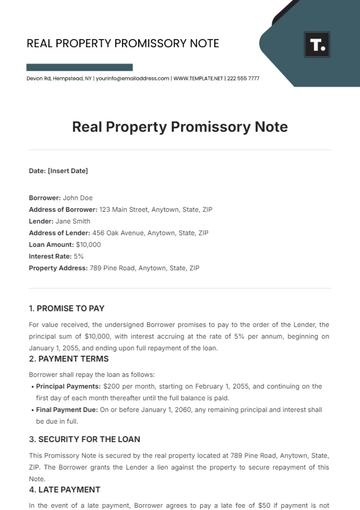

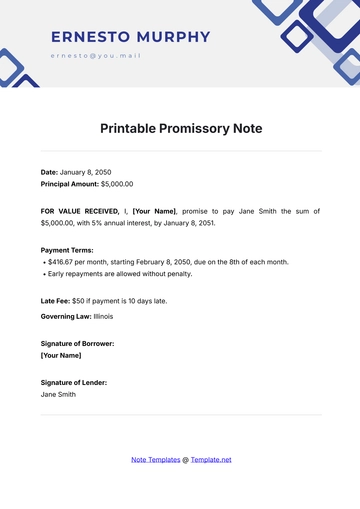

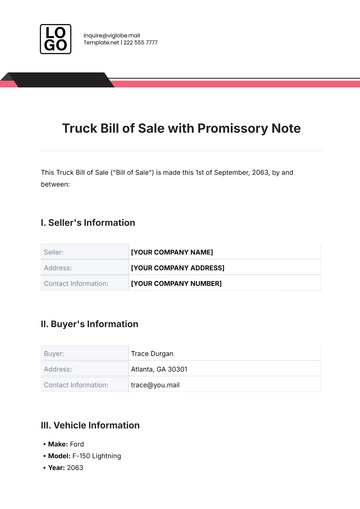

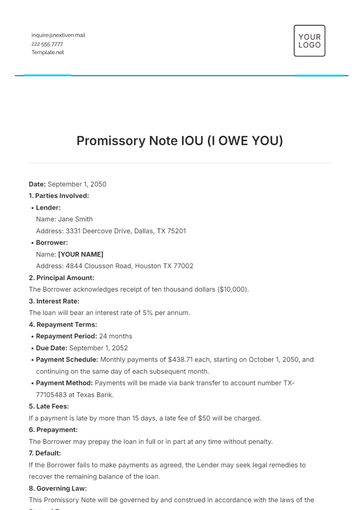

Free Accounting Promissory Note

I. Introduction

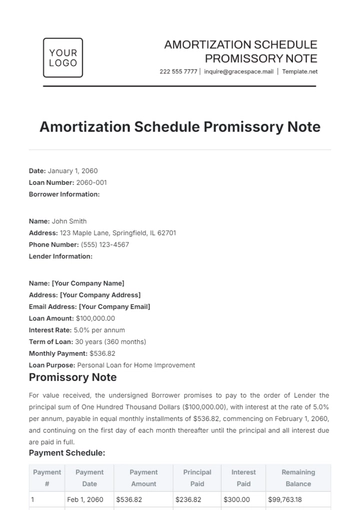

Date: August 27, 2050

Promissory Note Number: 2050-001

Lender: [Your Company Name]

Borrower: [Borrower's Name or Company Name]

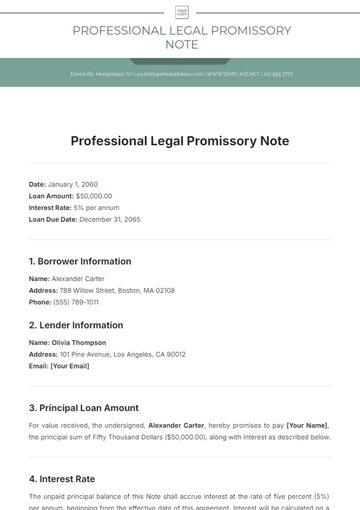

Principal Amount: $50,000

Interest Rate: 5% per annum

Maturity Date: August 27, 2050

This Promissory Note ("Note") is made and entered into as of the date set forth above by and between [Your Company Name], with its principal place of business at [Your Company Address] ("Lender"), and [Borrower's Name or Company Name], with its principal place of business at [Borrower's Address] ("Borrower").

II. Promise to Pay

Principal and Interest Payment

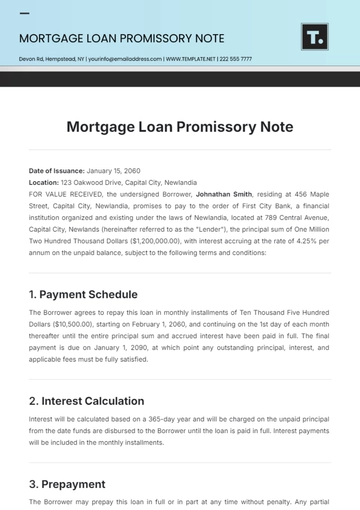

The Borrower hereby unconditionally promises to pay to the order of the Lender the principal sum of Fifty Thousand Dollars ($50,000), together with interest on the unpaid principal balance at a rate of five percent (5%) per annum. Interest shall be calculated on the basis of a 360-day year for the actual number of days elapsed.

Payment Schedule

a. Principal Payment

The Borrower agrees to make monthly payments of principal and interest in the amount of Four Thousand Four Hundred Fifty-One Dollars and 36/100 ($4,451.36) each, commencing on September 27, 2050, and continuing on the 27th day of each month thereafter until the Maturity Date.b. Final Payment

The entire remaining unpaid balance of this Note, including any accrued interest, shall be due and payable in full on the Maturity Date.

III. Prepayment

Right to Prepay

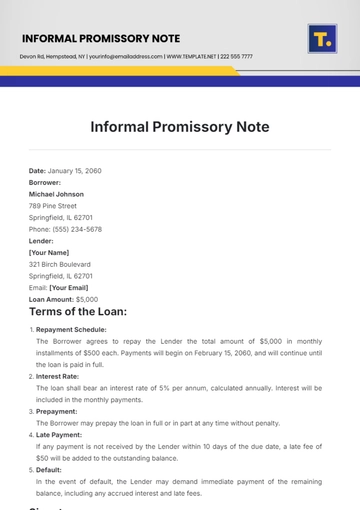

The Borrower may prepay all or any part of the principal amount of this Note at any time without penalty. Any prepayment shall be applied first to accrued interest and then to the principal balance.

Effect of Prepayment

Prepayment of this Note shall not alter or affect the terms and conditions of this Note except to reduce the remaining principal balance and the total amount of interest payable.

IV. Late Payment and Default

Late Payment

If any payment due under this Note is not paid within ten (10) days of its due date, the Borrower shall pay a late fee of One Hundred Dollars ($100) in addition to the amount due.

Events of Default

An event of default shall occur if:

a. The Borrower fails to make any payment due under this Note within thirty (30) days of the due date.

b. The Borrower becomes insolvent, files for bankruptcy, or has a bankruptcy petition filed against it.

Remedies

Upon the occurrence of an event of default, the Lender may declare the entire unpaid principal balance, together with all accrued interest, immediately due and payable. The Lender may also pursue any legal remedies available to enforce this Note.

V. Representations and Warranties

Borrower’s Representations

The Borrower represents and warrants that:

a. It has the full power and authority to enter into this Note and perform its obligations hereunder.

b. The execution and delivery of this Note have been duly authorized by all necessary corporate actions.

Lender’s Representations

The Lender represents and warrants that:

a. It has the full power and authority to enter into this Note and enforce its rights hereunder.

VI. Governing Law

This Note shall be governed by and construed in accordance with the laws of the state of [State], without regard to its conflict of law principles.

VII. Miscellaneous

Amendments

No modification or amendment of this Note shall be valid or binding unless made in writing and signed by both parties.

Notices

All notices and other communications under this Note shall be in writing and shall be deemed to have been duly given when delivered personally, sent by certified mail, or by electronic mail with confirmation of receipt, to the addresses provided above.

Severability

If any provision of this Note is held to be invalid or unenforceable, the remaining provisions shall continue in full force and effect.

VIII. Execution

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the date first above written.

[Your Company Name]

Name: [Lender’s Representative Name]

Title: [Lender’s Representative Title]

[Borrower's Name or Company Name]

Name: [Borrower’s Representative Name]

Title: [Borrower’s Representative Title]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Formalize your financial agreements with the Accounting Promissory Note Template on Template.net. This customizable template helps you draft a clear and binding promissory note for accounting purposes. Editable in our AI Editor Tool, it ensures accuracy and professionalism. Download now and manage your financial promises effectively!