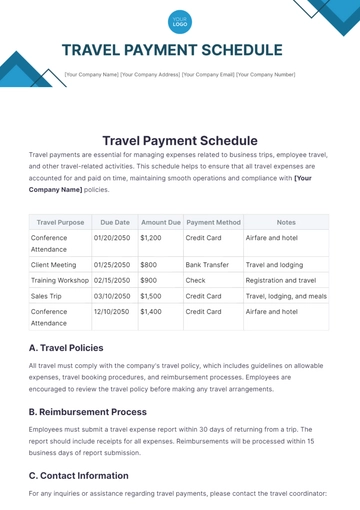

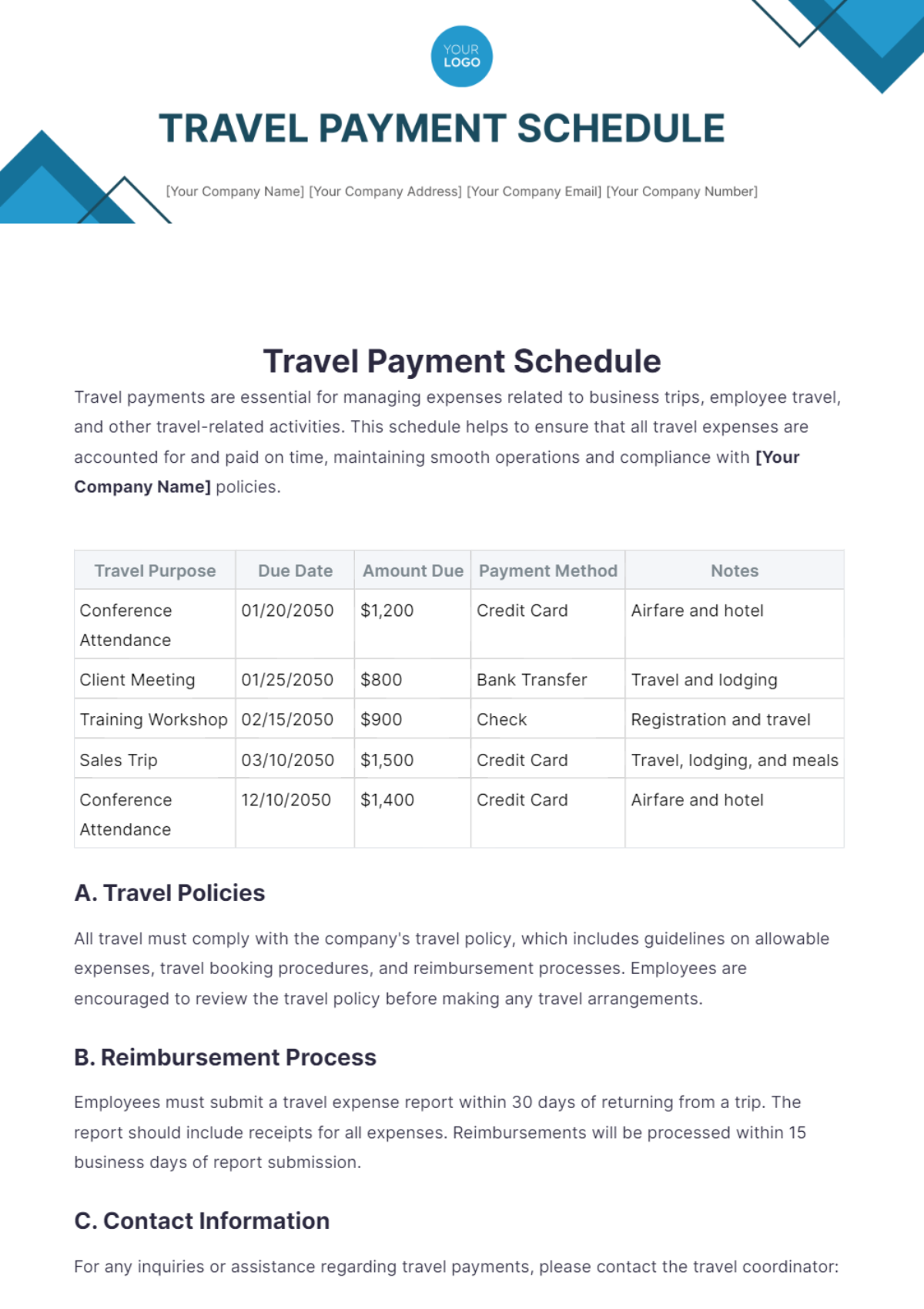

Free Travel Payment Schedule

Travel payments are essential for managing expenses related to business trips, employee travel, and other travel-related activities. This schedule helps to ensure that all travel expenses are accounted for and paid on time, maintaining smooth operations and compliance with [Your Company Name] policies.

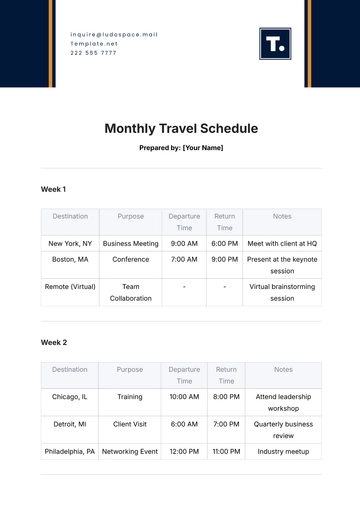

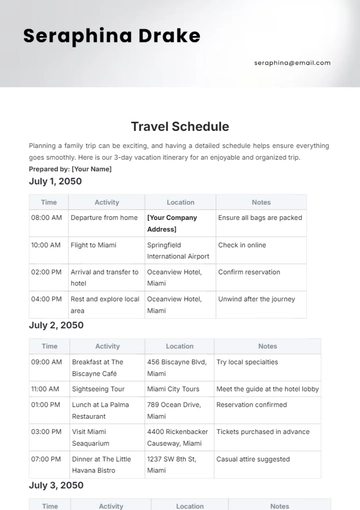

Travel Purpose | Due Date | Amount Due | Payment Method | Notes |

|---|---|---|---|---|

Conference Attendance | 01/20/2050 | $1,200 | Credit Card | Airfare and hotel |

Client Meeting | 01/25/2050 | $800 | Bank Transfer | Travel and lodging |

Training Workshop | 02/15/2050 | $900 | Check | Registration and travel |

Sales Trip | 03/10/2050 | $1,500 | Credit Card | Travel, lodging, and meals |

Conference Attendance | 12/10/2050 | $1,400 | Credit Card | Airfare and hotel |

A. Travel Policies

All travel must comply with the company's travel policy, which includes guidelines on allowable expenses, travel booking procedures, and reimbursement processes. Employees are encouraged to review the travel policy before making any travel arrangements.

B. Reimbursement Process

Employees must submit a travel expense report within 30 days of returning from a trip. The report should include receipts for all expenses. Reimbursements will be processed within 15 business days of report submission.

C. Contact Information

For any inquiries or assistance regarding travel payments, please contact the travel coordinator:

Phone: [Your Company Number]

Email: [Your Company Number]

Office Address: [Your Company Address]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Plan your travel expenses with ease using the Travel Payment Schedule Template from Template.net. This customizable, downloadable, and printable template helps you organize and track all your travel-related payments. Use our AI Editor Tool to edit and personalize the schedule to fit your specific travel itinerary and budget. Ensure timely payments, manage your expenses, and enjoy a hassle-free travel experience today!

You may also like

- Schedule Appointment

- Work Schedule

- Weekly Schedule

- Cleaning Schedule

- Payment Schedule

- School Schedule

- Maintenance Schedule

- Daily Schedule

- Class Schedule

- Workout Schedule

- Event Schedule

- Marketing Schedule

- Weekly Cleaning Schedule

- Work From Home Schedule

- Payroll Schedule

- Restaurant Schedule

- Kitchen Cleaning Schedule

- Schedule of Values

- Hourly Schedule

- Study Schedule

- University Schedule

- Construction Schedule

- Preventive Maintenance Schedule

- Fitness Schedule

- Education Schedule

- Training Schedule

- Agency Schedule

- Panel Schedule

- Monthly Schedule

- Nursing Home Schedule

- Project Schedule

- Real Estate Schedule

- Freelancer Schedule

- Medication Schedule

- IT and Software Schedule

- Interior Design Schedule

- Travel Schedule

- Travel Agency Schedule

- Hotel Schedule

- Wedding Schedule

- Camp Schedule