Free Investment Proposal Report

1. Executive Summary

1.1 Introduction

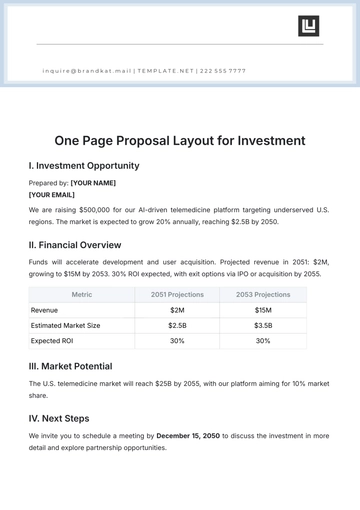

[Your Company Name] is seeking an investment of $5 million to expand its innovative AI-driven data analytics platform. With a robust growth trajectory and a scalable business model, the company aims to capture a significant share of the growing data analytics market, projected to reach $103 billion by 2059. The investment will be used to enhance product features, expand the sales team, and enter new markets, promising an attractive ROI of 20% within the next three years.

2. Company Overview

2.1 Company Background

Founded in 2050, our company has rapidly grown into a leading provider of AI-driven data analytics solutions. Our mission is to empower businesses with actionable insights derived from their data. With a strong commitment to innovation, we have secured several industry awards and built a loyal customer base.

2.2 Business Model

We operate on a subscription-based model, offering tiered pricing plans that cater to small businesses and large enterprises. Revenue is generated through monthly and annual subscriptions, with additional income from professional services such as custom analytics and consulting.

3. Market Analysis

3.1 Industry Overview

The data analytics industry is experiencing explosive growth, driven by the increasing volume of data generated across sectors. Valued at $30 billion in 2052, it is expected to grow at a CAGR of 12.3%, reaching $103 billion by 2059. Key drivers include the adoption of AI and machine learning technologies.

3.2 Target Market

Our target market includes mid-sized to large enterprises across various industries, including retail, finance, healthcare, and manufacturing. These businesses require advanced analytics to make data-driven decisions, improve efficiency, and gain competitive advantages.

3.3 Competitive Analysis

We face competition from established players like Tableau and Microsoft Power BI, as well as emerging startups. However, our unique AI-driven approach, ease of use, and customization capabilities provide a competitive edge. Key challenges include market penetration and staying ahead in technological advancements.

4. Products and Services

4.1 Product/Service Description

Our flagship product, Analytics Pro, offers advanced data analytics features, including predictive analytics, real-time data processing, and customizable dashboards. The platform is designed to be user-friendly, enabling non-technical users to gain insights effortlessly.

4.2 Development Stage

Analytics Pro is currently in its third version, with several patented technologies enhancing its capabilities. Future developments include integrating natural language processing and expanding API integrations to ensure seamless data flow from various sources.

5. Marketing and Sales Strategy

5.1 Marketing Strategy

We employ a multi-channel marketing strategy that includes digital marketing, content marketing, and participation in industry events. We leverage SEO, PPC campaigns, and social media to drive traffic and generate leads. Case studies and white papers are used to build credibility and showcase success stories.

5.2 Sales Strategy

Our sales strategy focuses on a direct sales approach for large enterprises and a scalable online sales model for smaller businesses. We have a dedicated sales team to handle enterprise accounts, supported by a robust CRM system to manage and nurture leads. Customer retention strategies include ongoing support, training, and regular product updates.

6. Operations Plan

6.1 Operational Workflow

Our operational workflow is designed for efficiency and scalability. We have streamlined processes for product development, customer support, and sales operations. Our supply chain management ensures timely delivery of software updates and hardware components, if applicable.

6.2 Management Team

Our management team comprises industry veterans with extensive experience in technology and business growth. The CEO has over 20 years in the tech industry and leads the team. The CTO, a former data scientist at Google, spearheads our product development. Our advisory board includes experts from leading tech firms and academic institutions.

7. Financial Plan

7.1 Financial Projections

We project revenue growth from $10 million in 2023 to $30 million by 2054, driven by market expansion and product enhancements. Gross margins are expected to improve from 60% to 70%, with operational efficiencies and economies of scale.

7.2 Funding Requirements

We are seeking $5 million in funding, allocated as follows: 40% for product development, 30% for sales and marketing, 20% for market expansion, and 10% for operational improvements. This funding will enable us to accelerate growth and achieve our revenue targets.

7.3 Return on Investment

Investors can expect a return on investment of 20% within three years. Potential exit strategies include acquisition by a larger tech company or an IPO, given the favorable market conditions and growth potential.

8. Risk Analysis

8.1 Risk Factors

Key risks include market competition, technological advancements, and economic downturns. Competition from larger, established players could impact market share. Rapid technological changes require continuous innovation. Economic downturns could reduce corporate spending on data analytics.

8.2 Mitigation Strategies

To mitigate these risks, [Your Company Name] focuses on continuous innovation and maintaining a flexible business model. We invest in R&D to stay ahead of technological trends and have a diversified customer base to reduce dependency on any single market segment. Robust financial planning ensures we can navigate economic fluctuations effectively.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your investment pitches with Template.net's Investment Proposal Report Template. This editable and customizable template covers key sections such as financial analysis, market potential, risk assessment, and return on investment. Editable in our AI Editor Tool, it ensures a professional and compelling presentation that helps secure investor confidence and funding.

You may also like

- Business Proposal

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal