PAYROLL VARIANCE ANALYSIS REPORT

Prepared by: [Your Name] |

I. Executive Summary

A. Overview

In 2051, the Finance Department of [Your Company Name] conducted a comprehensive Payroll Variance Analysis to scrutinize the discrepancies between budgeted and actual payroll expenses. This report delivers detailed insights into these variances, identifies their causes, and offers recommendations for enhanced payroll management and budget control.

B. Key Findings

Total Variance: The total payroll variance for 2051 amounted to $350,000, with actual expenses surpassing budgeted expenses by 8%.

Significant Variances: Notable variances were detected in the Sales Marketing, and Research and Development departments.

Root Causes: Primary factors contributing to variances included higher-than-anticipated overtime due to unexpected project delays, increased benefits costs stemming from a rise in healthcare premiums, and additional hiring in response to increased demand.

C. Strategic Implications

The analysis underscores areas where payroll management can be optimized, ensuring better budget adherence and resource allocation in the future. Addressing these variances will aid [Your Company Name] in maintaining financial stability and operational efficiency.

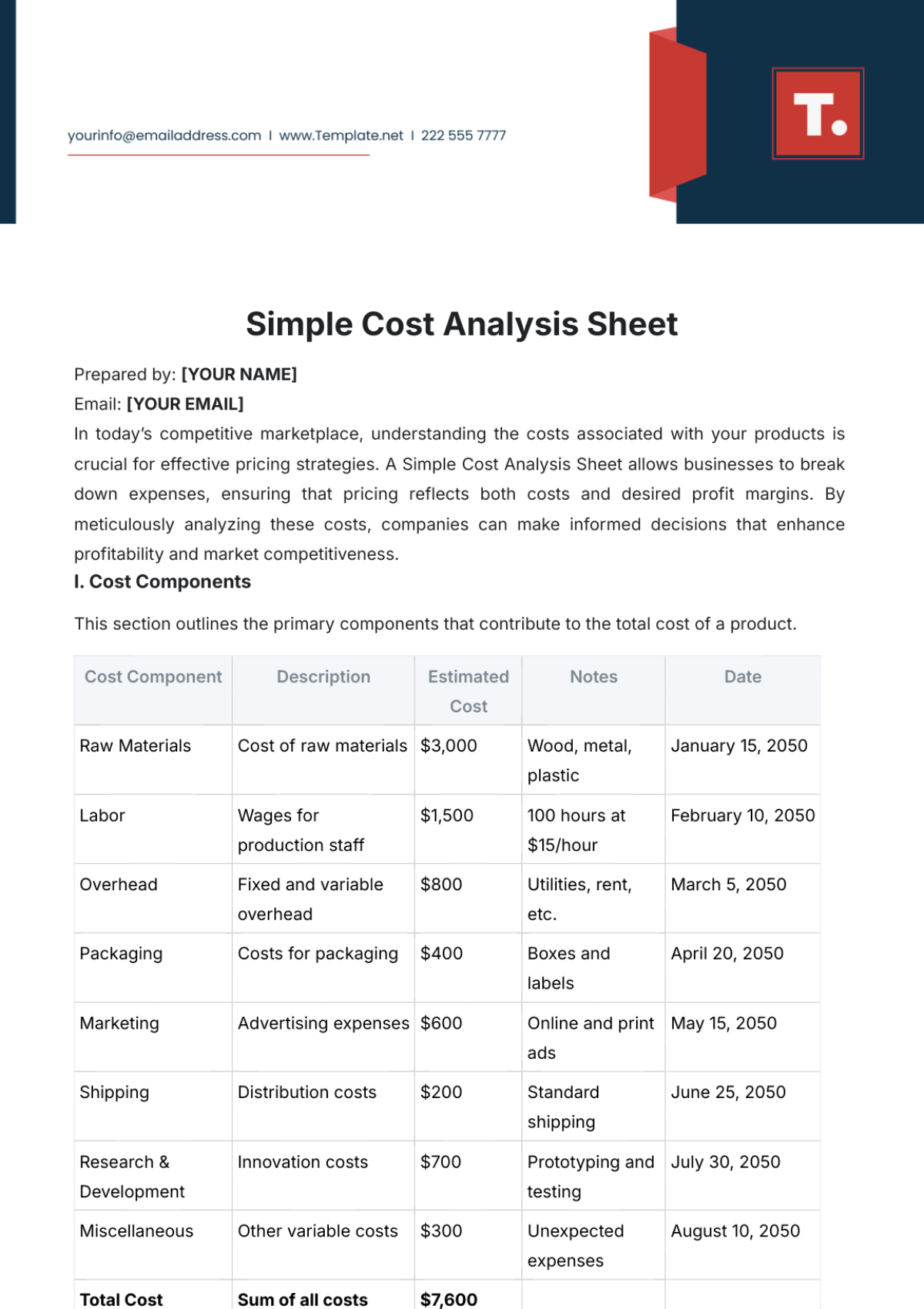

II. Variance Summary

A. Total Payroll Variance

Category | Budgeted Amount | Actual Amount | Variance ($) | Variance (%) |

|---|---|---|---|---|

Total Payroll | $4,500,000 | $4,850,000 | $350,000 | 8% |

B. Departmental Variance

Department | Budgeted Amount | Actual Amount | Variance ($) | Variance (%) |

|---|---|---|---|---|

Sales and Marketing | $1,200,000 | $1,350,000 | $150,000 | 12.5% |

Research and Development | $800,000 | $900,000 | $100,000 | 12.5% |

Administrative | $700,000 | $750,000 | $50,000 | 7.1% |

C. Variance by Expense Type

Expense Type | Budgeted Amount | Actual Amount | Variance ($) | Variance (%) |

|---|---|---|---|---|

Salaries | $3,000,000 | $3,150,000 | $150,000 | 5% |

Overtime | $300,000 | $400,000 | $100,000 | 33.3% |

Benefits | $1,200,000 | $1,300,000 | $100,000 | 8.3% |

III. Detailed Variance Analysis

Department | Budgeted Amount | Actual Amount | Variance ($) | Variance (%) |

|---|---|---|---|---|

Sales and Marketing | $1,200,000 | $1,350,000 | $150,000 | 12.5% |

Research and Development | $800,000 | $900,000 | $100,000 | 12.5% |

Administrative | $700,000 | $750,000 | $50,000 | 7.1% |

IV. Graphs and Charts

Graph/Chart | Description |

|---|---|

Total Payroll Variance | Bar chart showing budgeted vs. actual payroll |

Departmental Variance | Pie chart depicting variance distribution |

Expense Type Variance | Line graph tracking variances by expense type |

V. Recommendations

Improve Overtime Management: Implement stricter controls and monitoring to manage and reduce overtime costs, especially during peak project periods.

Optimize Hiring Process: Enhance forecasting methods to accurately predict staffing needs, minimizing the need for reactive hiring.

Review Benefits Packages: Conduct a comprehensive review of employee benefits to identify cost-saving opportunities without compromising coverage.

VI. Conclusion

The Finance Department's Payroll Variance Analysis Report for 2051, prepared for [Your Company Name], identifies critical areas for improvement in payroll management. By addressing the highlighted variances and implementing the recommended strategies, the company can achieve better financial control and operational efficiency. Continuous monitoring and proactive adjustments will ensure that payroll expenses align with budgeted expectations, supporting sustainable growth and profitability for [Your Company Name] in the future.