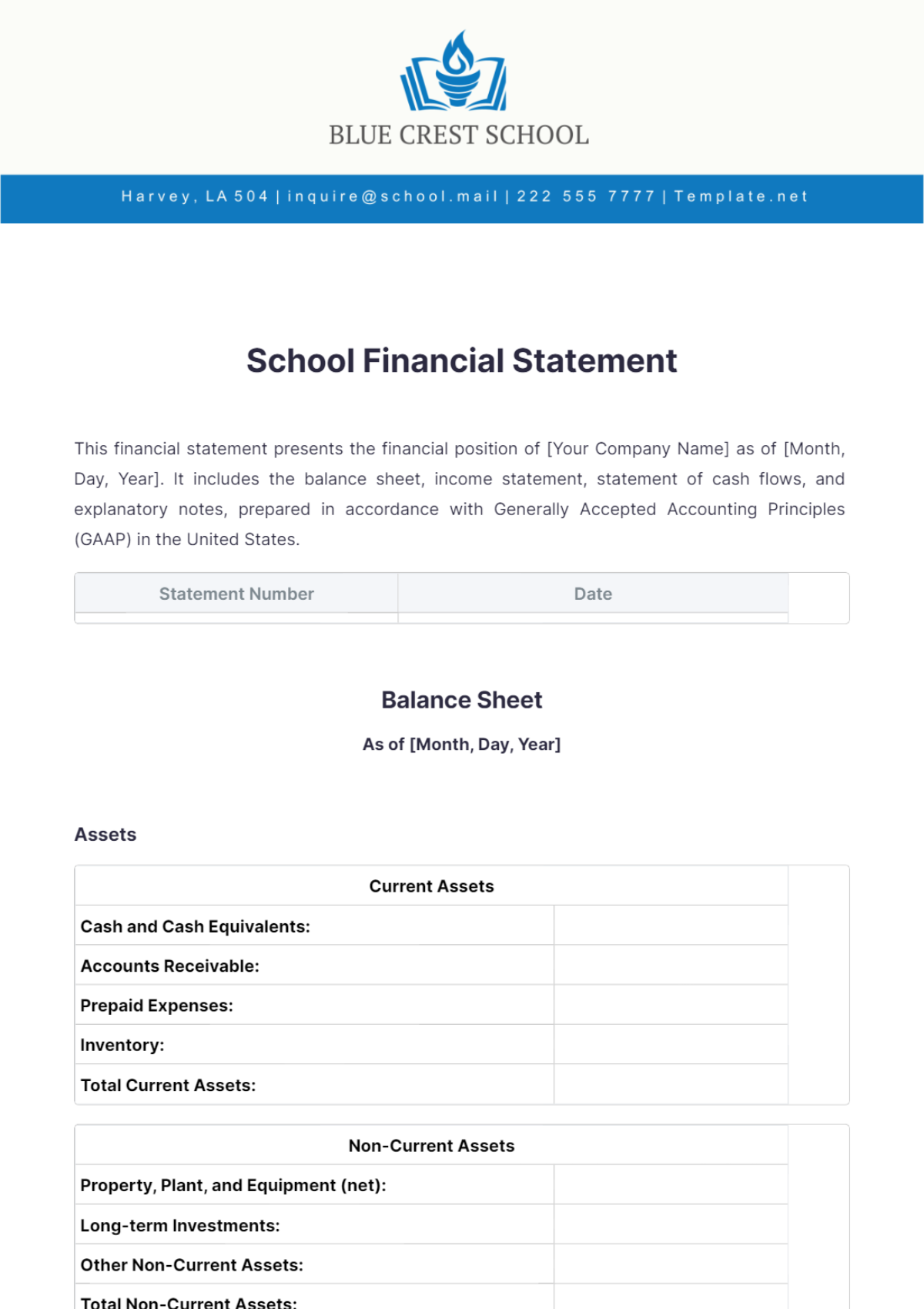

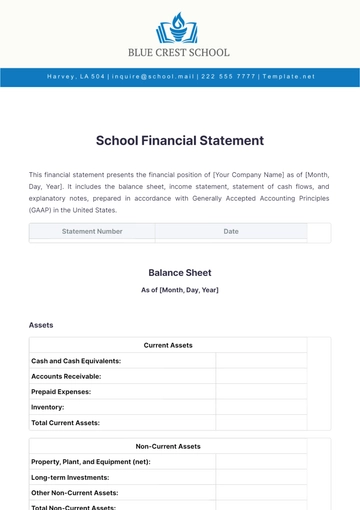

School Financial Statement

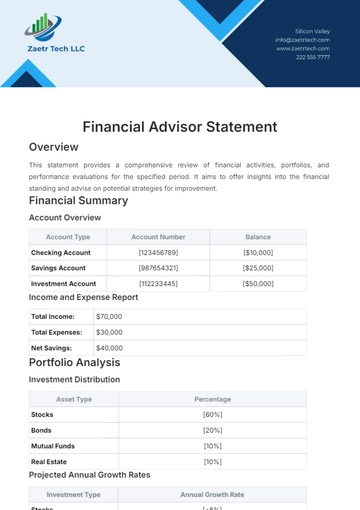

This financial statement presents the financial position of [Your Company Name] as of [Month, Day, Year]. It includes the balance sheet, income statement, statement of cash flows, and explanatory notes, prepared in accordance with Generally Accepted Accounting Principles (GAAP) in the United States.

Balance Sheet

As of [Month, Day, Year]

Assets

Current Assets |

Cash and Cash Equivalents: | |

Accounts Receivable: | |

Prepaid Expenses: | |

Inventory: | |

Total Current Assets: | |

Non-Current Assets |

Property, Plant, and Equipment (net): | |

Long-term Investments: | |

Other Non-Current Assets: | |

Total Non-Current Assets: | |

Liabilities

Current Liabilities |

Accounts Payable: | |

Accrued Expenses: | |

Deferred Revenue: | |

Short-term Loans: | |

Total Current Liabilities: | |

Non-Current Liabilities |

Long-term Debt: | |

Other Non-Current Liabilities: | |

Total Equity: | |

Equity

Retained Earnings: | |

Capital Contributions: | |

Total Non-Current Liabilities: | |

Total Liabilities and Equity: | |

|---|

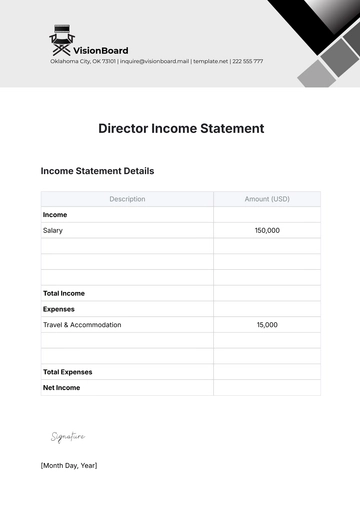

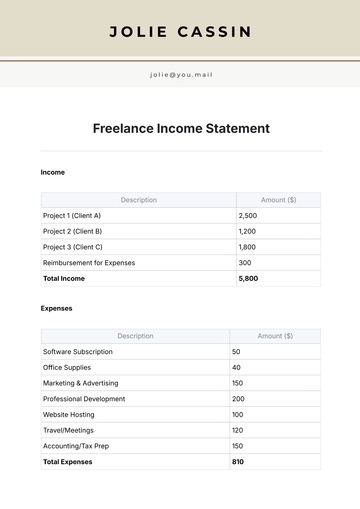

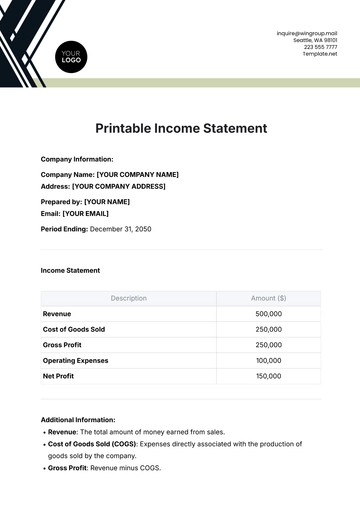

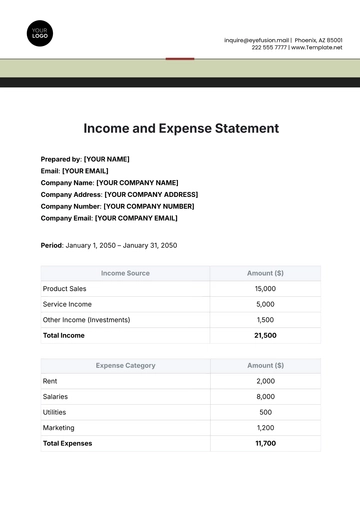

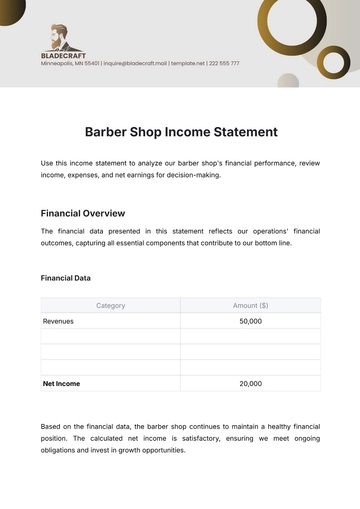

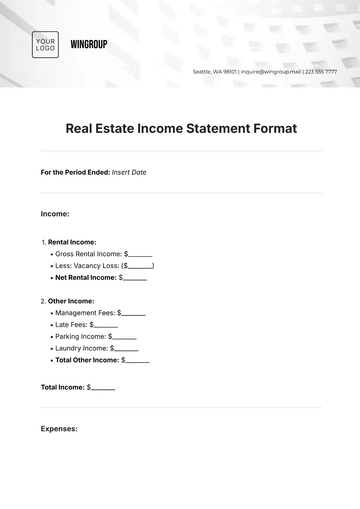

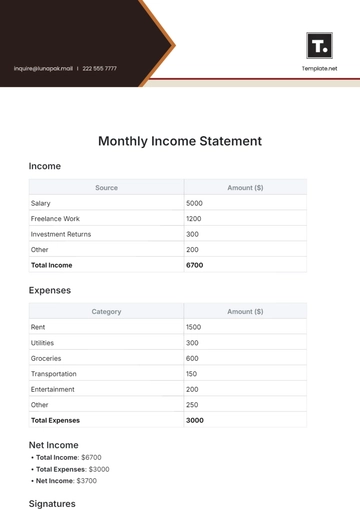

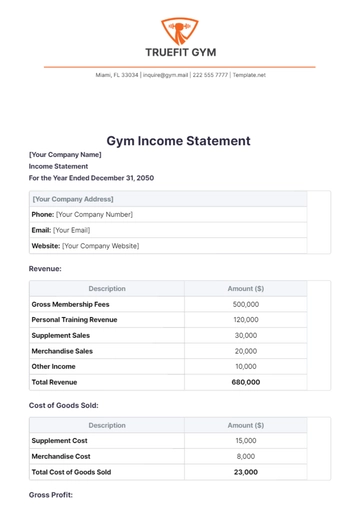

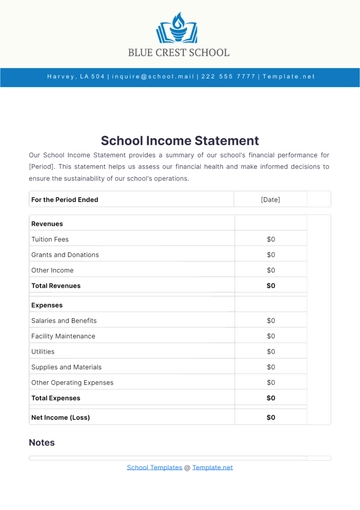

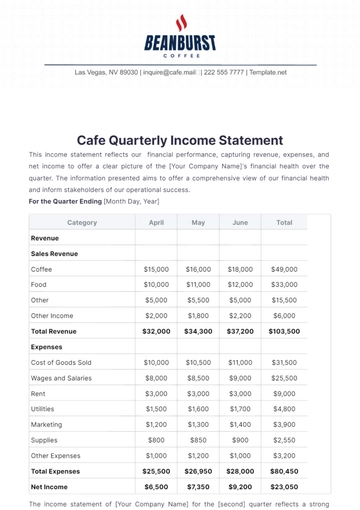

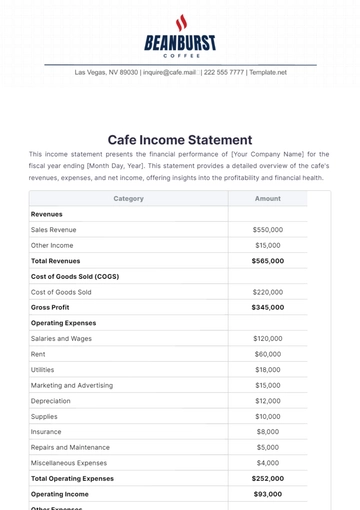

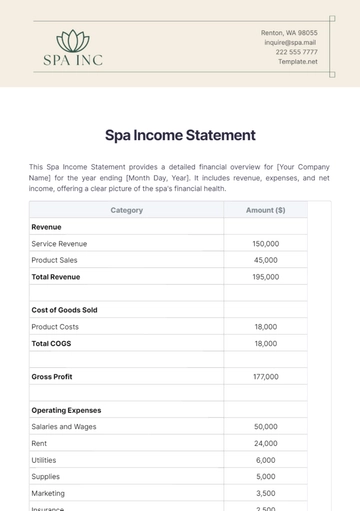

Income Statement

For the Year Ended [Month Day, Year]

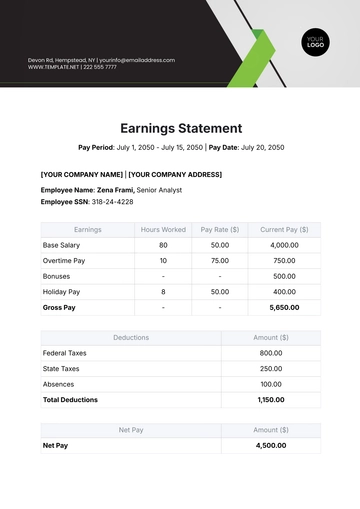

Revenues

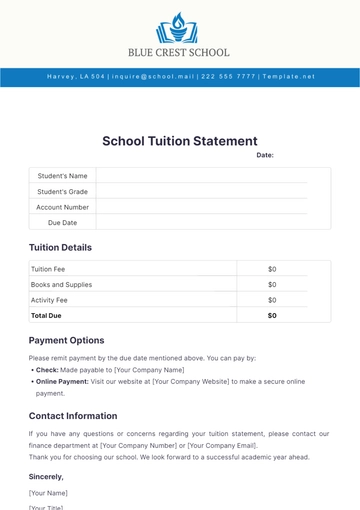

Tuition Fees: | |

Government Grants: | |

Donations: | |

Other Income: | |

Total Revenues: | |

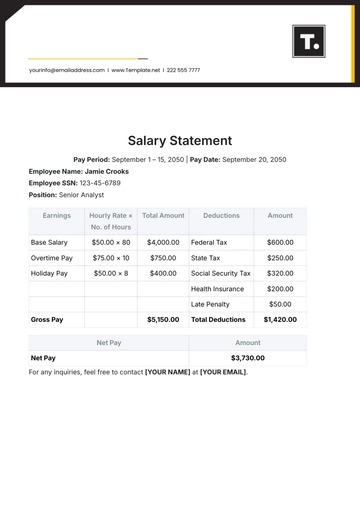

Expenses

Salaries and Wages: | |

Rent: | |

Utilities: | |

Supplies: | |

Depreciation: | |

Other Operating Expenses: | |

Total Expenses: | |

Statement of Cash Flows

For the Year Ended [Month, Day, Year]

Cash Flows from Operating Activities

Adjustments for Non-Cash Items |

Depreciation: | |

Changes in Working Capital | |

Accounts Receivable: | |

Accounts Payable: | |

Inventory: | |

Net Cash Provided by Operating Activities: | |

Cash Flows from Investing Activities

Purchase of Property, Plant, and Equipment: | |

Proceeds from Sale of Investments: | |

Net Cash Used in Investing Activities: | |

Cash Flows from Financing Activities

Proceeds from Loans: | |

Repayment of Debt: | |

Net Cash Provided by Financing Activities: | |

Net Increase in Cash and Cash Equivalents: | |

Cash and Cash Equivalents at Beginning of Year: | |

Cash and Cash Equivalents at End of Year: | |

Notes to the Financial Statements

Summary of Significant Accounting Policies |

Basis of Preparation | The financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) in the United States. |

Revenue Recognition | |

Property, Plant, and Equipment | |

Use of Estimates | |

Property, Plant, and Equipment

As of [Month Day, Year]

Land: | |

Buildings: | |

Equipment: | |

Less: Accumulated Depreciation: | |

Net Property, Plant, and Equipment: | |

Long-term Debt

As of [Month, Day, Year]

Description of Debt: | |

Interest Rate: | |

Maturity Date: | |

Prepared by:

[Your Name]

[Title]

[Your Company Name]

School Templates @Template.net