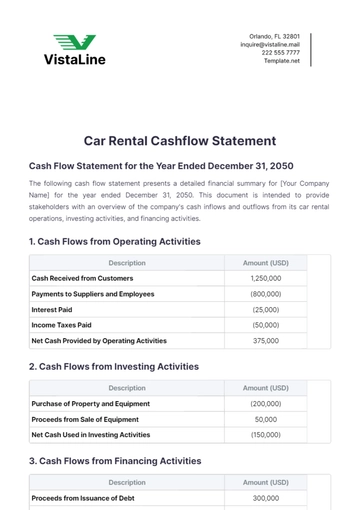

Free Car Rental Cashflow Statement

Cash Flow Statement for the Year Ended December 31, 2050

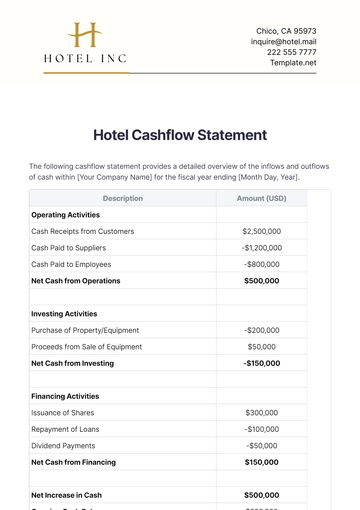

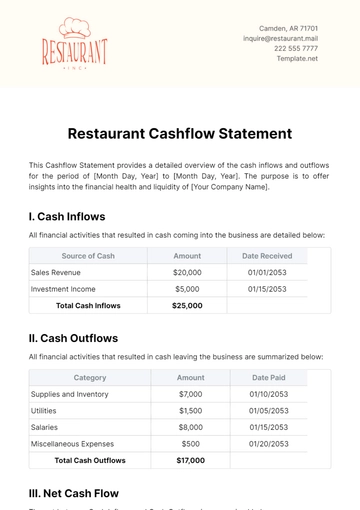

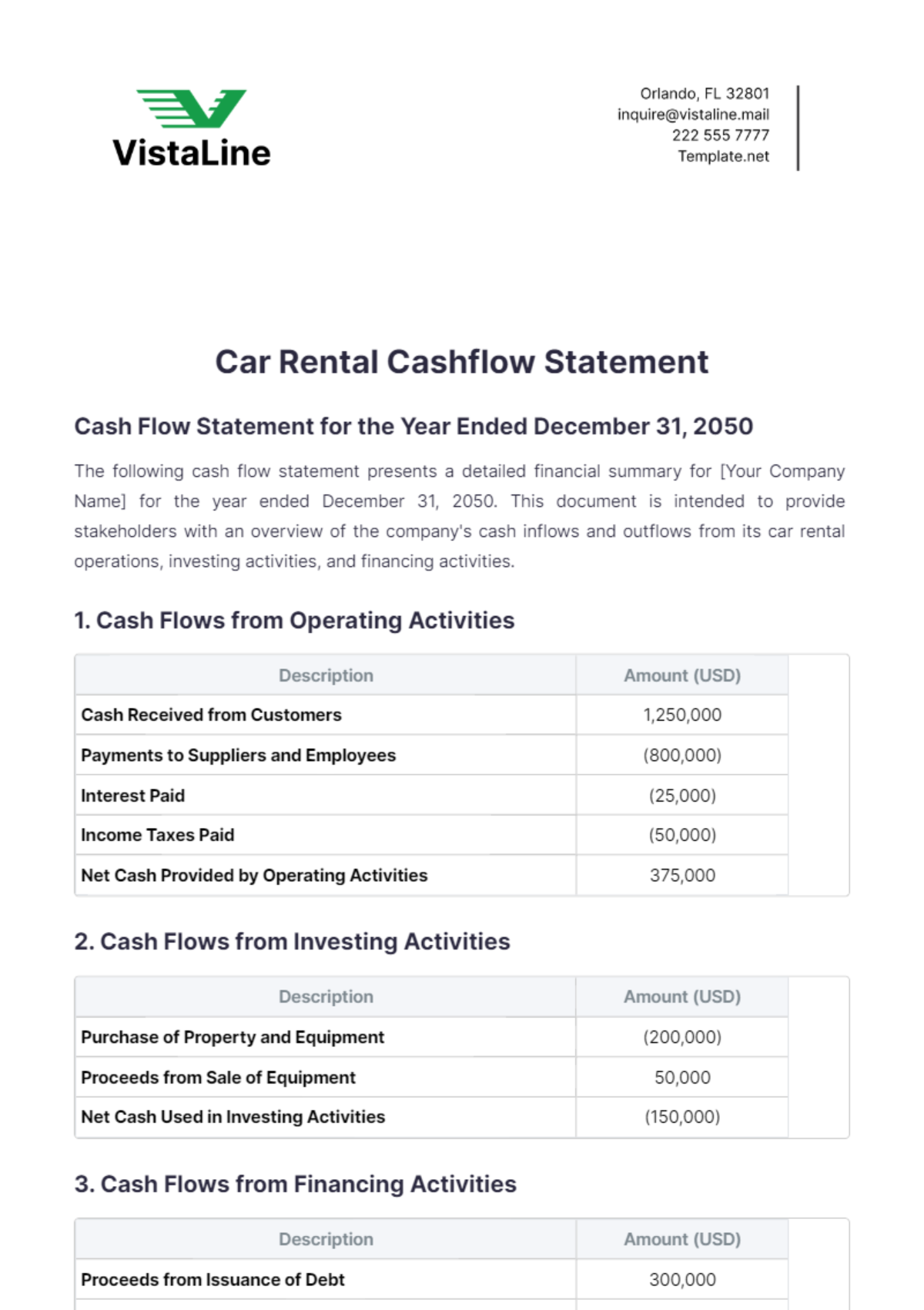

The following cash flow statement presents a detailed financial summary for [Your Company Name] for the year ended December 31, 2050. This document is intended to provide stakeholders with an overview of the company's cash inflows and outflows from its car rental operations, investing activities, and financing activities.

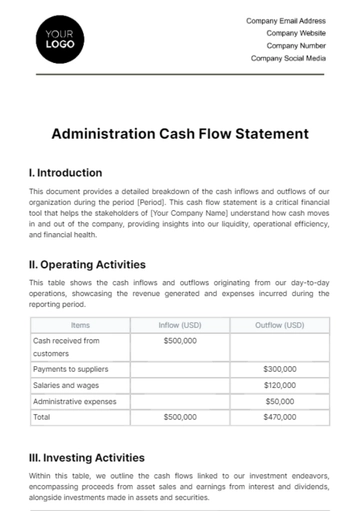

1. Cash Flows from Operating Activities

Description | Amount (USD) |

|---|---|

Cash Received from Customers | 1,250,000 |

Payments to Suppliers and Employees | (800,000) |

Interest Paid | (25,000) |

Income Taxes Paid | (50,000) |

Net Cash Provided by Operating Activities | 375,000 |

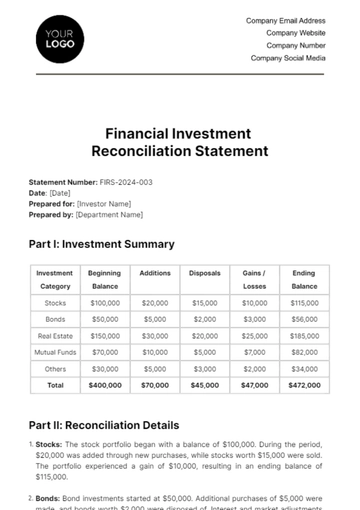

2. Cash Flows from Investing Activities

Description | Amount (USD) |

|---|---|

Purchase of Property and Equipment | (200,000) |

Proceeds from Sale of Equipment | 50,000 |

Net Cash Used in Investing Activities | (150,000) |

3. Cash Flows from Financing Activities

Description | Amount (USD) |

|---|---|

Proceeds from Issuance of Debt | 300,000 |

Repayment of Debt | (100,000) |

Dividends Paid | (30,000) |

Net Cash Provided by Financing Activities | 170,000 |

4. Net Increase in Cash

Description | Amount (USD) |

|---|---|

Net Increase in Cash and Cash Equivalents | 395,000 |

Cash at Beginning of Period | 200,000 |

Cash at End of Period | 595,000 |

Certification

This cash flow statement is a true and accurate representation of the financial activities of [Your Company Name] for the year ended December 31, 2050. It has been prepared in accordance with applicable accounting standards and is intended for use by shareholders, financial institutions, and regulatory bodies concerned with the financial positioning of [Your Company Name].

Authorized Signature:

![]()

[Name]

Chief Financial Officer

[Your Company Name]

[Date]

This cash flow statement reflects a solid fiscal performance by [Your Company Name] in 2050, with a significant net increase in cash and cash equivalents driven by robust operating activities and supported by strategic financial maneuvers. The data provided herein serves as a transparent representation of our financial maneuvers throughout the fiscal year, demonstrating our commitment to sustainable growth and operational efficiency. For further details, questions, or clarifications, stakeholders are encouraged to contact [Your Name] at [Your Company Email].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Keep your finances in check with the Car Rental Cashflow Statement Template from Template.net. This template is designed to help car rental businesses track their cash inflows and outflows effectively. Fully editable and customizable with our AI editor tool, it ensures accurate financial oversight, enabling smarter business decisions for sustained growth.