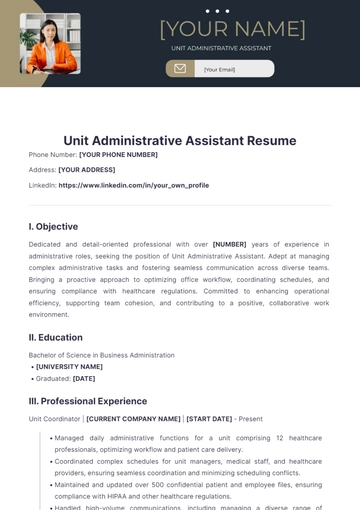

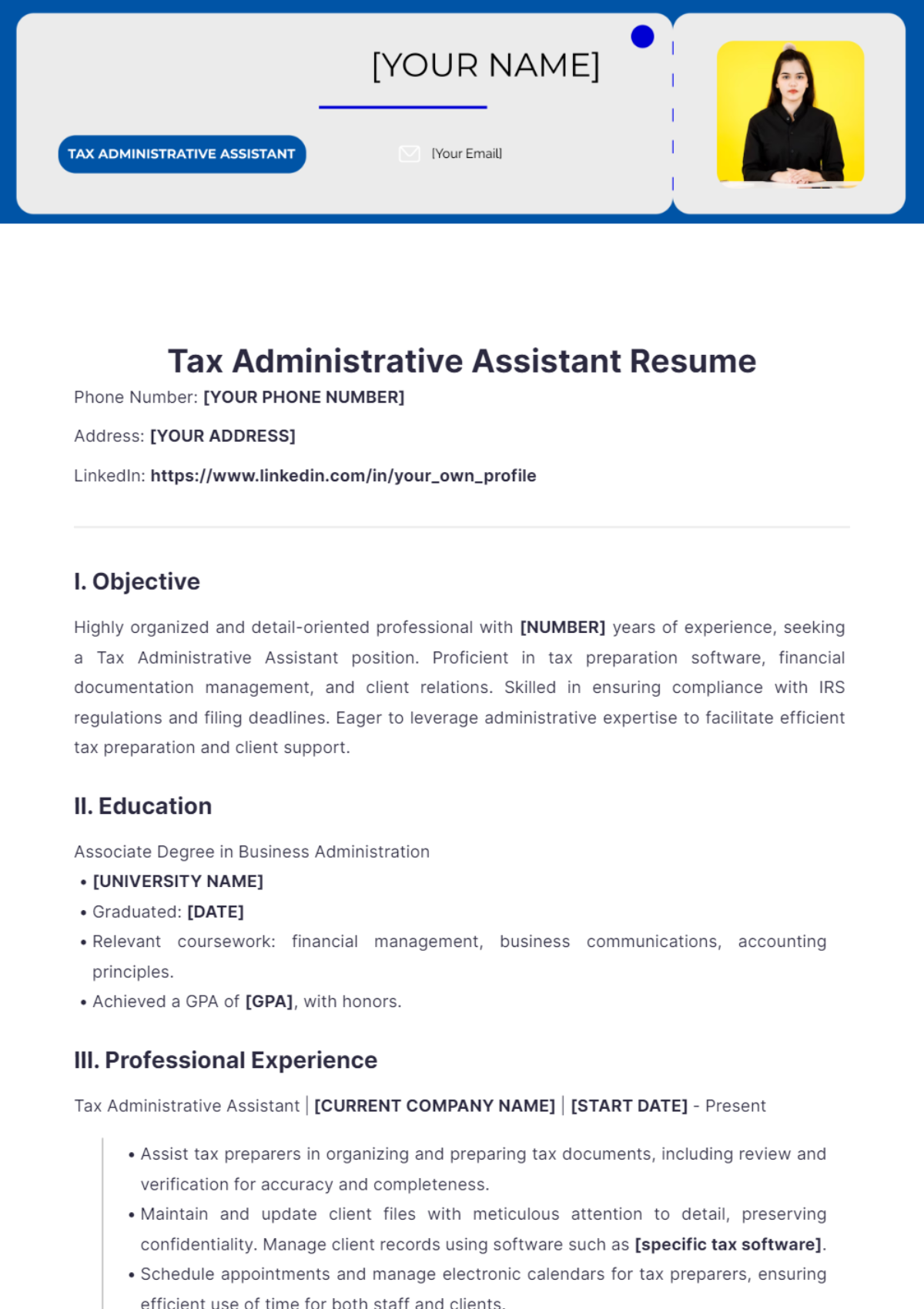

Free Tax Administrative Assistant Resume

Phone Number: [YOUR PHONE NUMBER]

Address: [YOUR ADDRESS]

LinkedIn: https://www.linkedin.com/in/your_own_profile

I. Objective

Highly organized and detail-oriented professional with [NUMBER] years of experience, seeking a Tax Administrative Assistant position. Proficient in tax preparation software, financial documentation management, and client relations. Skilled in ensuring compliance with IRS regulations and filing deadlines. Eager to leverage administrative expertise to facilitate efficient tax preparation and client support.

II. Education

Associate Degree in Business Administration

[UNIVERSITY NAME]

Graduated: [DATE]

Relevant coursework: financial management, business communications, accounting principles.

Achieved a GPA of [GPA], with honors.

III. Professional Experience

Tax Administrative Assistant | [CURRENT COMPANY NAME] | [START DATE] - Present

Assist tax preparers in organizing and preparing tax documents, including review and verification for accuracy and completeness.

Maintain and update client files with meticulous attention to detail, preserving confidentiality. Manage client records using software such as [specific tax software].

Schedule appointments and manage electronic calendars for tax preparers, ensuring efficient use of time for both staff and clients.

Respond to client inquiries via phone and email, ensuring prompt and informative responses.

Utilize specialized tax software (e.g., TurboTax, H&R Block) to prepare and process tax returns, achieving accuracy and adherence to deadlines.

Ensure timely submission of tax returns to the IRS and state tax authorities, verifying compliance with filing deadlines.

Administrative Assistant | [PREVIOUS COMPANY NAME] | [START DATE]-[DATE]

Provided comprehensive administrative support to financial advisors and other staff members, including managing scheduling and correspondence.

Organized and maintained physical and digital filing systems with high accuracy, ensuring easy retrieval of documents.

Assisted in preparing and editing financial reports and documentation, verifying accuracy and adherence to company standards.

Managed office supplies inventory, including ordering and maintaining stock.

Scheduled and confirmed client appointments, optimizing advisor time and resources.

IV. Skills

Tax Software Proficiency: Advanced in TurboTax, H&R Block, Drake Tax Software, and other relevant tax software platforms.

Organizational Acumen: Expert in managing complex filing systems, both physical and digital, including electronic document storage systems.

Communication Skills: Excellent written and verbal communication, ensuring effective client interactions. Able to explain complex tax information clearly.

Time Management: Capable of managing multiple tasks and deadlines with precision, ensuring timely submission of documentation to IRS and state tax authorities.

IRS Compliance: Familiar with IRS regulations, tax forms, and filing deadlines, ensuring strict adherence to legal requirements.

Technical Proficiency: Competent in Microsoft Office Suite (Word, Excel, Outlook), as well as other administrative software.

V. Certifications

Certified Administrative Professional (CAP)

QuickBooks Certification

Additional Certifications: (Optional) Tax Preparation Certification, Financial Management Certification, etc.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your job hunt with Template.net's Tax Administrative Assistant Resume. Fully customizable and editable in our Ai Editor Tool, this template is ideal for showcasing your tax administration expertise.

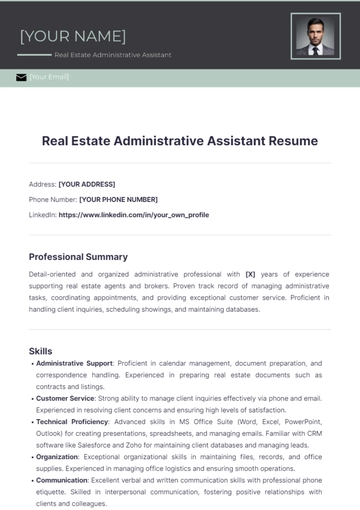

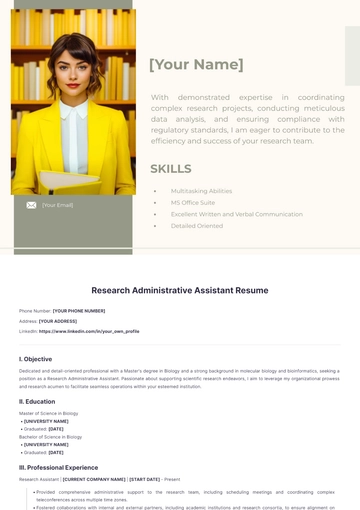

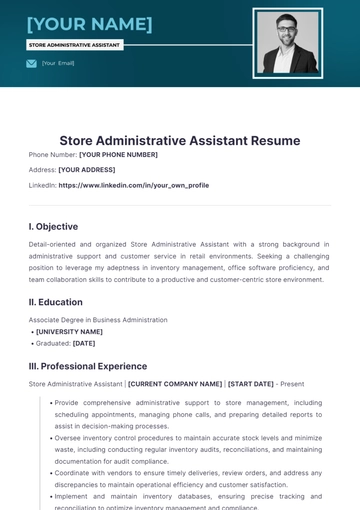

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

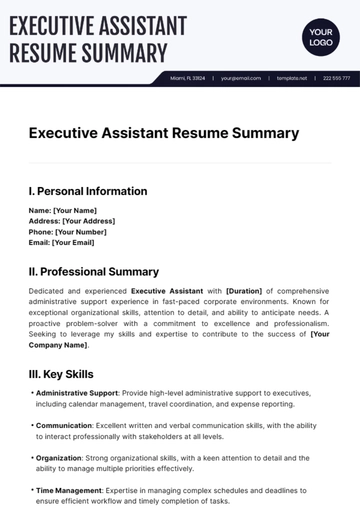

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

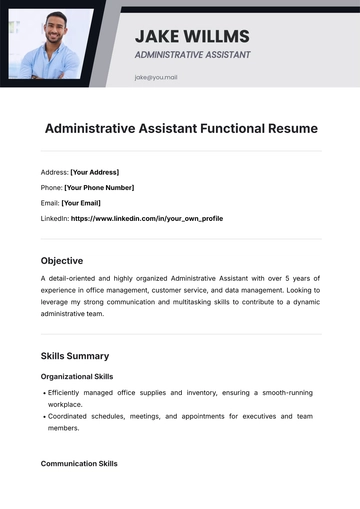

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

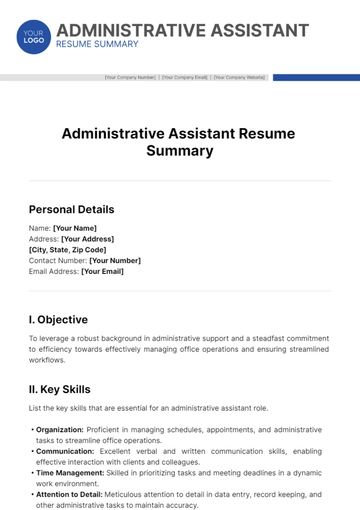

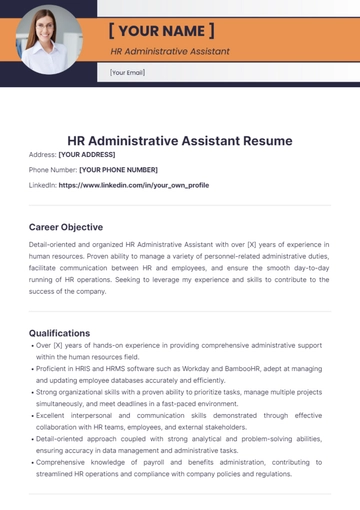

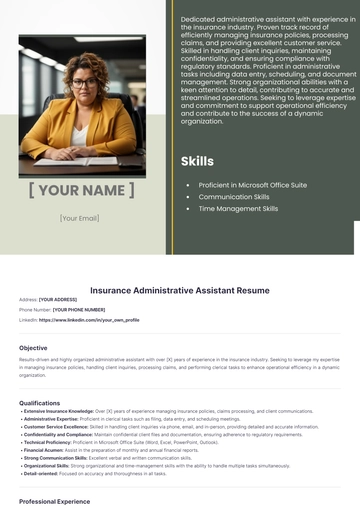

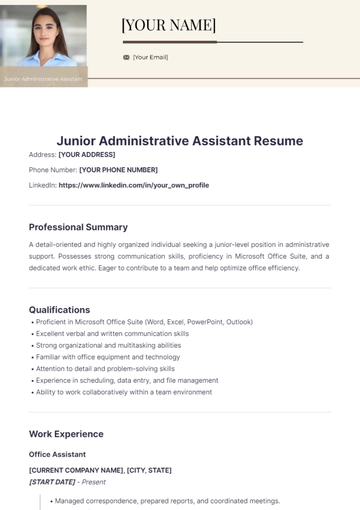

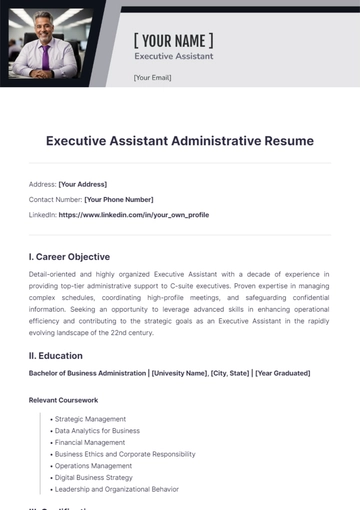

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

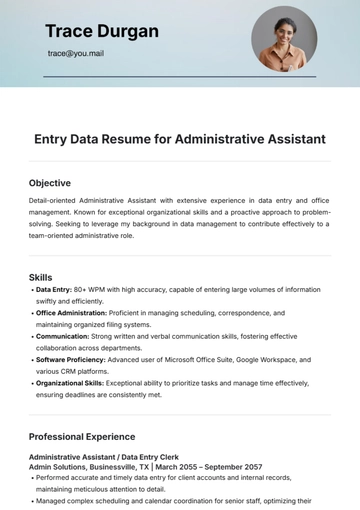

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume