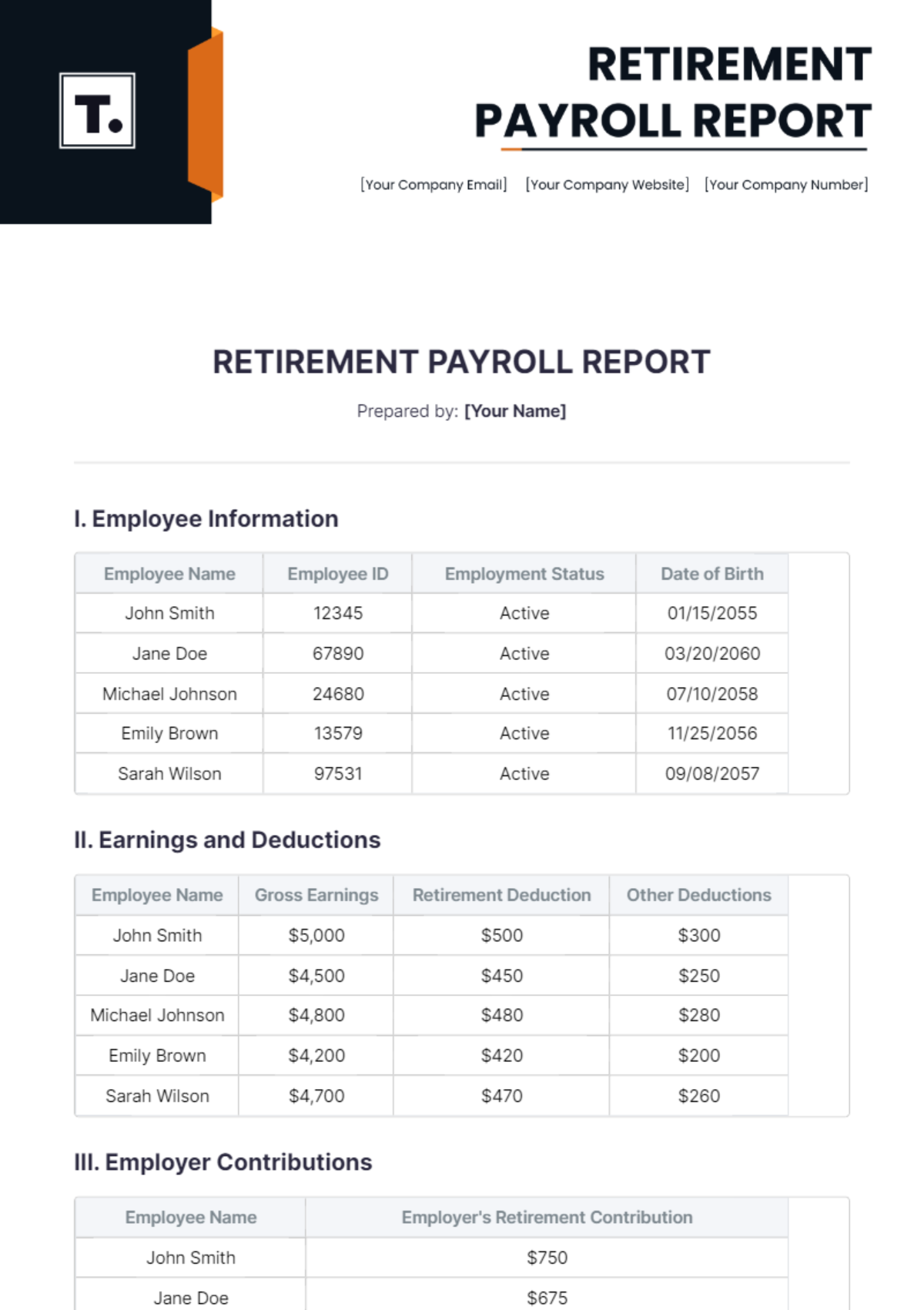

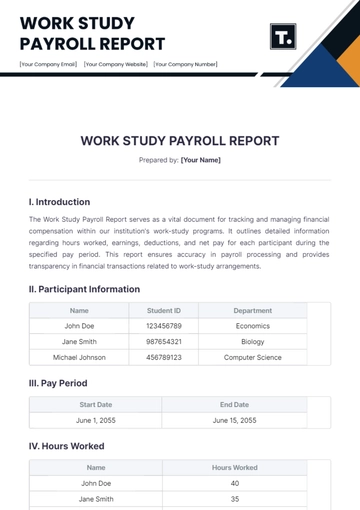

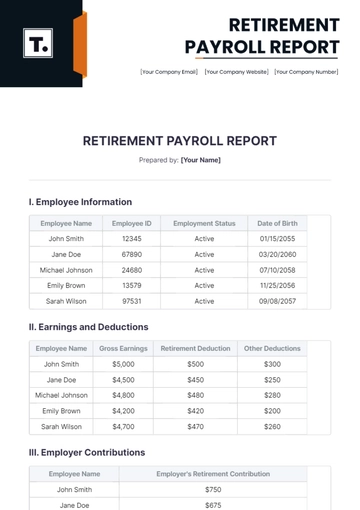

RETIREMENT PAYROLL REPORT

Prepared by: [Your Name]

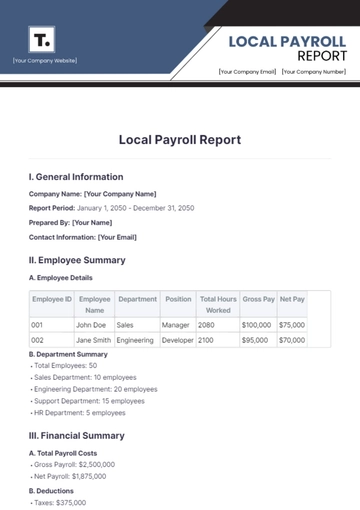

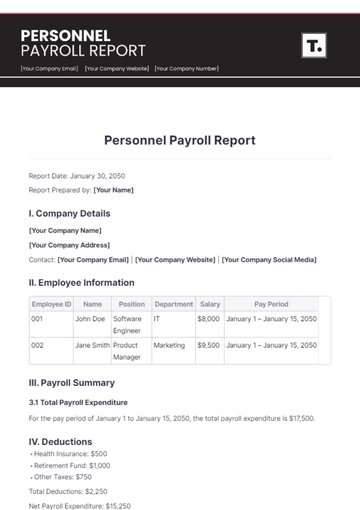

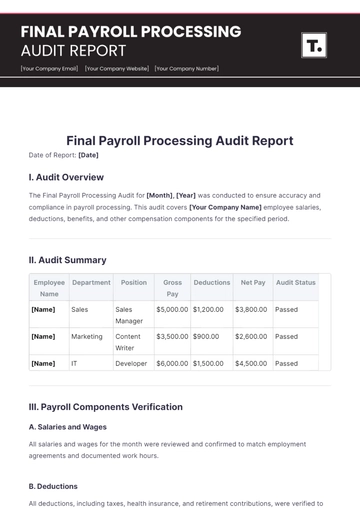

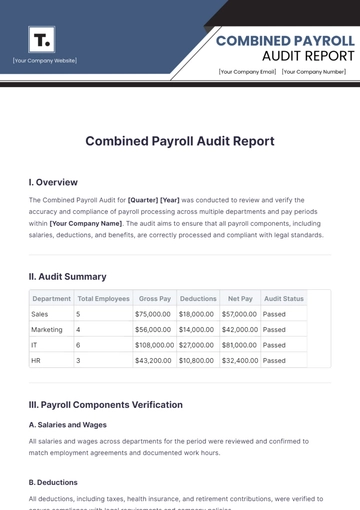

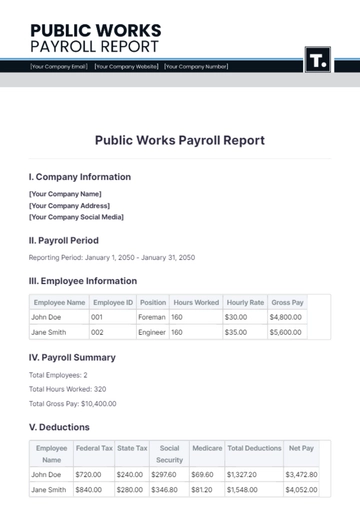

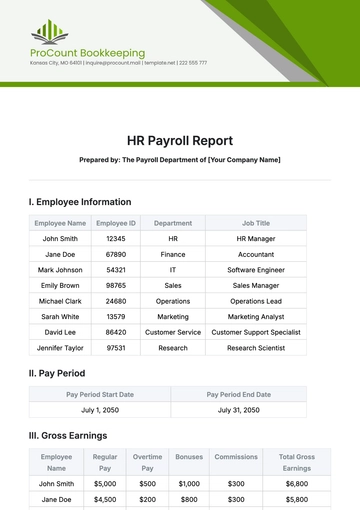

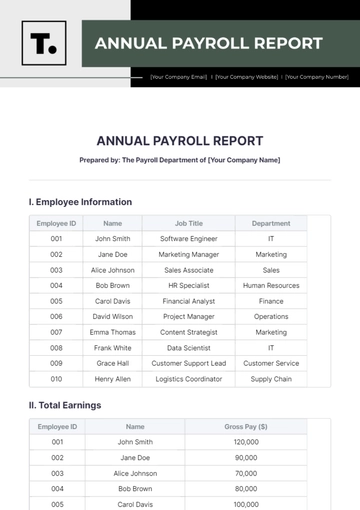

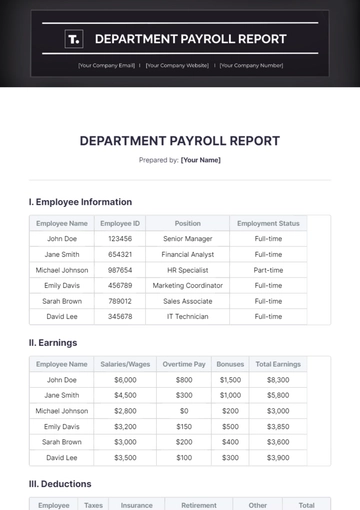

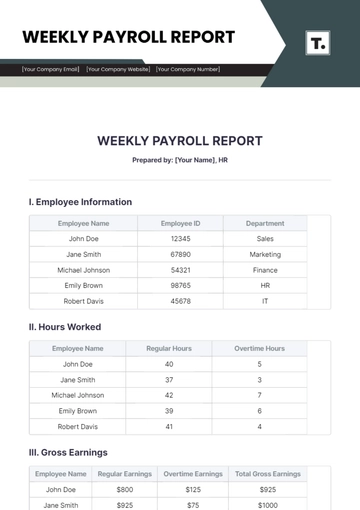

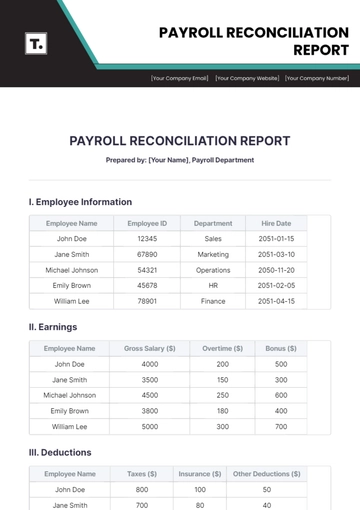

I. Employee Information

Employee Name | Employee ID | Employment Status | Date of Birth |

|---|

John Smith | 12345 | Active | 01/15/2055 |

Jane Doe | 67890 | Active | 03/20/2060 |

Michael Johnson | 24680 | Active | 07/10/2058 |

Emily Brown | 13579 | Active | 11/25/2056 |

Sarah Wilson | 97531 | Active | 09/08/2057 |

II. Earnings and Deductions

Employee Name | Gross Earnings | Retirement Deduction | Other Deductions |

|---|

John Smith | $5,000 | $500 | $300 |

Jane Doe | $4,500 | $450 | $250 |

Michael Johnson | $4,800 | $480 | $280 |

Emily Brown | $4,200 | $420 | $200 |

Sarah Wilson | $4,700 | $470 | $260 |

III. Employer Contributions

Employee Name | Employer's Retirement Contribution |

|---|

John Smith | $750 |

Jane Doe | $675 |

Michael Johnson | $720 |

Emily Brown | $620 |

Sarah Wilson | $700 |

IV. Employee Contributions

Employee Name | Employee's Retirement Contribution |

|---|

John Smith | $500 |

Jane Doe | $450 |

Michael Johnson | $480 |

Emily Brown | $400 |

Sarah Wilson | $470 |

V. Tax Withholdings

A. Federal Taxes

John Smith: $700

Jane Doe: $630

Michael Johnson: $680

Emily Brown: $590

Sarah Wilson: $660

B. State Taxes

John Smith: $300

Jane Doe: $270

Michael Johnson: $290

Emily Brown: $250

Sarah Wilson: $280

C. Local Taxes

John Smith: $100

Jane Doe: $90

Michael Johnson: $95

Emily Brown: $80

Sarah Wilson: $85

VI. Summary and Totals

Total Contributions | Total Deductions | Net Pay |

|---|

$2,025 | $1,790 | $3,235 |

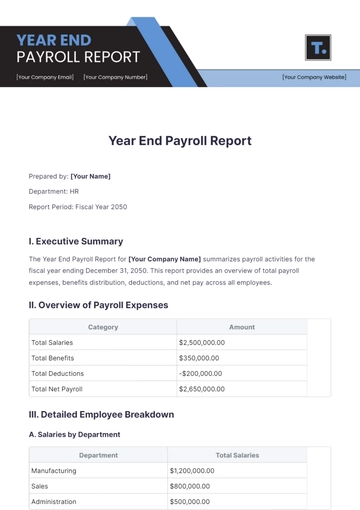

The Finance and Accounting Department provides a detailed Retirement Payroll Report to track retirement transactions for employees born after 2060. It ensures accurate financial reporting, compliance, and precise net pay calculations. The report includes sections on employee info, earnings, deductions, contributions, tax withholdings, and a summary of totals, ensuring transparency and accountability in payroll management.

Report Templates @ Template.net