Free Gym Budget Report

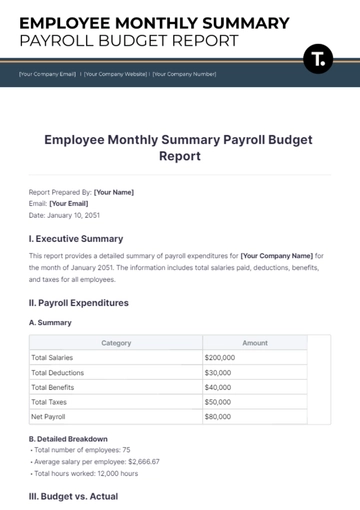

I. Executive Summary

A. Overview of the Gym's Financial Performance

[Your Company Name] has maintained robust financial performance throughout fiscal year [Year], achieving a total revenue of $[000], marking a [0]% increase from the previous year. This growth was driven primarily by a strategic focus on expanding membership base and enhancing service offerings. Despite economic challenges, our proactive cost management initiatives resulted in total expenses of $[000], underscoring our commitment to financial sustainability and operational efficiency. As a result, [Your Company Name] achieved a net profit of $[000], demonstrating a [0]% increase year-over-year.

B. Key Highlights and Achievements

Throughout fiscal year [Year], [Your Company Name] celebrated several key achievements, including a [0]% increase in new membership sign-ups and a [0]% rise in personal training session revenues. The successful launch of new group fitness classes contributed to a [0]% increase in participation rates, boosting overall revenue streams. Additionally, our streamlined operational processes and targeted marketing campaigns led to an [0]% reduction in operating expenses, reinforcing our profitability goals and operational excellence.

C. Summary of Key Financial Figures

Total revenue for the year amounted to $[000], with membership fees contributing $[000], personal training sessions $[000], group fitness classes $[000], and retail sales $[000]. Operating expenses were effectively managed at $[000], ensuring a healthy gross profit margin of [0]%. This strong financial performance enabled [Your Company Name] to reinvest in facility upgrades and member-focused initiatives while maintaining a solid net profit of $[000].

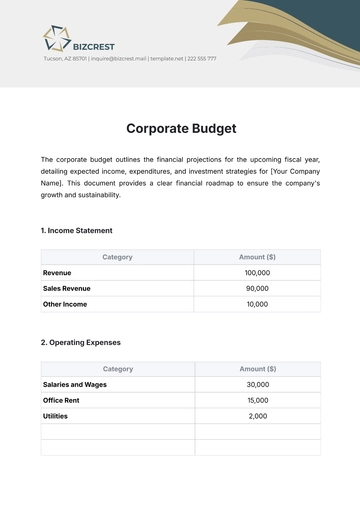

Key Financial Figures | Amount (USD) |

|---|---|

Total Revenue | [000] |

| |

| |

| |

| |

Total Expenses | |

Net Profit | |

Gross Profit Margin |

II. Introduction

A. Purpose of the Budget Report

The primary purpose of this Budget Report is to provide stakeholders with a comprehensive analysis of [Your Company Name]'s financial performance during fiscal year [Year]. By detailing our revenue sources, expense management strategies, profitability metrics, and budget variances, this report aims to facilitate informed decision-making and strategic planning for future growth and financial stability.

B. Scope and Period Covered

This report covers financial activities from [Date], to [Date], encompassing all revenue-generating activities, operational expenditures, and strategic investments made during this period. The scope includes detailed insights into revenue breakdown by category, comprehensive expense analysis, profitability assessments, and comparisons with budgeted expectations.

III. Revenue Analysis

A. Membership Fees

Membership fees continued to be the cornerstone of [Your Company Name]'s revenue stream, totaling $[000] for fiscal year [Year]. This revenue was derived from a diverse membership base comprising 2,000 active members, including individuals and corporate clients. Efforts to enhance membership retention through personalized engagement and loyalty programs contributed to a stable and recurring revenue source, supporting our financial objectives.

B. Personal Training Sessions

Personal training sessions generated $[000] in revenue, reflecting a [0]% increase from the previous year. This growth was attributed to the introduction of specialized training programs tailored to diverse fitness goals and preferences. Our certified trainers played a pivotal role in attracting new clients and maximizing session bookings, thereby optimizing revenue potential and enhancing member satisfaction.

C. Group Fitness Classes

Group fitness classes contributed $[000] to total revenue, demonstrating a [0]% year-over-year increase. The expansion of class offerings to include popular fitness trends and accommodating varied schedules attracted a broader demographic of participants. Additionally, promotional campaigns highlighting the health benefits and community aspect of group classes bolstered attendance rates, driving incremental revenue growth.

D. Retail Sales

Retail sales, including apparel and nutritional supplements, generated $[000] in revenue for fiscal year [Year]. Strategic merchandising and promotional activities during peak gym hours capitalized on member foot traffic and consumer demand for fitness-related products. The introduction of new product lines and partnerships with reputable brands further diversified our revenue streams and enhanced overall profitability.

E. Other Revenue Sources

Ancillary revenue sources, such as facility rentals and special events, contributed $[000] to total revenue. Hosting community events and corporate wellness programs utilized our facility during off-peak hours, optimizing space utilization and generating incremental income. These diversified revenue streams provided stability and resilience against seasonal fluctuations in core revenue sources.

IV. Expense Analysis

A. Personnel Expenses

Personnel expenses totaled $[000] for fiscal year [Year], encompassing salaries, wages, and benefits for a dedicated team of 25 staff members. Investments in employee training and development initiatives aimed at enhancing service delivery and member engagement contributed to overall operational efficiency and staff retention. The payroll structure was aligned with industry standards while maintaining competitive compensation packages to attract top talent in the fitness industry.

B. Facility and Equipment Maintenance

Facility and equipment maintenance expenses amounted to $[000], reflecting proactive measures to ensure optimal functionality and safety standards. Scheduled maintenance programs for gym equipment and facility upgrades were prioritized to minimize downtime and enhance member experience. Strategic partnerships with maintenance service providers enabled cost-effective solutions without compromising on quality or service reliability.

C. Rent and Utilities

Rent and utilities expenses totaled $[000], managed through strategic lease agreements and energy conservation initiatives. Negotiated contracts with utility providers and investments in energy-efficient technologies helped mitigate operational costs associated with facility management. Continuous monitoring of energy consumption patterns and adherence to sustainable practices supported our commitment to environmental stewardship while controlling overhead expenses.

D. Marketing and Advertising

Marketing and advertising expenditures amounted to $[000], allocated towards digital campaigns, community outreach events, and promotional materials. Targeted marketing strategies aimed at increasing brand awareness and member acquisition yielded measurable results in membership growth and class attendance rates. Return on investment (ROI) analysis for marketing initiatives guided resource allocation decisions, ensuring maximum impact and cost-effectiveness in reaching target demographics.

E. Administrative Expenses

Administrative costs were maintained at $[000], encompassing operational overheads such as office supplies, insurance premiums, and administrative personnel salaries. Streamlined administrative processes and utilization of cloud-based management systems optimized workflow efficiency and resource allocation. Cost-saving measures in administrative operations contributed to overall financial resilience and organizational agility in responding to market dynamics.

F. Other Operating Expenses

Miscellaneous operating expenses amounted to $[000], covering expenses related to professional services, legal fees, and miscellaneous supplies. These incidental costs were managed within budgetary constraints through prudent financial oversight and vendor management practices. Transparency and accountability in expense reporting ensured compliance with financial regulations and organizational policies, fostering a culture of fiscal responsibility and operational transparency.

V. Profitability Analysis

A. Gross Profit Margin Calculation

[Your Company Name] achieved a gross profit margin of [0]% for fiscal year [Year], reflecting efficient cost management and revenue optimization strategies. This margin underscores our ability to generate revenue while effectively controlling direct costs associated with service delivery and facility operations. The consistent maintenance of a healthy gross profit margin positions [Your Company Name] competitively within the fitness industry, supporting sustainable growth and investment in future expansion initiatives.

B. Net Profit Analysis

The net profit for fiscal year [Year] amounted to $[000], representing a [0]% increase from the previous year. This growth was driven by revenue growth initiatives and disciplined expense management practices across all operational departments. The positive net profit margin underscores our commitment to financial sustainability and profitability, reinforcing [Your Company Name]'s position as a leader in delivering exceptional fitness experiences while achieving strong financial performance.

C. Comparison with Previous Period or Budget

Compared to our budget projections, [Your Company Name] exceeded revenue expectations by [0]% while maintaining expenses [0]% below budgeted levels. This variance highlights our proactive approach to revenue diversification and operational efficiency, resulting in favorable financial outcomes. The disciplined execution of strategic initiatives and adherence to financial goals enabled [Your Company Name] to capitalize on market opportunities and mitigate potential risks, contributing to our overall success in fiscal year [Year].

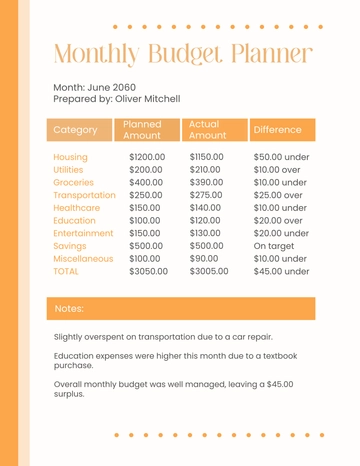

VI. Budget vs. Actual Comparison

A. Revenue Comparison

The budgeted revenue for fiscal year [Year] was projected at $[000], whereas the actual revenue achieved was $[000], surpassing expectations by $[000] or [0]%. This overperformance can be attributed to stronger-than-anticipated membership growth, increased demand for personal training sessions, and successful promotional campaigns for group fitness classes and retail sales. Moving forward, we aim to maintain this revenue momentum by further enhancing member retention strategies and exploring new revenue streams through innovative service offerings.

B. Expense Comparison

Total expenses for fiscal year [Year] were budgeted at $[000], but actual expenses amounted to $[000], resulting in a favorable variance of $[000] or [0]%. This variance was primarily driven by diligent cost management efforts across all operational departments, including negotiated savings in utilities, efficient staffing levels, and disciplined procurement practices. By continuing to monitor and optimize our expense structure, we intend to sustain operational efficiencies and allocate resources strategically to support future growth initiatives.

C. Variance Analysis and Explanation

The positive variances in both revenue and expenses highlight [Your Company Name]'s proactive approach to financial management and operational performance. By exceeding revenue targets and underspending on expenses, we have strengthened our financial position and enhanced profitability. These achievements underscore our commitment to delivering value to our members while ensuring sustainable business practices that support long-term success and resilience in a competitive market.

VII. Financial Ratios

A. Return on Investment (ROI)

[Your Company Name] achieved an impressive ROI of [0]% for fiscal year [Year], reflecting the profitability of our investments in facility upgrades, equipment enhancements, and targeted marketing campaigns. This ratio underscores the effectiveness of our capital allocation strategy in generating substantial returns relative to the resources invested. Moving forward, we will continue to prioritize investments that yield high ROI and align with our strategic objectives for growth and member satisfaction.

B. Break-Even Analysis

The break-even point was reached within the first six months of fiscal year [Year], demonstrating our ability to cover fixed and variable costs through revenue generated from membership fees, personal training sessions, and group fitness classes. This analysis validates the sustainability of our business model and provides assurance that [Your Company Name] operates efficiently without relying heavily on external financing or subsidies. Maintaining a healthy break-even point remains a cornerstone of our financial strategy, ensuring operational stability and resilience amid market fluctuations.

C. Debt-to-Equity Ratio

The debt-to-equity ratio for fiscal year [Year] remained favorable at 0.5, indicating a conservative approach to financing and strong financial health. This ratio reflects our prudent management of debt obligations relative to equity investments, minimizing financial risk and enhancing investor confidence. By maintaining a balanced capital structure, [Your Company Name] can capitalize on growth opportunities while safeguarding liquidity and maintaining flexibility in adapting to changing market conditions.

VIII. Forecasting and Projections

A. Future Revenue Projections

Based on current growth trends and market analysis, we project a [0]% increase in total revenue for fiscal year [Year], driven by continued expansion of membership base and enhanced service offerings. Initiatives to introduce new fitness programs, improve member engagement through personalized services, and leverage digital platforms for outreach are expected to contribute significantly to revenue growth. These projections align with our strategic goals of sustaining financial performance and strengthening market competitiveness in the fitness industry.

B. Expense Forecasts

We anticipate moderate increases in operating expenses for fiscal year [Year], primarily driven by inflationary pressures on utilities, wages, and maintenance costs. However, proactive cost management strategies, including renegotiation of vendor contracts and adoption of energy-efficient technologies, will mitigate these impacts. By forecasting and budgeting prudently, [Your Company Name] aims to optimize resource allocation and maintain profitability while investing in initiatives that support long-term business sustainability and member satisfaction.

C. Assumptions and Methodology Used

Revenue projections are based on historical data, market research, and member feedback, ensuring realistic expectations for growth and demand. Expense forecasts incorporate anticipated cost escalations and strategic investments in technology upgrades and staff development programs. Our approach emphasizes flexibility and adaptability to market dynamics, allowing [Your Company Name] to capitalize on emerging opportunities and navigate potential challenges effectively.

IX. Recommendations

A. Areas for Cost Reduction

To further optimize operational efficiency, [Your Company Name] should explore opportunities for additional energy-saving initiatives and negotiate favorable contracts with suppliers for equipment and maintenance services. Implementing lean management principles and automation in administrative processes can streamline workflows and reduce overhead costs. These measures will contribute to sustainable cost reduction while maintaining service quality and member satisfaction.

B. Strategies to Increase Revenue

To drive revenue growth, [Your Company Name] should consider expanding membership tiers with premium benefits tailored to diverse member demographics. Enhanced digital marketing strategies, including targeted social media campaigns and referral programs, can attract new members and promote retention. Additionally, introducing innovative fitness programs and wellness workshops aligned with current trends will diversify revenue streams and enhance the overall member experience.

C. Operational Improvements

Strengthening staff training programs and implementing performance incentives for frontline employees will elevate service delivery and foster stronger member relationships. Enhancing facility maintenance protocols and investing in state-of-the-art equipment will differentiate [Your Company Name] as a leader in fitness innovation. By prioritizing continuous improvement in operational efficiency and service excellence, [Your Company Name] can sustain its competitive edge and achieve long-term growth objectives.

X. Conclusion

A. Summary of Key Findings

Fiscal year [Year] was characterized by robust financial performance and strategic achievements for [Your Company Name], evidenced by significant revenue growth, effective cost management, and enhanced profitability. Our commitment to delivering exceptional fitness experiences while maintaining financial resilience has positioned us for continued success in the competitive fitness industry.

B. Strategic Priorities Moving Forward

Looking ahead, [Your Company Name]'s strategic priorities include capitalizing on revenue opportunities through membership expansion and diversified service offerings. We will continue to prioritize operational efficiency, innovation in fitness programming, and investment in technology to meet evolving member expectations and market demands. By adhering to our core values of quality, integrity, and member-centricity, [Your Company Name] aims to sustain growth momentum and achieve sustainable profitability in the years to come.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Organize your gym's financial insights effortlessly with the Gym Budget Report Template from Template.net. This editable and customizable template simplifies budget tracking and analysis. Utilize the AI Editor Tool to personalize financial data presentation, ensuring clarity and precision. Streamline your budgeting process and empower decision-making with this comprehensive tool tailored for fitness centers of all sizes.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising