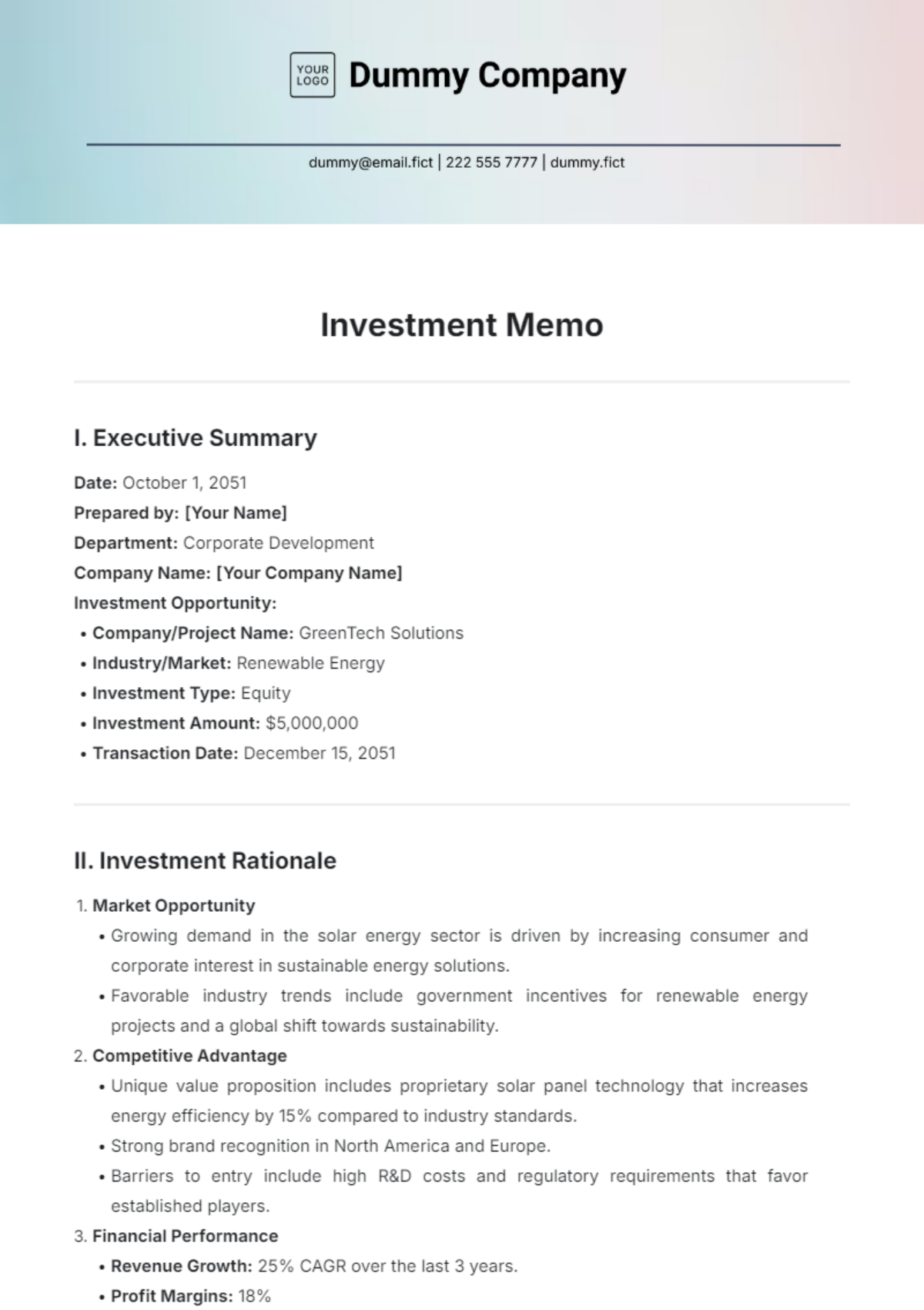

Investment Project Specification

1. Project Overview

This document outlines the scope, objectives, and requirements of a proposed investment project. This detailed specification serves as a guide for stakeholders and key decision-makers to understand the necessary steps, resources, and expected outcomes of the investment initiative. The project aims to enhance [Your Company Name]'s financial growth through strategic investments in high-potential sectors.

2. Scope

2.1 Project Description

The investment project aims to direct capital into emerging markets and innovative technologies. It involves market research, due diligence, selecting investment vehicles, and managing the investment portfolio to maximize returns.

2.2 Inclusions

Market Analysis: Research on market trends and growth opportunities.

Financial Modeling: Projections and risk assessment of investments.

Investment Selection Criteria: Criteria for choosing viable investments.

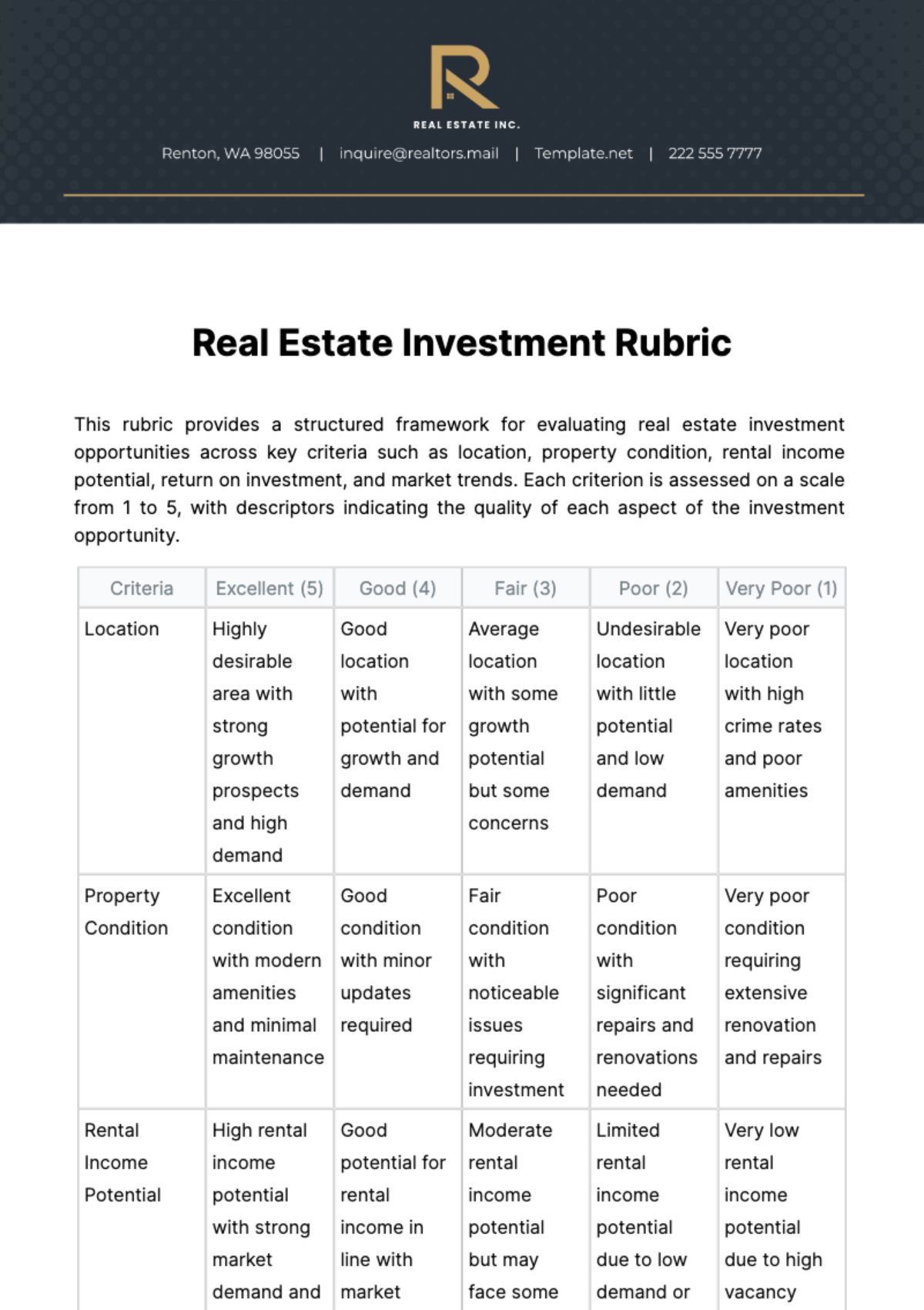

Risk Assessment: Identification and management of investment risks.

Performance Metrics: KPIs for measuring investment success.

Reporting and Compliance: Regular performance reporting and regulatory adherence.

2.3 Exclusions

Real Estate Investments: Excludes physical property investments.

Non-Securitized Loan Instruments: Excludes unsecured loans.

Foreign Currency Speculation: Excludes speculative currency investments.

3. Objectives

3.1 Primary Objectives

Achieve an annual return on investment (ROI) of 12% within the first three years.

Diversify the company's portfolio by including at least five different sectors.

Minimize risk through rigorous due diligence and continuous monitoring.

3.2 Secondary Objectives

Establish partnerships with promising startups and technology firms.

Gain industry insights and intelligence for strategic positioning.

Enhance company reputation as a forward-thinking market player.

4. Requirements

4.1 Functional Requirements

Development of a market research framework to identify potential investment opportunities.

Creation of financial models to evaluate investment scenarios.

Deployment of a portfolio management system for tracking investments and performance metrics.

Implementation of a reporting system for regular updates to stakeholders.

4.2 Non-functional Requirements

Scalability: The portfolio management system should handle an increasing number of investments without performance degradation.

Security: Ensure that all financial data and transactions are secured with industry-standard encryption.

Compliance: Adhere to financial regulations and reporting standards.

4.3 Resource Requirements

Resource | Description |

|---|---|

Project Manager | Oversees the project's execution and manages resources. |

Financial Analysts | Conduct market research and financial modeling. |

IT Team | Develops and maintains the portfolio management and reporting systems. |

Legal Advisors | Ensure compliance with financial regulations. |

5. Timeline

Milestone | Estimated Completion |

|---|---|

Project Kickoff | Q1 2050 |

Market Research Completion | Q2 2050 |

System Development | Q3 2050 |

Initial Investment Deployment | Q4 2050 |

First Performance Review | Q1 2056 |

6. Budget

Item | Estimated Cost |

|---|---|

Market Research | $100,000 |

System Development | $200,000 |

Initial Investment Capital | $5,000,000 |

Legal and Compliance | $50,000 |

Contingency | $150,000 |

7. Approval and Sign-off

This document requires the approval and sign-off of the following stakeholders to ensure alignment and commitment to the project objectives:

Stakeholder | Role | Signature | Date Signed |

|---|---|---|---|

[Name] | Chief Financial Officer |

| May 2, 2050 |

[Name] | Chief Executive Officer |

| May 2, 2050 |

[Name] | Head of Investment |

| May 2, 2050 |

Upon receiving the necessary approvals, this investment project specification will serve as the guiding document for project execution, ensuring that all activities align with the defined scope, objectives, and requirements.