Free Capital Investment Budget Justification

Prepared By: [YOUR NAME]

Date: [DATE]

I. Executive Summary

The proposed capital investment aims to enhance our operational capabilities through the acquisition of new infrastructure and equipment. This investment is strategically aligned with our organizational goals of increasing efficiency, reducing costs, and supporting sustainable growth. The project promises significant returns through improved productivity and the creation of long-term value.

II. Introduction

Our organization faces increasing demand for innovative solutions and higher production capacity. To respond effectively, we require updated infrastructure and state-of-the-art equipment. This proposal outlines the need for a significant capital investment to address these requirements, ensuring our position as a market leader.

III. Purpose and Objectives

The primary purpose of this investment is to modernize our facilities and equip our workforce with advanced tools. The objectives include:

Boosting Production Capacity: Achieve a 25% increase in production capacity to meet rising demand and support expanded market opportunities.

Enhancing Operational Efficiency: Streamline operations to significantly reduce downtime and improve workflow efficiency, leading to optimized resource utilization.

Advancing Energy Efficiency: Implement advanced, energy-efficient technologies to lower operational costs and minimize our environmental footprint, fostering sustainable practices.

Fostering Sustainable Growth: Position the organization for long-term success by building a scalable infrastructure for strategic growth and future industry trends.

IV. Justification

A. Benefits

Enhanced Productivity: Using advanced equipment will simplify and improve processes, reduce manual labor, and significantly boost overall productivity.

Substantial Cost Savings: Improved energy efficiency and lower maintenance requirements will decrease expenses and enhance financial stability.

Strategic Competitive Advantage: Enhancing our infrastructure will strengthen our market position, allowing us to provide superior products and surpass competitors in both innovation and efficiency.

B. Risks

Significant Initial Investment: The considerable upfront capital required for this investment may strain short-term financial liquidity, necessitating careful cash flow management and financing strategies.

Potential Implementation Delays: Unforeseen delays in project execution could postpone the realization of anticipated benefits, necessitating robust project management and contingency planning to mitigate these risks.

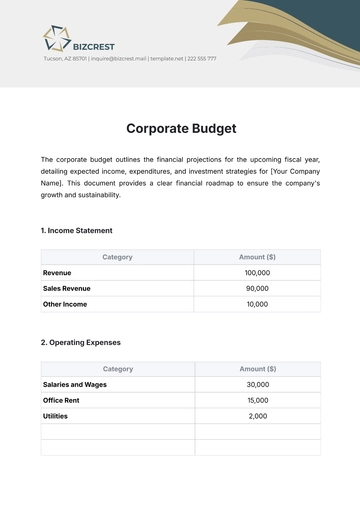

V. Cost Breakdown

Item | Cost |

|---|---|

Land Acquisition | $2,000,000 |

Building Construction | $5,000,000 |

Machinery and Equipment | $3,000,000 |

Installation and Testing | $500,000 |

Contingency Fund | $500,000 |

Total | $11,000,000 |

VI. Financial Analysis

The calculations of return on investment (ROI) and the payback period provide a compelling and robust financial justification for proceeding with the investment.

Return on Investment (ROI): The projected ROI is 15% annually over the next five years, indicating strong financial returns and increased profitability.

Payback Period: Estimated at 4 years, this period reflects a quick recovery of the initial investment and a positive impact on cash flow.

Annual Net Savings: The annual savings are projected to be $1,650,000 as a result of increased efficiency and reduced operational costs, demonstrating significant long-term financial advantages.

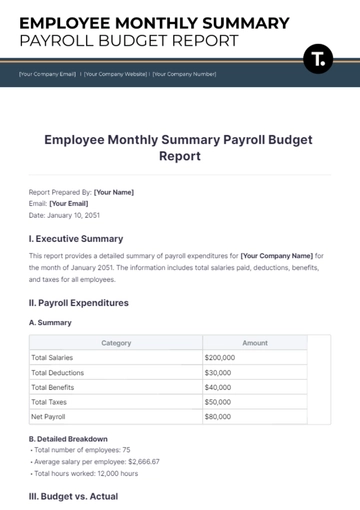

VII. Implementation Plan

Phase | Timeframe |

|---|---|

Planning and Design | 3 months |

Land Acquisition | 2 months |

Construction | 12 months |

Equipment Installation | 4 months |

Testing and Commissioning | 1 month |

Full Operation | 22 months (total) |

VIII. Conclusion

In summary, this capital investment is essential for our organization's growth and long-term success. The proposed expenditure will yield significant benefits in productivity, efficiency, and competitive positioning. We strongly recommend proceeding with the investment to secure a prosperous future.

IX. Appendices

The appendices offer an assortment of additional documents and data that bolster the main content, including detailed financial projections for future performance, thorough risk analysis reports highlighting potential risks and impacts, and vendor quotations with cost estimates from suppliers.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your capital investment proposals with Template.net’s Capital Investment Budget Justification Template. This editable and customizable template is designed to help you create thorough budget justifications that align with your investment goals. Editable in our Ai Editor Tool, it ensures precise financial reporting and easy adjustments. Ideal for financial analysts and investment managers, this template simplifies the budgeting process

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising