Payroll Summary Format

Preparer Name | [Your Name] |

Job Title | [Your Title] |

Department | Finance, [Your Company Name] |

Contact Number | [Your Number] |

Email Address | [Your Email] |

Date Prepared | August 16, 2054 |

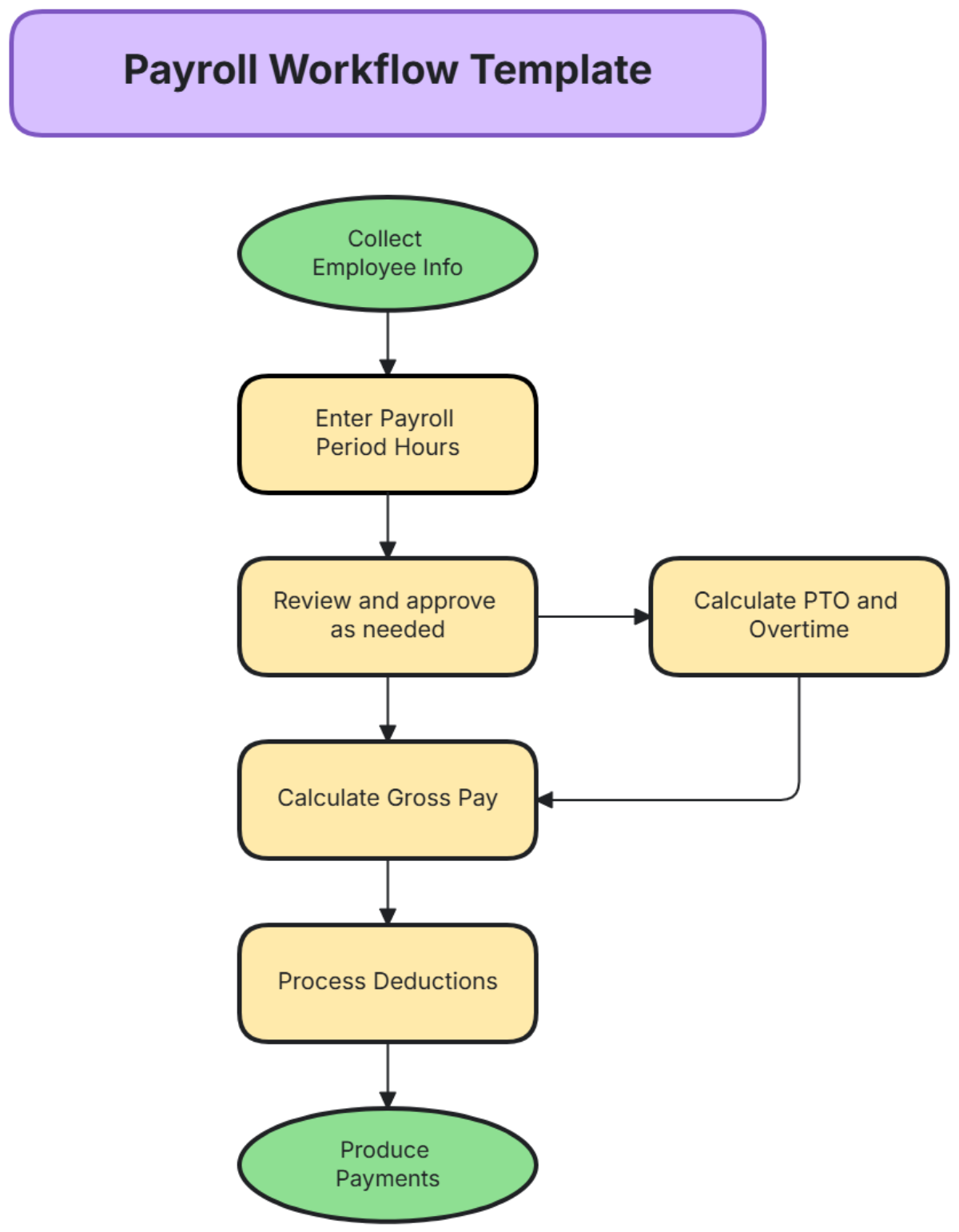

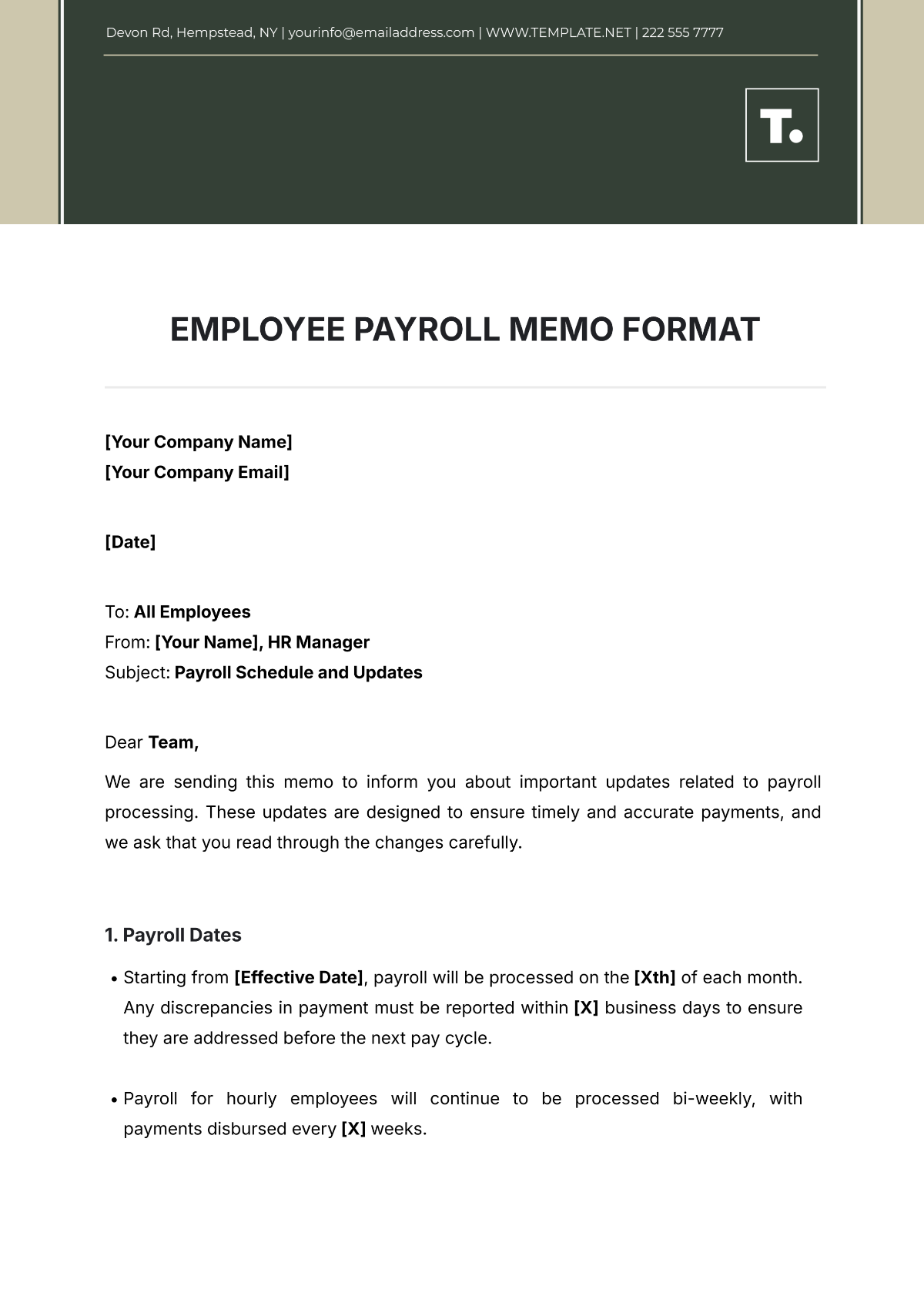

Introduction

This document outlines the payroll summary for the pay period ending August 15, 2054. It includes comprehensive details regarding employee earnings, deductions, and employer contributions to ensure accurate and transparent payroll processing.

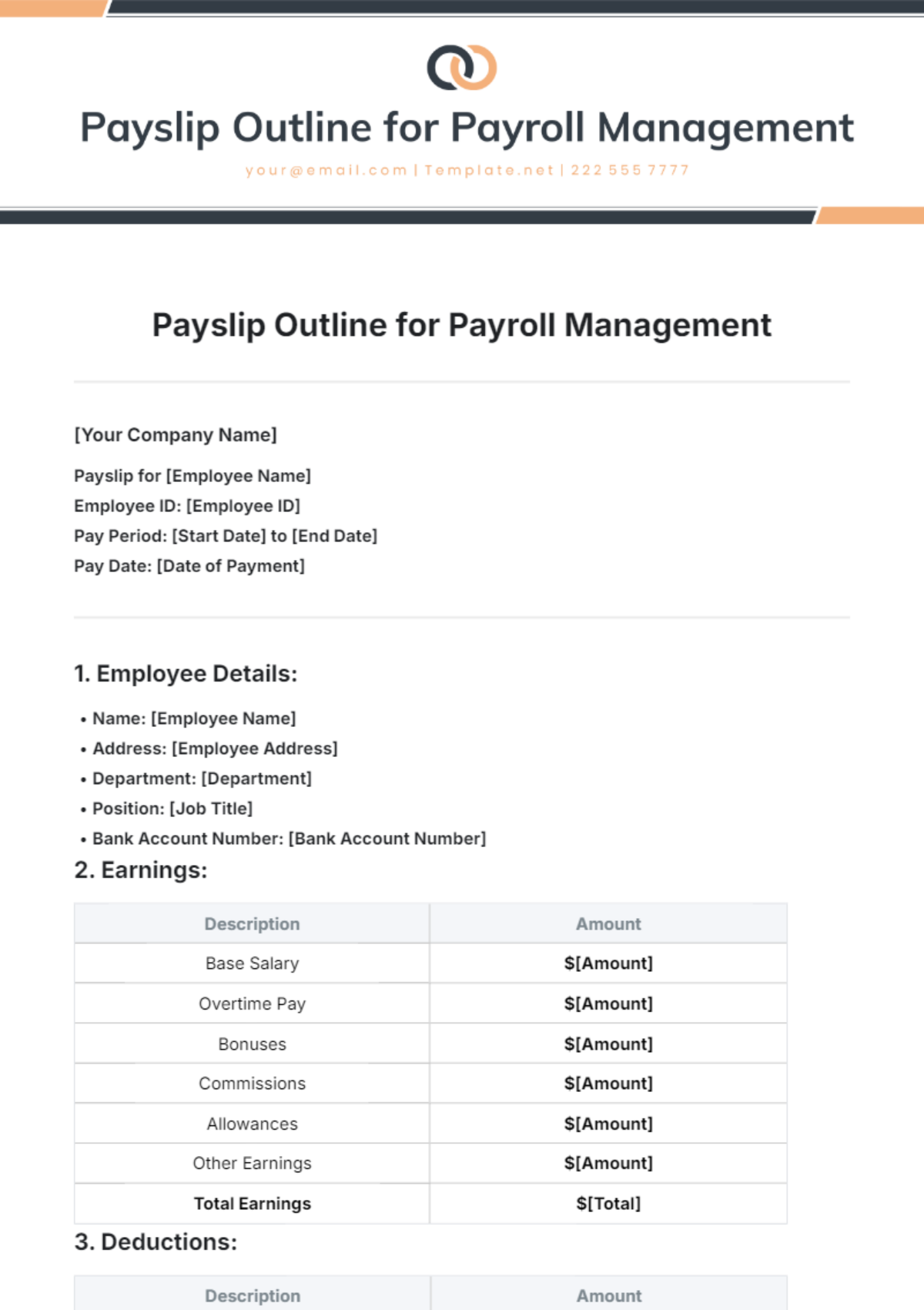

Sections of a Payroll Summary

The payroll summary is divided into the following key sections:

Employee Information

Earnings

Deductions

Net Pay

Employer Contributions

Preparer Details

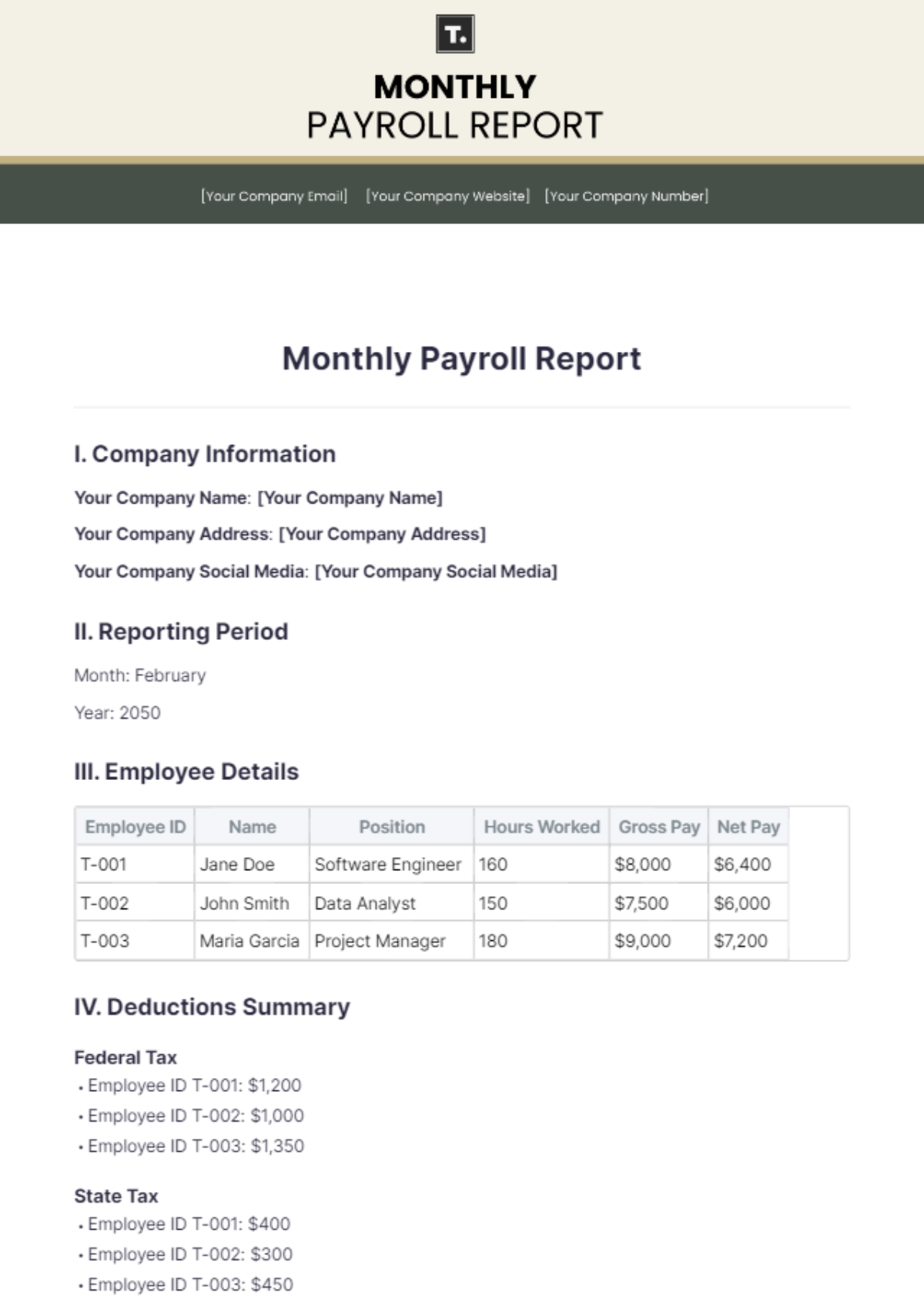

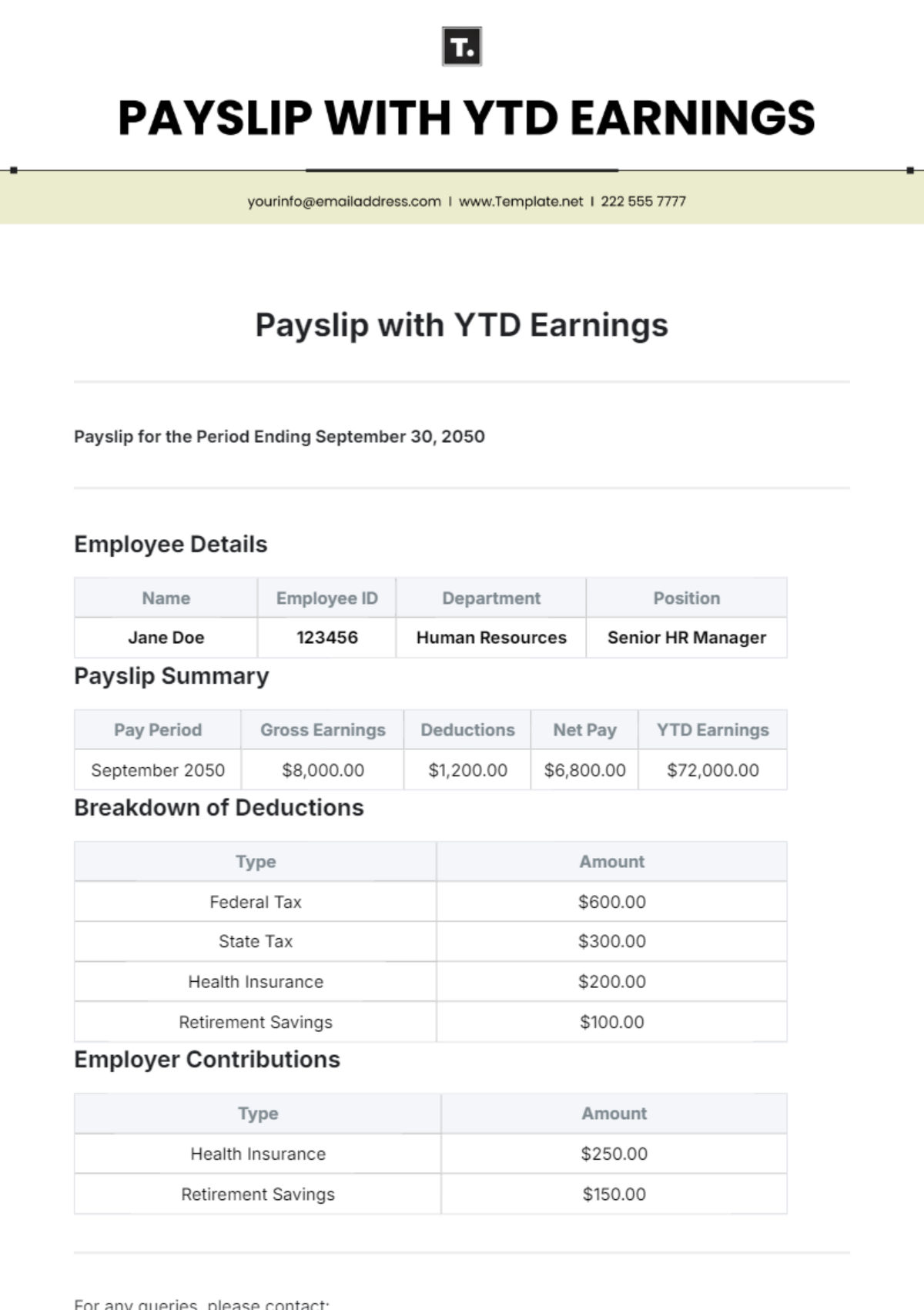

Employee Information

This section contains details related to the employee:

Field | Description |

|---|---|

Employee ID | E45678 |

Full Name | Alice Johnson |

Department | Marketing |

Position | Marketing Coordinator |

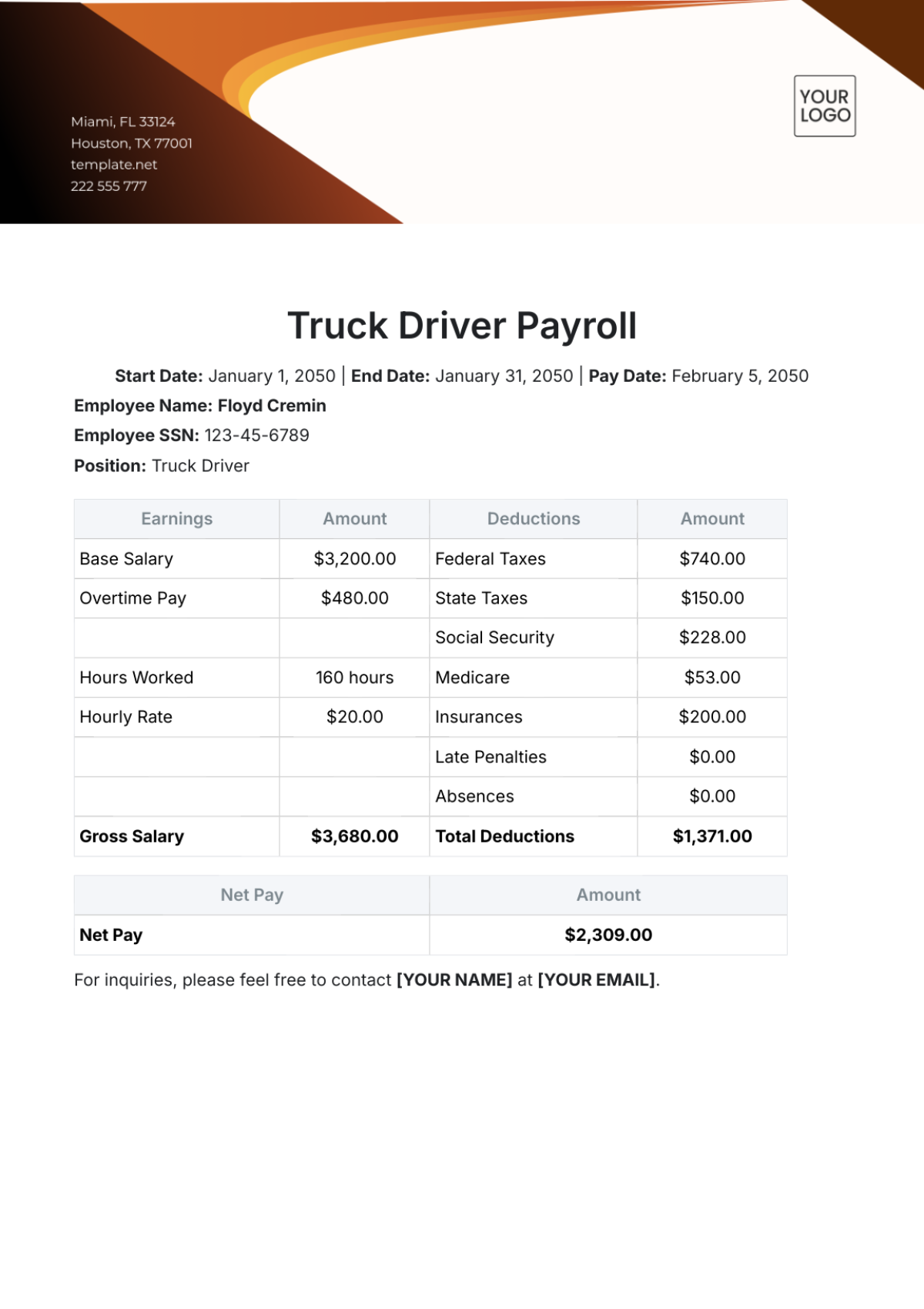

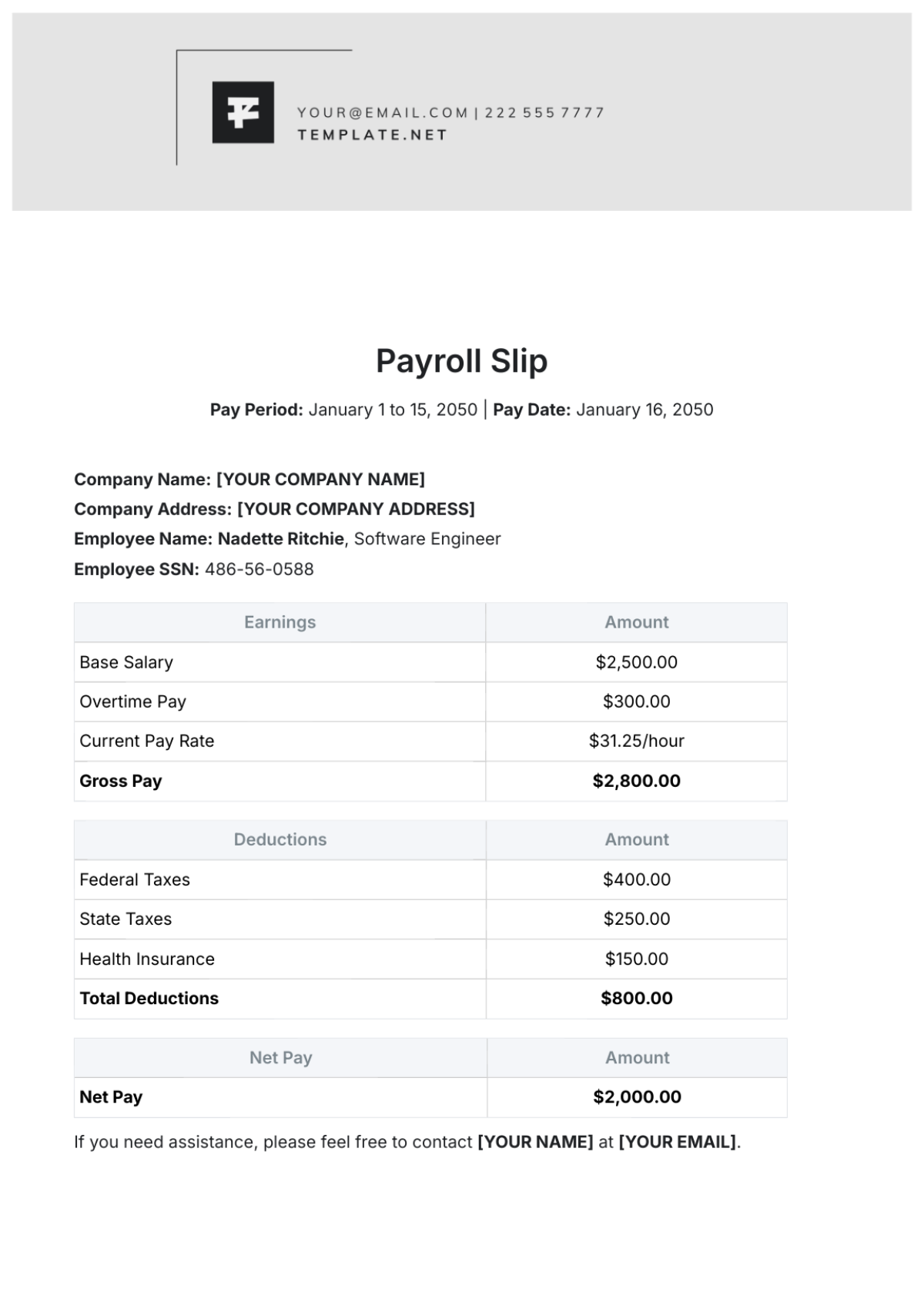

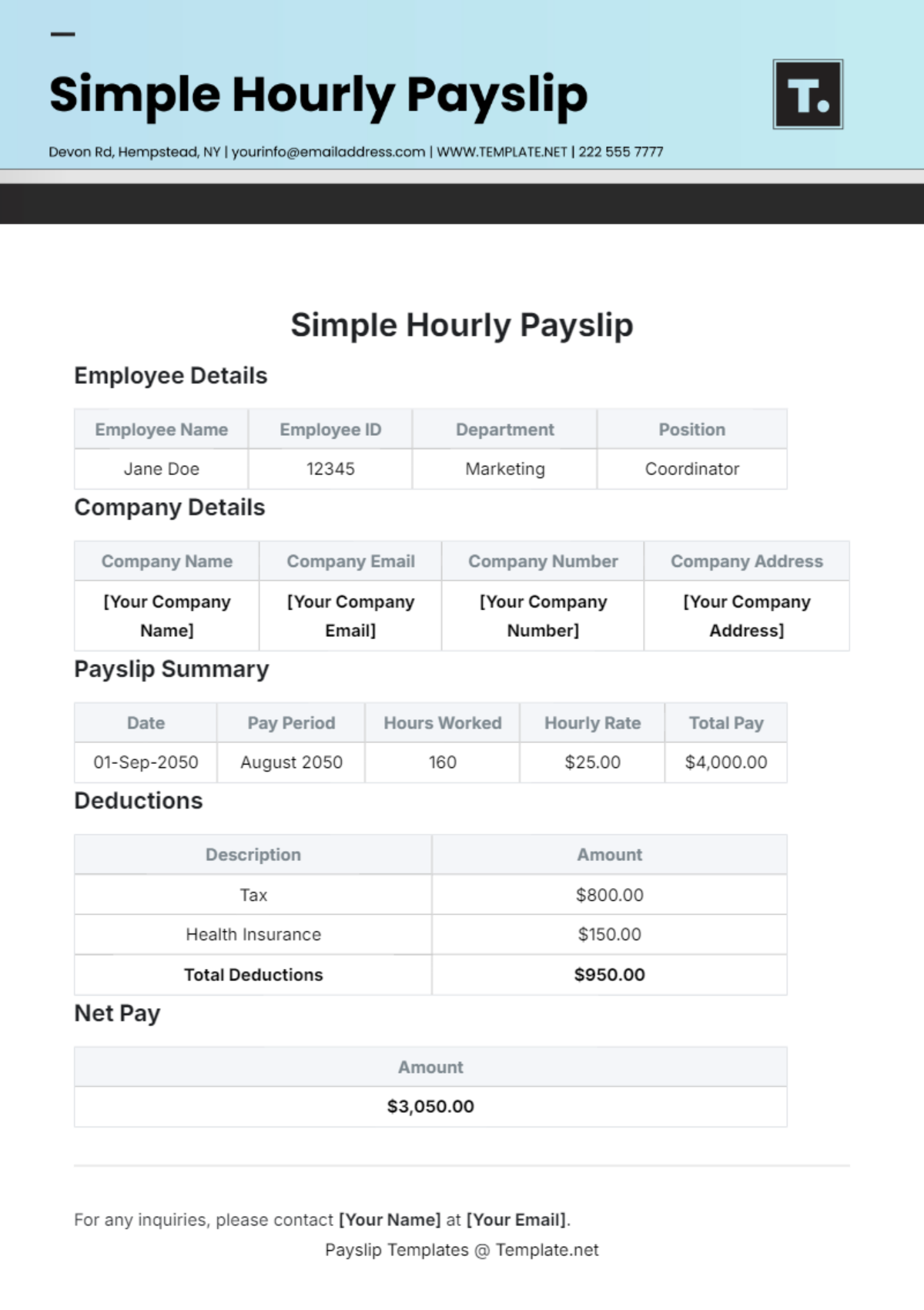

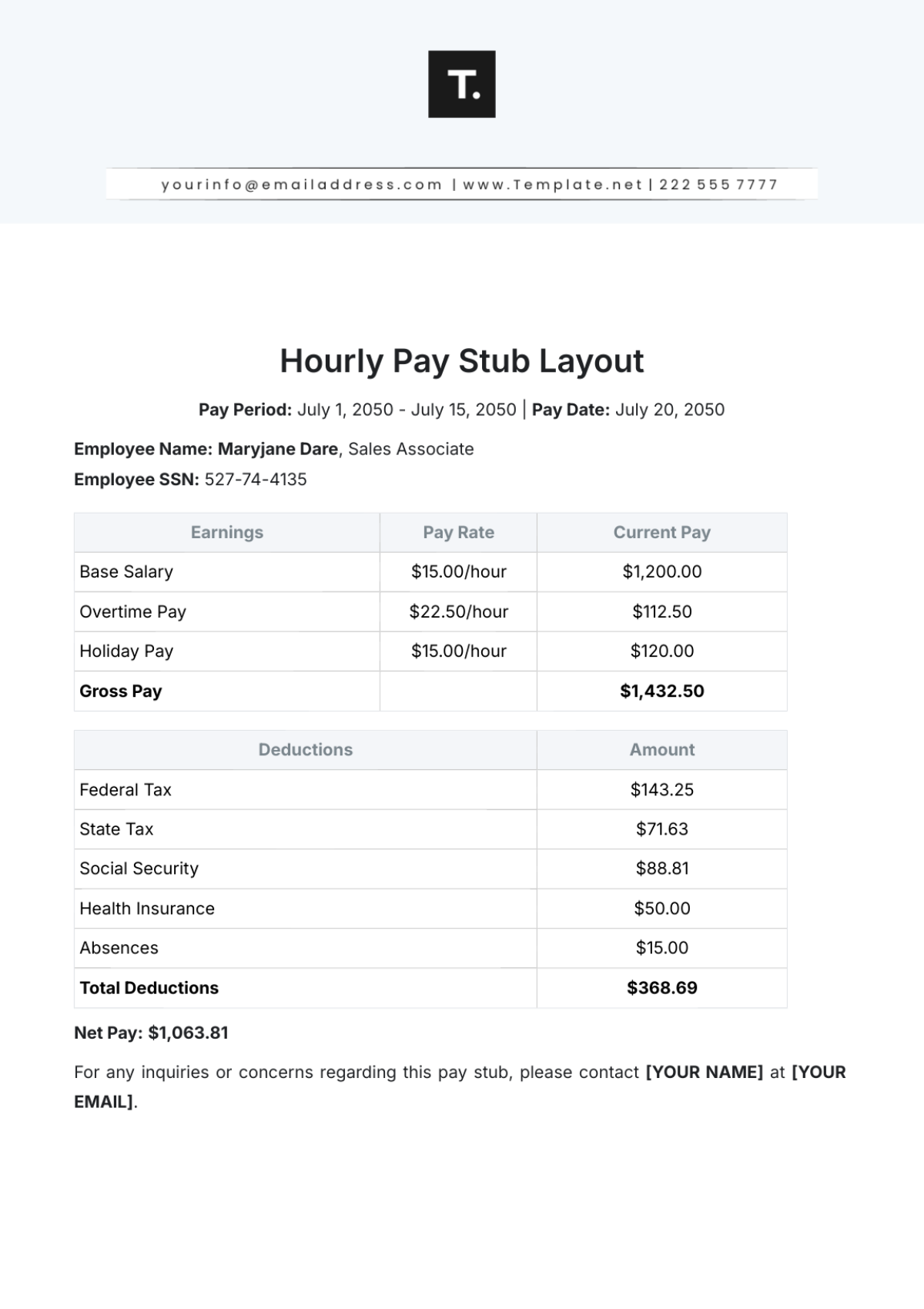

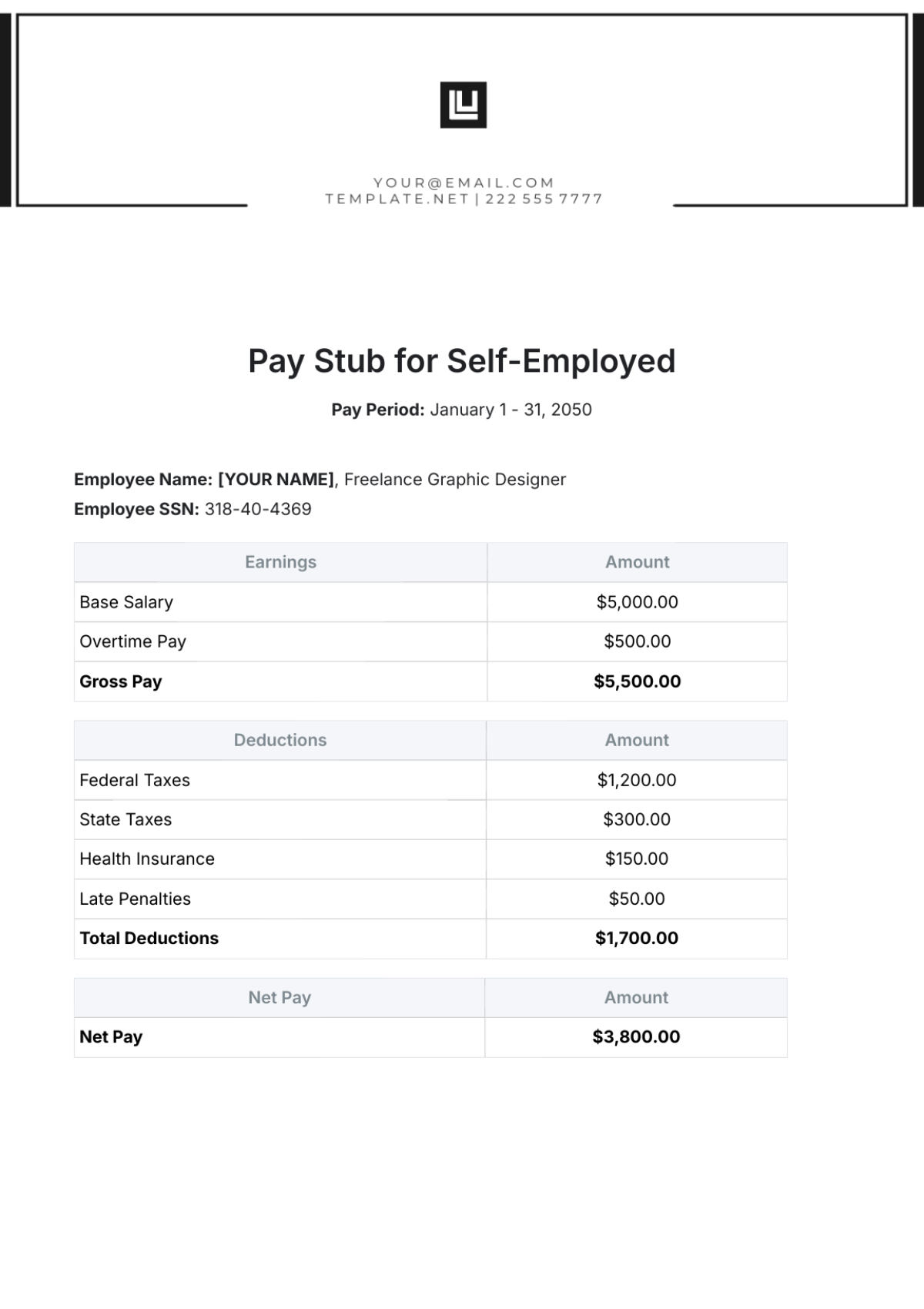

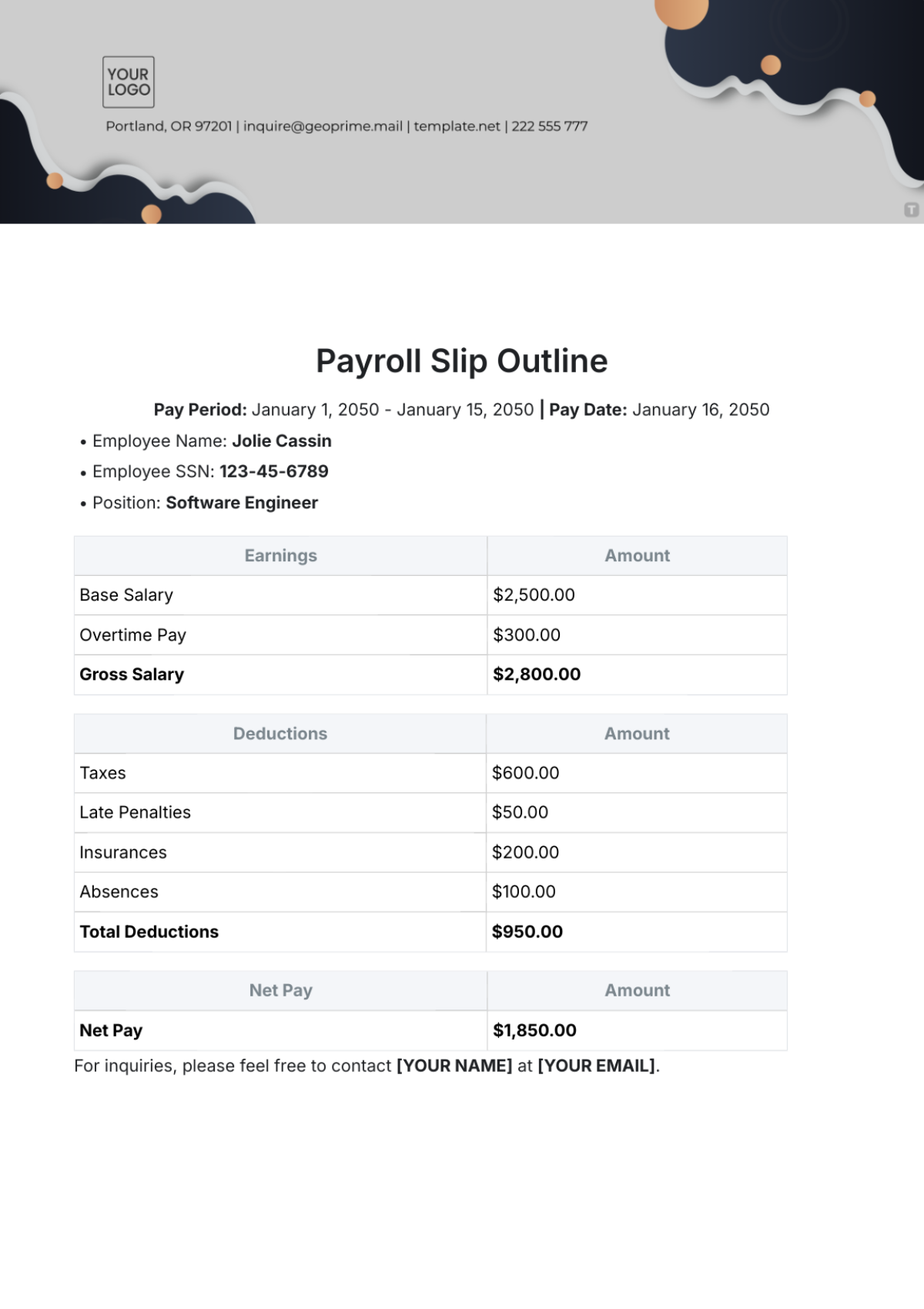

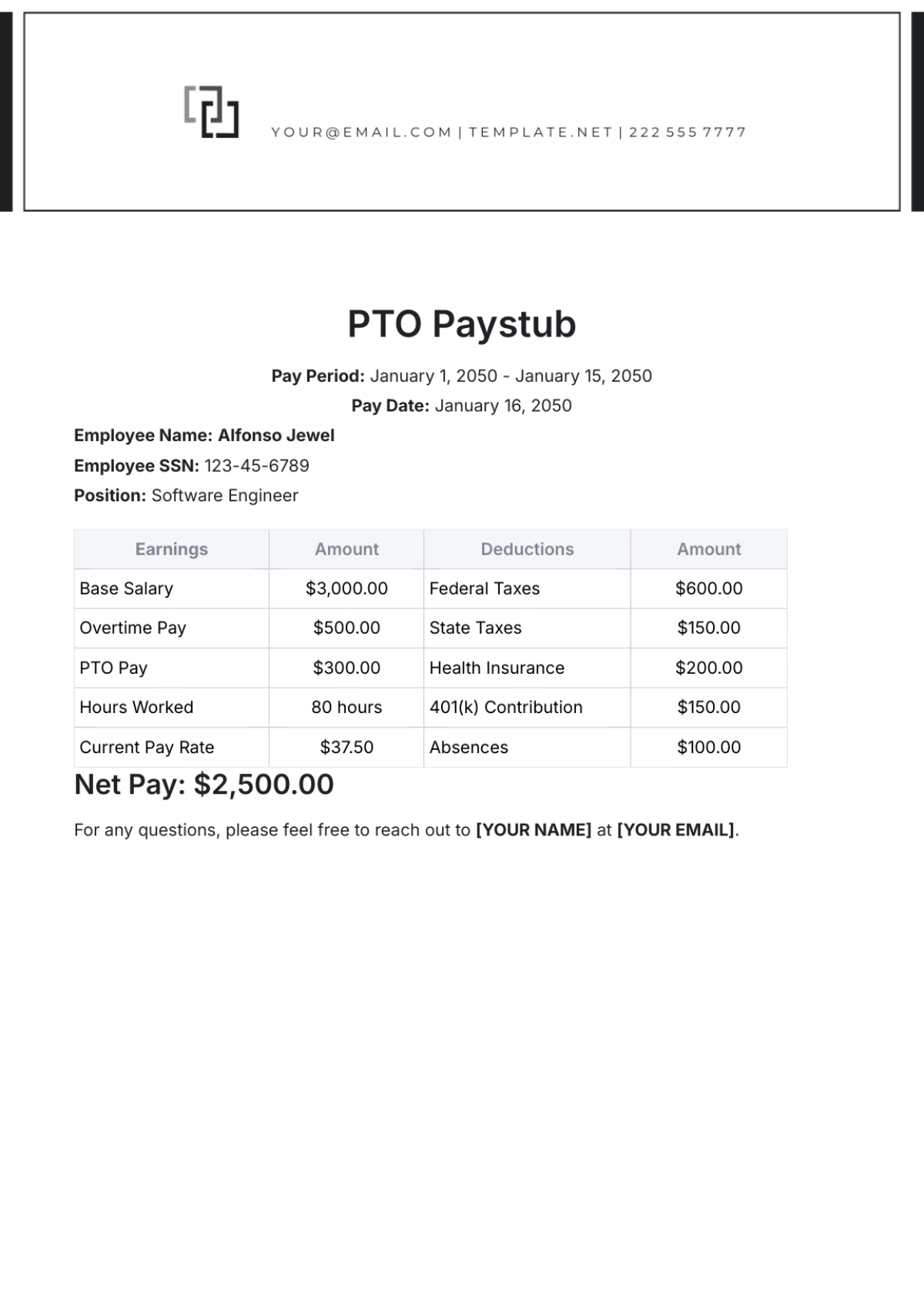

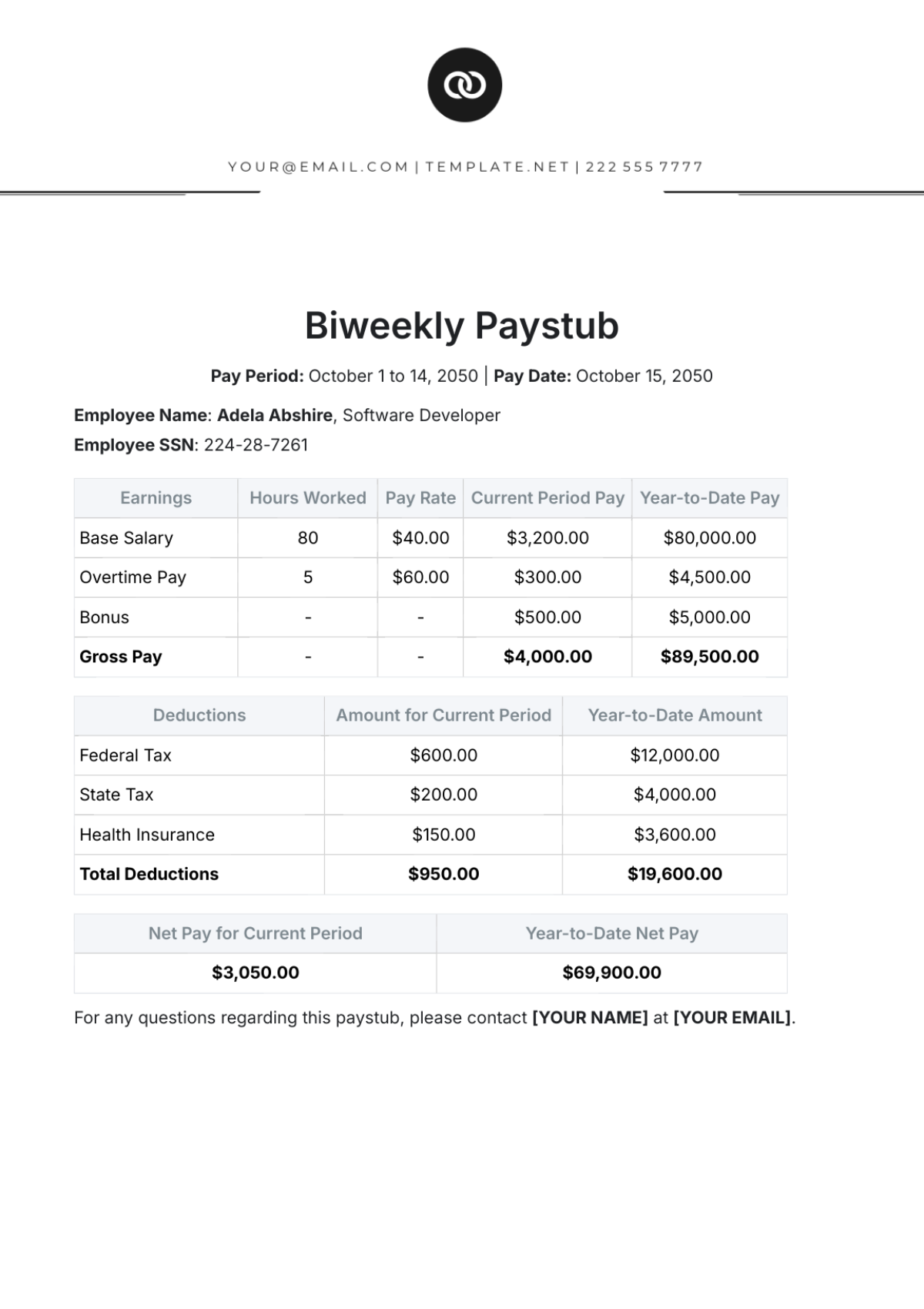

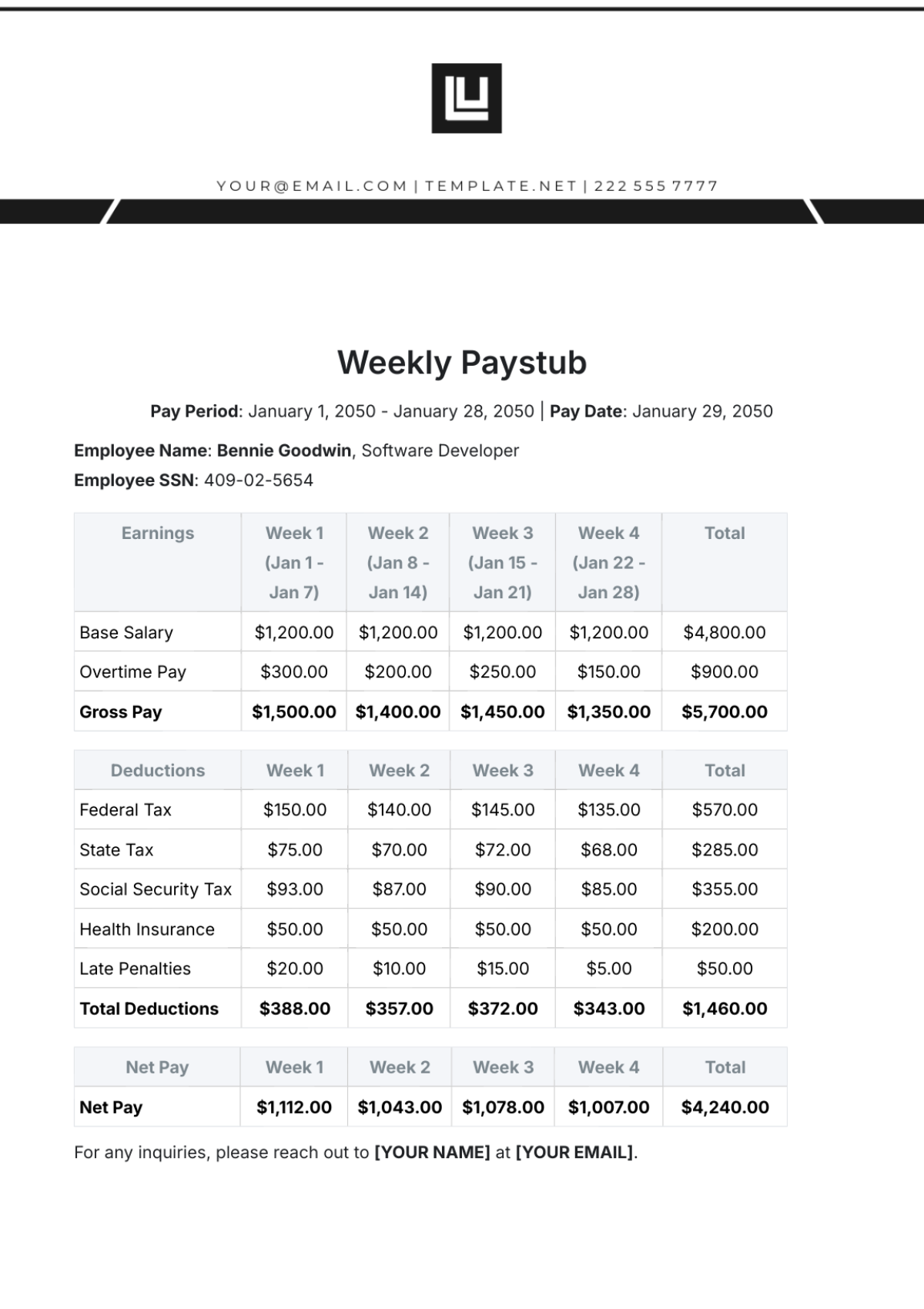

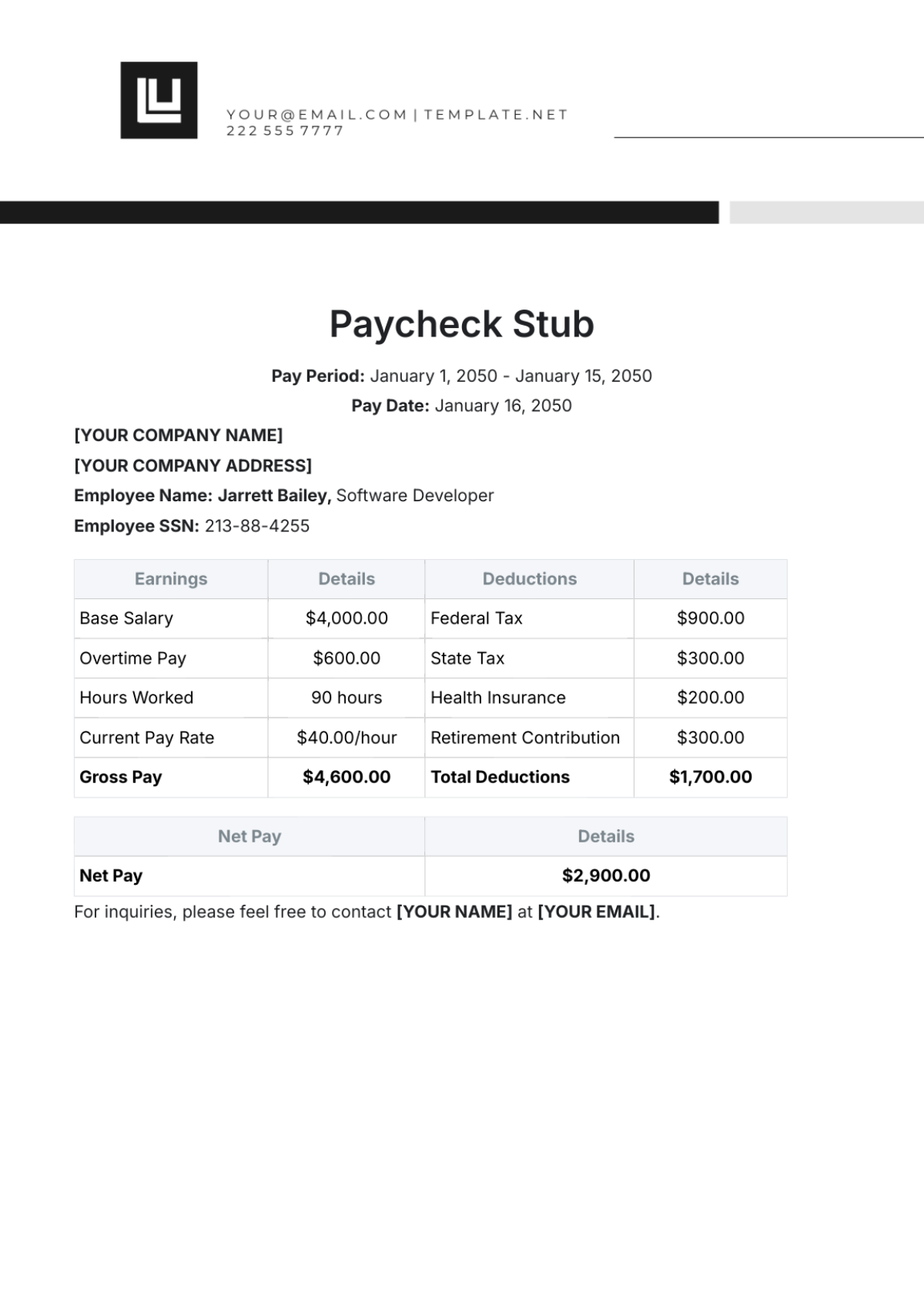

Earnings

This section outlines all earnings for the pay period:

Field | Description |

|---|---|

Base Salary | $4,200 |

Overtime | $300 |

Bonuses | $150 |

Deductions

This section lists all deductions made from the employee's earnings:

Field | Description |

|---|---|

Taxes | $950 |

Insurance | $250 |

Retirement | $350 |

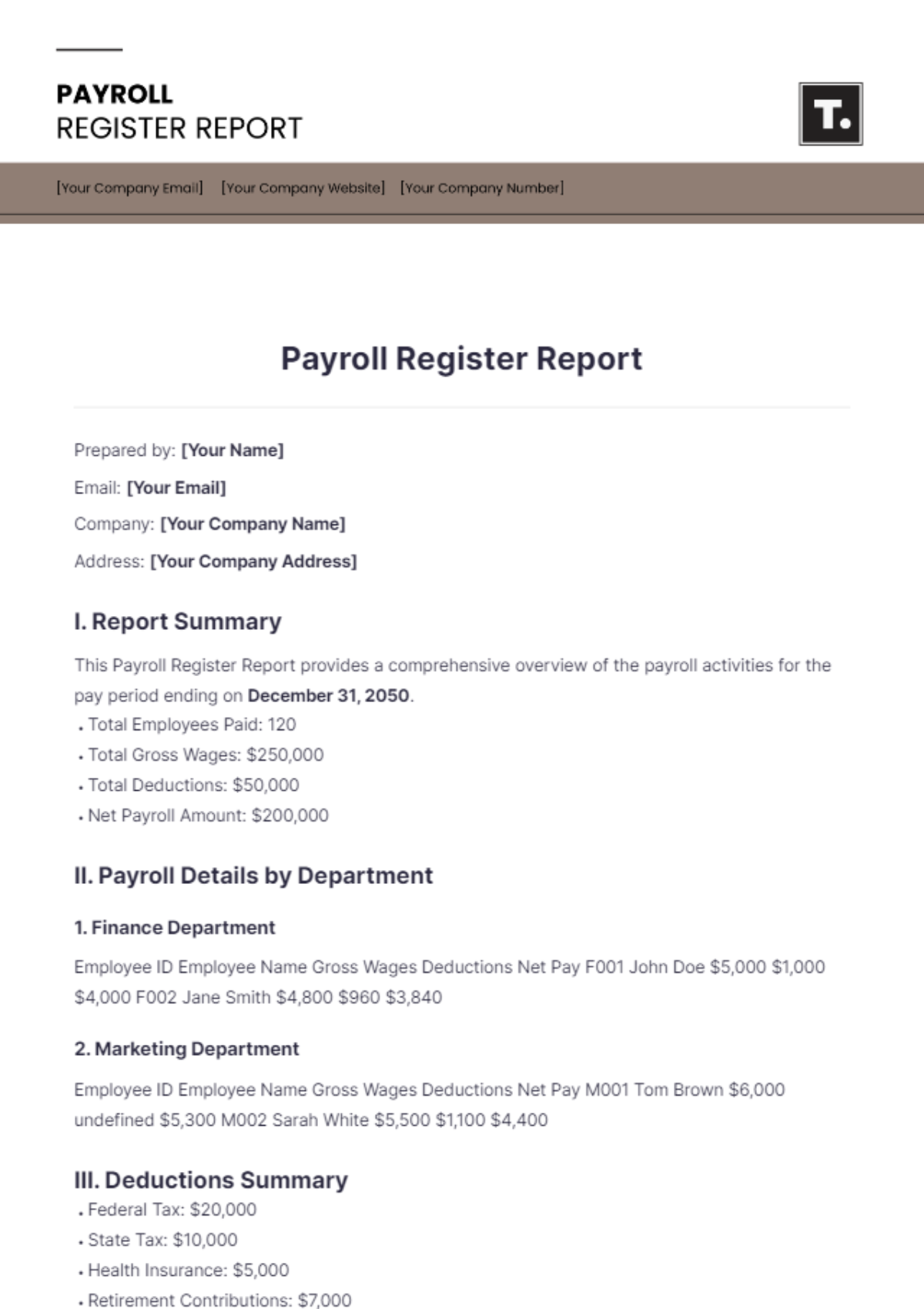

Net Pay

This section details the net amount paid to the employee after deductions:

Field | Description |

|---|---|

Total Earnings | $4,650 |

Total Deductions | $1,550 |

Net Pay | $3,100 |

Employer Contributions

This section lists contributions made by the employer on behalf of the employee:

Field | Description |

|---|---|

Retirement Plan | $400 |

Insurance | $300 |

Conclusion

This payroll summary ensures that all details related to employee earnings, deductions, and employer contributions are accurately reported. This format promotes transparency and facilitates efficient payroll processing.