Payroll Management Action Research

Prepared By: [Your Name]

Company Name: [Your Company Name]

1. Introduction

1.1 Overview of Payroll Management

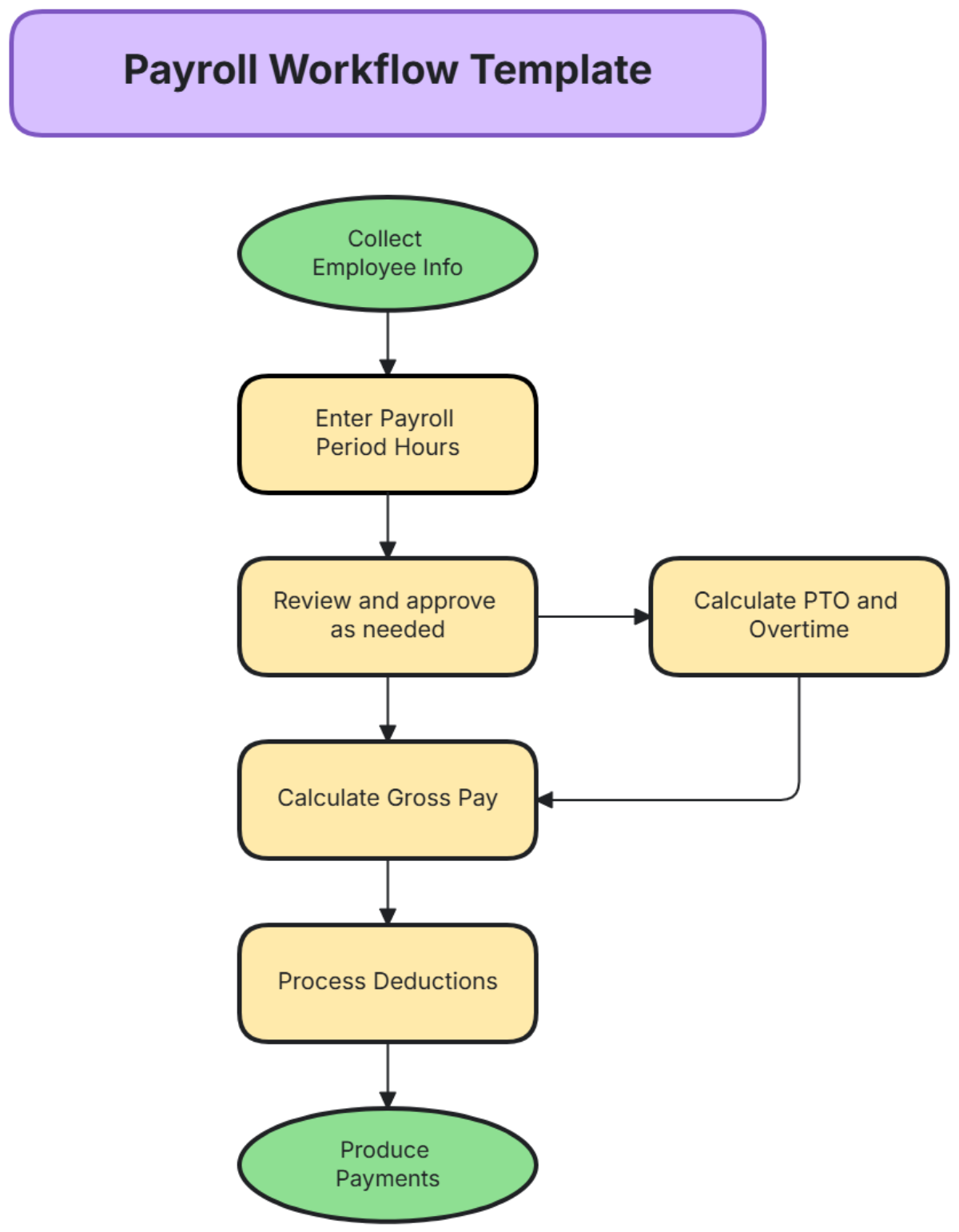

Payroll management involves the systematic administration of employee salaries, wages, bonuses, and deductions. It is critical to ensure employees are compensated accurately and promptly while adhering to legal and tax obligations. Efficient payroll management helps maintain employee satisfaction, avoid legal penalties, and manage organizational finances effectively.

1.2 Purpose of the Research

The purpose of this research is to conduct a thorough analysis of the current payroll management system at [Your Company Name]. This involves identifying inefficiencies, compliance gaps, and inaccuracies within the payroll processes and developing actionable strategies to enhance overall payroll efficiency, compliance, and accuracy.

1.3 Scope and Objectives

This research covers the entire payroll management process, including data collection, processing, compliance, and reporting. The primary objectives are to:

Assess the effectiveness of the current payroll system.

Identify and address inefficiencies and compliance issues.

Implement improvements to streamline payroll processes and ensure accuracy.

2. Data Collection

2.1 Methodology

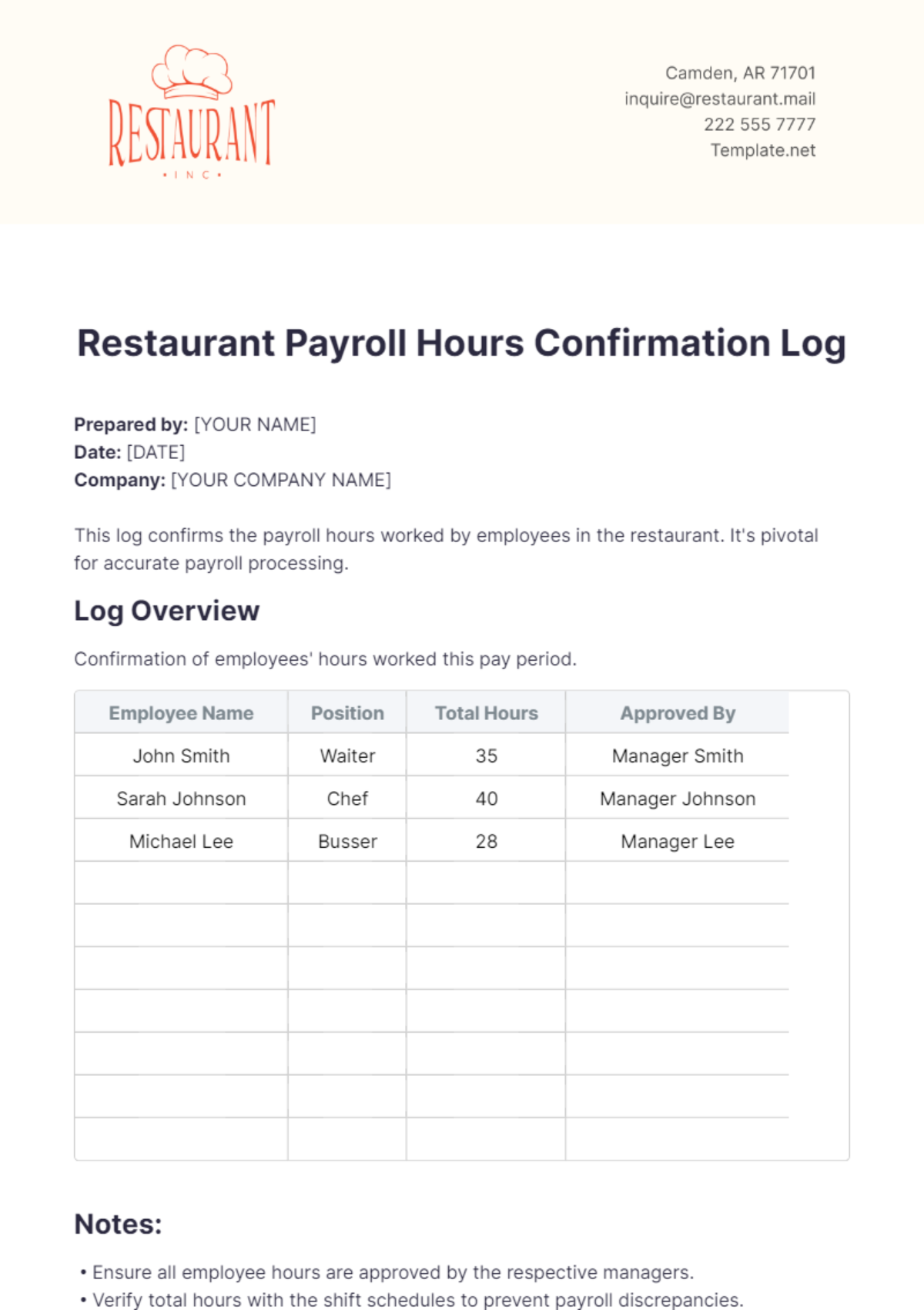

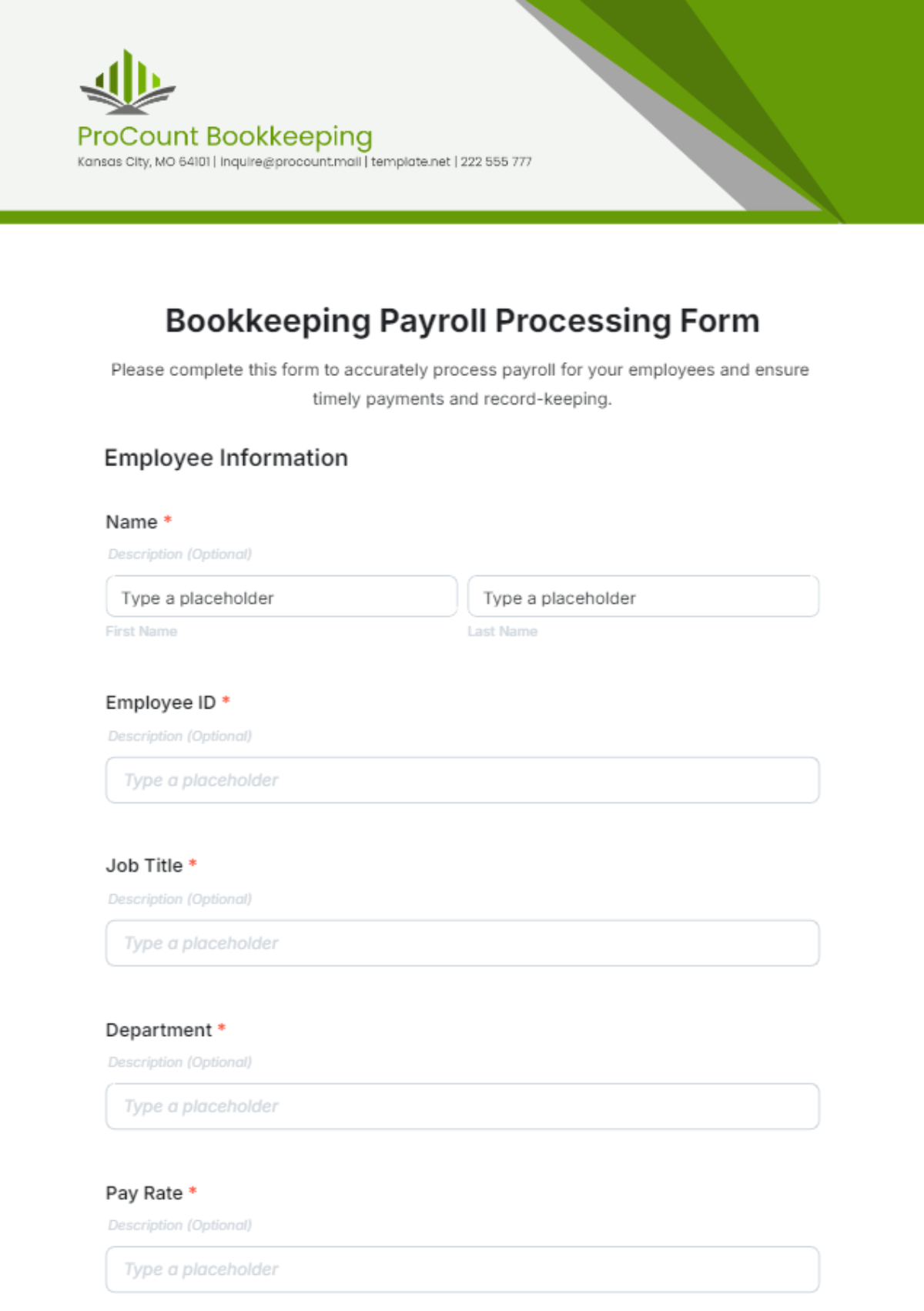

The research employs a mixed-method approach to gather comprehensive data on payroll processes. This includes quantitative data from payroll records and qualitative data from employee surveys and interviews with payroll staff.

2.2 Data Sources

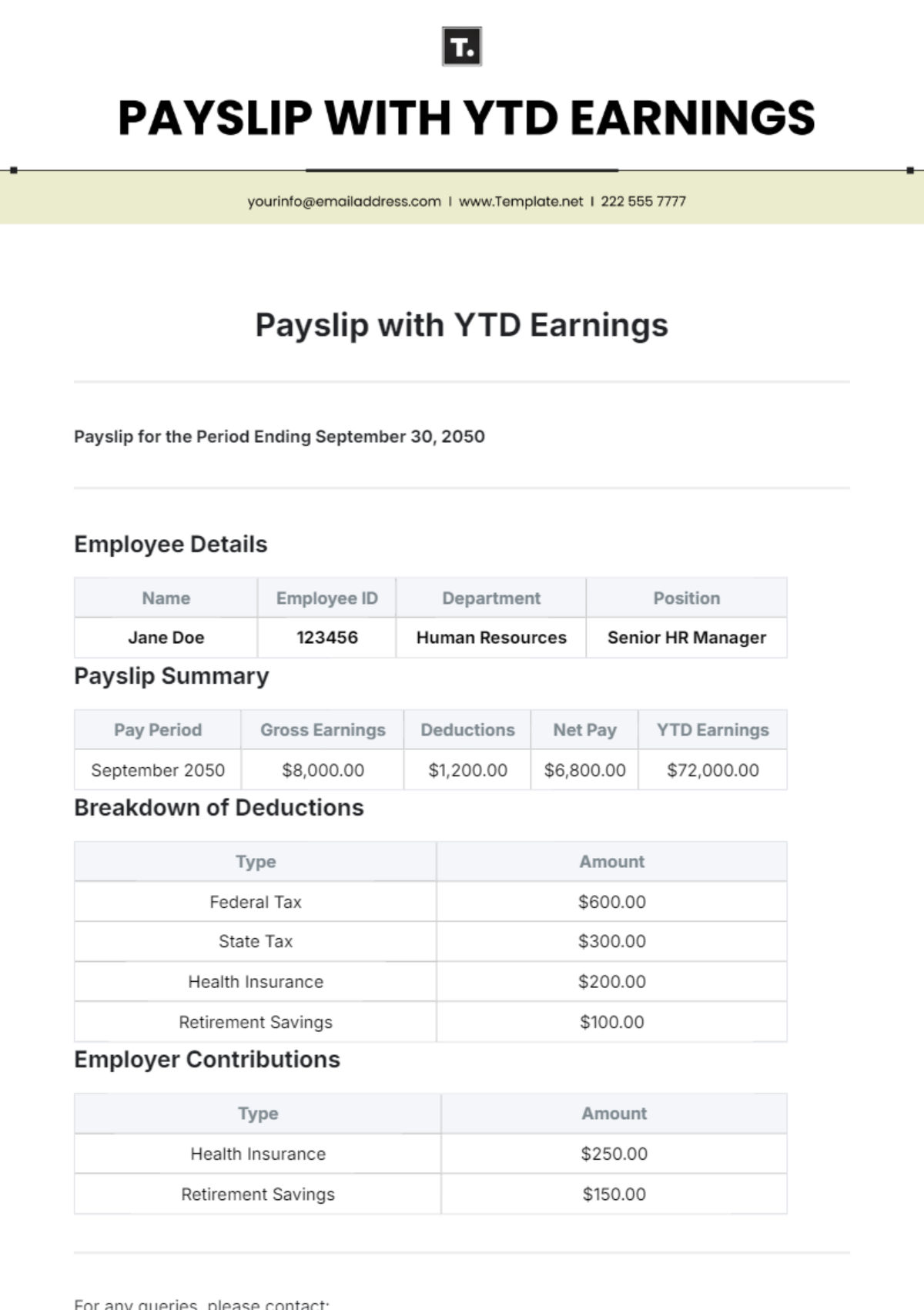

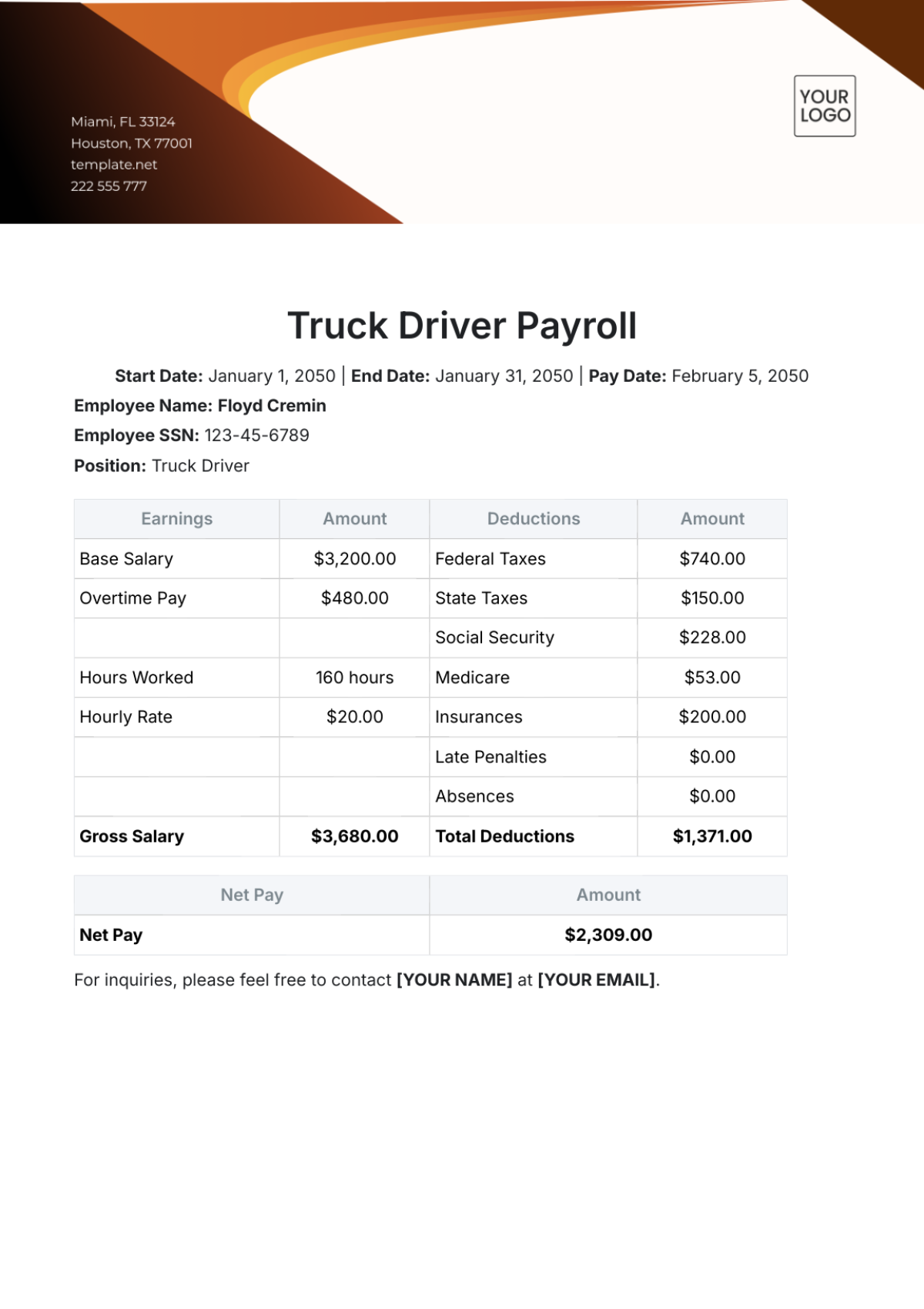

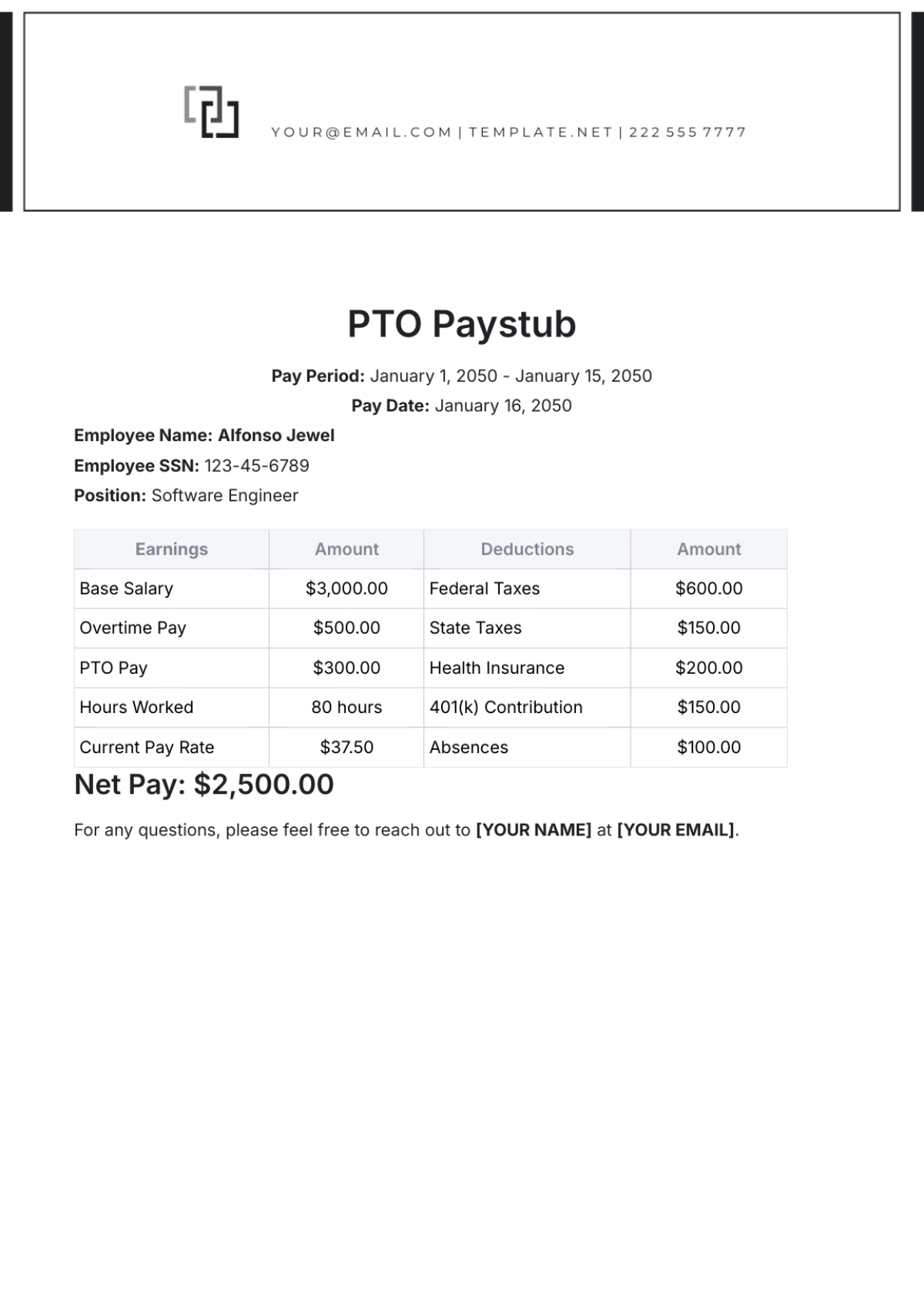

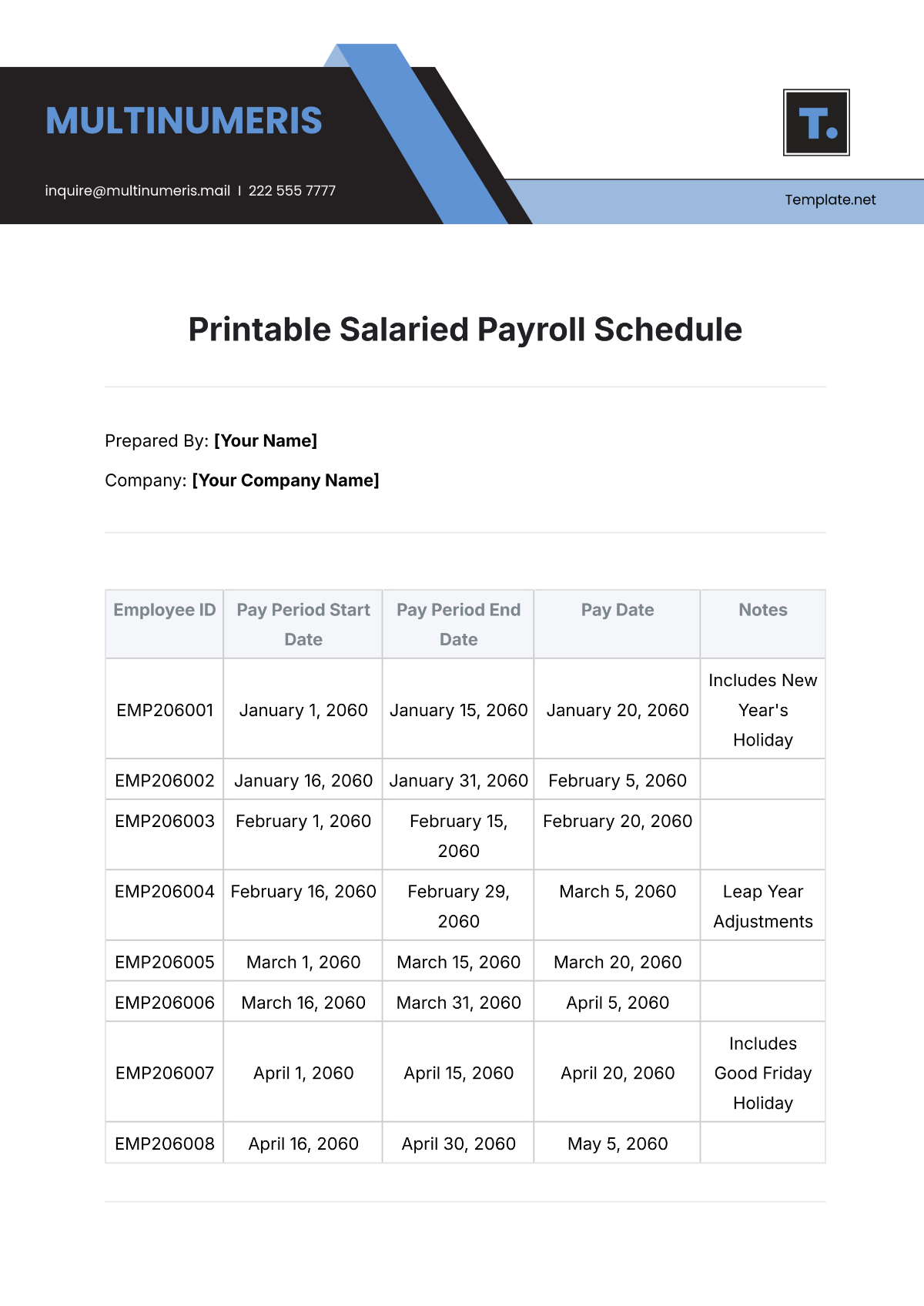

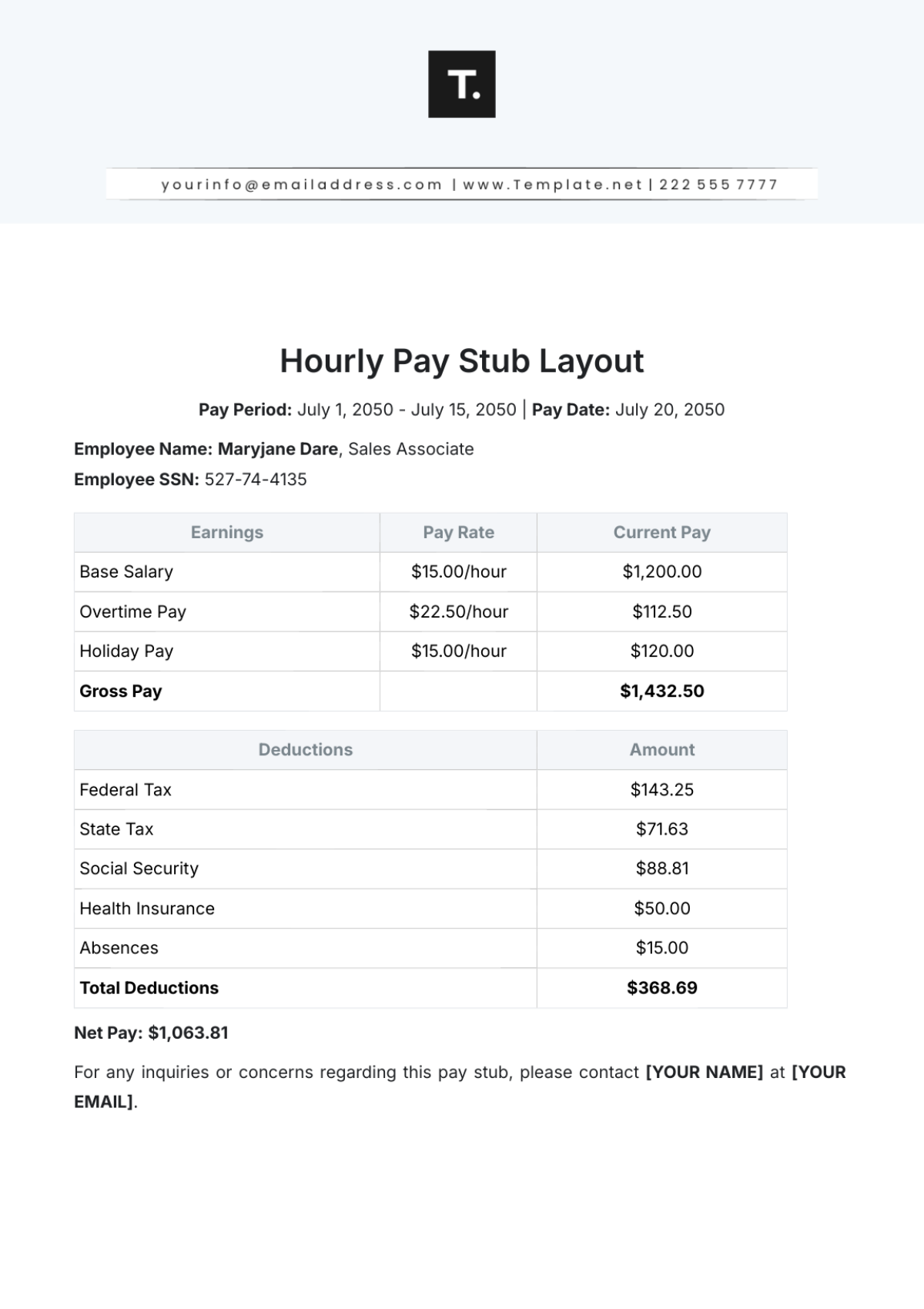

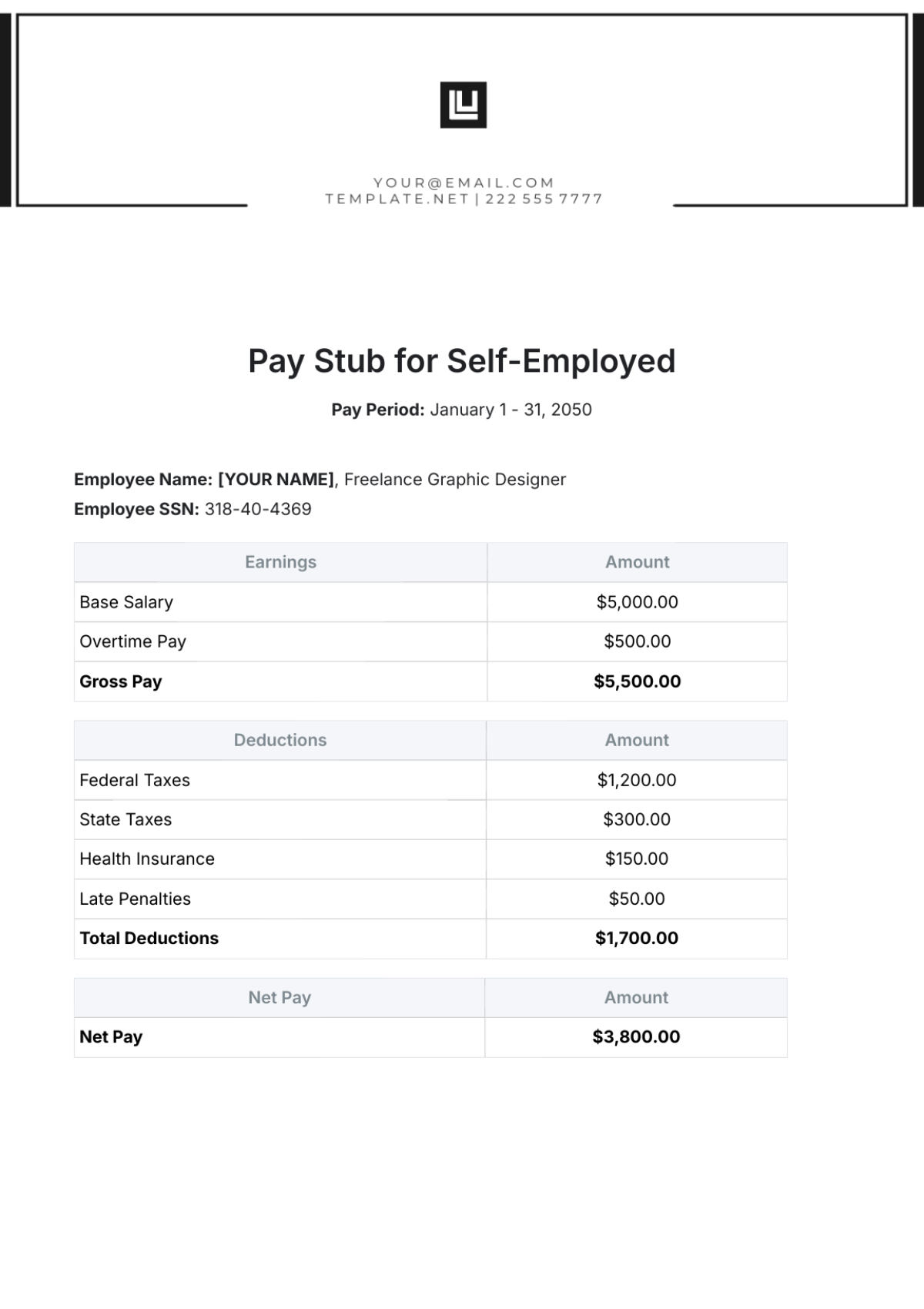

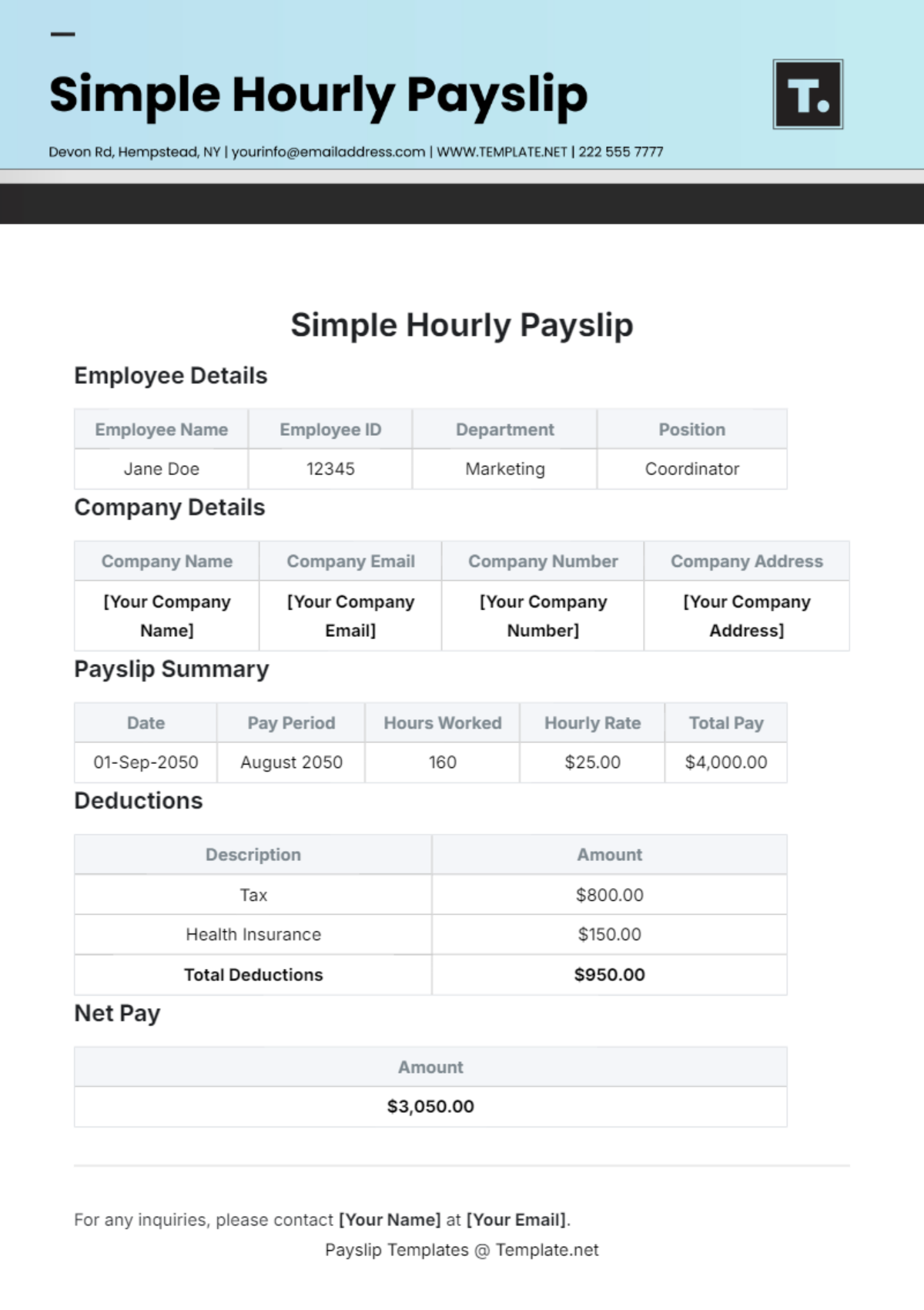

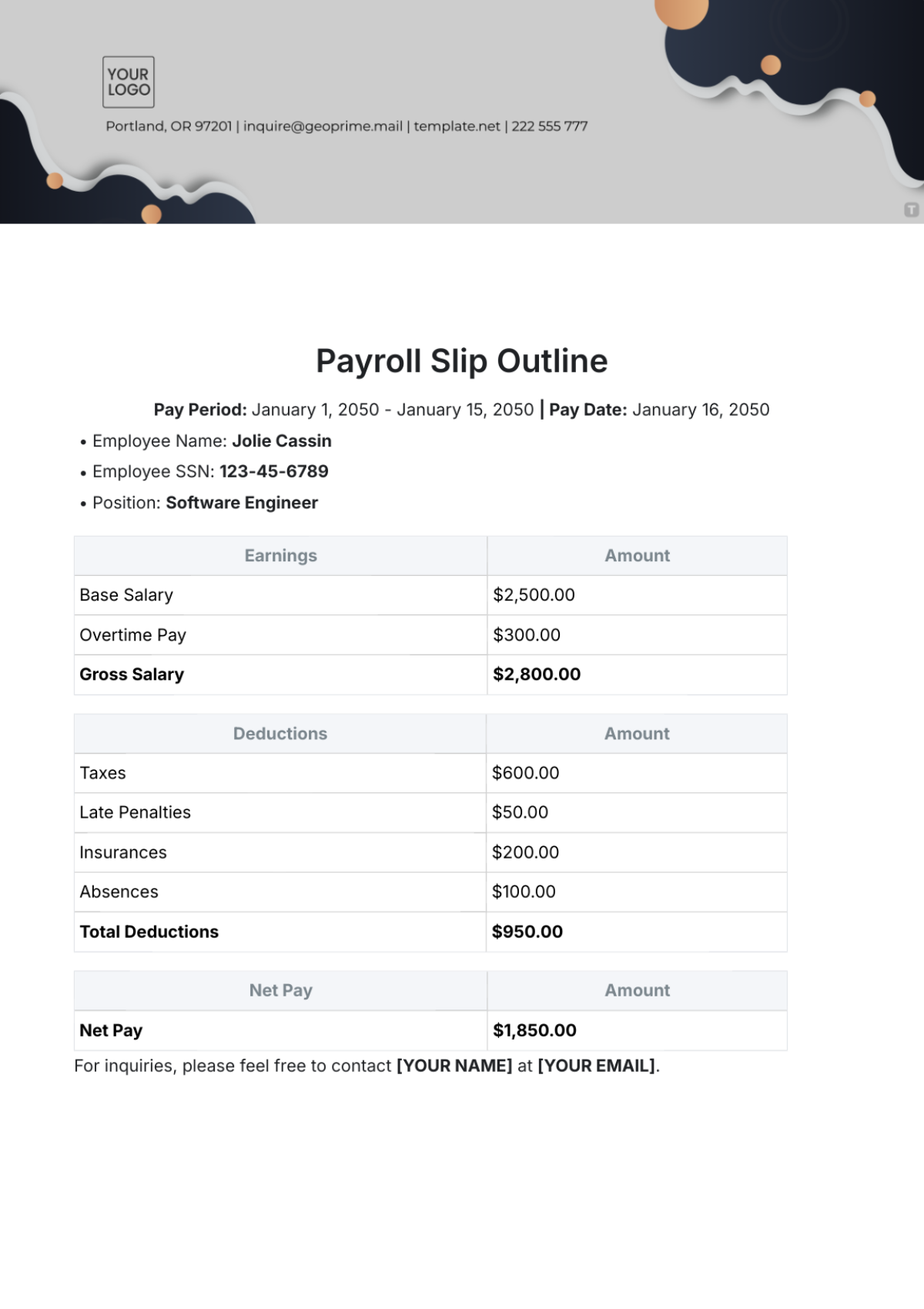

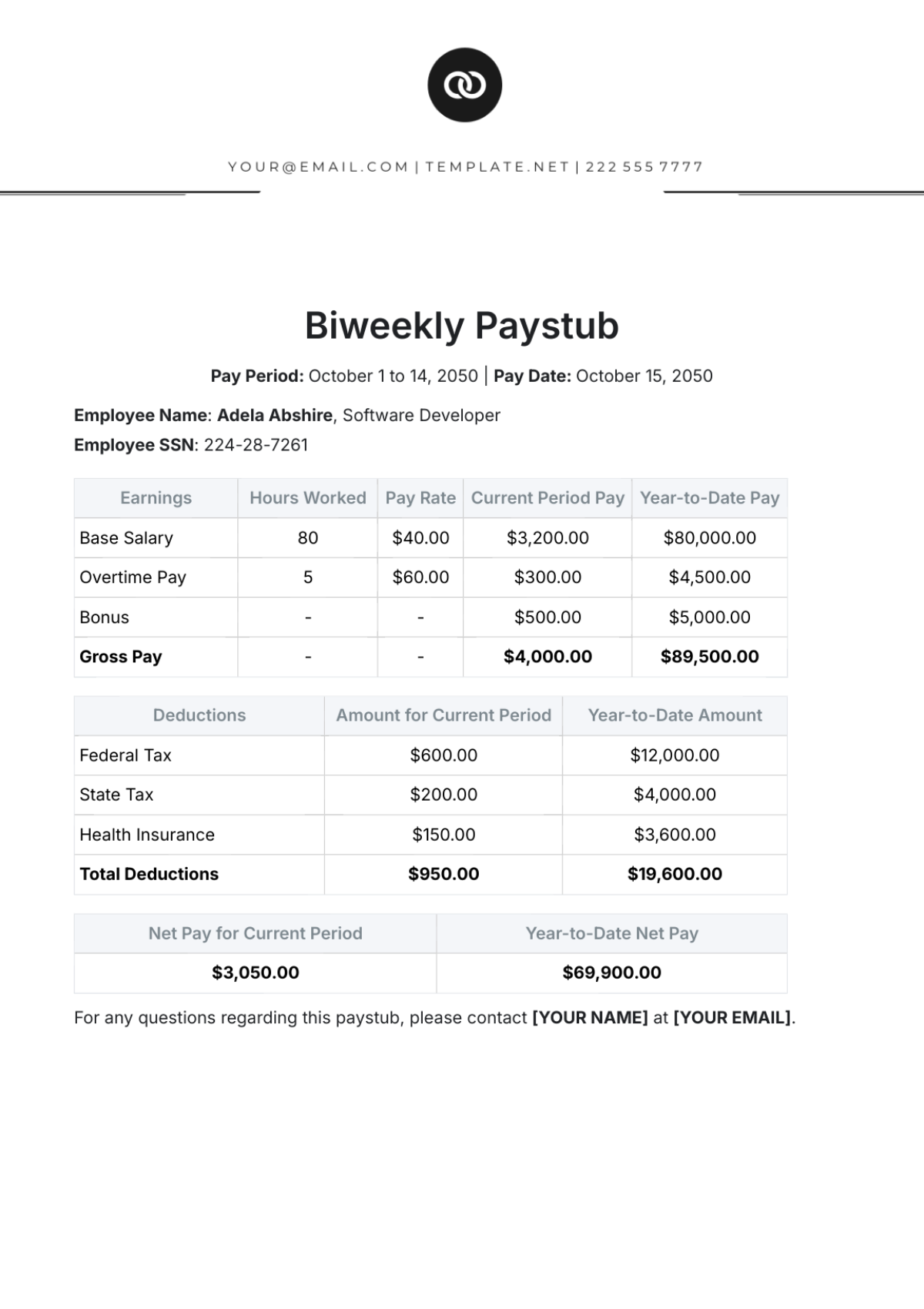

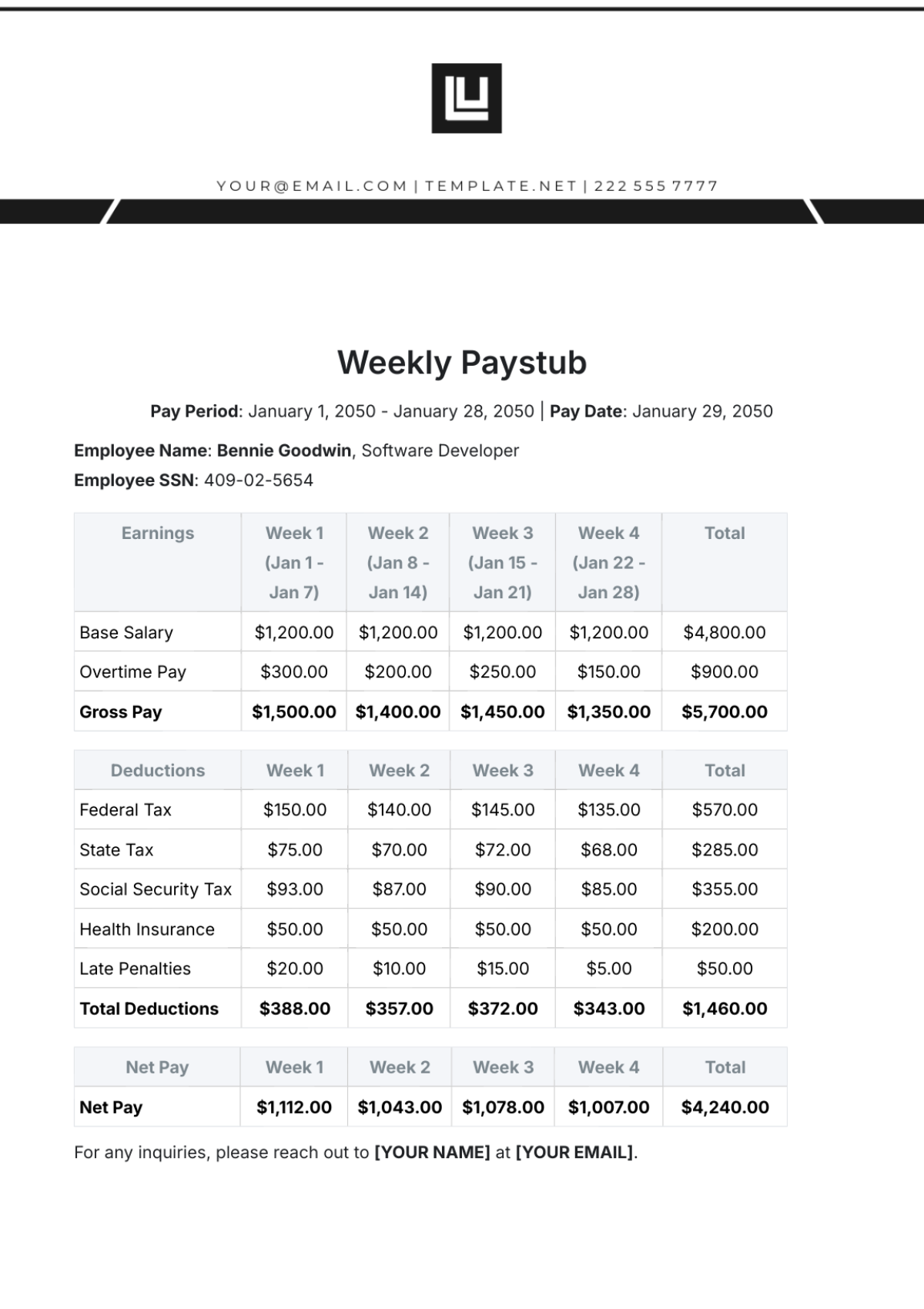

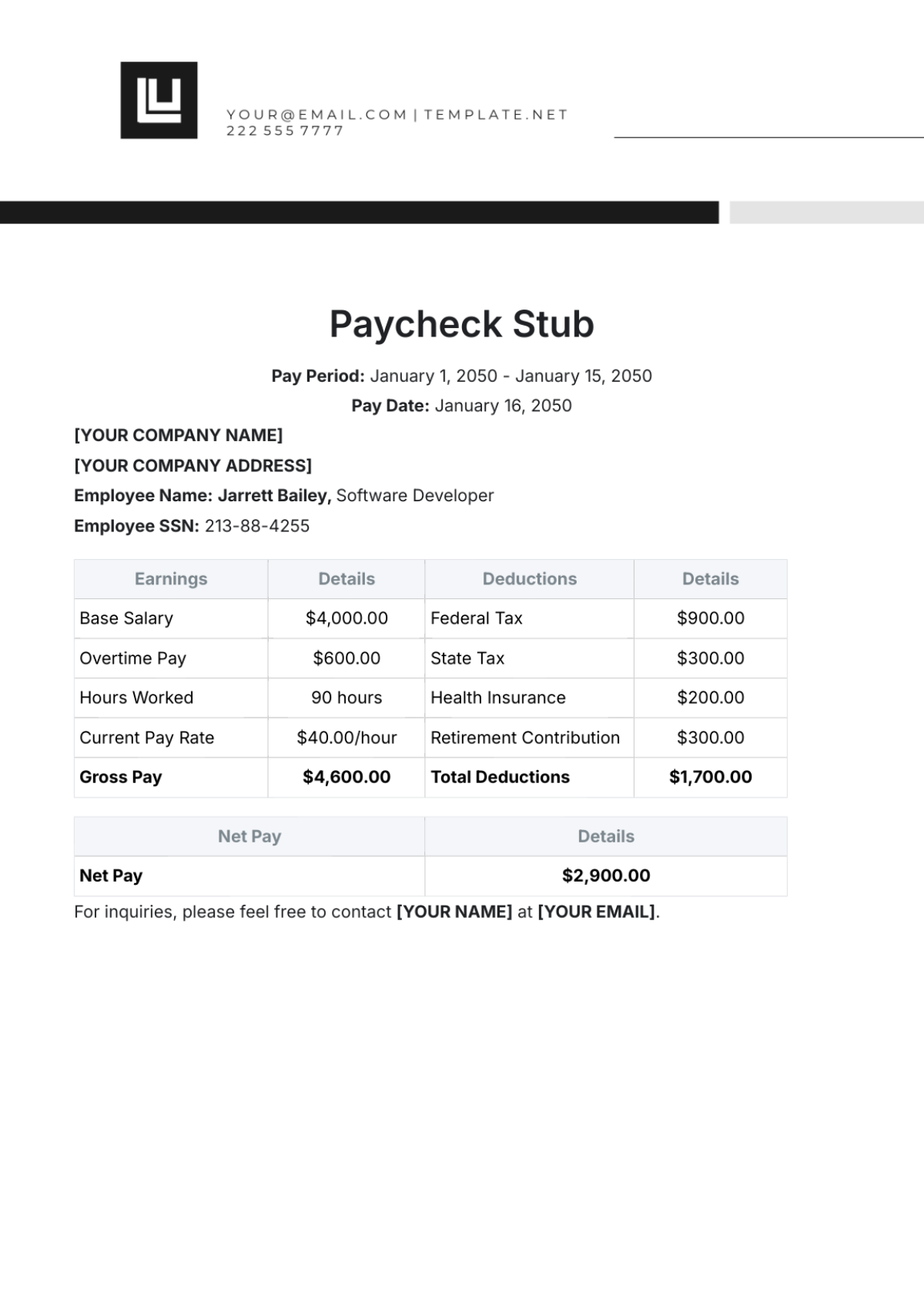

Payroll Records: Historical data on payroll processing, including salary payments, deductions, and bonuses.

Employee Surveys: Feedback from employees regarding their satisfaction with payroll accuracy and timeliness.

Compliance Reports: Documentation of audits and compliance checks related to payroll.

Staff Interviews: Discussions with payroll and HR staff to gain insights into system challenges and inefficiencies.

2.3 Data Collection Tools

Online Surveys: Platforms like SurveyMonkey or Google Forms for collecting employee feedback.

Payroll Software Reports: Data exports from existing payroll systems to analyze processing metrics.

Interview Guides: Structured questions used during staff interviews to gather qualitative insights.

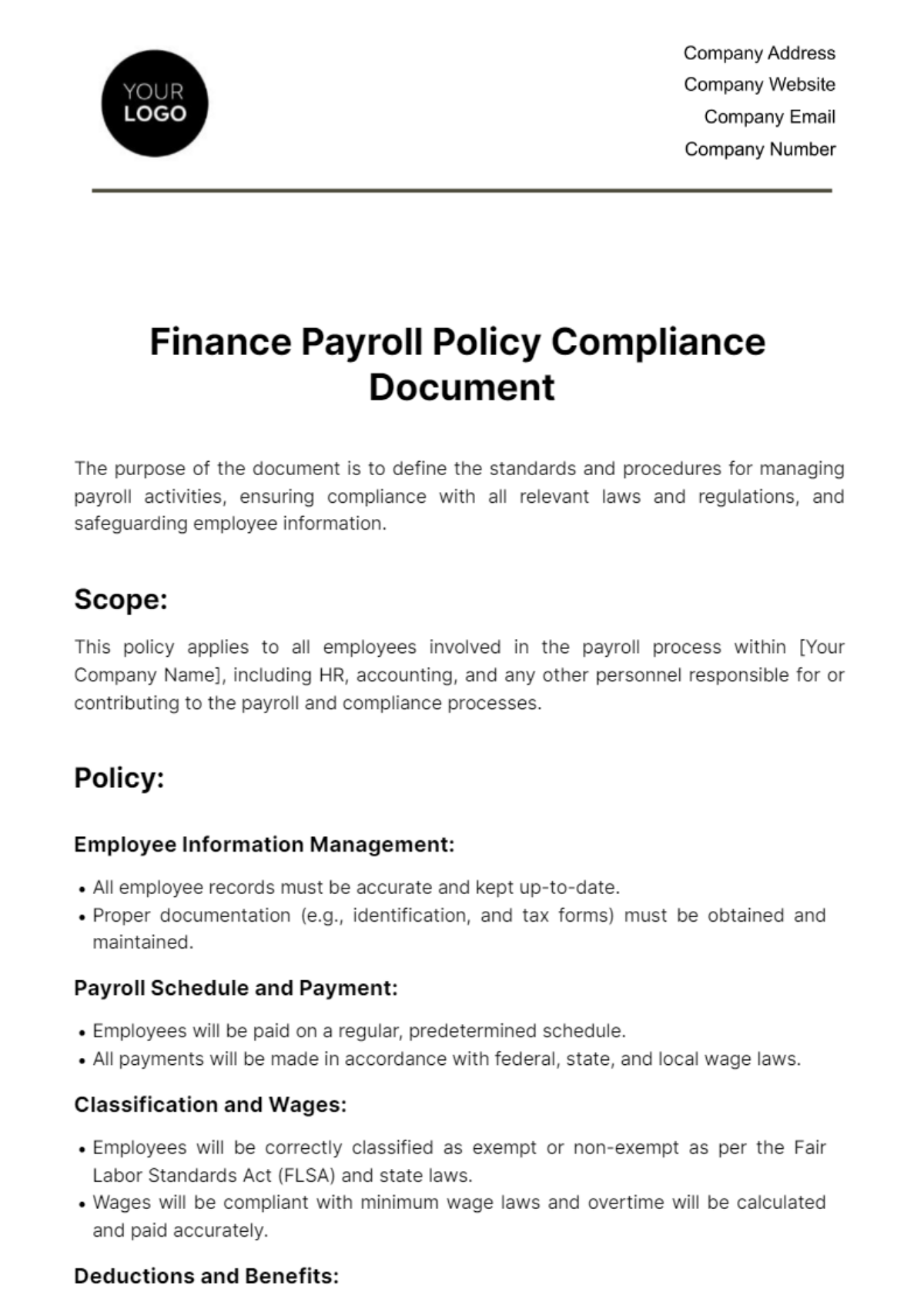

Compliance Checklists: Tools for assessing adherence to legal and regulatory requirements.

2.4 Summary of Collected Data

Data analysis revealed several key issues:

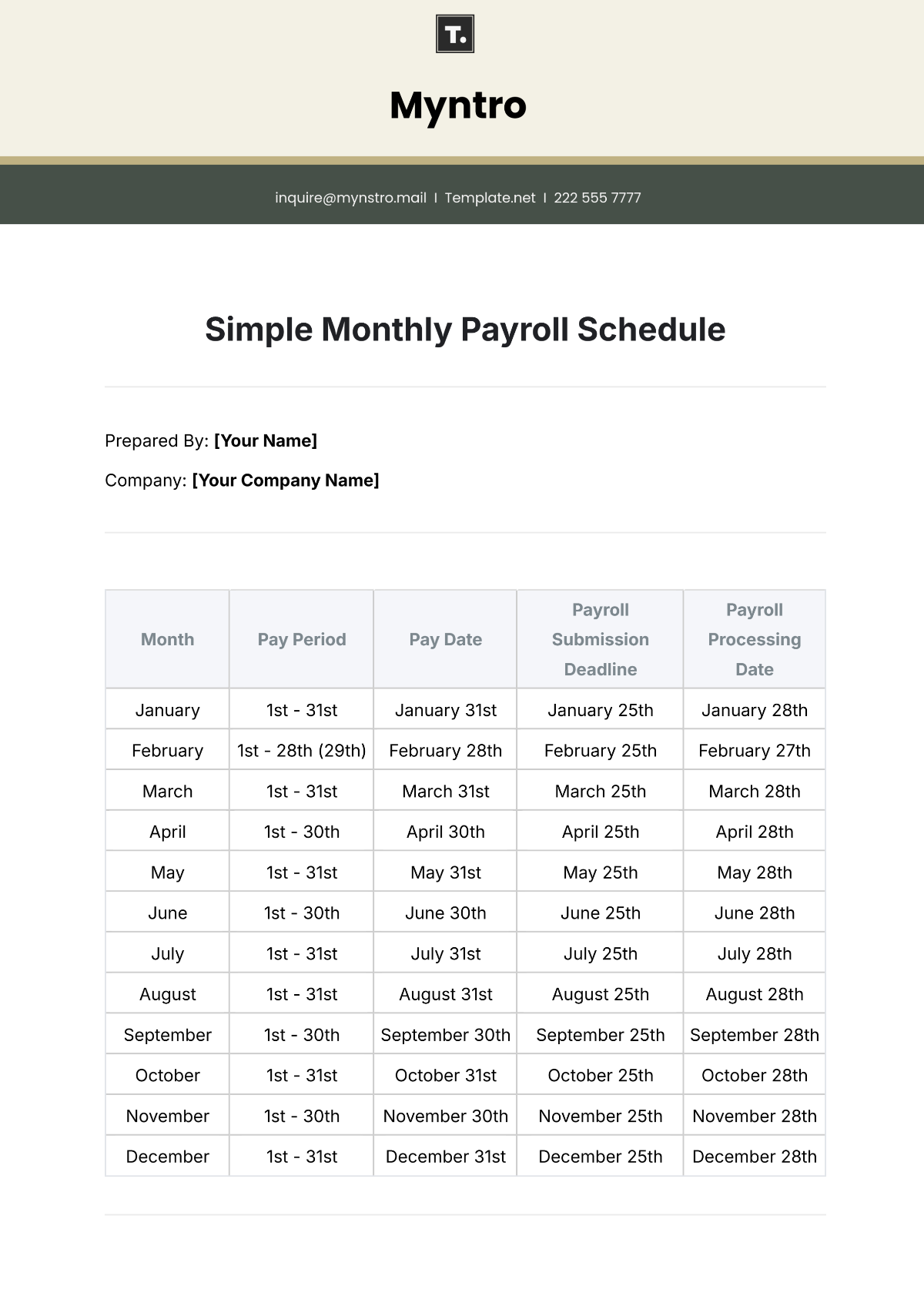

Processing Delays: Payroll processing times are longer than industry benchmarks, leading to delayed employee payments.

Error Rates: A notable percentage of payroll entries contain errors due to manual data entry.

Compliance Gaps: Recent changes in tax laws and labor regulations have not been fully integrated into the payroll system.

3. Analysis of Current Payroll Processes

3.1 Description of Existing Payroll System

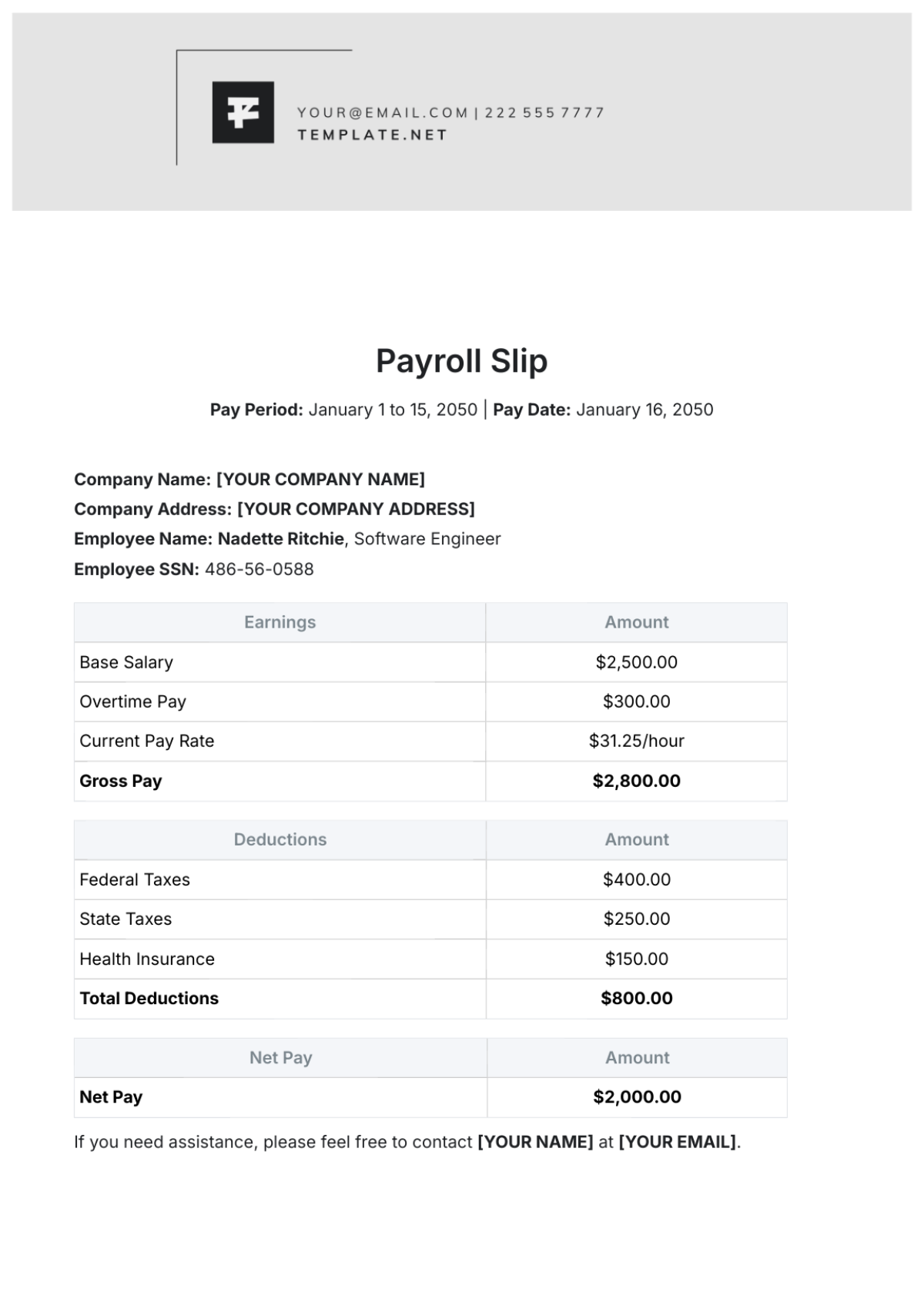

The current payroll system at [Your Company Name] utilizes legacy payroll software combined with manual data entry methods. Payroll is processed bi-weekly, with payroll staff manually entering hours worked, deductions, and adjustments. This system lacks real-time reporting capabilities and automated compliance updates.

3.2 Identification of Inefficiencies

Manual Data Entry: Frequent errors occur due to manual input, requiring additional time for corrections.

Outdated Software: The legacy system is not equipped to handle modern payroll requirements, including automated tax updates and real-time reporting.

Processing Delays: Manual processing steps contribute to longer payroll cycles, affecting timely salary payments.

3.4 Compliance and Accuracy Issues

Tax Withholding Errors: Errors in tax calculations have led to occasional discrepancies in employee paychecks and potential compliance issues.

Regulatory Non-Compliance: The system has not been updated to reflect recent changes in labor laws, risking penalties and legal challenges.

Inconsistent Policy Application: Variations in how payroll policies are applied across departments have resulted in inconsistencies in pay and deductions.

3.5 Stakeholder Feedback

Feedback from stakeholders highlighted the following concerns:

Payroll Staff: Reported challenges with the outdated software and the labor-intensive nature of manual data entry.

Employees: Expressed dissatisfaction with occasional payroll errors and delays.

HR Professionals: Noted difficulties in maintaining compliance with evolving regulations and managing payroll discrepancies.

4. Areas for Improvement

4.1 Key Issues Identified

Manual Data Entry: The reliance on manual data entry results in frequent errors and inefficiencies, leading to inaccurate payroll processing and increased administrative burden.

Outdated Payroll Software: The current payroll software lacks essential features such as automation and real-time updates, hindering our ability to process payroll efficiently and adapt to changing requirements.

Compliance Issues: There are significant gaps in our adherence to current labor laws and tax regulations, which could expose us to legal penalties and damage our organization’s reputation.

4.2 Impact Analysis

Employee Satisfaction: Payroll delays and inaccuracies negatively impact employee satisfaction and trust, causing frustration and potentially affecting morale and retention.

Legal Risks: Failing to comply with labor laws and tax regulations exposes the organization to potential fines, legal actions, and reputational damage, which could have severe financial and operational consequences.

Operational Efficiency: Inefficient payroll processes lead to increased administrative costs and strain on resources, reducing overall productivity and increasing operational expenses.

4.3 Prioritization of Issues

Compliance and Accuracy: Addressing regulatory compliance gaps and correcting payroll inaccuracies is essential to mitigate legal risks and ensure reliable payroll processing.

Software Upgrades: Modernizing our payroll software is crucial to incorporating advanced features, automating processes, and improving overall payroll efficiency and accuracy.

Process Improvements: Streamlining data entry and payroll processing procedures will enhance operational efficiency, reduce errors, and lower administrative costs.

5. Proposed Strategies for Improvement

5.1 Detailed Action Plan

Implement New Payroll Software: Select and deploy a modern payroll system with automation and real-time reporting capabilities.

Automate Data Entry: Integrate automated tools to reduce manual data entry and minimize errors.

Enhance Compliance Procedures: Update payroll procedures and provide training to ensure adherence to current regulations.

5.2 Resource Allocation

Budget: Allocate funding for new software purchase, implementation, and staff training.

Personnel: Designate a project team including IT specialists, payroll managers, and compliance officers.

Technology: Invest in advanced payroll software and related tools.

Timeline for Implementation

Month | Task |

|---|---|

Month 1 | Complete software selection and finalize purchase agreements |

Month 2 | Begin installation and configuration of the new system |

Month 3 | Conduct training sessions for payroll staff and transition to the new system |

Month 4 | Monitor and adjust the new system based on initial feedback and performance metrics |

5.3 Expected Outcomes

Reduced Error Rates: Lower incidence of payroll errors due to automated data entry and advanced software features.

Faster Processing Times: Quicker payroll processing cycles, leading to timely employee payments.

Improved Compliance: Enhanced adherence to regulatory requirements and reduced risk of penalties.

6. Implementation Plan

6.1 Steps for Execution

Software Acquisition: Finalize the selection of new payroll software and complete the purchase.

System Integration: Configure the new software and integrate it with existing HR systems.

Staff Training: Provide comprehensive training on the new system for payroll staff and HR personnel.

Transition: Phase out the old system and fully transition to the new payroll system.

6.2 Responsible Parties

Project Manager: Oversees the entire implementation process and coordinates activities.

IT Team: Manages software installation, integration, and technical support.

Payroll Department: Leads the transition and provides feedback on system performance.

6.3 Milestones and Deliverables

Milestone | Deliverable | Completion Date |

|---|---|---|

Software Selection | Finalized selection and purchase of new payroll software | End of Month 1 |

System Installation | Installation and configuration of the new payroll system | End of Month 2 |

Training Completion | Completion of training sessions for payroll staff | End of Month 3 |

Full System Implementation | Full operational transition to the new payroll system | End of Month 4 |

6.4 Risk Management

Potential risks include resistance to change from staff, technical issues during implementation, and training challenges. Mitigation strategies involve clear communication, phased implementation, and additional support during the transition.

7. Monitoring and Evaluation

7.1 Metrics for Success

Processing Efficiency: Measure the time taken to complete payroll processing before and after implementation.

Error Rates: Track the frequency of payroll errors and discrepancies.

Compliance Adherence: Evaluate compliance with regulatory requirements and audit results.

7.2 Evaluation Methods

Performance Audits: Conduct regular audits to assess the accuracy and efficiency of the new payroll system.

Feedback Surveys: Collect feedback from payroll staff and employees to gauge satisfaction and identify areas for improvement.

Performance Reviews: Evaluate system performance based on predefined metrics and benchmarks.

7.3 Review Schedule

Monthly: Review progress and address any immediate issues.

Quarterly: Conduct a comprehensive evaluation of system performance and compliance.

7.4 Continuous Improvement Strategies

Ongoing Training: Provide regular updates and training on system features and regulatory changes.

System Updates: Ensure the payroll software is kept up-to-date with the latest features and compliance requirements.

Feedback Integration: Continuously collect and incorporate feedback to refine and improve payroll processes.

8. Conclusion

8.1 Summary of Findings

The research identified critical issues in the current payroll management system, including manual processing inefficiencies, outdated software, and compliance gaps. The proposed strategies aim to address these issues and enhance the overall payroll system.

8.2 Recommendations

It is recommended to prioritize the implementation of a new payroll software system, automate data entry processes, and improve compliance procedures to achieve a more efficient, accurate, and compliant payroll operation.

8.3 Final Thoughts

Investing in modernizing the payroll system will lead to significant improvements in accuracy, efficiency, and compliance. The organization can enhance payroll management and ensure a more reliable and satisfactory employee experience by implementing the recommended strategies.