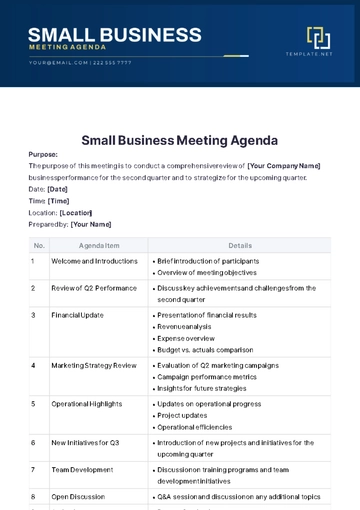

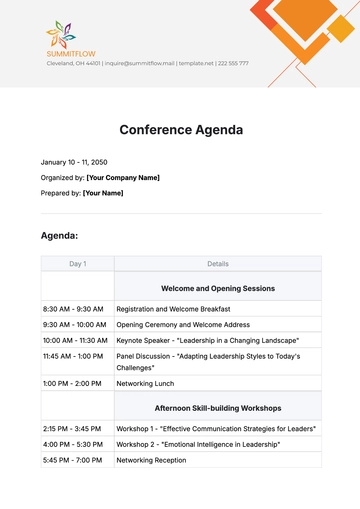

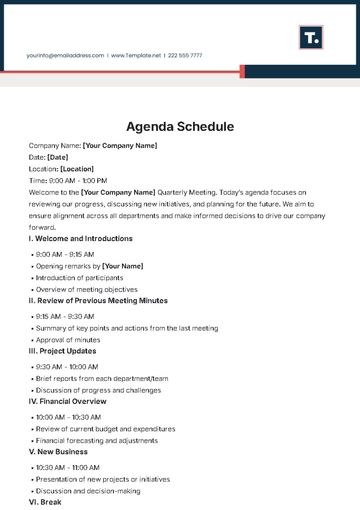

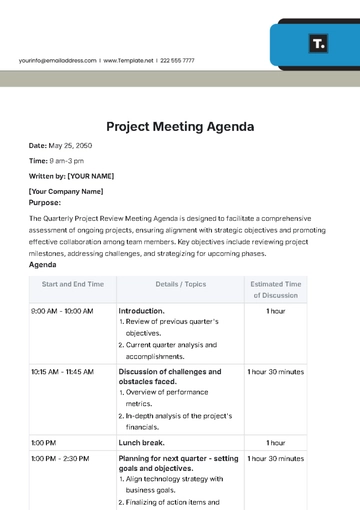

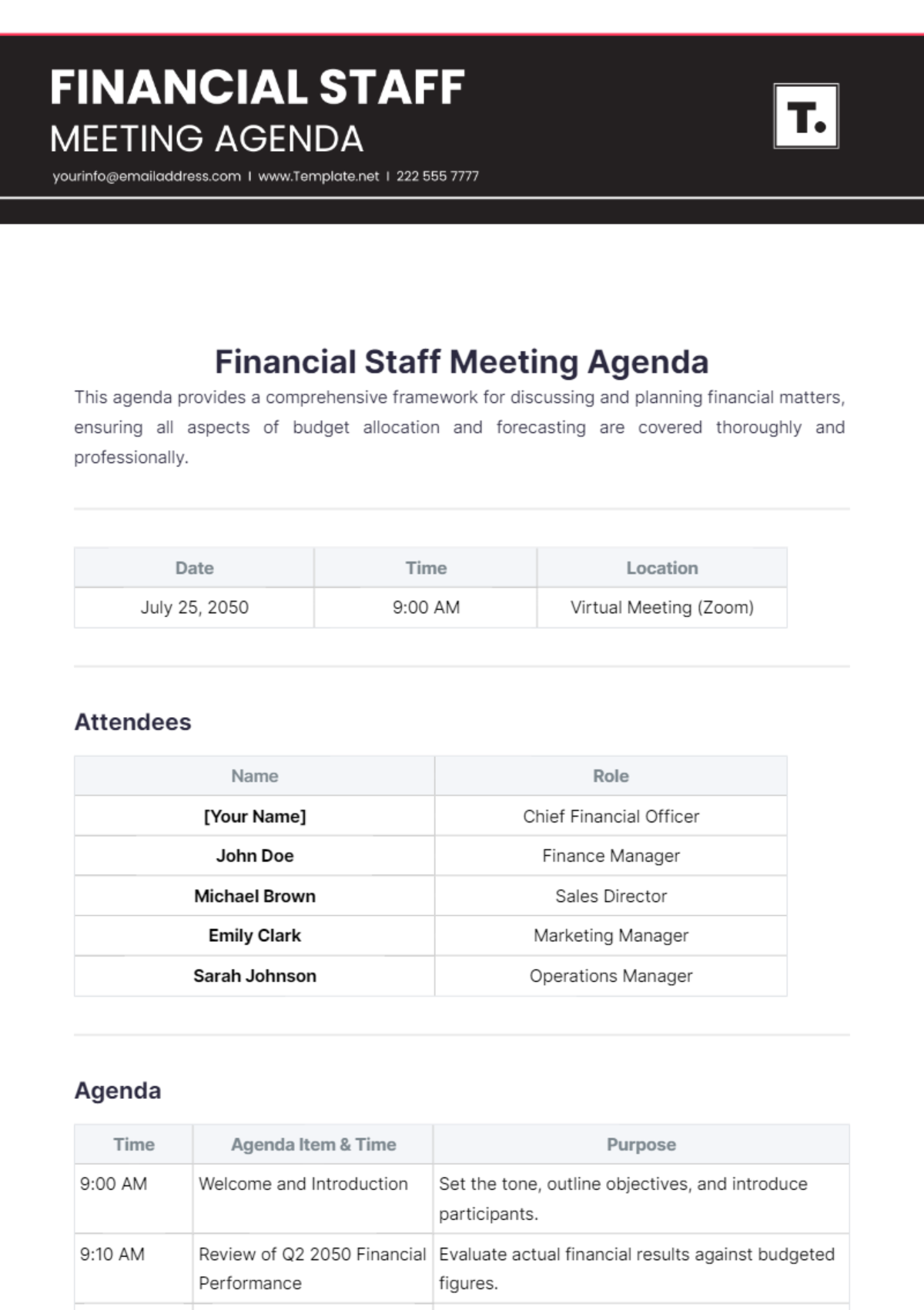

Free Financial Staff Meeting Agenda

This agenda provides a comprehensive framework for discussing and planning financial matters, ensuring all aspects of budget allocation and forecasting are covered thoroughly and professionally.

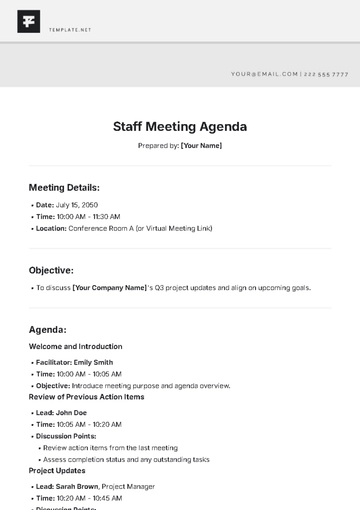

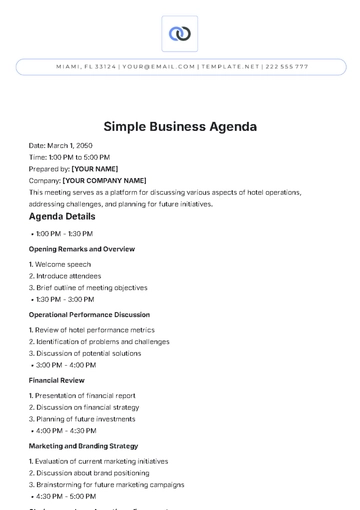

Date | Time | Location |

|---|---|---|

July 25, 2050 | 9:00 AM | Virtual Meeting (Zoom) |

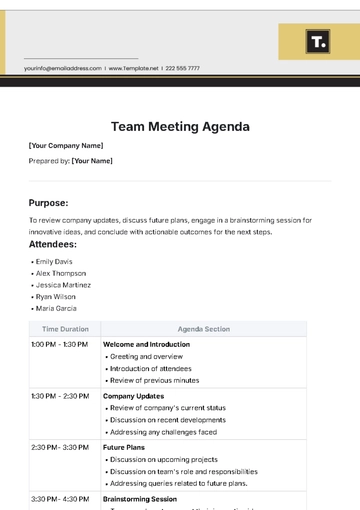

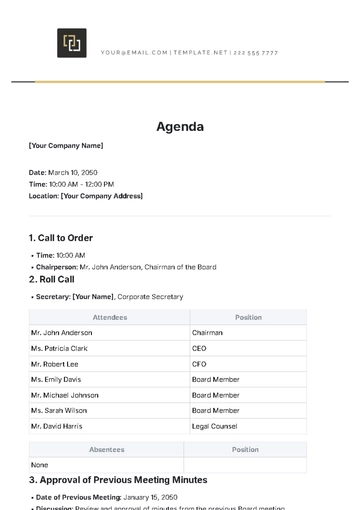

Attendees

Name | Role |

|---|---|

[Your Name] | Chief Financial Officer |

John Doe | Finance Manager |

Michael Brown | Sales Director |

Emily Clark | Marketing Manager |

Sarah Johnson | Operations Manager |

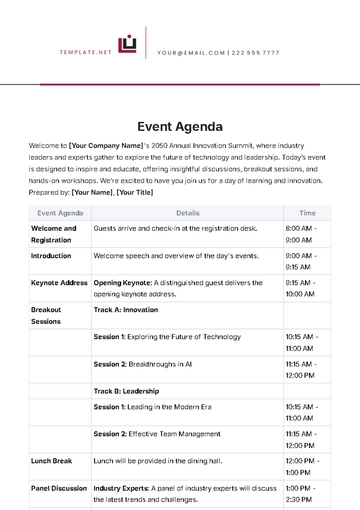

Agenda

Time | Agenda Item & Time | Purpose |

|---|---|---|

9:00 AM | Welcome and Introduction | Set the tone, outline objectives, and introduce participants. |

9:10 AM | Review of Q2 2050 Financial Performance | Evaluate actual financial results against budgeted figures. |

9:30 AM | Revenue analysis | Understand revenue trends and deviations from forecasts. |

9:50 AM | Expense overview | Identify areas of overspend or underspend. |

10:10 AM | Profitability metrics | Assess overall financial health and profitability. |

10:30 AM | Forecasting for Q3 2050 | Discuss anticipated market conditions, risks, and opportunities. |

10:50 AM | Economic outlook | Review macroeconomic factors impacting business operations. |

11:10 AM | Sales projections | Forecast sales volumes and revenue streams for the upcoming quarter. |

11:30 AM | Cost projections | Estimate anticipated costs and identify potential cost-saving measures. |

Break: 11:50 AM

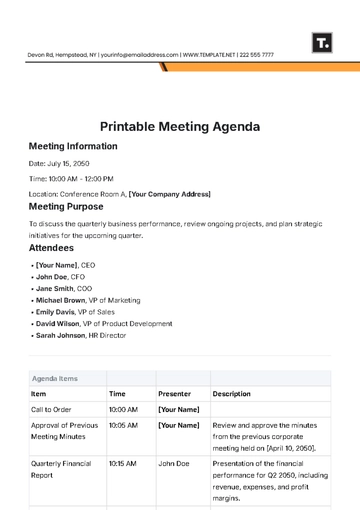

Time | Agenda Item & Time | Purpose |

|---|---|---|

12:00 PM | Budget Allocation | Allocate resources based on forecasts and strategic priorities. |

12:10 PM | Investment planning | Identify key areas for capital investment and resource allocation. |

12:20 PM | Departmental budgets | Allocate budgets to departments based on their operational needs. |

12:30 PM | Risk Management and Contingency Planning | Discuss risk mitigation strategies and develop contingency plans. |

12:45 PM | Risk assessment | Identify and assess potential risks that could impact financial goals. |

1:00 PM | Contingency measures | Plan alternative courses of action to address unexpected challenges. |

1:15 PM | Summary and Action Points | Recap key decisions and outline actionable steps for implementation. |

1:25 PM | Closing Remarks | Conclude the meeting, reinforce commitments, and set follow-up actions. |

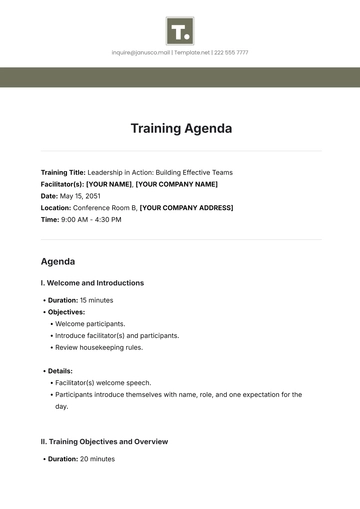

Preparation

Materials Required: Financial reports for Q2 2050, forecast models, budget templates.

Pre-Meeting Tasks: Ensure all participants have access to relevant reports and data beforehand.

Follow-up Actions: Assign responsibilities for implementing budget allocations and monitoring financial performance.

Contact:

[Your Company Email] | [Your Company Address] |

[Your Company Number] | [Your Company Website] |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline financial discussions with Template.net Financial Staff Meeting Agenda Template. This customizable, printable tool ensures structured and productive meetings. Downloadable and editable in our AI Editor Tool, it provides a clear framework for planning and executing financial staff sessions. Enhance efficiency and professionalism with this essential template, ensuring every financial meeting is effective and well-organized.