Free Car Rental Security Agreement

This Car Rental Security Agreement ("Agreement") is made and entered into as of this [Date] by and between [Your Company Name], located at [Your Company Address], City of [City], State of [State], ZIP Code [ZIP Code], contact number [Your Company Number], and email [Your Company Email] (hereinafter referred to as the "Secured Party"), and [Borrower's Name], located at [Borrower's Address], City of [City], State of [State], ZIP Code [ZIP Code], contact number [Borrower's Number], and email [Borrower's Email] (hereinafter referred to as the "Debtor").

WHEREAS, the Debtor has agreed to purchase or lease certain vehicles from the Secured Party and has agreed to grant the Secured Party a security interest in the vehicles and other collateral described herein to secure the obligations of the Debtor to the Secured Party; and

WHEREAS, the Secured Party is willing to extend credit to the Debtor upon the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual covenants and promises herein contained, the parties hereto agree as follows:

1. Grant of Security Interest

1.1 The Debtor hereby grants to the Secured Party a security interest in the following described property (the "Collateral"):

All vehicles purchased or leased from the Secured Party, including but not limited to the following:

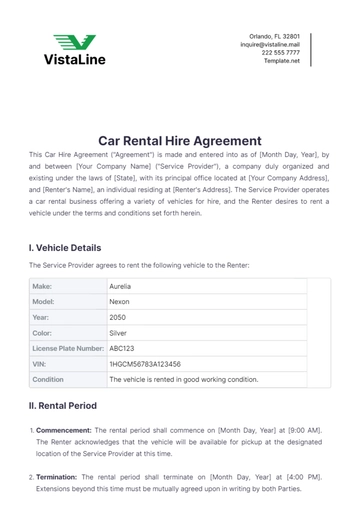

Make: [Vehicle Make]

Model: [Vehicle Model]

Year: [Vehicle Year]

Vehicle Identification Number (VIN): [VIN]

Color: [Vehicle Color]

All accessories, attachments, and additions to the vehicles.

All proceeds and products of the vehicles, including but not limited to insurance proceeds.

2. Obligations Secured

2.1 The security interest granted herein is to secure the following obligations of the Debtor to the Secured Party (the "Obligations"):

The payment of the purchase price or lease payments for the vehicles.

The payment of any interest, fees, or other charges related to the purchase or lease of the vehicles.

The performance of all covenants, conditions, and agreements contained in this Agreement and any other agreement between the Debtor and the Secured Party.

3. Representations and Warranties

3.1 The Debtor represents and warrants that:

The Debtor is the sole owner of the Collateral and has good and marketable title to the Collateral.

The Collateral is free from all liens, encumbrances, and other security interests, except for the security interest granted herein.

The Debtor has the full right, power, and authority to grant the security interest in the Collateral.

The execution and delivery of this Agreement have been duly authorized by all necessary corporate or other action.

3.2 The Secured Party represents and warrants that:

The Secured Party is duly organized, validly existing, and in good standing under the laws of the State of [State].

The Secured Party has the full right, power, and authority to enter into this Agreement and to perform its obligations hereunder.

The execution and delivery of this Agreement have been duly authorized by all necessary corporate action.

4. Covenants

4.1 The Debtor covenants and agrees that:

The Debtor will pay all amounts due under the Obligations when due.

The Debtor will maintain the Collateral in good condition and repair and will not permit the Collateral to be damaged, destroyed, or subjected to any lien or encumbrance other than the security interest granted herein.

The Debtor will keep the Collateral insured against loss or damage in such amounts and under such policies as the Secured Party may require, with the Secured Party named as an additional insured and loss payee.

The Debtor will promptly notify the Secured Party of any change in the Debtor’s address or the location of the Collateral.

The Debtor will not sell, transfer, or otherwise dispose of the Collateral without the prior written consent of the Secured Party.

4.2 The Secured Party covenants and agrees that:

The Secured Party will release the security interest in the Collateral upon payment in full of the Obligations.

The Secured Party will not unreasonably withhold or delay consent to any request by the Debtor to sell, transfer, or otherwise dispose of the Collateral, provided that the Debtor has made arrangements satisfactory to the Secured Party to pay the Obligations in full.

5. Default

5.1 The Debtor shall be in default under this Agreement if:

The Debtor fails to pay any amount due under the Obligations when due.

The Debtor breaches any covenant, representation, or warranty contained in this Agreement or any other agreement between the Debtor and the Secured Party.

The Debtor becomes insolvent or is the subject of any bankruptcy or insolvency proceeding.

The Debtor fails to maintain the insurance required under this Agreement.

5.2 Upon the occurrence of any event of default, the Secured Party shall have the following rights and remedies:

The Secured Party may declare the Obligations to be immediately due and payable.

The Secured Party may take possession of the Collateral without notice or demand and without legal process, wherever the Collateral may be located.

The Secured Party may sell, lease, or otherwise dispose of the Collateral at public or private sale, with or without notice to the Debtor, and apply the proceeds to the payment of the Obligations.

The Secured Party may exercise any other rights and remedies available to a secured party under the Uniform Commercial Code or other applicable law.

6. Insurance

6.1 The Debtor agrees to maintain, at its own expense, comprehensive insurance coverage for the Collateral, including but not limited to:

Collision and liability insurance.

Comprehensive insurance against loss or damage due to theft, vandalism, fire, and other risks.

6.2 The Debtor shall provide the Secured Party with certificates of insurance evidencing the above coverage and shall notify the Secured Party of any changes or cancellations. The insurance policies shall name the Secured Party as an additional insured and loss payee.

7. Further Assurances

7.1 The Debtor agrees to execute and deliver such further documents and take such further actions as may be reasonably necessary to carry out the intent and purposes of this Agreement, including but not limited to:

Executing and filing financing statements or other documents necessary to perfect the security interest granted herein.

Providing additional information or documentation requested by the Secured Party to verify the condition, location, or value of the Collateral.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State], without regard to its conflict of laws principles. Any disputes arising under or related to this Agreement shall be subject to the jurisdiction of the courts in [City, State].

9. Dispute Resolution

9.1 Any disputes arising out of or in connection with this Agreement shall be resolved through good faith negotiations between the parties. Both parties agree to attempt to resolve any disputes amicably and expeditiously.

9.2 If the parties are unable to resolve the dispute through negotiation, the dispute shall be submitted to mediation in [City, State]. The parties agree to select a mediator mutually acceptable to both parties and to participate in the mediation process in good faith.

9.3 If mediation fails, the dispute shall be submitted to binding arbitration in accordance with the rules of the American Arbitration Association. The decision of the arbitrator shall be final and binding on both parties, and judgment upon the award rendered by the arbitrator may be entered in any court having jurisdiction thereof.

10. Entire Agreement

This Agreement constitutes the entire agreement between the parties and supersedes all prior negotiations, understandings, and agreements, whether written or oral, between the parties with respect to its subject matter. Any amendments or modifications to this Agreement must be in writing and signed by both parties.

11. Amendments

No amendment, modification, or waiver of any provision of this Agreement shall be effective unless in writing and signed by both parties. Any such amendment, modification, or waiver shall be binding on the parties and their respective successors and assigns.

12. Severability

If any provision of this Agreement is held to be invalid or unenforceable, such provision shall be struck and the remaining provisions shall be enforced to the fullest extent under law. The parties agree to negotiate in good faith to replace any invalid or unenforceable provision with a valid and enforceable provision that achieves the original intent of the parties.

13. Notices

All notices required or permitted under this Agreement shall be in writing and shall be deemed delivered when delivered in person, sent by facsimile, sent by certified mail, return receipt requested, or delivered by a nationally recognized overnight delivery service to the addresses set forth above. Notices sent by certified mail or overnight delivery service shall be deemed delivered upon receipt.

14. Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same document. Faxed or electronically transmitted signatures shall be deemed valid and binding for all purposes.

15. Assignment

The Debtor may not assign or transfer their rights or obligations under this Agreement without the prior written consent of the Secured Party. Any attempted assignment or transfer in violation of this provision shall be null and void.

16. Force Majeure

Neither party shall be liable for any failure to perform any obligation under this Agreement due to events beyond their control, including but not limited to acts of God, war, natural disasters, strikes, and governmental actions. The affected party shall notify the other party as soon as practicable of any event of force majeure and shall use reasonable efforts to resume performance as soon as possible.

17. Headings

The headings in this Agreement are for reference purposes only and shall not affect the interpretation of this Agreement. The use of headings is solely for the convenience of the parties and shall not be used to interpret or construe any provision of this Agreement.

18. Confidentiality

18.1 Both parties agree to keep confidential and not to disclose to any third party any confidential or proprietary information disclosed by the other party in connection with this Agreement. This obligation of confidentiality shall survive the termination or expiration of this Agreement.

18.2 Confidential information shall not include information that is publicly known or becomes publicly known through no fault of the receiving party, is disclosed to the receiving party by a third party without breach of any confidentiality obligation, or is independently developed by the receiving party without use of or reference to the disclosing party’s confidential information.

19. Indemnification

19.1 The Debtor agrees to indemnify, defend, and hold harmless the Secured Party, its officers, directors, employees, and agents from and against any and all claims, liabilities, damages, losses, and expenses, including reasonable attorneys’ fees, arising out of or in any way connected with the Debtor’s breach of any representation, warranty, or covenant contained in this Agreement.

19.2 The Secured Party agrees to indemnify, defend, and hold harmless the Debtor, its officers, directors, employees, and agents from and against any and all claims, liabilities, damages, losses, and expenses, including reasonable attorneys’ fees, arising out of or in any way connected with the Secured Party’s breach of any representation, warranty, or covenant contained in this Agreement.

20. Waiver

The failure of either party to enforce any provision of this Agreement shall not be construed as a waiver or limitation of that party’s right to subsequently enforce and compel strict compliance with every provision of this Agreement. Any waiver of a provision of this Agreement must be in writing and signed by the party granting the waiver.

21. Further Assurances

Each party agrees to execute and deliver such further documents and take such further actions as may be reasonably necessary to carry out the intent and purposes of this Agreement.

22. Survival

The provisions of this Agreement that by their nature are intended to survive the termination or expiration of this Agreement, including but not limited to provisions regarding confidentiality, indemnification, and governing law, shall survive the termination or expiration of this Agreement.

23. Representation by Counsel

Each party acknowledges that it has had the opportunity to consult with legal counsel of its choice regarding this Agreement and that it has either done so or voluntarily chosen not to do so. Each party further acknowledges that it has read and understood this Agreement and agrees to be bound by its terms and conditions.

24. Binding Effect

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors, assigns, heirs, and legal representatives.

25. Third-Party Beneficiaries

This Agreement is intended for the sole benefit of the parties hereto and their respective successors and assigns, and nothing herein is intended to or shall confer upon any other person or entity any legal or equitable right, benefit, or remedy of any nature whatsoever under or by reason of this Agreement.

26. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Car Rental Security Agreement as of the day and year first above written.

Secured Party:

![]()

[Your Name]

[Your Position]

[Your Company Name]

Debtor:

![]()

[Borrower's Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Safeguard your assets with the Car Rental Security Agreement Template from Template.net. This editable and customizable template helps you create professional security agreements for your car rental business. Editable in our Ai Editor Tool, it offers a user-friendly experience, making it easy to tailor to your specific needs. Ensure comprehensive protection with this essential security agreement template.

You may also like

- Lease Agreement

- Non Compete Agreement

- Rental Agreement

- Prenuptial Agreement

- Non Disclosure Agreement

- Operating Agreement

- Hold Harmless Agreement

- LLC Operating Agreement

- Arbitration Agreement

- Purchase Agreement

- Residential Lease Agreement

- Executive Agreement

- Confidentiality Agreement

- Contractor Agreement

- Partnership Agreement

- Postnuptial Agreement

- Collective Bargaining Agreement

- Loan Agreement

- Roommate Agreement

- Commercial Lease Agreement

- Separation Agreement

- Cohabitation Agreement

- Room Rental Agreement

- Child Custody Agreement

- Employee Agreement

- License Agreements

- Settlement Agreement

- Joint Venture Agreement

- Indemnity Agreement

- Subordination Agreement

- Sales Agreement

- Agreements Between Two Parties

- Business Agreement

- Real Estate Agreement

- HR Agreement

- Service Agreement

- Property Agreement

- Agreement Letter

- Restaurant Agreement

- Construction Agreement

- Finance Agreement

- Marketing Agreement

- Payment Agreement

- Investment Agreement

- Management Agreement

- Nonprofit Agreement

- Software Agreement

- Startup Agreement

- Agency Agreement

- Copyright Agreement

- Collaboration Agreement

- Reseller Agreement

- Car Rental Agreement

- Cleaning Services Agreement

- Consultant Agreement

- Deed Agreement

- Car Agreement

- Equipment Agreement

- Shares Agreement

- Data Sharing Agreement

- Advertising Agreement

- School Agreement

- Franchise Agreement

- Event Agreement

- Travel Agency Agreement

- Vehicle Agreement

- Board Resolution Agreement

- Land Agreement

- Binding Agreement

- Tenancy Agreement

- Exclusive Agreement

- Development Agreement

- Assignment Agreement

- Design Agreement

- Equity Agreement

- Mortgage Agreement

- Purchase and Sale Agreement

- Shareholder Agreement

- Vendor Agreement

- Royalty Agreement

- Vehicle Lease Agreement

- Hotel Agreement

- Tenant Agreement

- Artist Agreement

- Commission Agreement

- Consignment Agreement

- Debt Agreement

- Recruitment Agreement

- Training Agreement

- Transfer Agreement

- Apprenticeship Agreement

- IT and Software Agreement

- Referral Agreement

- Resolution Agreement

- Waiver Agreement

- Consent Agreement

- Partner Agreement

- Social Media Agreement

- Customer Agreement

- Credit Agreement

- Supply Agreement

- Agent Agreement

- Brand Agreement

- Law Firm Agreement

- Maintenance Agreement

- Mutual Agreement

- Retail Agreement

- Deposit Agreement

- Land Purchase Agreement

- Nursing Home Agreement

- Supplier Agreement

- Buy Sell Agreement

- Child Support Agreement

- Landlord Agreement

- Payment Plan Agreement

- Release Agreement

- Research Agreement

- Sponsorship Agreement

- Buyout Agreement

- Equipment Rental Agreement

- Farm Agreement

- Manufacturing Agreement

- Strategic Agreement

- Termination of Lease Agreement

- Compliance Agreement

- Family Agreement

- Interior Design Agreement

- Ownership Agreement

- Residential Lease Agreement

- Retainer Agreement

- Trade Agreement

- University Agreement

- Broker Agreement

- Dissolution Agreement

- Funding Agreement

- Hosting Agreement

- Investor Agreement

- Memorandum of Agreement

- Advisory Agreement

- Affiliate Agreement

- Freelancer Agreement

- Grant Agreement

- Master Service Agreement

- Parking Agreement

- Subscription Agreement

- Trust Agreement

- Cancellation Agreement

- Horse Agreement

- Influencer Agreement

- Membership Agreement

- Vacation Rental Agreement

- Wholesale Agreement

- Author Agreement

- Distributor Agreement

- Exchange Agreement

- Food Agreement

- Guarantee Agreement

- Installment Agreement

- Internship Agreement

- Music Agreement

- Severance Agreement

- Software Development Agreement

- Storage Agreement

- Facility Agreement

- Intercompany Agreement

- Lending Agreement

- Lodger Agreement

- Outsourcing Services Agreement

- Usage Agreement

- Assurance Agreement

- Photography Agreement

- Profit Sharing Agreement

- Relationship Agreement

- Rent To Own Agreement

- Repayment Agreement

- Volunteer Agreement

- Co Parenting Agreement

- HVAC Agreement

- Lawn Care Agreement

- SAAS Agreement

- Work from Home Agreement

- Coaching Agreement

- Protection Agreement

- Security Agreement

- Repair Agreement

- Agreements License