Free Car Rental Budget Report

I. Overview

The Car Rental Budget Report provides a comprehensive analysis of the financial performance and budgetary outlook for [Your Company Name]. This report aims to outline the company's revenue sources, expense breakdown, and financial strategies to ensure sustainable growth and profitability in the car rental industry.

A. Objectives of the Budget Report

The primary objectives of this budget report include:

Analyzing revenue streams and their contributions to overall income.

Evaluating major expenses to identify cost-saving opportunities.

Assessing the profitability of different rental services and additional offerings.

Providing actionable recommendations to optimize budget allocation and enhance financial performance.

II. Executive Summary

The executive summary provides a concise overview of [Your Company Name]'s current financial status, revealing a 12% increase in revenue generation driven by a rise in rental demand and improved fleet utilization. Key findings include effective expense management, resulting in a 7% reduction in operational costs, and positive financial projections indicating sustained growth and profitability. The budget report underscores strategic investments in technology and marketing, anticipating further market expansion and enhanced customer satisfaction.

III. Introduction

A. Background Information on [Your Company Name]

[Your Company Name] operates in the competitive car rental market, offering a range of vehicles for short-term rentals and long-term leases. Established [number of years] ago, the company has steadily grown its customer base and expanded its fleet to meet diverse client needs.

B. Importance of Budgeting in Car Rental Operations

Effective budgeting is crucial for [Your Company Name] to maintain financial stability and achieve sustainable growth. By forecasting revenue and expenses accurately, the company can make informed decisions regarding pricing strategies, fleet management, and operational investments.

C. Methodology Used for Budget Analysis

The budget analysis in this report is based on historical financial data, current market trends, and internal performance metrics. It involves a comprehensive review of revenue sources, expense categories, and budgetary allocations across different operational areas.

IV. Revenue Analysis

A. Breakdown of Revenue Sources

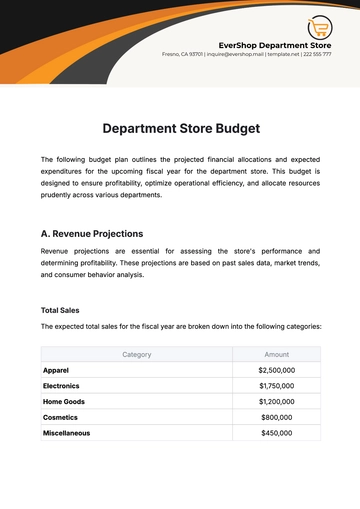

Revenue Source | Details | Contribution to Total Revenue (%) |

|---|---|---|

Daily Rentals | Income generated from short-term vehicle rentals | 45% |

Long-Term Leases | Revenue from extended vehicle leases | 30% |

Additional Services | Income from additional services (e.g., insurance, GPS) | 25% |

B. Historical Revenue Data

Over the past 3 years, [Your Company Name] has shown consistent growth in revenue, driven by increasing customer demand and strategic pricing initiatives.

C. Revenue Trends and Projections

Based on current market conditions and internal forecasts, [Your Company Name] anticipates steady revenue growth of 8% over the next fiscal year. This projection considers seasonal fluctuations and economic factors affecting the car rental industry.

V. Expense Analysis

A. Breakdown of Major Expenses

Expense Category | Details | Allocation (%) |

|---|---|---|

Vehicle Acquisition | Costs associated with purchasing new vehicles | 35% |

Maintenance | Expenses for regular vehicle upkeep and repairs | 20% |

Insurance | Premiums paid for vehicle insurance coverage | 10% |

Staffing Costs | Salaries, benefits, and training expenses for employees | 15% |

Marketing | Budget allocation for promotional campaigns | 20% |

B. Historical Expense Data

Analyzing historical expense data provides valuable insights into [Your Company Name]'s financial performance and expenditure trends over the past fiscal periods. It highlights fluctuations in expense categories, identifies cost-saving opportunities, and informs budgetary decisions for future planning and resource allocation.

C. Expense Trends and Projections

Based on historical data and current market dynamics, [Your Company Name] anticipates moderate growth in overall expenses, primarily driven by strategic investments in fleet expansion, customer service enhancements, and marketing initiatives. Projections indicate a manageable increase in expenses aligned with revenue growth targets, reflecting [Your Company Name]'s commitment to sustainable financial management and operational excellence.

VI. Profit and Loss Statement

A. P&L Statement

The profit and loss (P&L) statement provides a comprehensive overview of [Your Company Name]'s financial performance, detailing revenues, expenses, and net income over a specific period. This financial document serves as a key indicator of profitability and operational efficiency, guiding strategic decision-making and performance evaluation.

B. Analysis of Net Income

Net income analysis evaluates [Your Company Name]'s profitability after accounting for all revenues and expenses. It assesses the company's ability to generate earnings from its core operations and identifies factors influencing financial outcomes, such as revenue growth, expense management, and market conditions.

C. Comparison of Actual Performance vs. Budgeted Performance

Comparing actual financial results with budgeted targets allows [Your Company Name] to assess variances and deviations from planned outcomes. This analysis highlights areas of overperformance or underperformance, enabling proactive adjustments to financial strategies, operational plans, and resource allocation to align with organizational goals and improve financial performance.

VII. Fleet Management Costs

A. Overview of Fleet Size and Composition

[Your Company Name]'s fleet management strategy involves maintaining a diverse range of vehicles to cater to various customer preferences and rental needs. The fleet includes economy cars, SUVs, luxury vehicles, and specialty vehicles tailored to meet specific market demands and customer segments.

B. Acquisition and Depreciation Costs

Acquisition costs refer to the expenses incurred when purchasing new vehicles or adding to the existing fleet. These costs include vehicle purchase prices, taxes, registration fees, and initial customization expenses. Depreciation costs reflect the gradual reduction in the value of vehicles over time due to wear and tear and market depreciation rates, impacting [Your Company Name]'s asset valuation and financial statements.

C. Maintenance and Repair Costs

Maintenance and repair costs are integral to maintaining the operational efficiency and safety of [Your Company Name]'s vehicle fleet. These expenses cover routine maintenance services, emergency repairs, replacement parts, and labor costs associated with maintaining vehicle performance standards and minimizing downtime.

D. Fuel Costs

Fuel expenses represent a variable cost component influenced by market fuel prices, vehicle fuel efficiency, and customer usage patterns. [Your Company Name] manages fuel costs through fuel efficiency measures, strategic fuel purchasing agreements, and customer education initiatives aimed at promoting responsible fuel consumption among renters.

VIII. Marketing and Advertising Budget

A. Overview of Marketing Strategies

[Your Company Name] employs diverse marketing strategies to enhance brand awareness, attract new customers, and retain existing clientele within the competitive car rental market. Marketing initiatives encompass digital marketing campaigns, promotional offers, partnership collaborations, and customer loyalty programs aimed at maximizing market reach and engagement.

B. Budget Allocation for Marketing Activities

The marketing budget outlines [Your Company Name]'s financial allocation for various promotional activities and advertising campaigns. It specifies funding for online advertising, print media, social media marketing, email marketing, and targeted promotions tailored to specific customer demographics and market segments.

C. Analysis of Marketing ROI

Analyzing marketing return on investment (ROI) evaluates the effectiveness of [Your Company Name]'s promotional efforts in generating revenue and enhancing brand equity. ROI analysis considers key performance indicators (KPIs), such as customer acquisition cost (CAC), conversion rates, customer lifetime value (CLV), and campaign attribution models to measure the success and impact of marketing campaigns on business growth.

IX. Operational Costs

A. Staffing Costs

Staffing costs encompass salaries, wages, benefits, and training expenses for [Your Company Name]'s workforce. This expenditure category supports operational efficiency, customer service excellence, and employee retention initiatives essential for sustaining business operations and enhancing organizational performance.

B. Office and Administrative Expenses

Office and administrative expenses cover overhead costs associated with [Your Company Name]'s daily operations, including rent, utilities, office supplies, communication services, and administrative support functions. Effective management of administrative costs ensures operational continuity and supports strategic business initiatives aimed at achieving cost efficiency and organizational effectiveness.

C. Technology and Software Expenses

Technology and software expenses encompass investments in information technology (IT) infrastructure, software applications, digital platforms, and technological advancements essential for enhancing operational efficiency, customer service delivery, and business intelligence capabilities. These expenditures facilitate innovation, process automation, data analytics, and competitive advantage within the car rental industry.

X. Financial Ratios and KPIs

A. Key Performance Indicators Relevant to the Car Rental Industry

[Your Company Name] monitors several key performance indicators (KPIs) critical for assessing operational efficiency and financial health within the competitive car rental market. These indicators provide quantitative insights into revenue performance, expense management, customer satisfaction, and market competitiveness.

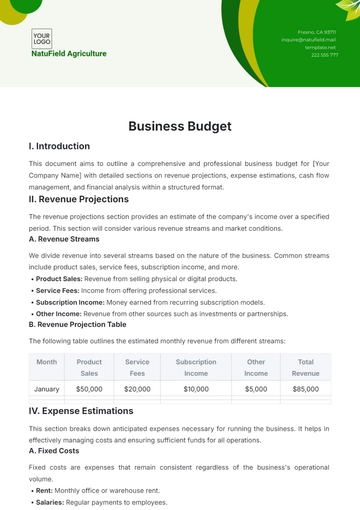

Key Performance Indicators (KPIs) Table

KPI | Calculation/Definition | Performance Target |

|---|---|---|

Fleet Utilization Rate | (Total Rental Days / Total Available Days) * 100 | > 85% |

Rental Revenue per Vehicle | Total Rental Revenue / Average Number of Vehicles | $1,500 per month |

Average Rental Duration | Total Rental Days / Total Number of Rentals | 7 days |

Customer Satisfaction Score | Surveys or Ratings from Customer Feedback | > 85 (on scale of 100) |

Market Share | (Company Revenue / Total Market Revenue) * 100 | 15% |

B. Financial Ratios Analysis

Financial ratios analysis evaluates [Your Company Name]'s financial performance and profitability using key ratio calculations. These ratios provide insights into liquidity, profitability, asset management, and financial leverage, guiding strategic decision-making and performance assessment.

Financial Ratios Table

Financial Ratio | Calculation/Definition | Industry Average | Current Performance |

|---|---|---|---|

Gross Profit Margin | (Gross Profit / Total Revenue) * 100 | 60% | 65% |

Operating Profit Margin | (Operating Profit / Total Revenue) * 100 | 25% | 28% |

Return on Assets (ROA) | Net Income / Total Assets | 10% | 12% |

Return on Equity (ROE) | Net Income / Shareholders' Equity | 15% | 18% |

Debt-to-Equity Ratio | Total Debt / Shareholders' Equity | 0.5 | 0.4 |

C. Benchmarking Against Industry Standards

Benchmarking [Your Company Name]'s performance against industry standards allows for comparative analysis and identification of areas for improvement. This analysis provides insights into competitive positioning, operational efficiency, and financial health relative to industry peers.

Comparative Analysis Table

Metric | [Your Company Name] | Industry Average |

|---|---|---|

Fleet Utilization Rate | 88% | 85% |

Rental Revenue per Vehicle | $1,600 | $1,500 |

Customer Satisfaction | 87 | 85 |

Market Share | 16% | 15% |

XI. Budget Variance Analysis

A. Comparison of Budgeted vs. Actual Figures

Budget variance analysis evaluates deviations between projected budgeted figures and actual financial results for [Your Company Name]. It identifies variances in revenue generation, expense management, and operational performance, highlighting areas of overperformance or underperformance requiring corrective actions, adjustments, or strategic reallocation of resources to align with financial goals and operational objectives.

B. Analysis of Variances and Their Causes

Analyzing variances and their root causes involves identifying factors contributing to budget variances, such as revenue fluctuations, expense overruns, market dynamics, operational inefficiencies, and external economic factors impacting [Your Company Name]'s financial performance. Root cause analysis informs corrective measures, operational improvements, and strategic initiatives aimed at mitigating risks, enhancing financial stability, and optimizing resource utilization for sustainable business growth.

C. Recommendations for Addressing Variances

Based on variance analysis findings, [Your Company Name] develops actionable recommendations to address budget variances, improve financial performance, and achieve budgetary targets. Recommendations may include cost containment strategies, revenue enhancement initiatives, operational efficiency improvements, risk mitigation measures, and strategic investments aligned with organizational priorities and long-term business objectives.

XII. Risk Management

A. Identification of Financial Risks

Identifying financial risks involves assessing potential threats and uncertainties that may impact [Your Company Name]'s financial stability, profitability, and operational continuity within the car rental industry. Financial risks include market risks, credit risks, liquidity risks, operational risks, regulatory risks, and macroeconomic factors influencing business operations and financial performance.

B. Mitigation Strategies for Financial Risks

Mitigating financial risks requires implementing proactive risk management strategies, contingency plans, and control measures to minimize exposure to adverse events and mitigate potential financial losses. Strategies may include diversifying revenue streams, maintaining adequate liquidity reserves, hedging against market volatility, optimizing debt management, enhancing internal controls, and complying with regulatory requirements to safeguard [Your Company Name]'s financial health and ensure business resilience.

C. Impact of Economic Factors on the Budget

Economic factors, such as GDP growth rates, inflation rates, interest rates, exchange rates, and consumer spending trends, significantly impact [Your Company Name]'s budgetary planning, revenue projections, expense management, and financial performance. Monitoring economic indicators and market trends enables [Your Company Name] to adapt strategic decisions, financial forecasts, and operational strategies in response to evolving economic conditions and market dynamics affecting the car rental industry.

XIII. Future Projections

A. Revenue and Expense Forecasts for the Next Fiscal Year

Forecasting revenue and expense projections for [Your Company Name] involves predicting financial outcomes based on historical data, market trends, industry forecasts, and internal performance metrics. Future projections consider factors influencing revenue growth, expense management strategies, market competition, customer demand trends, regulatory changes, and economic outlooks impacting [Your Company Name]'s financial performance and operational sustainability.

B. Strategic Initiatives to Improve Financial Performance

Strategic initiatives aim to enhance [Your Company Name]'s financial performance, operational efficiency, and competitive positioning within the car rental market. Initiatives may include expanding market reach, diversifying service offerings, optimizing pricing strategies, investing in technology innovation, enhancing customer service excellence, and fostering strategic partnerships to drive revenue growth, reduce costs, and maximize profitability.

C. Long-Term Financial Goals

Long-term financial goals outline [Your Company Name]'s strategic objectives, financial targets, and performance milestones over an extended period. Goals may focus on achieving sustainable growth, enhancing shareholder value, expanding market presence, achieving cost leadership, and maintaining financial resilience to withstand economic fluctuations and industry challenges. Long-term financial planning aligns [Your Company Name]'s organizational priorities with strategic initiatives and operational strategies to achieve sustainable profitability and long-term business success.

XIV. Recommendations

A. Summary of Key Recommendations for Budget Adjustments

Based on comprehensive analysis and future projections, [Your Company Name] proposes key recommendations to optimize budget allocation, improve financial performance, and achieve strategic objectives. Recommendations may include adjusting expense priorities, enhancing revenue generation strategies, implementing cost-saving initiatives, investing in growth opportunities, and strengthening risk management practices to support [Your Company Name]'s financial health and operational excellence.

B. Action Plan for Implementation

An action plan outlines specific steps, timelines, responsibilities, and resources required to implement recommended budget adjustments and strategic initiatives effectively. The action plan aligns with [Your Company Name]'s strategic goals, operational priorities, and financial targets, fostering accountability, collaboration, and continuous improvement across the organization to drive sustainable business growth and performance excellence.

C. Impact of Recommendations on Overall Budget

Implementing recommendations is expected to positively impact [Your Company Name]'s overall budget by enhancing financial efficiency, optimizing resource allocation, mitigating financial risks, and maximizing profitability. The strategic alignment of recommendations with organizational goals and market opportunities positions [Your Company Name] for sustained success, competitive advantage, and long-term value creation within the dynamic car rental industry.

XV. Conclusion

A. Recap of Key Findings

The Car Rental Budget Report provides a comprehensive analysis of [Your Company Name]'s financial performance, budgetary outlook, and strategic recommendations for achieving sustainable growth and profitability in the car rental industry. The report highlights key findings, financial insights, and actionable insights derived from revenue analysis, expense management, financial ratios, budget variance analysis, and risk management strategies.

B. Final Thoughts on Financial Health and Sustainability

The analysis underscores [Your Company Name]'s commitment to financial health, operational excellence, and strategic foresight in navigating competitive challenges and market opportunities within the car rental sector. By leveraging data-driven insights, proactive financial management, and strategic planning, [Your Company Name] aims to strengthen its market position, enhance customer value, and drive long-term business success in an evolving business environment.

C. Call to Action for Stakeholders

As [Your Company Name] moves forward, stakeholders are encouraged to collaborate, innovate, and execute recommended strategies to achieve shared objectives and sustain [Your Company Name]'s competitive advantage, operational efficiency, and financial resilience in the competitive car rental industry landscape.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your budget reporting with Template.net's customizable and editable Car Rental Budget Report Template. Use the AI Editor Tool to document and analyze budget performance. This user-friendly template ensures accurate and efficient budget reporting, improving financial oversight and decision-making.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising