Accounts Receivable Action Research

Prepared By: [Your Name]

Company Name: [Your Company Name]

1. Introduction

Effective management of accounts receivable is crucial for maintaining the financial health of [Your Company Name]. Accounts receivable impacts cash flow, liquidity, and overall financial performance, making its management a key area of focus. This research aims to thoroughly investigate current accounts receivable practices, identify areas where improvements can be made, and propose actionable strategies to enhance the efficiency and effectiveness of receivables management. By analyzing existing processes and comparing them with industry best practices, this report seeks to provide targeted recommendations that will optimize accounts receivable operations and support strategic financial decision-making.

2. Objectives and Scope

2.1 Objectives

Identify inefficiencies in the current accounts receivable processes.

Enhance cash flow management through optimized receivables processes.

Improve the effectiveness of credit and collection practices.

Provide actionable recommendations for process improvements.

2.2 Scope

The research focuses on:

Current accounts receivable processes and practices.

Key metrics and performance indicators.

Comparative analysis with industry best practices.

Recommendations for process improvements and optimization strategies.

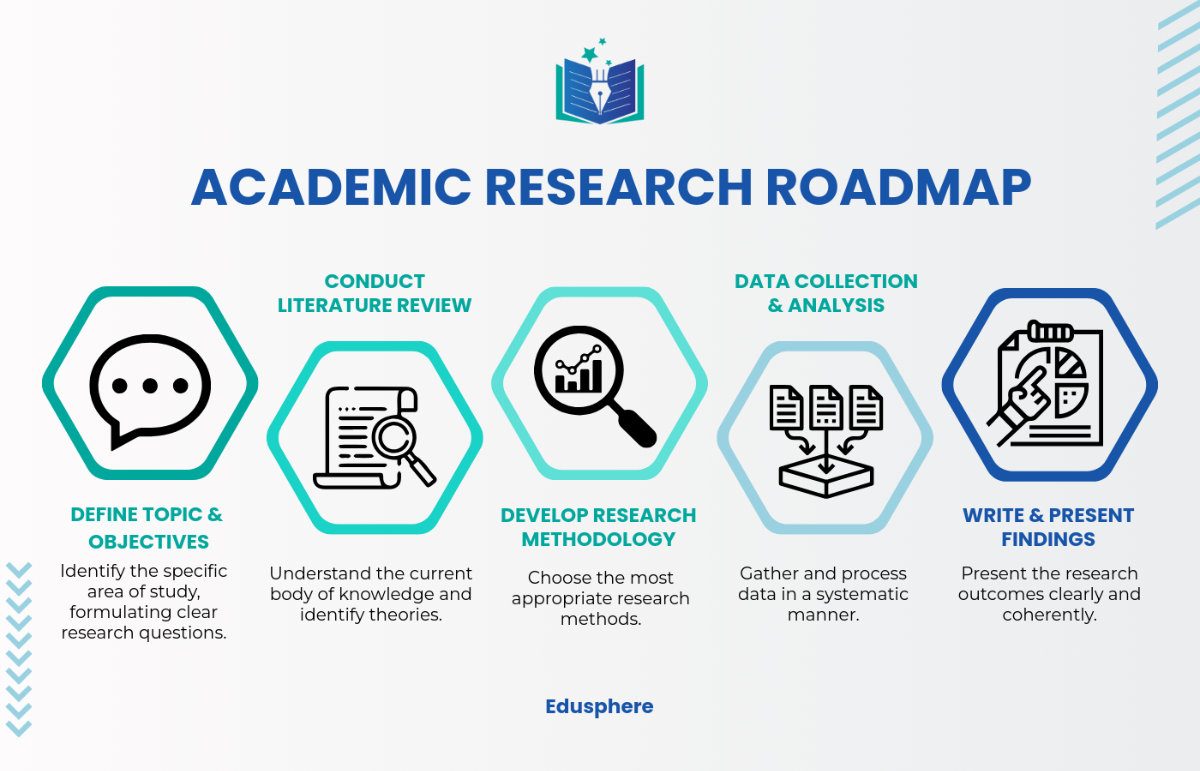

3. Methodology

The research methodology includes:

Data Collection: Gathering quantitative and qualitative data on current accounts receivable practices.

Analysis: Evaluating data to identify inefficiencies and areas for improvement.

Benchmarking: Comparing current practices against industry standards and best practices.

Interviews: Conducting interviews with key stakeholders, including accounts receivable staff, financial managers, and credit controllers.

4. Findings and Analysis

4.1 Current Practices

Invoicing: Examination of invoicing processes, including frequency, accuracy, and delivery methods.

Credit Management: Analysis of credit policies, approval processes, and risk assessment.

Collections: Review of collection procedures, follow-up strategies, and customer communication.

4.2 Inefficiencies Identified

Delayed Invoicing: Instances of late or inaccurate invoicing leading to delayed payments.

Ineffective Credit Management: Gaps in credit risk assessment and approval processes.

Suboptimal Collection Strategies: Inconsistent follow-up and communication with customers regarding overdue invoices.

4.3 Benchmarking Results

Comparison with industry best practices revealed opportunities for improvement in:

Automation: Adoption of automated invoicing and collection systems.

Credit Policies: Refinement of credit approval and risk assessment processes.

Customer Communication: Enhancement of communication strategies to improve collection rates.

5. Recommendations

5.1 Process Optimization

Automate Invoicing: Implement automated invoicing systems to ensure timely and accurate billing.

Revise Credit Policies: Update credit approval processes and risk assessment criteria to better manage credit risk.

Enhance Collection Procedures: Develop a structured collection strategy with clear follow-up protocols and customer communication plans.

5.2 Performance Monitoring

Implement KPIs: Establish key performance indicators (KPIs) to monitor and evaluate accounts receivable performance.

Regular Reviews: Conduct regular reviews of accounts receivable processes to identify and address emerging issues.

6. Implementation Plan

6.1 Short-Term Actions

Conduct Staff Training: Train accounts receivable staff on new systems and processes.

Upgrade Technology: Invest in technology to support automation and process improvements.

6.2 Long-Term Actions

Continuous Improvement: Establish a continuous improvement program for accounts receivable processes.

Performance Evaluation: Regularly assess the impact of implemented changes on cash flow and receivables management.

7. Metrics and KPIs

7.1 Key Metrics

Days Sales Outstanding (DSO): Measure the average number of days it takes to collect payments.

Collection Effectiveness Index (CEI): Evaluate the effectiveness of collection efforts.

Bad Debt Ratio: Track the proportion of receivables written off as bad debt.

7.2 KPIs for Success

Reduction in DSO: Aim for a measurable reduction in the average DSO.

Improved Collection Rates: Increase the percentage of overdue invoices collected.

Lower Bad Debt Ratio: Decrease the ratio of bad debts to total receivables.

8. Conclusion

This Accounts Receivable Action Research identifies critical areas for improvement in the management of accounts receivable processes. By implementing the recommendations provided, the organization can enhance cash flow, reduce inefficiencies, and improve overall effectiveness in receivables management.