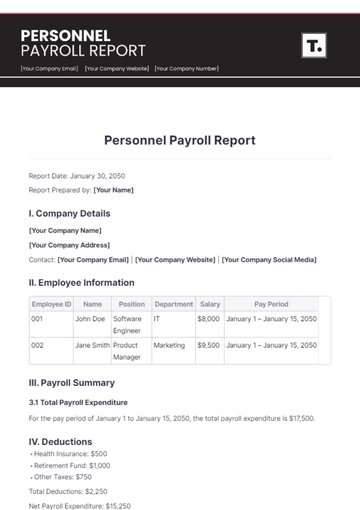

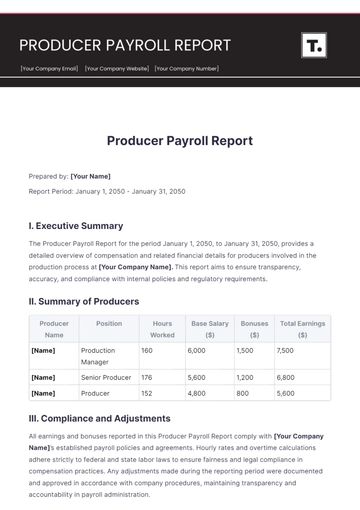

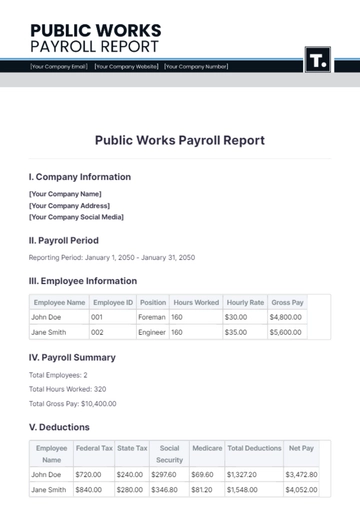

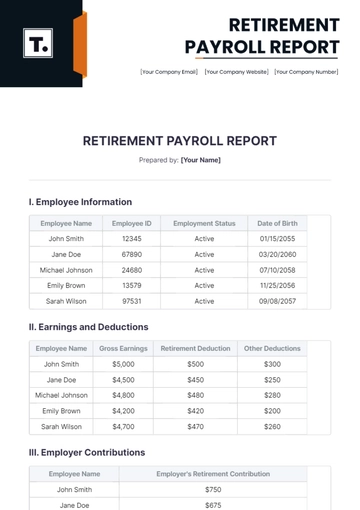

Free Department Payroll Report

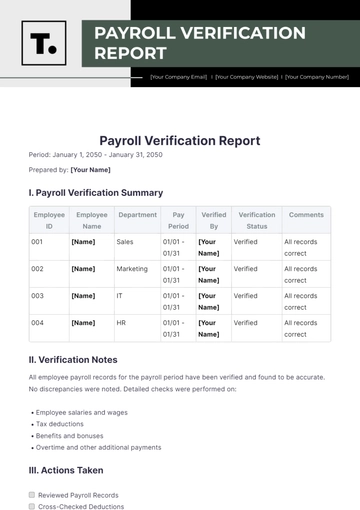

Prepared by: [Your Name]

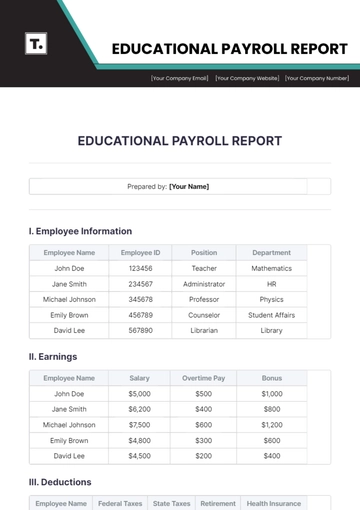

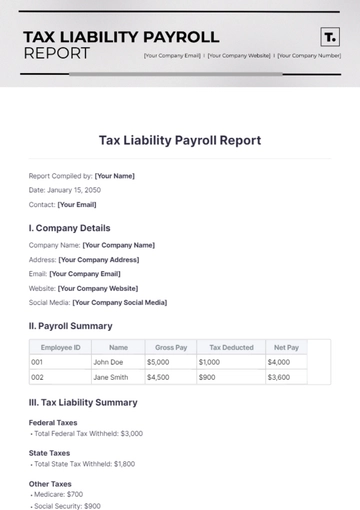

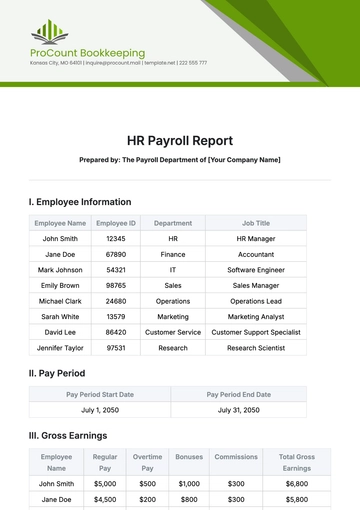

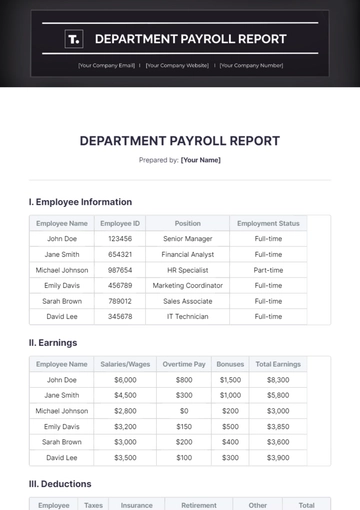

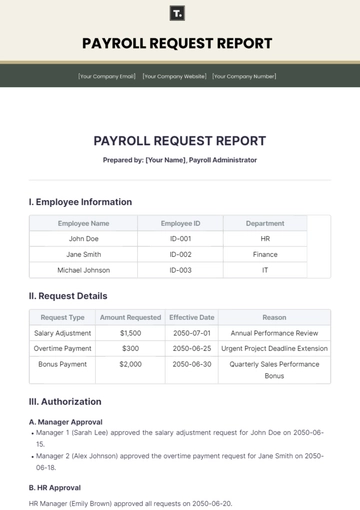

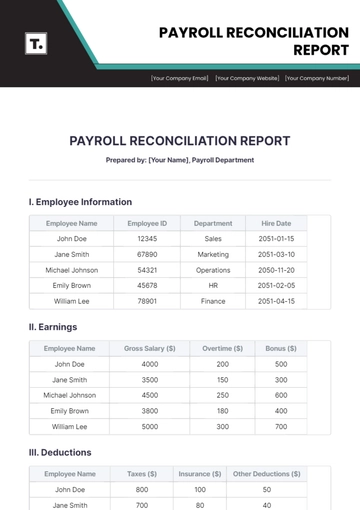

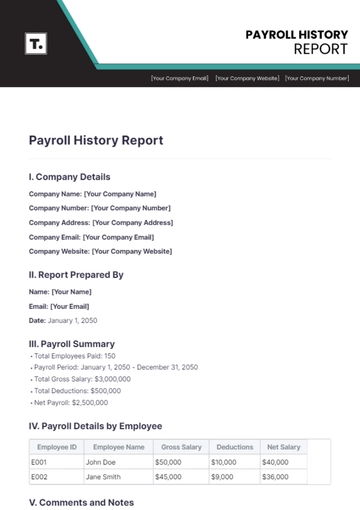

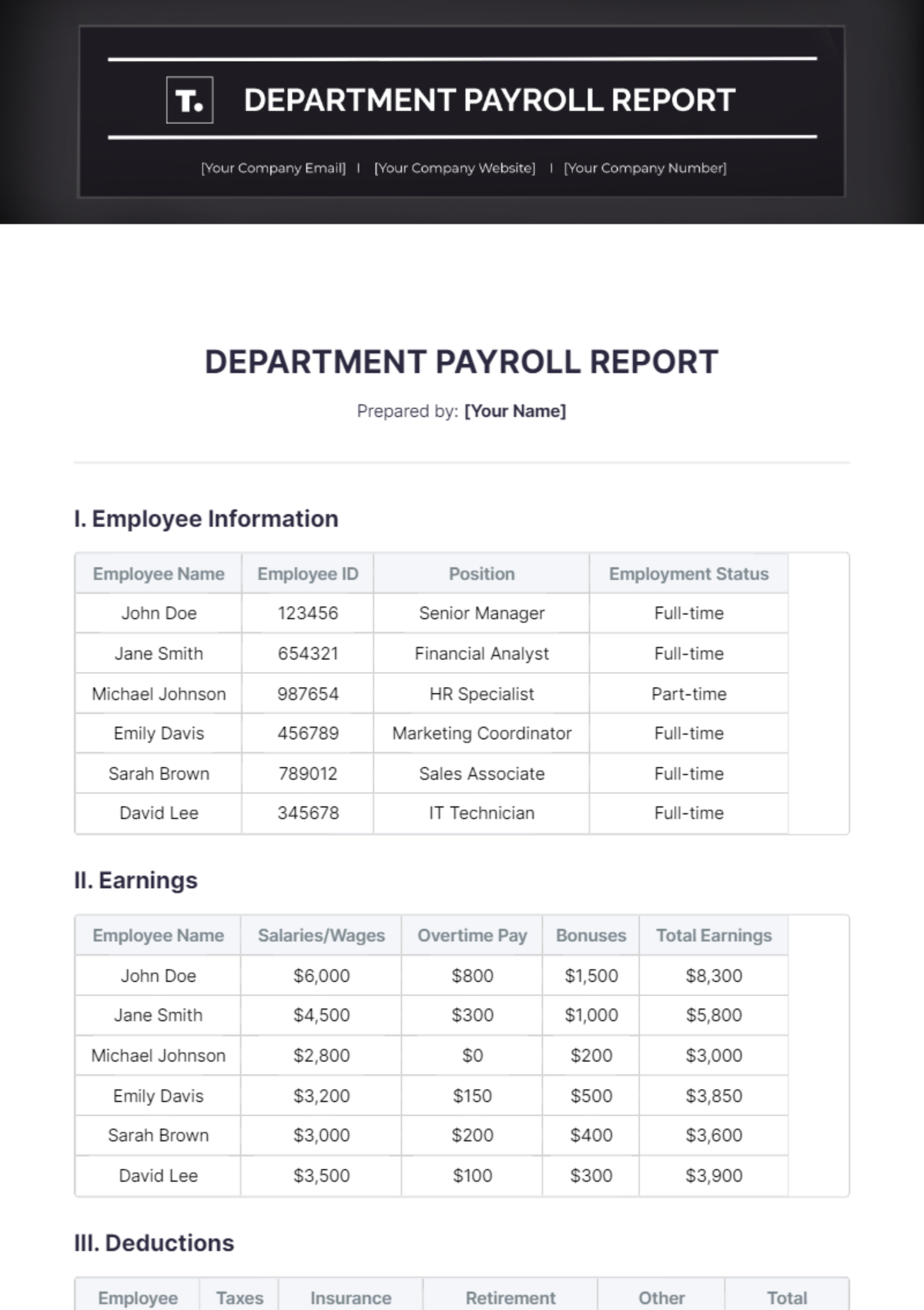

I. Employee Information

Employee Name | Employee ID | Position | Employment Status |

|---|---|---|---|

John Doe | 123456 | Senior Manager | Full-time |

Jane Smith | 654321 | Financial Analyst | Full-time |

Michael Johnson | 987654 | HR Specialist | Part-time |

Emily Davis | 456789 | Marketing Coordinator | Full-time |

Sarah Brown | 789012 | Sales Associate | Full-time |

David Lee | 345678 | IT Technician | Full-time |

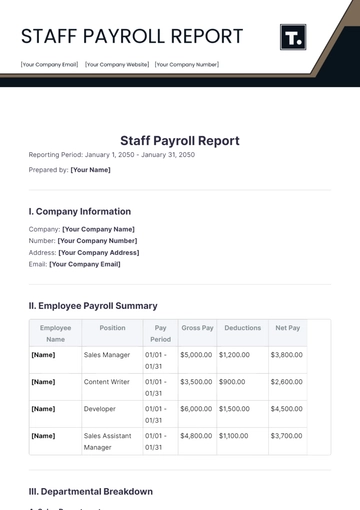

II. Earnings

Employee Name | Salaries/Wages | Overtime Pay | Bonuses | Total Earnings |

|---|---|---|---|---|

John Doe | $6,000 | $800 | $1,500 | $8,300 |

Jane Smith | $4,500 | $300 | $1,000 | $5,800 |

Michael Johnson | $2,800 | $0 | $200 | $3,000 |

Emily Davis | $3,200 | $150 | $500 | $3,850 |

Sarah Brown | $3,000 | $200 | $400 | $3,600 |

David Lee | $3,500 | $100 | $300 | $3,900 |

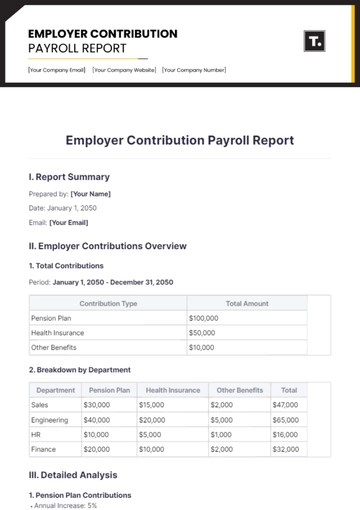

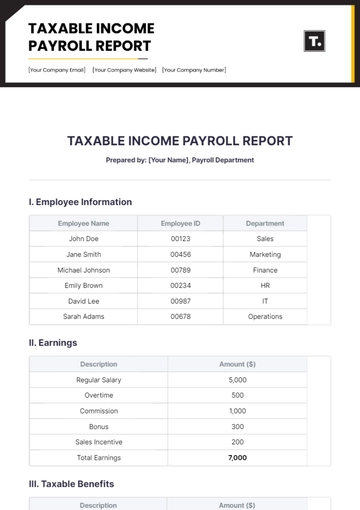

III. Deductions

Employee Name | Taxes | Insurance Premiums | Retirement Contributions | Other Deductions | Total Deductions |

|---|---|---|---|---|---|

John Doe | $1,800 | $200 | $600 | $50 | $2,650 |

Jane Smith | $1,200 | $150 | $400 | $30 | $1,780 |

Michael Johnson | $600 | $80 | $200 | $20 | $900 |

Emily Davis | $900 | $100 | $300 | $25 | $1,325 |

Sarah Brown | $850 | $90 | $250 | $15 | $1,205 |

David Lee | $1,000 | $120 | $350 | $30 | $1,500 |

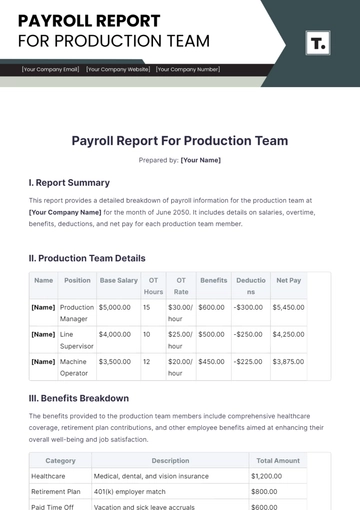

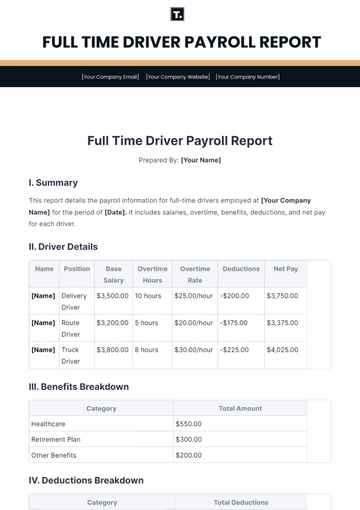

IV. Benefits

Employee Name | Health Insurance | Retirement Plan | Other Benefits | Total Benefits |

|---|---|---|---|---|

John Doe | $350 | $600 | $50 | $1,000 |

Jane Smith | $300 | $450 | $40 | $790 |

Michael Johnson | $200 | $250 | $20 | $470 |

Emily Davis | $250 | $350 | $30 | $630 |

Sarah Brown | $220 | $300 | $25 | $545 |

David Lee | $280 | $400 | $35 | $715 |

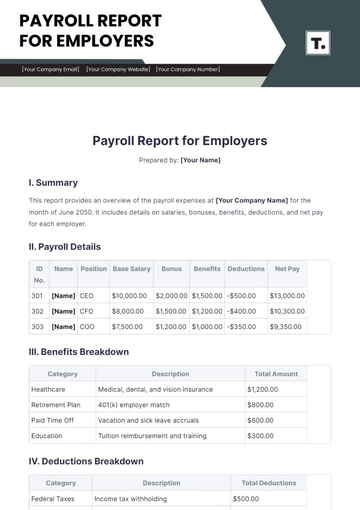

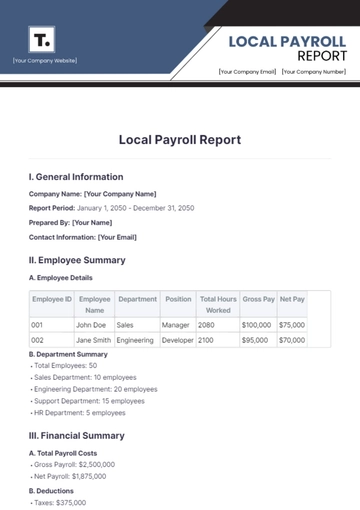

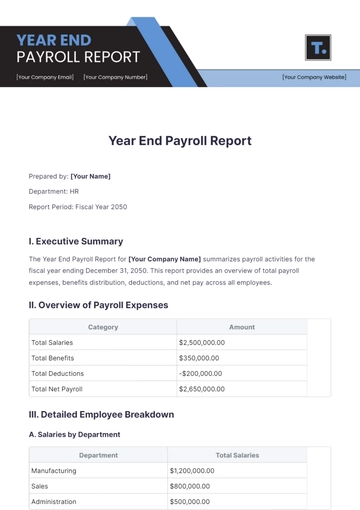

V. Summary Totals

A. Gross Payroll

Total Earnings: $26,450

B. Total Deductions

Total Deductions: $9,960

C. Net Payroll

Net Payroll (Gross Payroll - Total Deductions): $16,490

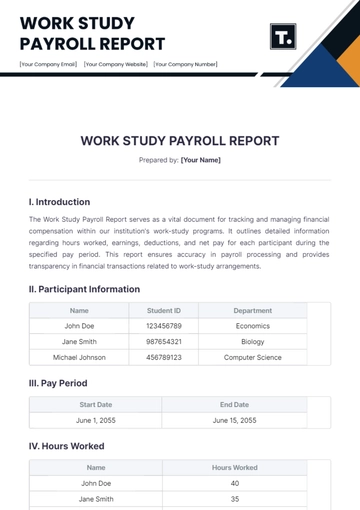

VI. Comparisons and Trends

Employee Name | Previous Payroll (Last Month) | Current Payroll (This Month) |

|---|---|---|

John Doe | $8,800 | $8,300 |

Jane Smith | $6,000 | $5,800 |

Michael Johnson | $3,100 | $3,000 |

Emily Davis | $3,950 | $3,850 |

Sarah Brown | $3,700 | $3,600 |

David Lee | $4,000 | $3,900 |

This comprehensive report provides me, as a manager, with detailed insights into the payroll expenses within my department. It helps in budgeting, monitoring employee compensation, and ensuring compliance with company policies and regulations. The data presented allows for informed decision-making regarding resource allocation and workforce management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover efficiency with the Department Payroll Report Template from Template.net. This editable and customizable template streamlines your payroll processes effortlessly. Tailor and modify it to suit your department's needs using our Ai Editor Tool, ensuring precision and clarity in every report. Simplify your payroll management today with this versatile template.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report