Gym Expense Report

I. Introduction

A. Purpose of the Report

The Gym Expense Report for [Your Company Name] aims to provide a detailed analysis of the financial expenditures incurred during the reporting period of [Month] to [Month] [Year] This report is essential for understanding the financial health of the gym, identifying areas of high expenditure, and optimizing budget allocation for future periods.

B. Reporting Period

This report covers the first quarter of [Year], specifically from [Month] to [Month].

C. Summary of Key Findings

During this period, [Your Company Name] has invested significantly in upgrading equipment and maintaining facilities to enhance member experience. Operational costs, including staffing and administrative expenses, have been carefully managed to align with the budgetary constraints and operational needs of the gym.

II. Expense Categories

A. Equipment Costs

Purchase of New Equipment

[Your Company Name] invested $50,000 in new gym equipment during the first quarter. This included state-of-the-art cardio machines, weight training equipment, and fitness accessories aimed at improving member satisfaction and retention. The investment was part of our commitment to offering top-notch facilities and maintaining a competitive edge in the fitness industry.

Maintenance and Repairs

Maintenance and repair costs totaled $12,000 during the reporting period. This expenditure covered routine servicing, repairs of malfunctioning equipment, and replacements of worn-out parts. By ensuring timely maintenance, [Your Company Name] aims to extend the lifespan of equipment and minimize disruptions to member services.

B. Facility Costs

Rent/Lease Payments

Monthly rent for our gym facility amounted to $20,000 per month, totaling $60,000 for the quarter. The lease agreement includes maintenance services and utilities, providing a stable operational environment for [Your Company Name] to deliver exceptional fitness services.

Utilities (Electricity, Water, etc.)

Utilities expenses, including electricity, water, and heating, amounted to $8,000 for the quarter. Energy-efficient practices and monitoring systems are in place to optimize usage and reduce operational costs while maintaining a comfortable environment for members.

Cleaning and Maintenance

Cleaning and maintenance services totaled $5,000 for the quarter. This includes daily cleaning, sanitation supplies, and periodic deep cleaning to ensure a hygienic and welcoming environment for members and staff.

C. Staff Costs

Salaries and Wages

Total payroll expenses for staff salaries and wages amounted to $100,000 for the quarter. This includes compensation for trainers, front desk staff, maintenance personnel, and administrative support. Competitive wages and benefits are essential to attracting and retaining qualified staff members.

Training and Development

Investment in staff training and development programs totaled $6,000. This includes certifications, workshops, and seminars aimed at enhancing employee skills, improving service delivery, and maintaining industry standards.

Benefits and Insurance

Employee benefits, including health insurance and retirement contributions, totaled $12,000 for the quarter. Ensuring comprehensive benefits enhances employee satisfaction and loyalty, contributing to a positive work environment at [Your Company Name].

D. Administrative Costs

Office Supplies

Office supplies and consumables amounted to $2,000 for the quarter. This includes stationery, printer supplies, and administrative essentials necessary for day-to-day operations.

Software and Subscriptions

Investment in software licenses and subscriptions totaled $4,000. This includes management software for member databases, scheduling, and accounting, ensuring efficient operations and customer relationship management.

Marketing and Advertising

Marketing and advertising expenses totaled $15,000 for the quarter. This includes digital marketing campaigns, social media promotions, and local advertising efforts aimed at attracting new members and promoting gym services.

E. Miscellaneous Costs

Member Amenities

Expenses for member amenities, such as towels, refreshments, and locker facilities, totaled $3,000. Providing these amenities enhances member experience and satisfaction, contributing to member retention rates.

Events and Promotions

Costs associated with organizing events and promotional activities amounted to $10,000 for the quarter. This includes hosting fitness workshops, member appreciation events, and promotional offers to attract new memberships.

Other Unexpected Expenses

Unexpected expenses, including repairs not covered by warranty and unforeseen operational costs, totaled $5,000. These expenses are managed through a contingency budget to ensure minimal impact on regular operations.

III. Detailed Expense Breakdown

A. Itemized List of Expenses

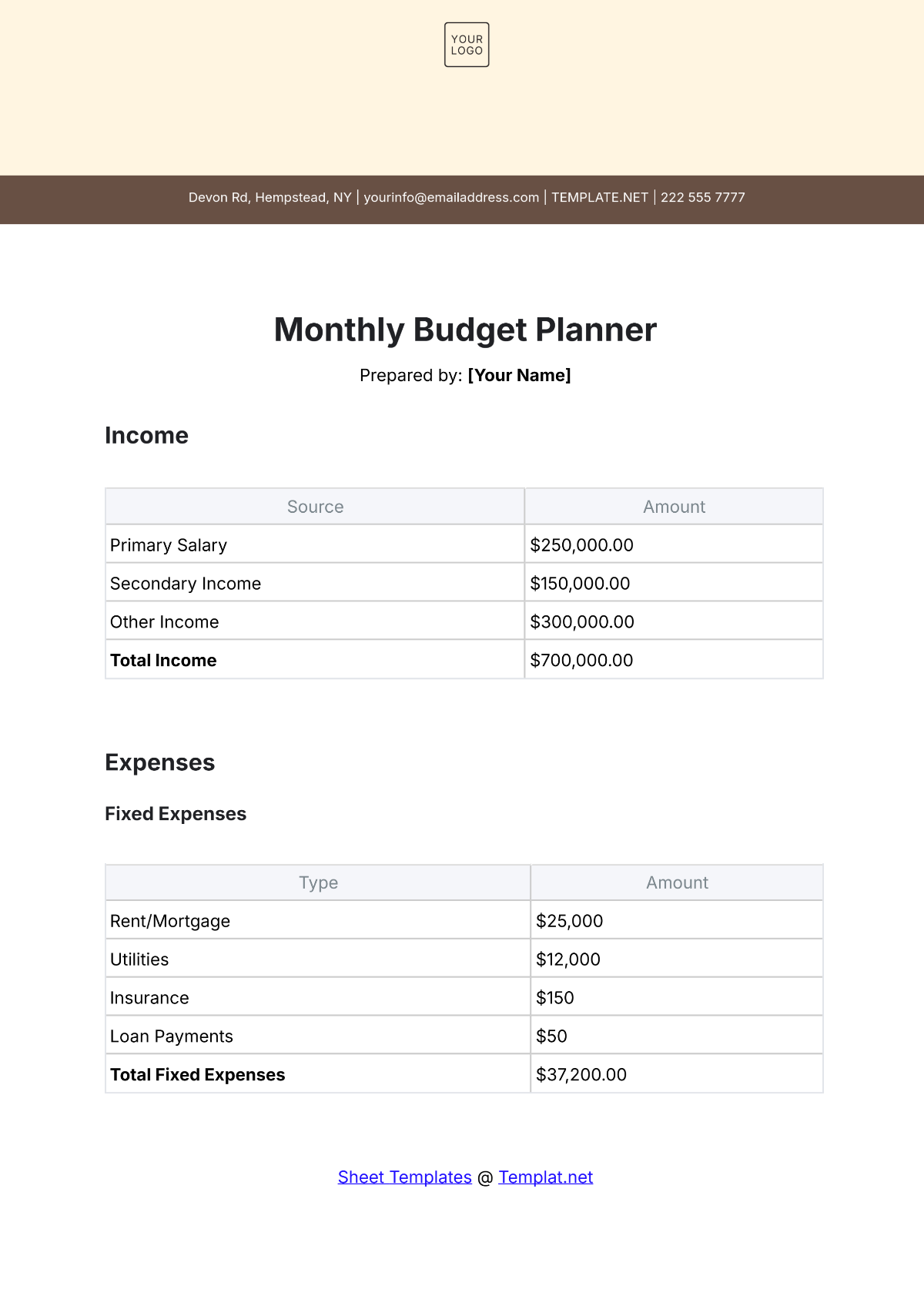

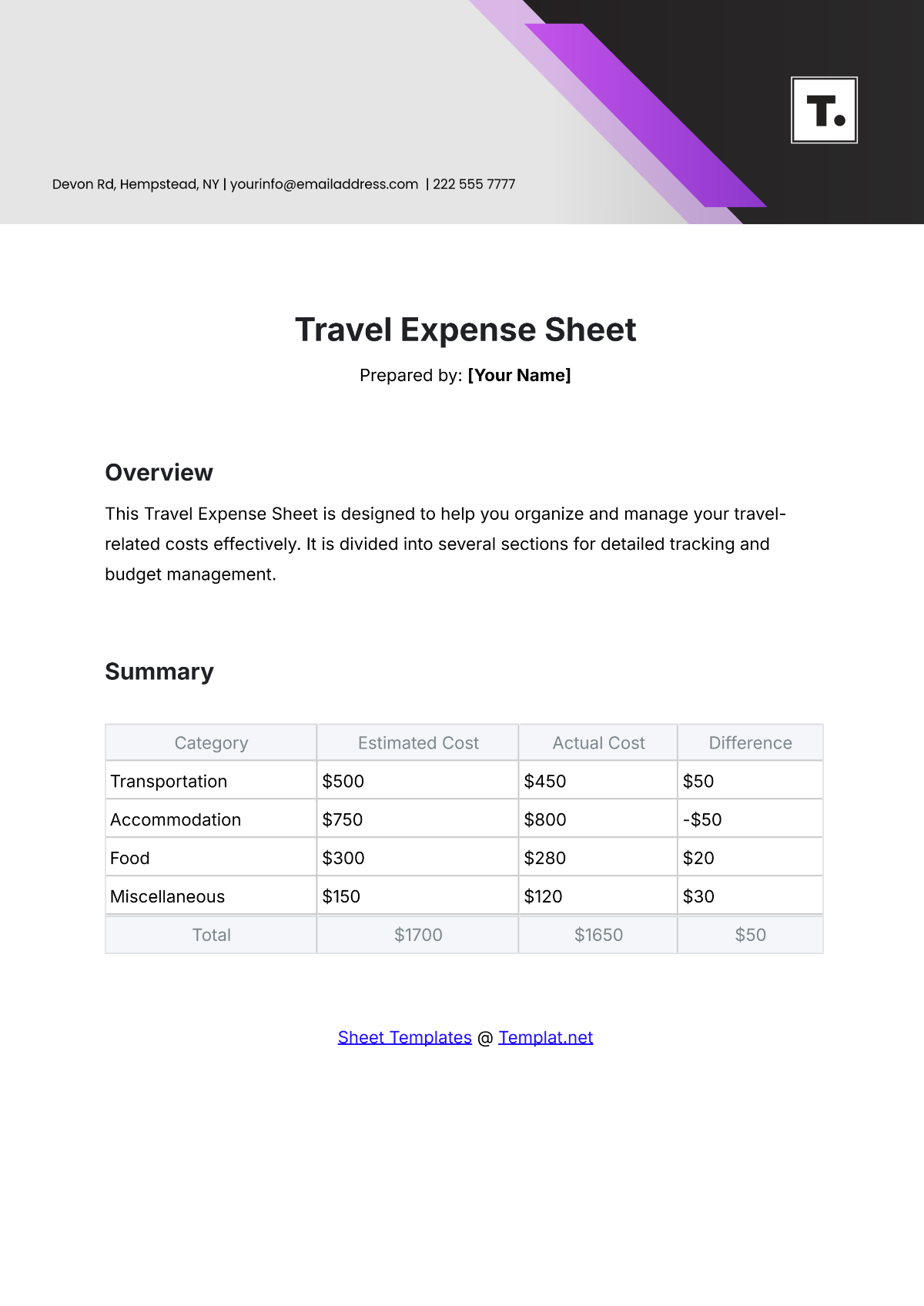

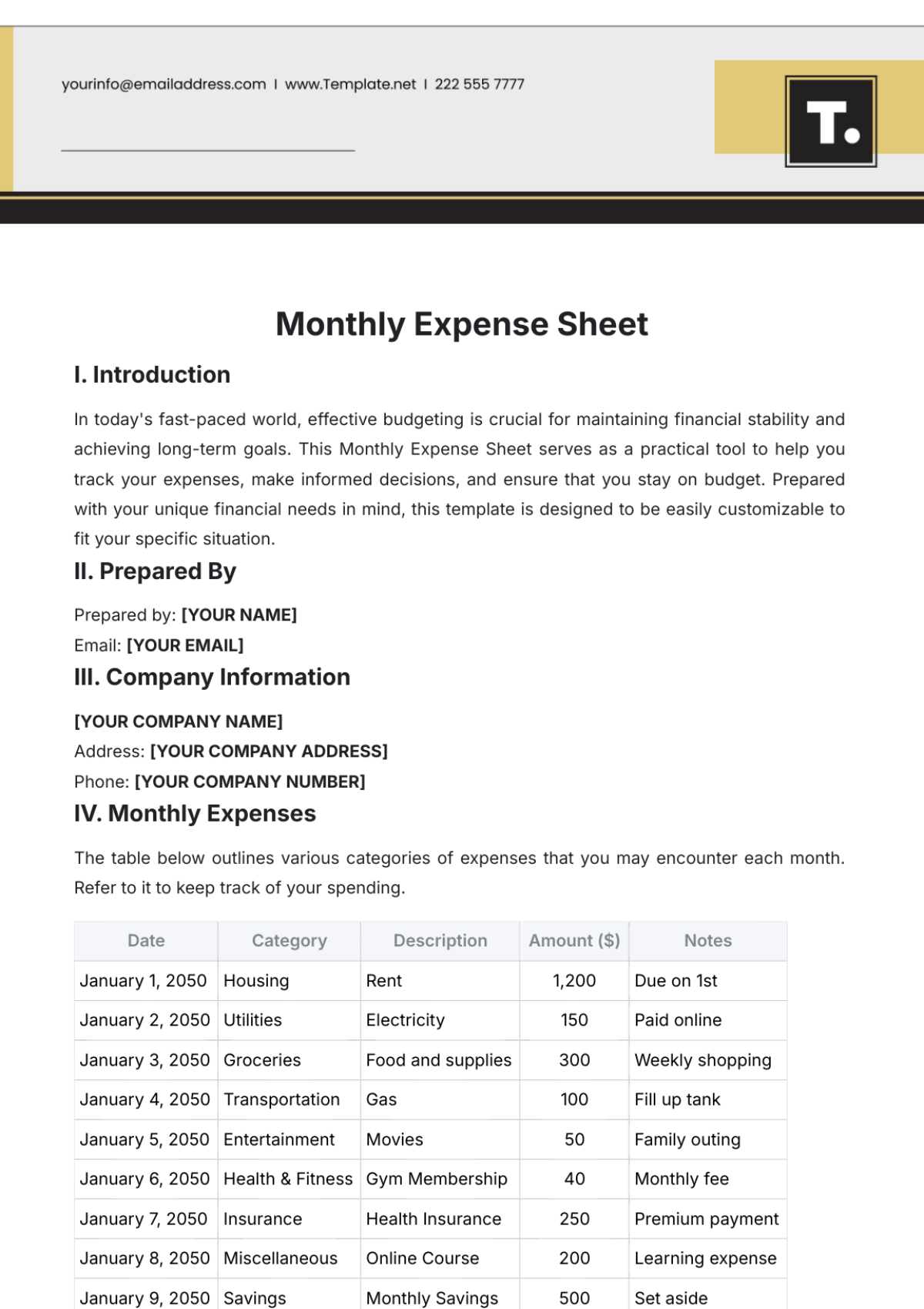

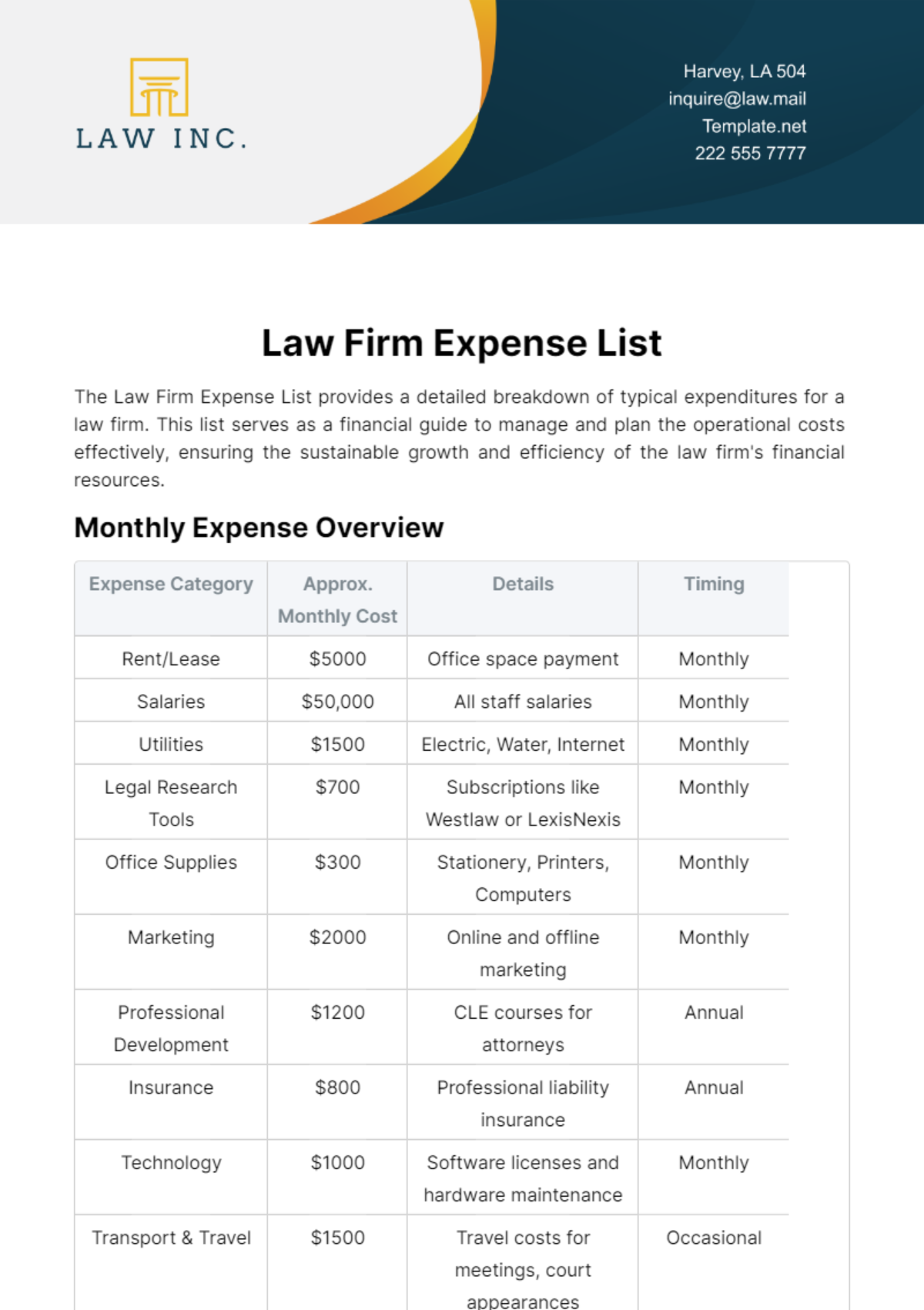

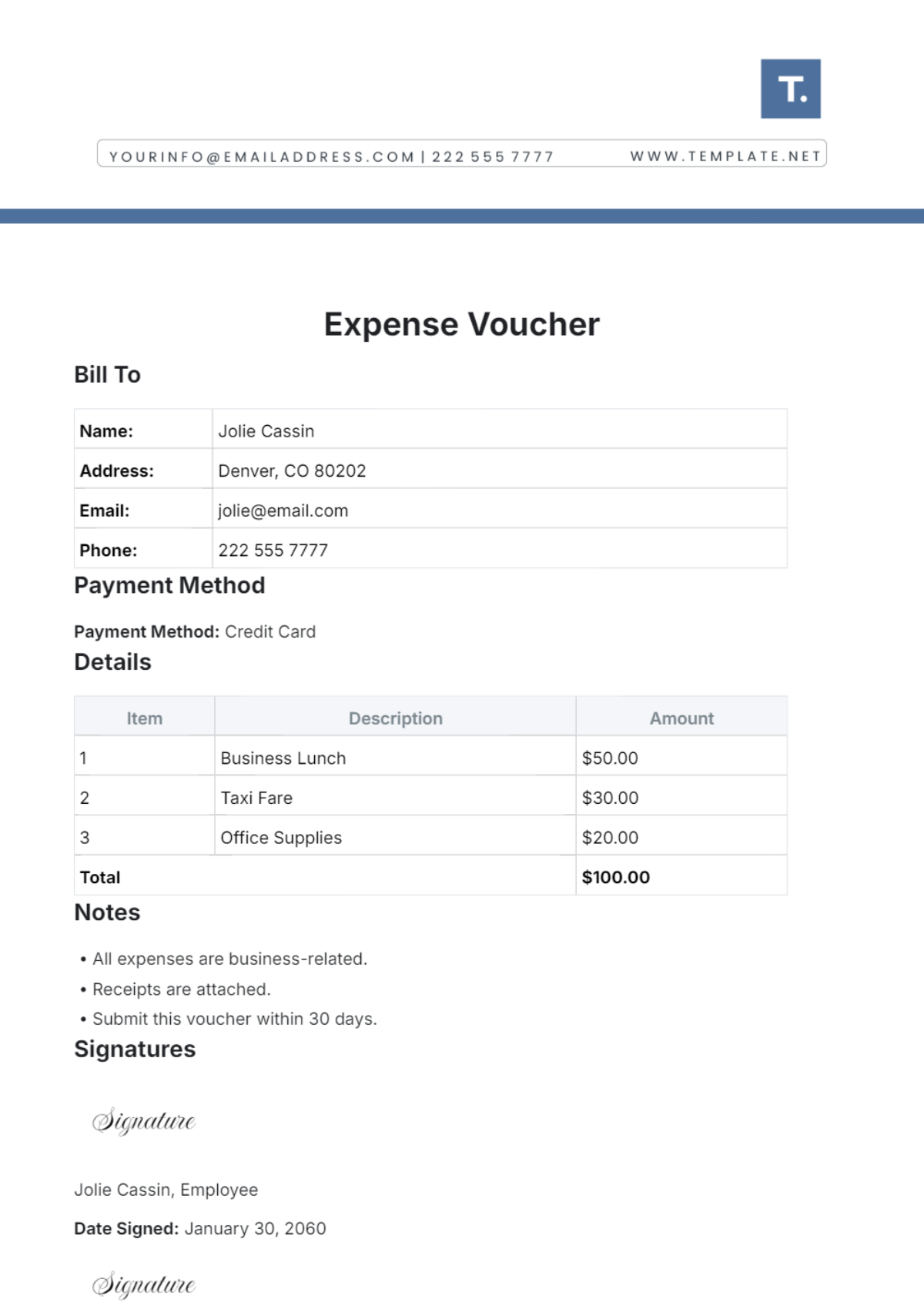

The itemized list of expenses for the first quarter of [Year] is detailed in Table 1 below:

Category | Amount ($) |

|---|---|

Equipment Costs | 62,000 |

Facility Costs | 93,000 |

Staff Costs | 118,000 |

Administrative Costs | 21,000 |

Miscellaneous Costs | 18,000 |

Total Expenses | 312,000 |

B. Cost per Category

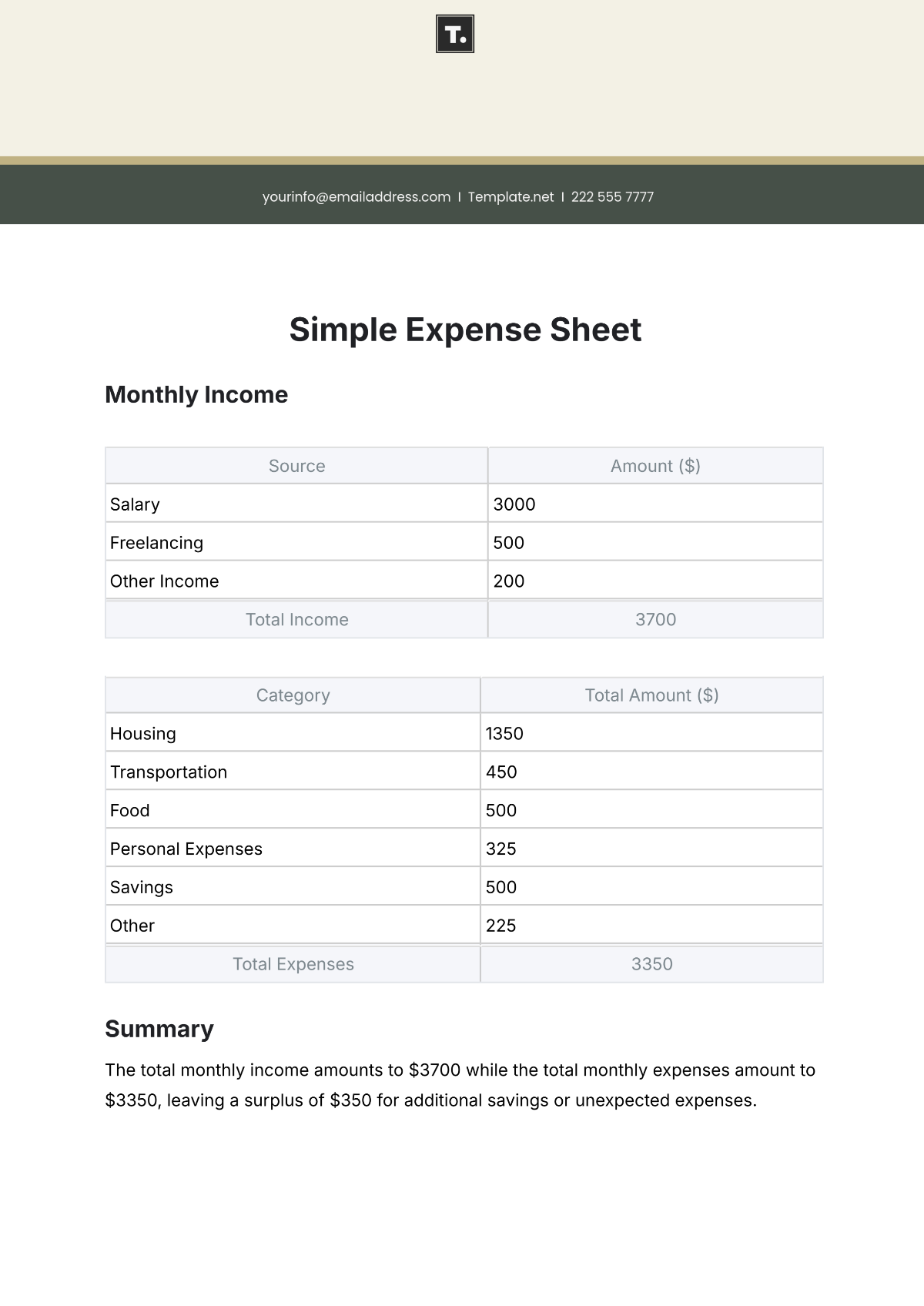

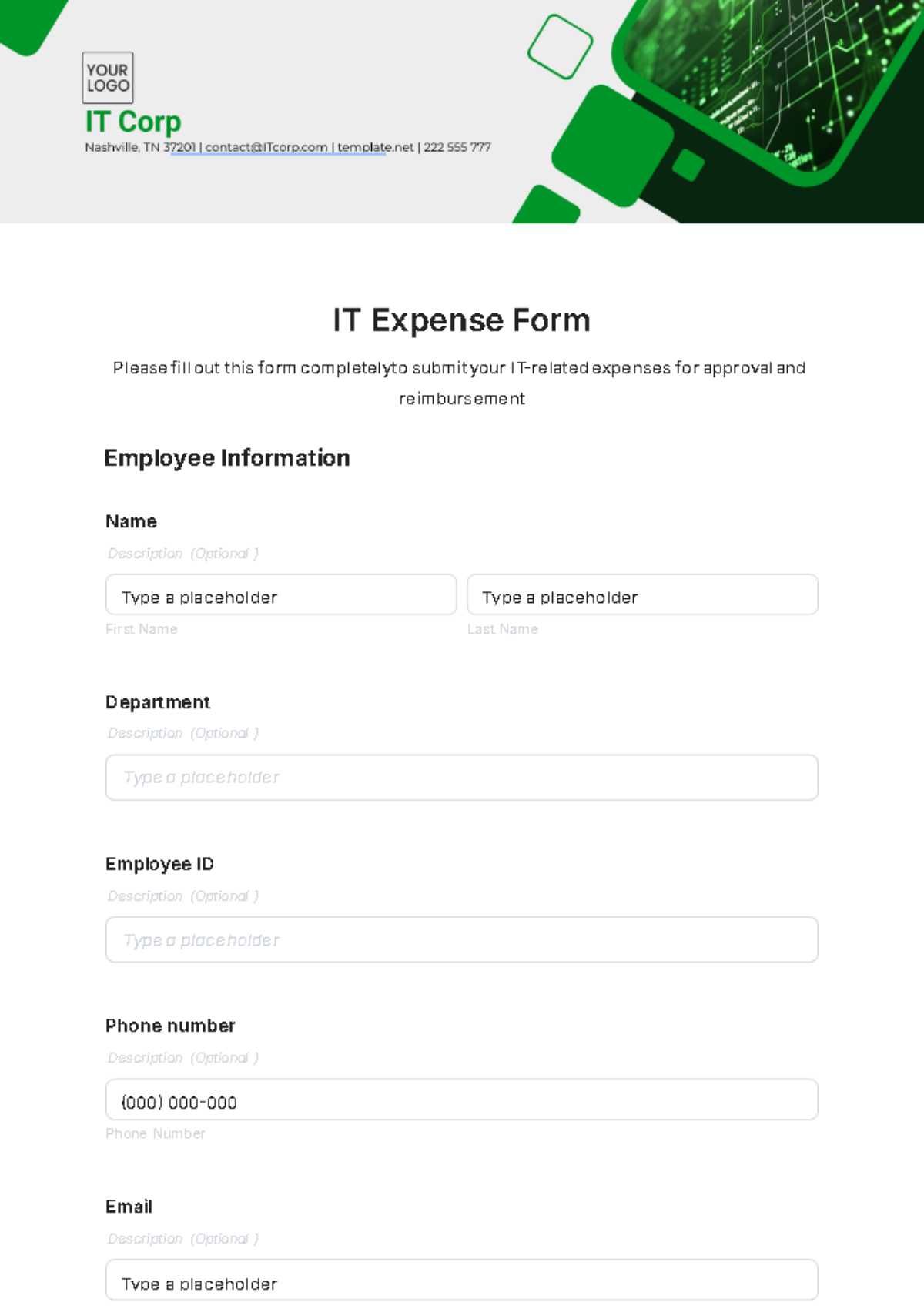

The cost per category as a percentage of total expenses is summarized in Table 2:

Category | Percentage (%) |

|---|---|

Equipment Costs | 19.87 |

Facility Costs | 29.81 |

Staff Costs | 37.82 |

Administrative Costs | 6.73 |

Miscellaneous Costs | 5.77 |

IV. Financial Analysis

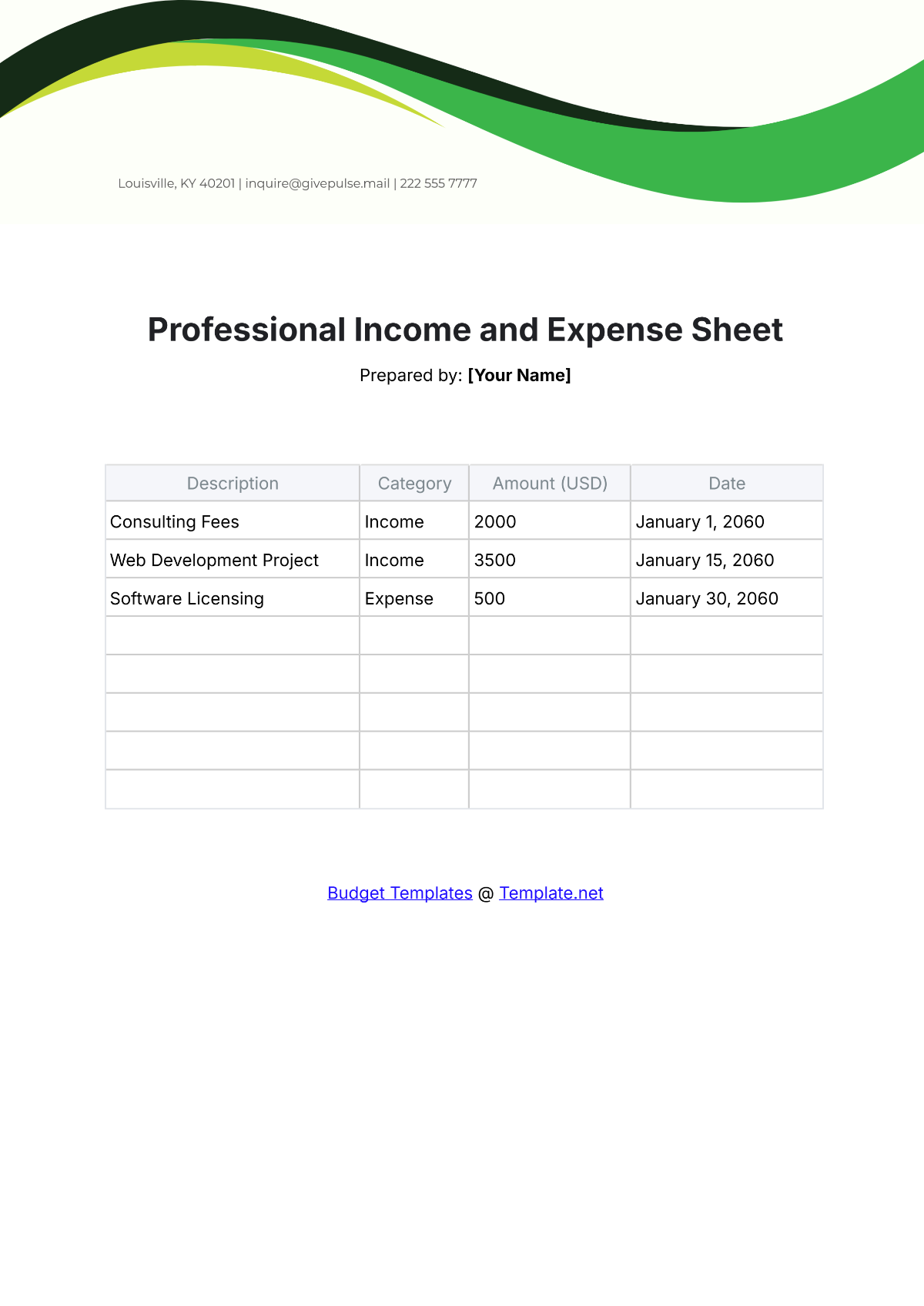

A. Total Expenses vs. Budget

The total expenses of $312,000 align closely with the budgeted expenditure for the first quarter, ensuring fiscal discipline and effective resource allocation.

B. Variance Analysis

Over-budget Items

Equipment costs exceeded the budget by 10% due to unexpected maintenance needs and the purchase of additional fitness accessories.

Under-budget Items

Administrative costs remained under budget by 15% due to efficient resource management and cost-saving measures implemented.

C. Trends and Patterns

Analyzing expense trends reveals a seasonal increase in member amenities during peak months, necessitating flexible budgeting strategies to accommodate fluctuating demands.

V. Recommendations

A. Cost-saving Measures

Implementing energy-saving initiatives and negotiating competitive vendor contracts can reduce facility and operational costs without compromising service quality.

B. Budget Adjustments

Allocate additional funds towards staff training and development to enhance service excellence and maintain employee satisfaction.

C. Future Expense Projections

Forecasting future expenses based on current trends and anticipated growth will facilitate proactive financial planning and resource allocation.

VI. Conclusion

A. Summary of Report Findings

The Gym Expense Report for [Your Company Name] highlights the meticulous tracking and management of financial expenditures for the first quarter of [Year]. Our analysis reveals that significant investments were made in equipment and facility upgrades, which are essential for maintaining our competitive edge and providing high-quality services to our members. Staff costs, which constitute a substantial portion of our expenses, reflect our commitment to attracting and retaining skilled personnel through competitive wages and benefits. Administrative and miscellaneous costs have been managed efficiently, ensuring alignment with our budgetary goals.

B. Final Remarks

The findings of this report underscore the importance of strategic financial planning and disciplined budget management. Despite some categories exceeding budget expectations, the overall financial health of [Your Company Name] remains robust due to effective cost-control measures and proactive resource allocation. The investments made during this period are expected to yield long-term benefits, including enhanced member satisfaction, increased membership retention, and improved operational efficiency.

Our focus on regular maintenance and timely repairs ensures that our equipment remains in optimal condition, thereby minimizing disruptions and enhancing the overall member experience. The investments in staff training and development are crucial for maintaining high service standards and fostering a culture of continuous improvement.

C. Next Steps

To build on the successes of this reporting period, [Your Company Name] will implement the following steps:

Enhanced Financial Monitoring: Establish a more granular financial monitoring system to track expenses in real-time, allowing for quicker adjustments and more precise budget management.

Energy Efficiency Initiatives: Explore and implement energy-saving measures, such as upgrading to LED lighting, optimizing HVAC systems, and investing in energy-efficient equipment. These initiatives are expected to reduce utility costs and contribute to environmental sustainability.

Vendor Contract Negotiations: Renegotiate contracts with suppliers and service providers to secure better rates and terms, thereby reducing operational costs without compromising quality.

Member Feedback Integration: Incorporate member feedback into our expense allocation strategy to ensure that investments align with member preferences and enhance their overall gym experience.

Future Projections and Scenario Planning: Develop detailed financial projections and conduct scenario planning to prepare for potential future challenges and opportunities. This proactive approach will enable [Your Company Name] to navigate economic fluctuations and market changes effectively.

Marketing and Outreach: Allocate additional resources towards targeted marketing and outreach efforts to attract new members and retain existing ones. This includes leveraging digital marketing platforms, community engagement initiatives, and member referral programs.

Training and Development: Continue investing in the professional development of our staff, with a focus on emerging fitness trends, customer service excellence, and advanced technical skills. This investment will ensure that our team remains at the forefront of industry developments and delivers exceptional service.

By adopting these strategies, [Your Company Name] aims to maintain financial stability, optimize resource utilization, and enhance overall operational efficiency. Our commitment to excellence in service delivery and prudent financial management will ensure continued growth and success in the competitive fitness market.