Free Agriculture Financial SWOT Analysis

I. Introduction

A. Overview of the Agricultural Business

[Your Company Name], spanning 500 acres of fertile land, has been a cornerstone of organic vegetable production in the region since its establishment in [Year]. We pride ourselves on sustainable farming practices that prioritize soil health and environmental stewardship. Our product range includes premium tomatoes, peppers, lettuce, and seasonal herbs, catering primarily to local markets and high-end restaurants known for their commitment to quality ingredients.

B. Purpose of the Financial SWOT Analysis

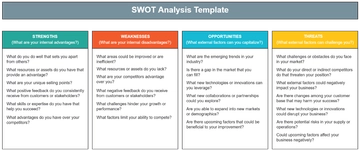

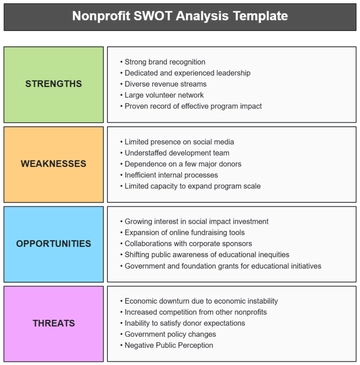

The Financial SWOT Analysis serves as a strategic tool to evaluate [Your Company Name]' financial health and strategic positioning within the competitive agricultural sector. By identifying internal strengths and weaknesses alongside external opportunities and threats, this analysis aims to guide informed decision-making, optimize resource allocation, and foster sustainable growth strategies aligned with our long-term business objectives.

II. Internal Factors: Strengths and Weaknesses

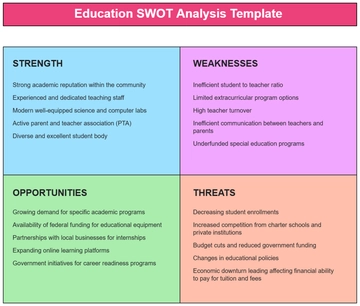

A. Strengths

Financial Resources

[Your Company Name] upholds substantial cash reserves that have been significantly strengthened through strategic financial planning and prudent spending practices. This strong financial foundation empowers the company to make timely investments in infrastructure improvements and technological advancements. As a result, [Your Company Name] is able to maintain operational efficiency and secure a competitive edge in the market.

Operational Efficiency

Our unwavering commitment to the ongoing enhancement of agricultural practices has led to a significant optimization of crop yields per acre. As a result, we have successfully reduced production costs and increased profit margins. Furthermore, our effective management of the supply chain and logistics has streamlined our overall operations. This ensures that fresh produce is delivered to the market in a timely manner, maintaining both quality and efficiency in our processes.

Product Diversification

Beyond cultivating staple crops such as tomatoes and peppers, [Your Company Name] has effectively broadened its agricultural portfolio to include specialty crops, specifically heirloom varieties and niche herbs. This strategic diversification plays a crucial role in mitigating revenue instability that often arises due to seasonal fluctuations. Furthermore, it enhances our market presence by appealing to discerning consumers who are in search of unique, locally sourced agricultural products.

Strong Market Presence

For more than thirty years, [Your Company Name] has diligently maintained a consistent supply of products while strictly adhering to the rigorous standards of organic farming. As a result of this unwavering dedication, the company has successfully established a robust brand reputation that has become synonymous with both premium quality and reliability. This well-established market presence not only encourages a strong sense of customer loyalty but also paves the way for strategic collaborations with retailers and distributors who are equally committed to the principles of sustainable agriculture.

B. Weaknesses

High Debt Levels

Even though [Your Company Name] boasts robust cash reserves, the company is burdened by a considerable amount of debt incurred from past expansions and investments in infrastructure. The task of managing debt repayment schedules, especially during off-peak seasons, continues to pose a significant challenge. This situation has a direct impact on the company's liquidity and financial flexibility, making it more difficult to maneuver through periods of lower revenue.

Seasonal Revenue Fluctuations

Relying heavily on seasonal harvest cycles leads to income fluctuations throughout the year, creating peaks and troughs in revenue generation. This inherent cyclic nature presents significant obstacles when it comes to accurately forecasting budgets and planning finances over the long term. As a result, it becomes essential to adopt proactive strategies aimed at stabilizing cash flow. Such measures are crucial not only to smooth out income throughout the year but also to minimize the financial risks associated with these periodic highs and lows.

Limited Technological Integration

Despite the fact that [Your Company Name] employs contemporary farming machinery, the adoption of cutting-edge technologies, including Internet of Things (IoT) sensors and data analytics, is still relatively restricted. This shortfall in embracing such advanced technologies hinders the ability to make informed, real-time decisions and optimize various farming operations. Consequently, this limitation may obstruct opportunities for enhancing productivity and achieving cost savings.

Dependency on Specific Markets

The majority of the revenue generated by [Your Company Name] originates from local markets and regional distributors. This reliance exposes the company to fluctuations in the market and pricing pressures that are shaped by local economic conditions and consumer preferences. Consequently, it is essential for [Your Company Name] to broaden its sales channels and investigate potential export opportunities as a strategy to manage and reduce the risks associated with market dependency.

III. External Factors: Opportunities and Threats

A. Opportunities

Emerging Market Trends

Growing consumer awareness and preference for organic and locally sourced produce present significant growth opportunities for [Your Company Name]. By expanding our product line to include specialty organic crops and value-added products, we can capture a larger share of the evolving market demand.

Technological Advancements

Rapid advancements in agricultural technology offer [Your Company Name] opportunities to enhance operational efficiency and yield optimization. Adopting precision farming techniques, automated irrigation systems, and predictive analytics can reduce input costs, improve crop quality, and optimize resource utilization.

Government Subsidies or Incentives

Access to government grants and subsidies aimed at promoting sustainable agriculture and environmental stewardship can provide [Your Company Name] with financial support for infrastructure upgrades, renewable energy adoption, and compliance with regulatory standards. Leveraging these incentives can lower operational costs and enhance profitability.

Export Market Expansion

Exploring export opportunities to neighboring regions and international markets represents a strategic growth avenue for [Your Company Name]. By leveraging our reputation for premium quality and adherence to organic standards, we can penetrate new markets, diversify revenue streams, and reduce dependency on local market dynamics.

B. Threats

Volatile Commodity Prices

Fluctuations in global commodity prices, influenced by factors such as international trade policies and weather conditions, pose a significant threat to [Your Company Name]'s revenue stability. Developing risk management strategies and hedging mechanisms are essential to mitigate the impact of price volatility on profitability.

Regulatory Changes

Evolving regulations pertaining to agricultural practices, environmental standards, and food safety requirements introduce compliance challenges and potential cost implications for [Your Company Name]. Staying abreast of regulatory updates and investing in sustainable farming practices are crucial to maintaining operational continuity and market competitiveness.

Climate Change and Environmental Risks

Increasing frequency of extreme weather events, such as droughts, floods, and heatwaves, threatens crop yields, soil fertility, and overall farm productivity. Implementing climate-resilient farming techniques, water conservation strategies, and disaster preparedness plans are imperative to mitigate climate-related risks and ensure long-term sustainability.

Intense Competition from Imports

Heightened competition from imported produce, often at lower price points, poses a competitive threat to [Your Company Name]'s market share and pricing strategy. Focusing on differentiation through quality assurance, brand loyalty, and local community support can fortify our competitive position in the marketplace.

IV. Financial SWOT Analysis

A. Strengths and Opportunities (SO)

Strategies to Leverage Strengths to Capitalize on Opportunities

[Your Company Name] will leverage its strong market presence and reputation for quality to expand product offerings into emerging specialty markets, such as organic herbs and heirloom vegetables. By enhancing marketing efforts and customer engagement strategies, we aim to increase market penetration and capture new consumer segments.

Investing in advanced agricultural technologies, such as precision farming and automated irrigation systems, will further optimize operational efficiency and yield management. This technological integration not only reduces production costs but also enhances crop quality and consistency, meeting growing consumer demands for premium organic produce.

Strengthening partnerships with local retailers and expanding distribution networks will facilitate geographic market expansion and reduce dependency on specific regional markets. By diversifying sales channels and exploring direct-to-consumer models, [Your Company Name] can enhance revenue streams and mitigate market volatility risks.

Exploring opportunities for vertical integration, such as value-added processing or agritourism initiatives, will capitalize on consumer trends favoring transparency and sustainability. These initiatives not only add value to our products but also create new revenue streams and strengthen customer loyalty.

B. Strengths and Threats (ST)

Mitigation Plans to Address Threats Using Existing Strengths

[Your Company Name] will mitigate the impact of volatile commodity prices by leveraging operational efficiencies and cost-effective production practices. Implementing forward contracts and hedging strategies will stabilize revenue streams and protect profitability against market fluctuations.

Strengthening relationships with existing customers and diversifying product offerings will buffer against competitive pressures from imported produce. By emphasizing our commitment to quality, freshness, and local sourcing, we can maintain market differentiation and uphold premium pricing strategies.

Enhancing supply chain resilience through strategic partnerships with local suppliers and distributors will mitigate risks associated with supply chain disruptions. Implementing inventory management systems and contingency plans will ensure continuity of supply and minimize operational disruptions during peak demand periods.

Proactively monitoring regulatory changes and investing in compliance measures will mitigate legal and regulatory risks. Engaging with industry associations and participating in advocacy efforts will influence policy developments favorable to sustainable agriculture practices and business operations.

C. Weaknesses and Opportunities (WO)

Actionable Steps to Overcome Weaknesses to Exploit Opportunities

[Your Company Name] will prioritize debt restructuring initiatives to improve financial flexibility and reduce interest expenses. Negotiating favorable loan terms and exploring debt consolidation options will free up capital for strategic investments in technology and market expansion.

Investing in workforce training and development programs will address skill gaps and enhance operational efficiency. Empowering employees with knowledge of advanced farming techniques and sustainable practices will optimize yield potential and minimize resource wastage.

Collaborating with research institutions and agricultural experts to pilot innovative farming technologies will enhance productivity and crop resilience to climate change. Adopting precision agriculture tools for data-driven decision-making will optimize resource allocation and mitigate environmental risks.

Expanding organic certification and sustainability credentials will strengthen market positioning and appeal to environmentally conscious consumers. Communicating our commitment to ethical farming practices and transparent supply chains will build trust and brand loyalty among discerning customers.

D. Weaknesses and Threats (WT)

Risk Management Strategies to Minimize Weaknesses in Face of Threats

[Your Company Name] will implement proactive debt management strategies, such as refinancing and debt restructuring, to alleviate financial strain during economic downturns. Maintaining robust cash flow projections and contingency funds will ensure liquidity and financial stability.

Developing diversified revenue streams through value-added products and agritourism initiatives will reduce dependency on seasonal revenue fluctuations. By diversifying customer base and revenue sources, [Your Company Name] can mitigate risks associated with market volatility and competitive pressures.

Enhancing disaster preparedness plans and investing in climate-resilient farming practices will mitigate risks posed by extreme weather events. Implementing water management strategies and soil conservation practices will safeguard crop yields and preserve long-term soil health.

Strengthening partnerships with local regulatory bodies and industry stakeholders will facilitate early adoption of regulatory changes and compliance requirements. Proactively engaging in advocacy efforts and industry forums will influence policy developments favorable to sustainable agricultural practices and business operations.

V. Conclusion

A. Summary of Key Findings

The Agriculture Financial SWOT Analysis underscores [Your Company Name]' strengths in operational efficiency, product diversification, and strong market presence, poised to capitalize on opportunities in organic market growth and technological advancements. Addressing weaknesses in debt management and technological integration, while mitigating threats from regulatory changes and market volatility, will guide strategic decisions aimed at sustainable growth and profitability.

B. Recommendations for Financial Strategy Enhancement

Based on the analysis, [Your Company Name] will prioritize debt restructuring initiatives, expand technological adoption, and diversify market channels to optimize financial performance. Investing in workforce development and sustainability initiatives will reinforce market leadership and resilience against external challenges, ensuring long-term viability and profitability.

VI. Implementation Plan

A. Timeline for Initiating Recommendations

Q3 [Year]: Begin in-depth conversations with professional financial advisors to explore various strategies and possibilities for restructuring our company’s existing debt and investigating new refinancing options.

Q4 [Year]: Implement and test advanced precision agriculture technologies along with automated irrigation systems on designated sections or areas of crop fields to evaluate their effectiveness and efficiency.

Q1 [Year]: We should work on broadening and enhancing our distribution networks to ensure that our products reach a wider audience. We should actively explore global export opportunities for our premium organic produce. This dual focus will meet local and international demands, maximizing our reach and impact.

B. Responsible Personnel and Departments

CFO: Supervise and manage strategies for handling and reducing debt, as well as spearheading and orchestrating comprehensive financial planning initiatives.

Operations Manager: Take the initiative to lead the adoption of new technologies and spearhead efforts to enhance operational efficiency.

Marketing Manager: Investigate and identify potential opportunities for expanding into new markets, as well as develop and implement comprehensive strategies aimed at enhancing the brand's visibility, reputation, and overall value.

VII. Monitoring and Evaluation

A. Metrics to Track Progress

Financial metrics: The debt-to-equity ratio, as well as the projections of future cash flows, and the measurements of profit margins, are critical financial indicators.

Operational metrics: The amount of crop produced per acre of land, the improvements in productivity and effectiveness resulting from the adoption of new technologies, and the extent to which products or services have successfully entered and established a presence in a given market.

Customer metrics: The rates at which new customers are acquired, the rates at which existing customers are retained, and the results of surveys measuring customer satisfaction.

Sustainability metrics: The reduction of carbon footprints, the efficiency in water usage, and the adoption of sustainable farming practices.

B. Regular Review and Adjustment of Strategies

Quarterly financial reviews and bi-annual strategic planning sessions will monitor progress, assess market dynamics, and adjust strategies accordingly. Continuous engagement with stakeholders, industry peers, and regulatory bodies will ensure alignment with emerging trends and regulatory changes, sustaining [Your Company Name]'s competitive edge and long-term success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Organize your agricultural strategy with ease using the Agriculture Financial SWOT Analysis Template from Template.net. This editable and customizable template empowers you to assess financial strengths, mitigate weaknesses, and capitalize on opportunities and threats. With an intuitive AI Editor Tool, tailor your analysis effortlessly to adapt to evolving market conditions and enhance financial planning precision.