Free Agriculture Accounting Memo

To: [Recipient's Name]

From: [Your Name], [Your Job Title]

Date: [Month Day, Year]

Subject: Agriculture Accounting Memo

I. Introduction

This memo aims to provide a detailed overview of the accounting practices and financial status of [Your Company Name]. The accounting practices implemented by our company ensure accurate and transparent financial reporting, essential for maintaining stakeholder trust and supporting decision-making processes. Our financial data is presented systematically to facilitate understanding and analysis by all relevant parties. By adhering to standardized accounting principles, we strive to reflect the true economic reality of our operations. This memo will cover various aspects of our accounting practices, financial performance, and future outlook.

II. Accounting Practices

A. Financial Reporting Standards

Adoption of IFRS

1.1. [Your Company Name] adheres to the International Financial Reporting Standards (IFRS) to ensure consistency and comparability in our financial statements. These standards are globally recognized and provide a robust framework for financial reporting.

1.2. Implementing IFRS allows us to present our financial data transparently, facilitating better decision-making for investors and other stakeholders.

Internal Controls

2.1. We have established stringent internal controls to safeguard our assets and ensure the accuracy of our financial records. These controls include regular audits, segregation of duties, and detailed documentation procedures.

2.2. Regular assessments of our internal control systems help identify and mitigate potential risks, enhancing the overall reliability of our financial reporting.

B. Revenue Recognition

Sales of Agricultural Products

1.1. Revenue from the sale of agricultural products is recognized when the control of goods is transferred to the customer. This typically occurs upon delivery or when the customer takes possession of the goods.

1.2. Accurate revenue recognition ensures that our financial statements reflect the true performance of our core operations.

Government Grants and Subsidies

2.1. Government grants and subsidies are recognized as income when there is reasonable assurance that the conditions attached to them will be met, and the grants will be received.

2.2. Proper accounting for these funds ensures that we accurately report our financial support and the impact on our overall financial health.

III. Financial Performance

A. Income Statement

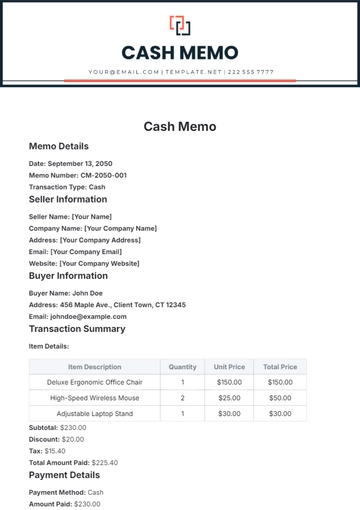

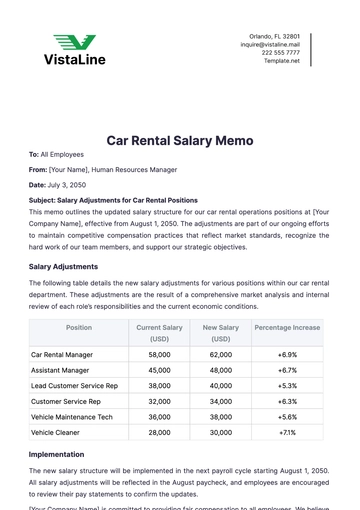

The following table showcases the income statement of [Your Company Name]:

Description | Amount |

|---|---|

Revenue | $1,200,000 |

Cost of Goods Sold | $800,000 |

Gross Profit | $400,000 |

Operating Expenses | $150,000 |

Operating Income | $250,000 |

Net Income | $200,000 |

The income statement reveals a strong financial performance with total revenue of $1,200,000. The cost of goods sold stands at $800,000, resulting in a gross profit of $400,000, which indicates efficient management of production costs. Operating expenses amount to $150,000, leading to an operating income of $250,000, demonstrating effective control over operational expenditures. The net income of $200,000 reflects a profitable period, showcasing our company's ability to generate profit after all expenses. This robust financial outcome supports our strategic initiatives and future growth plans.

B. Cash Flow Statement

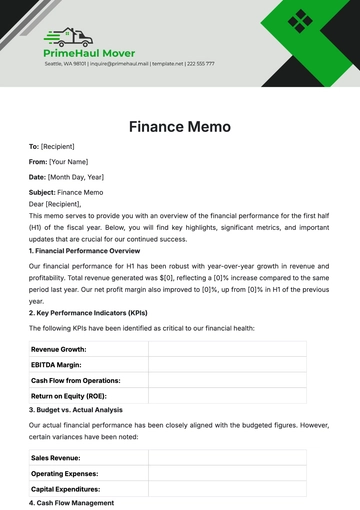

The following table presents the cash flow statement of [Your Company Name]:

Description | Amount |

|---|---|

Net Cash from Operating Activities | $300,000 |

Net Cash from Investing Activities | -$50,000 |

Net Cash from Financing Activities | $100,000 |

Net Increase in Cash | $350,000 |

The cash flow statement highlights a healthy cash inflow from operating activities totaling $300,000, which signifies strong core business operations. The outflow of $50,000 in investing activities reflects our strategic investments in infrastructure and technology to enhance future productivity. Financing activities contributed an additional $100,000 in cash, indicating successful financial strategies to support our capital structure. The net increase in cash by $350,000 underscores our company's solid liquidity position, ensuring we have adequate resources to meet short-term obligations and fund future projects. Overall, our cash flow management demonstrates our financial stability and growth potential.

C. Balance Sheet

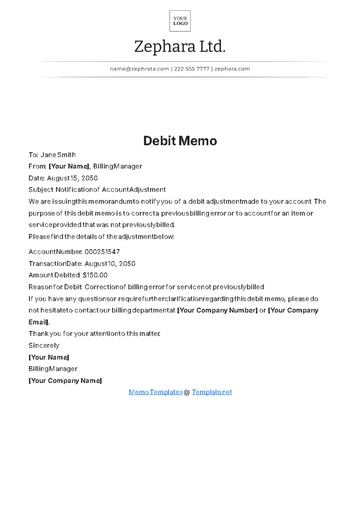

The following table outlines the balance sheet of [Your Company Name]:

Description | Amount |

|---|---|

Assets | |

Current Assets | $500,000 |

Non-Current Assets | $1,000,000 |

Total Assets | $1,500,000 |

Liabilities | |

Current Liabilities | $200,000 |

Non-Current Liabilities | $300,000 |

Total Liabilities | $500,000 |

Equity | $1,000,000 |

Total Liabilities and Equity | $1,500,000 |

The balance sheet demonstrates a strong financial position with total assets valued at $1,500,000. Current assets of $500,000 indicate a healthy liquidity position, while non-current assets of $1,000,000 reflect substantial investments in long-term assets. Total liabilities amount to $500,000, comprising $200,000 in current liabilities and $300,000 in non-current liabilities, indicating manageable debt levels. The equity of $1,000,000 signifies a solid financial foundation and the shareholders' stake in the company. This balance between assets, liabilities, and equity showcases our company's financial health and resilience, positioning us well for sustainable growth.

IV. Future Outlook

[Your Company Name] plans to expand its agricultural operations by acquiring additional farmland and investing in advanced farming technologies. These investments are expected to increase our production capacity and improve operational efficiency. We are committed to implementing sustainable farming practices to reduce our environmental impact and promote long-term ecological balance. This includes adopting organic farming methods, utilizing renewable energy sources, and minimizing waste.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Communicate financial information effectively with our Agriculture Accounting Memo Template from Template.net! This template includes editable sections to tailor the memo to your specific accounting needs! Customizable fields allow for seamless business branding integration. The integrated AI Editor Tool ensures quick and precise memo creation, providing clear financial communication immediately!