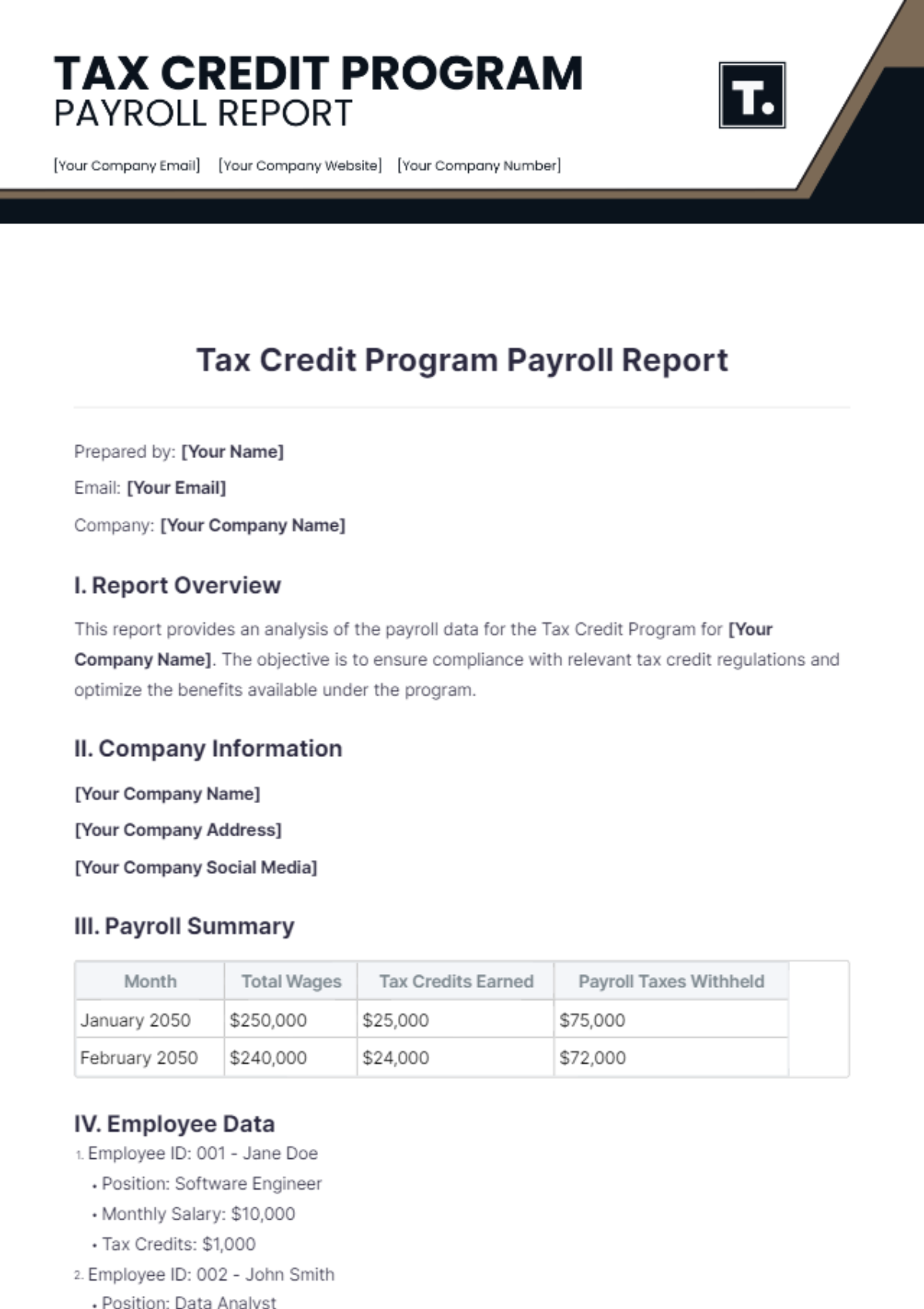

Free Tax Credit Program Payroll Report

Discover the Tax Credit Program Payroll Report Template on Template.net—a game-changer in payroll management. This editable and customizable tool simplifies tax credit reporting with precision. Harness its AI Editable Tool for seamless updates and personalized insights. Streamline compliance effortlessly with our meticulously crafted template, tailored to optimize efficiency and accuracy in financial reporting. Ideal for modern businesses navigating complex tax landscapes.