Free Church Financial Management SOP Layout

I. Introduction

A. Purpose

(This section outlines the intent of the SOP, which is to standardize financial management practices within the church. It ensures consistency, transparency, and accountability in all financial dealings.)

B. Scope

(The scope describes the areas and activities covered by the SOP, including budgeting, accounting, income and expense management, and reporting. It applies to all church financial operations and staff involved in these processes.)

C. Objectives

Objectives detail the goals of the SOP, such as improving financial oversight, enhancing accuracy in record-keeping, and ensuring compliance with regulations. These objectives guide the implementation and review of financial practices.

D. Definitions

(This section provides clear definitions for key financial terms and concepts used throughout the SOP. It ensures that all readers have a consistent understanding of terminology.)

II. Financial Planning and Budgeting

A. Annual Budget Preparation

(The budget preparation process involves creating a comprehensive financial plan for the upcoming year based on historical data and projected needs. It requires review and approval by church leadership to align with the church’s mission and goals.)

B. Forecasting Income and Expenses

(Forecasting involves predicting future income and expenses based on past performance and expected changes. Accurate forecasts help in planning and avoiding financial shortfalls.)

C. Budget Adjustments

(Procedures for adjusting the budget ensure that any deviations from the planned budget are managed effectively. Adjustments require approval from designated authorities to maintain financial control.)

III. Accounting and Record-Keeping

A. Financial Recording Procedures

(This subsection outlines methods for accurately recording all financial transactions, including receipts and disbursements. Consistent recording practices are essential for reliable financial reporting and audit trails.)

B. Documentation and Retention

(It details the types of documentation required for financial transactions and the duration for retaining records. Proper documentation supports transparency and compliance with legal requirements.)

C. Reconciliation Processes

(Reconciliation processes involve comparing recorded financial transactions with bank statements to identify and resolve discrepancies. Regular reconciliations help ensure the accuracy of financial records.)

IV. Income Management

A. Receiving and Depositing Donations

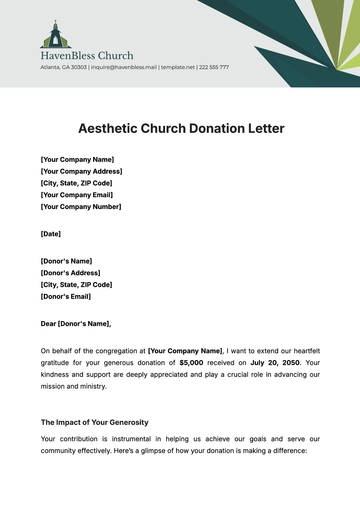

(Procedures for receiving donations include securing funds and ensuring proper recording and deposit into church accounts. Timely deposits and accurate recording are critical for maintaining financial integrity.)

B. Tracking Contributions

(This section describes methods for tracking and acknowledging contributions to provide accurate records for donors and ensure proper reporting. Acknowledgment processes include sending receipts or thank-you letters to contributors.)

C. Handling Special Funds

(Special funds, such as designated or restricted funds, require specific management practices to ensure they are used for their intended purposes. This subsection outlines procedures for monitoring and reporting on these funds.)

V. Expense Management

A. Approval and Processing of Expenditures

(Procedures for approving and processing expenditures ensure that all expenses are authorized and documented. This includes purchase requests, payment approvals, and adherence to budget limits.)

B. Expense Reimbursement

(This section details the process for reimbursing staff or volunteers for out-of-pocket expenses. It includes submitting reimbursement requests, reviewing supporting documentation, and ensuring compliance with church policies.)

C. Payroll Management

(Payroll management includes procedures for processing employee salaries and benefits, ensuring timely and accurate payments. This subsection also covers payroll record-keeping and compliance with tax regulations.)

VI. Financial Reporting

A. Generating Financial Reports

(Procedures for generating financial reports involve creating periodic statements such as income statements and balance sheets. These reports provide a snapshot of the church’s financial status and are used for decision-making.)

B. Report Review and Approval

(Financial reports must be reviewed and approved by designated church officials to ensure accuracy and completeness. This review process helps identify any discrepancies or issues that need addressing.)

C. Reporting to Stakeholders

(Reporting to stakeholders includes sharing financial information with the congregation, board members, and regulatory bodies. Transparent reporting fosters trust and keeps stakeholders informed about the church’s financial health.)

VII. Internal Controls and Audits

A. Internal Control Procedures

(Internal control procedures are designed to prevent and detect fraud and errors in financial management. These controls include segregation of duties, access controls, and regular oversight.)

B. Internal Audits

(Internal audits involve periodic reviews of financial practices and records to ensure adherence to policies and identify areas for improvement. These audits help maintain financial integrity and address any internal issues.)

C. External Audits

(External audits are conducted by independent auditors to provide an objective evaluation of the church’s financial statements and practices. The audit process includes selecting auditors, conducting the audit, and reviewing findings.)

VIII. Compliance and Governance

A. Legal and Regulatory Compliance

(Compliance with legal and regulatory requirements ensures that the church meets its obligations regarding tax laws, nonprofit regulations, and financial reporting. This section outlines procedures for adhering to these requirements.)

B. Governance Policies

(Governance policies address the rules and procedures for managing the church’s financial operations and addressing conflicts of interest. These policies help ensure ethical and transparent financial practices.)

IX. Emergency Financial Procedures

A. Financial Contingency Planning

(Contingency planning involves preparing for unexpected financial challenges, such as natural disasters or economic downturns. This section outlines procedures for managing and accessing emergency funds.)

B. Communication Protocols

(Communication protocols specify how financial information should be shared during emergencies, both internally and externally. Clear communication ensures that all stakeholders are informed and involved in decision-making.)

X. Training and Implementation

A. Staff Training

(Staff training programs ensure that all individuals involved in financial management understand the SOP and their roles. Ongoing education helps maintain up-to-date knowledge and adherence to procedures.)

B. SOP Implementation

(The implementation plan includes strategies for rolling out the SOP across the church and monitoring its effectiveness. Feedback mechanisms help refine the SOP and address any challenges encountered.)

XI. Review and Revision

A. SOP Review Process

(The review process involves regularly assessing the SOP to ensure its relevance and effectiveness. It includes setting review intervals and criteria for evaluating the SOP’s performance.)

B. Updating the SOP

(Procedures for updating the SOP include incorporating feedback, making necessary revisions, and obtaining approval for changes. Regular updates ensure the SOP remains aligned with current practices and regulations.)

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Draft your ideal Church Financial Management SOP effortlessly with our Template.net layout. This editable and customizable template features an AI Editor Tool, ensuring seamless integration into your existing processes. Tailor the SOP to fit your church’s unique needs while maintaining clarity and compliance. Streamline financial management with this professional, easy-to-use template.