Accounting Expense Report

Reporting Period: January 1, 2050 - December 31, 2050

Prepared by: John Doe

Date: January 15, 2051

I. Introduction

A. Purpose of the Report

Objective

The objective of this Accounting Expense Report is to provide a comprehensive overview of all expenses incurred by [Your Company Name] during the fiscal year 2050. This report aims to ensure financial transparency, facilitate effective budgeting, and aid in strategic decision-making by analyzing spending patterns across various departments and expense categories.Scope

This report encompasses all operational, administrative, travel and entertainment, and miscellaneous expenses recorded between January 1, 2050, and December 31, 2050. The data has been compiled from the company's financial records, invoices, receipts, and internal accounting systems to present an accurate and detailed account of the company's expenditures.Audience

The primary audience for this report includes the company's executive management team, finance department, board of directors, and external auditors. The information presented herein will assist stakeholders in assessing the company's financial health, identifying areas for cost optimization, and ensuring compliance with financial regulations and internal policies.

B. Methodology

Data Collection

The expense data was collected through the company's integrated accounting software, which consolidates financial information from various sources including departmental expense reports, vendor invoices, and employee reimbursement claims. All data entries were verified against original documentation to ensure accuracy and reliability.Data Categorization

Expenses were systematically categorized into four main sections:Operational Costs

Administrative Expenses

Travel and Entertainment

Miscellaneous Expenses

Each category was further divided into subcategories for detailed analysis.

Analysis Techniques

The report utilizes quantitative analysis methods such as variance analysis and trend analysis to compare actual expenses against budgeted figures and previous fiscal years. Visual aids including tables and charts have been incorporated to facilitate easier interpretation of data and highlight key findings.Assumptions

All expenses reported are exclusive of taxes unless otherwise specified.

Currency is presented in US Dollars (USD).

Budget figures are based on the approved budget for the fiscal year 2050.

Comparative analyses refer to data from the fiscal year 2050 for benchmarking purposes.

II. Executive Summary

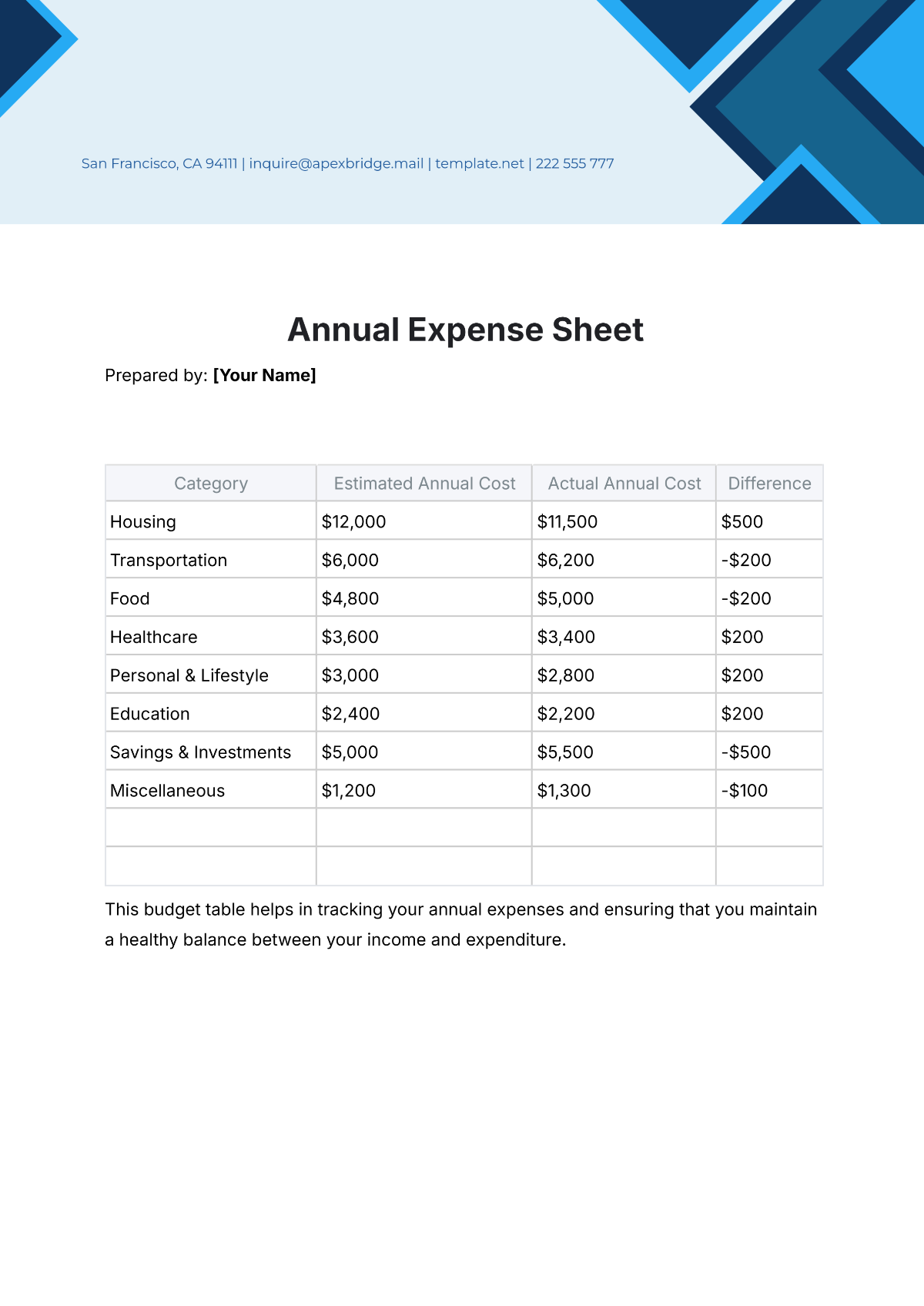

A. Overview of Fiscal Year 2050 Expenses

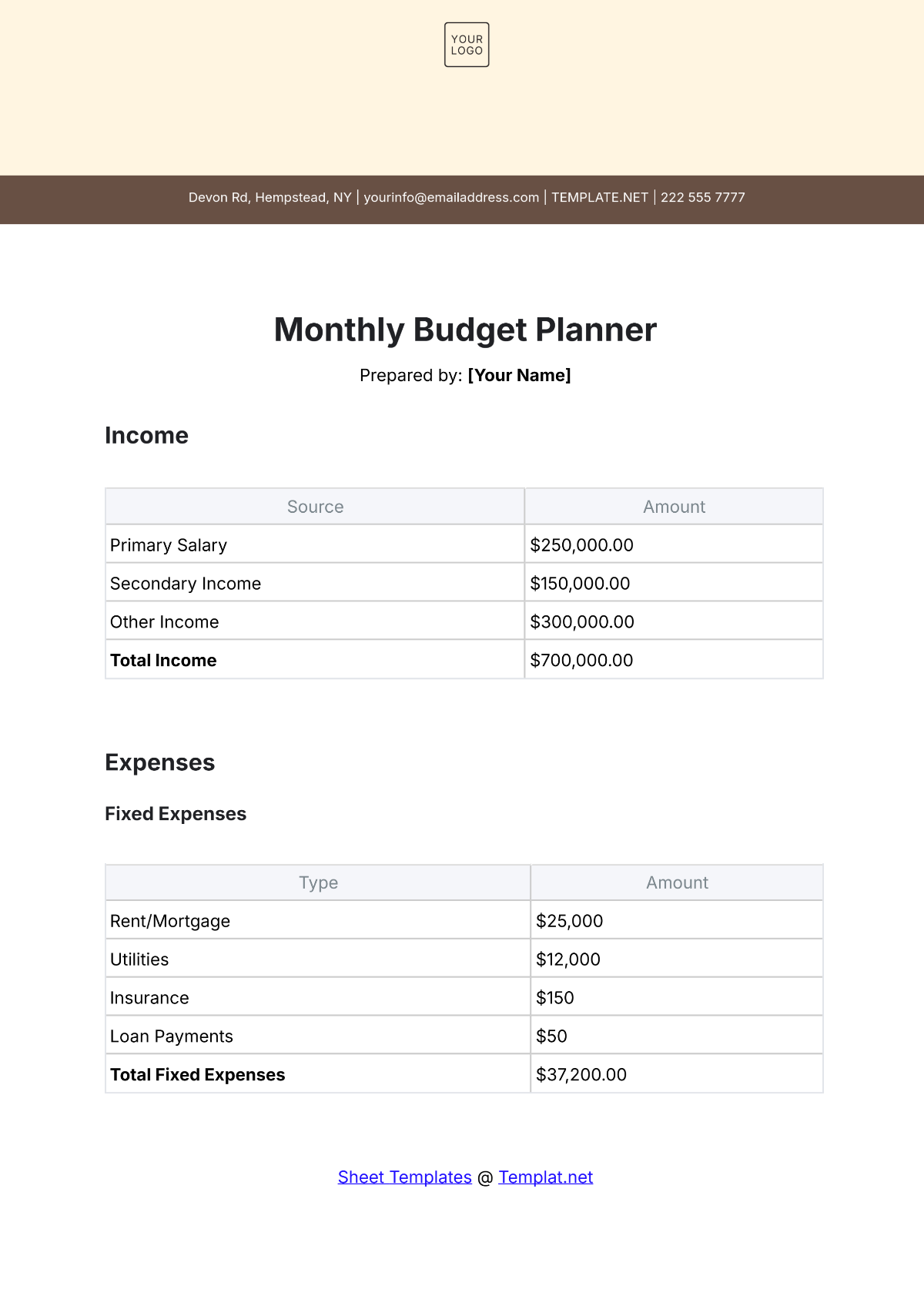

Total Expenditures

In the fiscal year 2050, [Your Company Name] incurred total expenses amounting to $12,500,000, which represents a 5% increase compared to the previous year’s expenditures of $11,900,000.Budget Compliance

The total expenses were 2% over the allocated budget of $12,250,000 for the year. The majority of the overspending occurred in the Travel and Entertainment category due to unforeseen business development activities.Expense Breakdown by Category

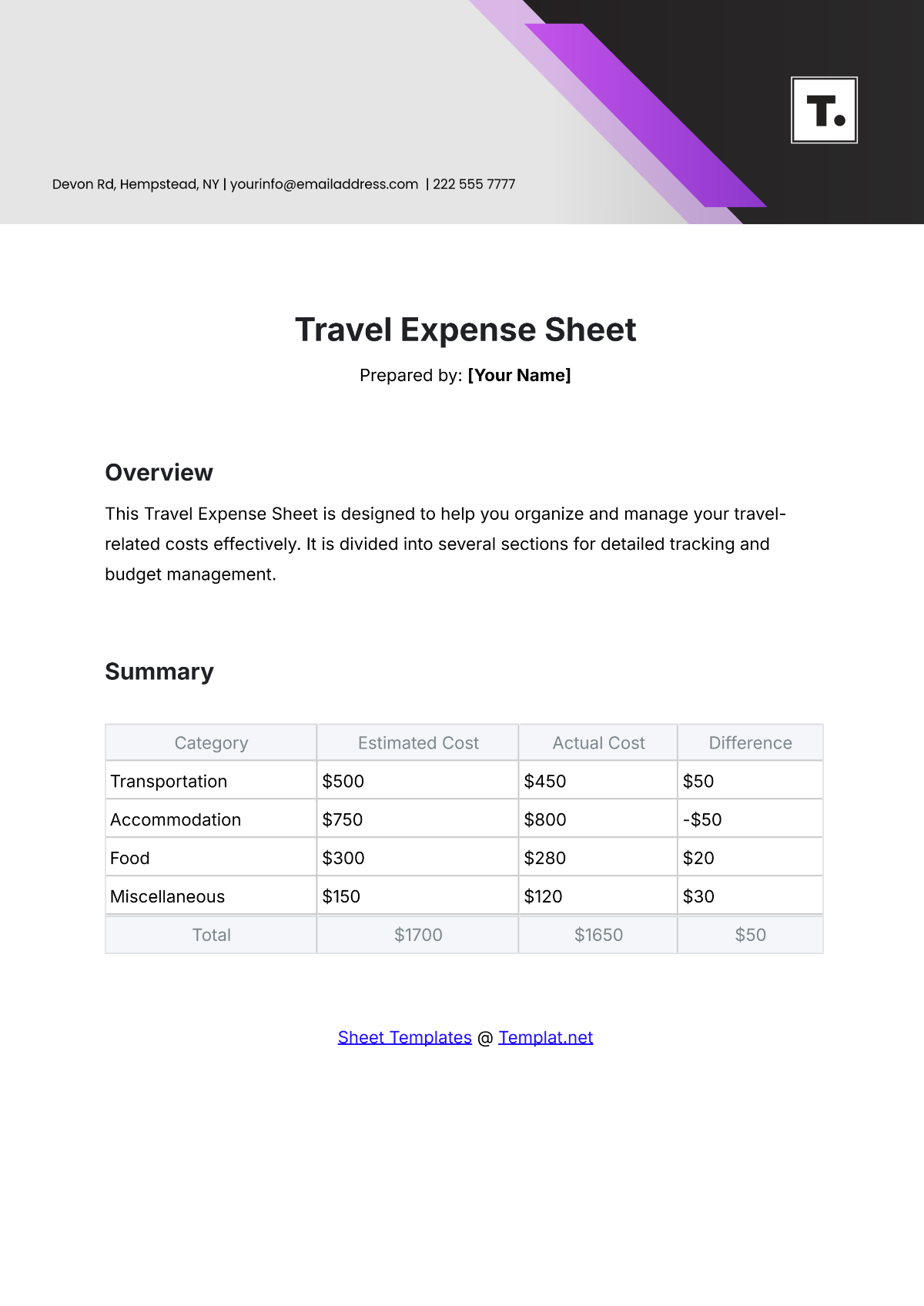

Expense Category | Actual Expense (USD) | Budgeted Expense (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Operational Costs | 6,500,000 | 6,600,000 | -100,000 | -1.5% |

Administrative Expenses | 3,200,000 | 3,000,000 | 200,000 | 6.7% |

Travel and Entertainment | 1,800,000 | 1,400,000 | 400,000 | 28.6% |

Miscellaneous Expenses | 1,000,000 | 1,250,000 | -250,000 | -20% |

Total | 12,500,000 | 12,250,000 | 250,000 | 2% |

Key Highlights

Operational Costs were effectively managed, coming in under budget by 1.5%.

Administrative Expenses exceeded the budget primarily due to increased staffing and office maintenance costs.

Travel and Entertainment Expenses saw a significant increase owing to expanded marketing efforts and client engagement initiatives.

Miscellaneous Expenses were notably lower than budgeted, reflecting cost-saving measures and efficient resource utilization.

B. Recommendations

Cost Control Measures

Implement stricter monitoring and approval processes for travel-related expenses to prevent future budget overruns.Budget Reallocation

Reassess and adjust budget allocations for administrative and travel expenses to better reflect the company’s operational needs and growth strategies.Efficiency Improvements

Explore opportunities for automation and process optimization within administrative functions to reduce overhead costs.Forecasting Enhancements

Utilize advanced forecasting tools and methods to improve the accuracy of future budget planning and expense predictions.

III. Detailed Expense Analysis

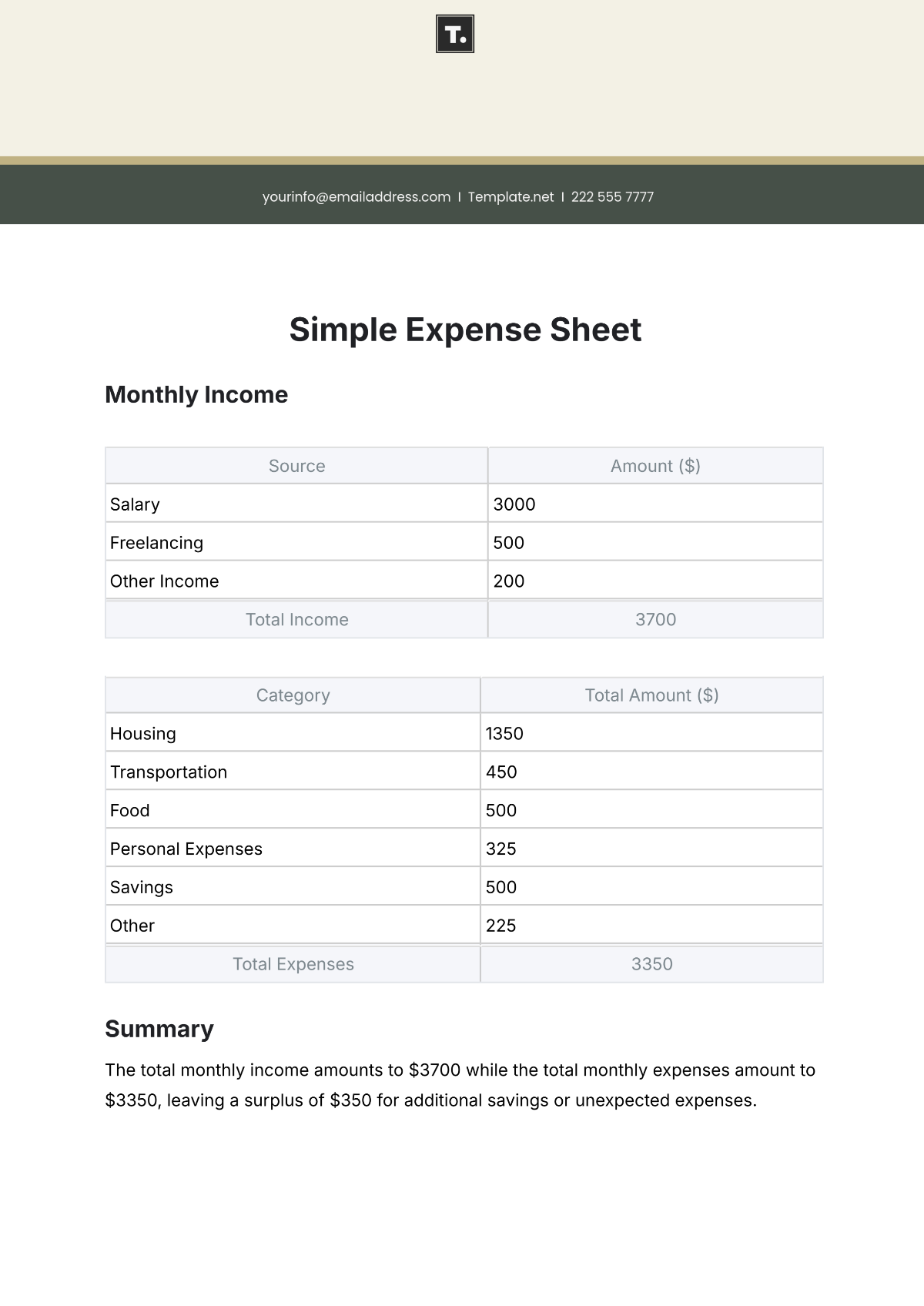

A. Operational Costs

Summary

Operational Costs for the fiscal year 2050 totaled $6,500,000, which is 1.5% below the allocated budget of $6,600,000. Effective resource management and procurement strategies contributed to the cost savings in this category.Breakdown by Subcategory

Manufacturing and Production

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Raw Materials | 2,500,000 | 2,600,000 | -100,000 | -3.8% |

Equipment Maintenance | 500,000 | 550,000 | -50,000 | -9.1% |

Labor Costs | 1,200,000 | 1,150,000 | 50,000 | 4.3% |

Utilities | 300,000 | 300,000 | 0 | 0% |

Total | 4,500,000 | 4,600,000 | -100,000 | -2.2% |

Observations:

Raw Materials: Achieved cost savings through bulk purchasing agreements and negotiating better terms with suppliers.

Equipment Maintenance: Reduced expenses by implementing preventive maintenance schedules and extending equipment lifespan.

Labor Costs: Slightly over budget due to overtime payments during peak production periods.

Utilities: Maintained within budget by adopting energy-efficient practices and monitoring usage closely.

Service Delivery

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Software Licenses | 800,000 | 750,000 | 50,000 | 6.7% |

Cloud Services | 500,000 | 500,000 | 0 | 0% |

Customer Support | 400,000 | 400,000 | 0 | 0% |

Total | 1,700,000 | 1,650,000 | 50,000 | 3% |

Observations:

Software Licenses: Increased costs due to the adoption of new software solutions aimed at enhancing service quality and operational efficiency.

Cloud Services and Customer Support: Maintained within budget through effective vendor management and optimization of service processes.

Year-over-Year Comparison

Subcategory | 2050 Actual (USD) | 2050 Actual (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Manufacturing and Production | 4,500,000 | 4,400,000 | 100,000 | 2.3% |

Service Delivery | 1,700,000 | 1,600,000 | 100,000 | 6.3% |

Total | 6,200,000 | 6,000,000 | 200,000 | 3.3% |

Observations:

Overall operational costs increased by 3.3% compared to the previous year, primarily due to investments in new technologies and infrastructure upgrades to support business growth.

Recommendations

Continue leveraging bulk purchasing and supplier negotiations to maintain low raw material costs.

Explore alternative software solutions or negotiate existing contracts to control licensing expenses.

Invest in training programs to optimize labor efficiency and reduce overtime requirements.

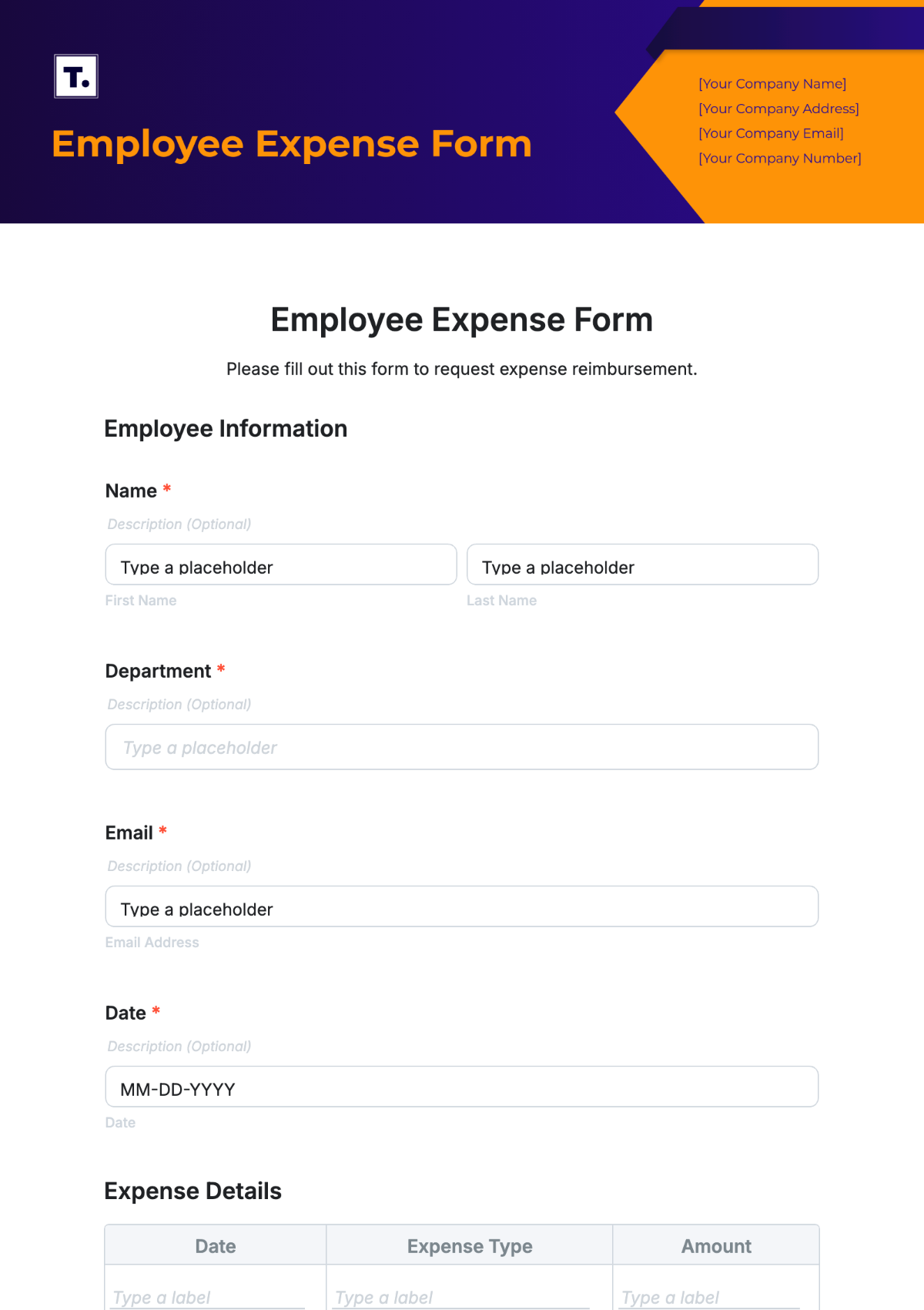

B. Administrative Expenses

Summary

Administrative Expenses for fiscal year 2050 amounted to $3,200,000, exceeding the budgeted amount of $3,000,000 by 6.7%. The overrun is mainly attributed to increased personnel costs and unexpected facility maintenance expenditures.Breakdown by Subcategory

Personnel Expenses

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Salaries and Wages | 2,000,000 | 1,800,000 | 200,000 | 11.1% |

Employee Benefits | 400,000 | 350,000 | 50,000 | 14.3% |

Training and Development | 150,000 | 100,000 | 50,000 | 50% |

Total | 2,550,000 | 2,250,000 | 300,000 | 13.3% |

Observations:

Salaries and Wages: Increased due to hiring additional administrative staff to support expanded operations.

Employee Benefits: Higher costs resulting from improved benefit packages aimed at attracting and retaining talent.

Training and Development: Significant investment in professional development programs to enhance employee skills and productivity.

Office Expenses

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Office Supplies | 100,000 | 120,000 | -20,000 | -16.7% |

Facility Maintenance | 300,000 | 250,000 | 50,000 | 20% |

Utilities | 150,000 | 150,000 | 0 | 0% |

Communication Expenses | 100,000 | 100,000 | 0 | 0% |

Total | 650,000 | 620,000 | 30,000 | 4.8% |

Observations:

Office Supplies: Achieved cost savings through bulk purchasing and reducing unnecessary expenditures.

Facility Maintenance: Over budget due to unplanned repairs and upgrades to office infrastructure.

Utilities and Communication Expenses: Maintained within budget through effective resource management.

Year-over-Year Comparison

Subcategory | 2050 Actual (USD) | 2051 Actual (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Personnel Expenses | 2,550,000 | 2,300,000 | 250,000 | 10.9% |

Office Expenses | 650,000 | 600,000 | 50,000 | 8.3% |

Total | 3,200,000 | 2,900,000 | 300,000 | 10.3% |

Observations:

Administrative expenses increased by 10.3% compared to 2050, reflecting the company's growth and the corresponding need for expanded administrative support and facilities maintenance.

Recommendations

Conduct a thorough review of staffing needs to ensure personnel costs align with operational requirements.

Implement preventive maintenance schedules to minimize unexpected facility repair costs.

Continue monitoring and optimizing office supply usage to sustain cost savings.

C. Travel and Entertainment

Summary

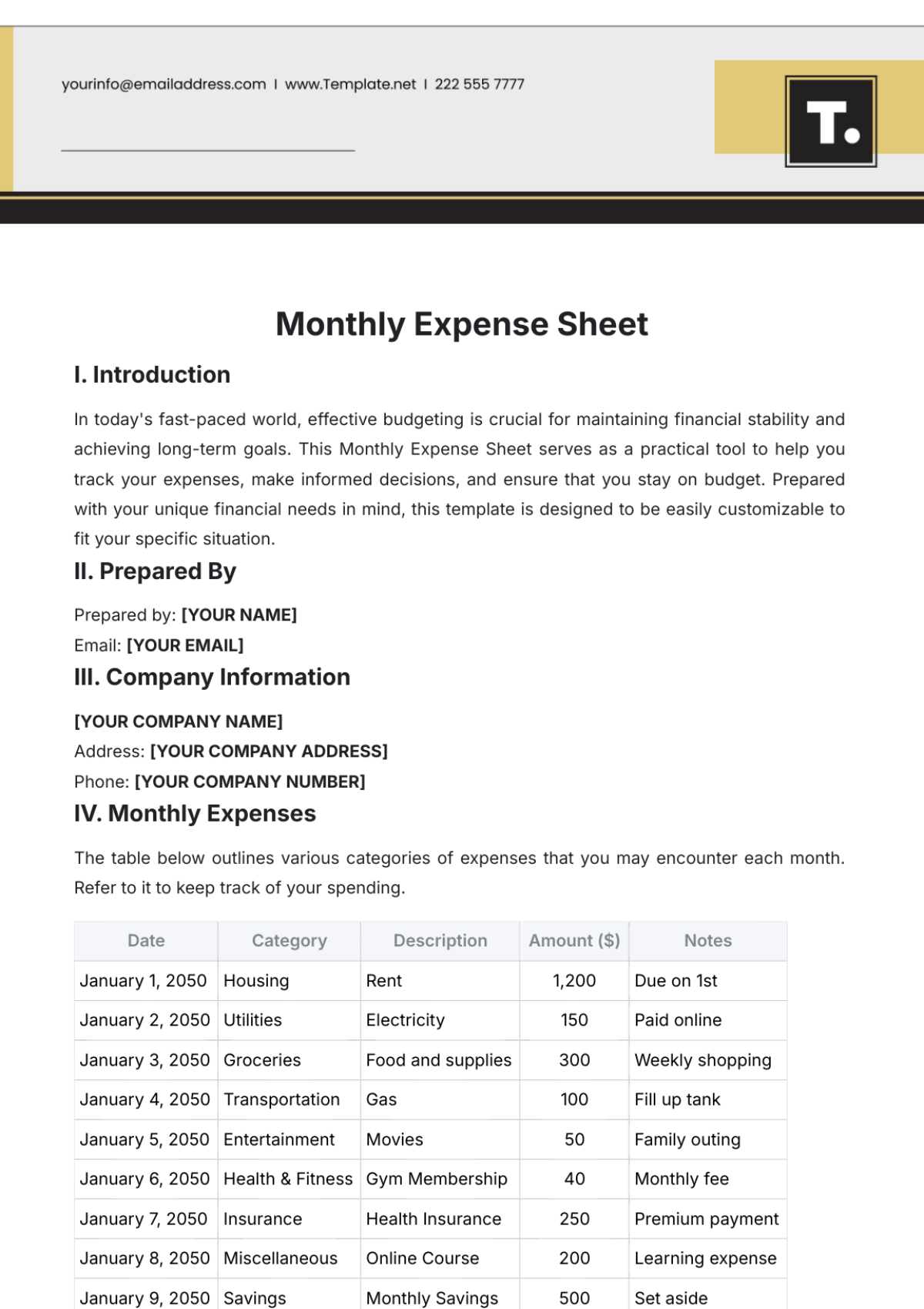

Travel and Entertainment Expenses totaled $1,800,000 in 2050, exceeding the budgeted amount of $1,400,000 by 28.6%. The increase is primarily due to extensive business development activities and participation in international conferences and trade shows.Breakdown by Subcategory

Travel Expenses

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Airfare | 600,000 | 400,000 | 200,000 | 50% |

Accommodation | 400,000 | 300,000 | 100,000 | 33.3% |

Transportation | 150,000 | 100,000 | 50,000 | 50% |

Meals and Incidentals | 100,000 | 80,000 | 20,000 | 25% |

Total | 1,250,000 | 880,000 | 370,000 | 42% |

Observations:

Airfare and Accommodation: Increased expenses due to additional international trips aimed at exploring new markets and establishing partnerships.

Transportation: Higher costs resulting from frequent use of rental cars and local transport services during business trips.

Meals and Incidentals: Slightly over budget, reflecting extended durations of travel and increased number of traveling employees.

Entertainment Expenses

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Client Entertainment | 300,000 | 250,000 | 50,000 | 20% |

Corporate Events | 150,000 | 150,000 | 0 | 0% |

Conferences and Seminars | 100,000 | 120,000 | -20,000 | -16.7% |

Total | 550,000 | 520,000 | 30,000 | 5.8% |

Observations:

Client Entertainment: Overspending driven by efforts to strengthen client relationships and close significant deals.

Conferences and Seminars: Achieved cost savings by leveraging early-bird registrations and negotiating group discounts.

Year-over-Year Comparison

Subcategory | 2050 Actual (USD) | 2051 Actual (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Travel Expenses | 1,250,000 | 1,000,000 | 250,000 | 25% |

Entertainment Expenses | 550,000 | 500,000 | 50,000 | 10% |

Total | 1,800,000 | 1,500,000 | 300,000 | 20% |

Observations:

Overall Travel and Entertainment expenses increased by 20% compared to 2050, indicating an aggressive push towards business expansion and market penetration.

Recommendations

Develop and enforce a comprehensive travel policy to control and monitor travel-related expenses effectively.

Utilize virtual meeting technologies where feasible to reduce the need for physical travel.

Set predefined budgets for client entertainment and seek cost-effective alternatives for hosting events.

D. Miscellaneous Expenses

Summary

Miscellaneous Expenses amounted to $1,000,000 in 2050, coming in 20% below the budgeted amount of $1,250,000. The decrease is largely due to prudent financial management and deferral of certain discretionary expenditures.Breakdown by Subcategory

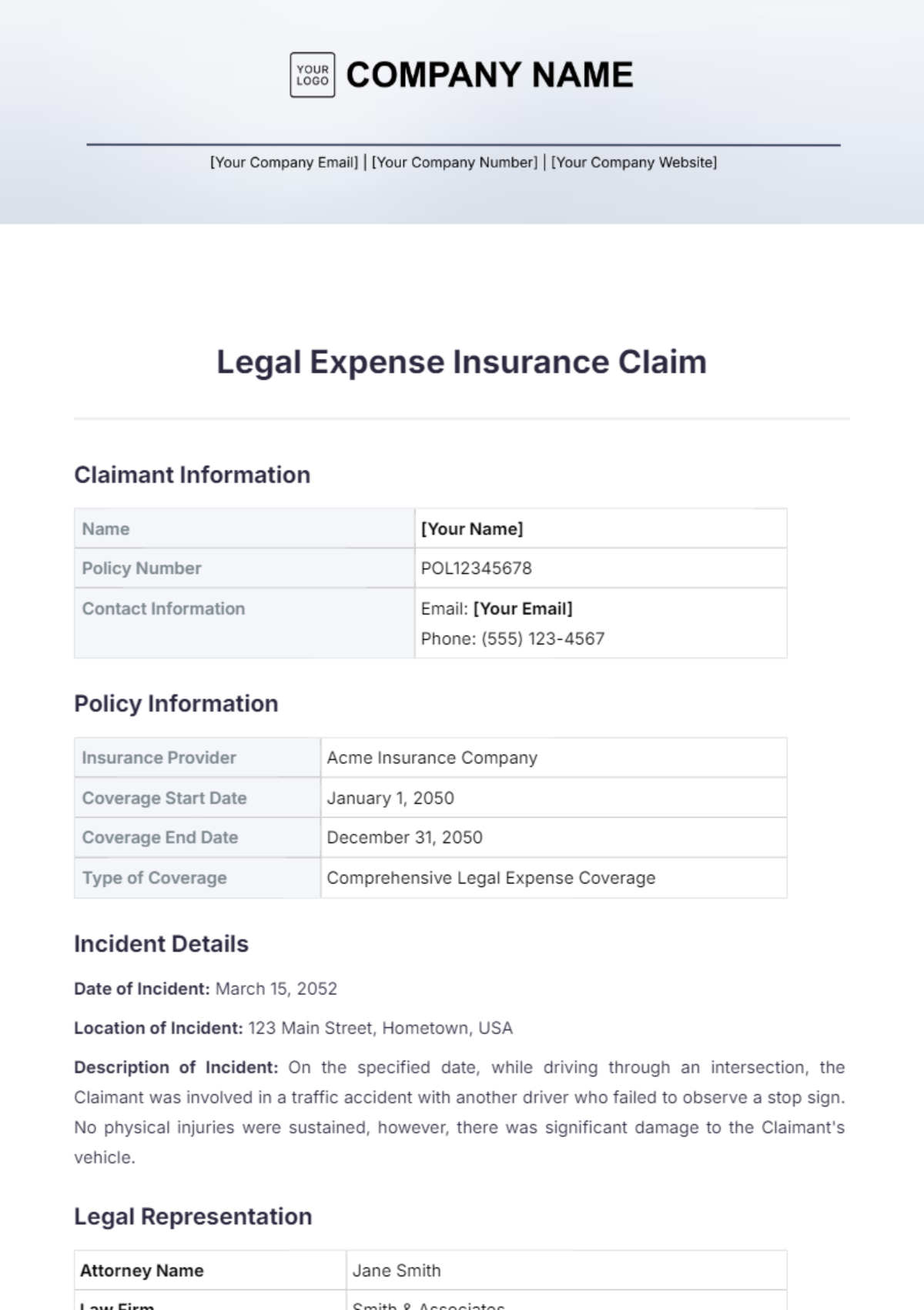

Legal and Professional Fees

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Legal Services | 300,000 | 400,000 | -100,000 | -25% |

Consulting Services | 200,000 | 250,000 | -50,000 | -20% |

Audit Fees | 100,000 | 100,000 | 0 | 0% |

Total | 600,000 | 750,000 | -150,000 | -20% |

Observations:

Legal Services: Reduced costs due to fewer legal disputes and effective in-house legal counsel utilization.

Consulting Services: Savings achieved by handling projects internally and limiting external consultant engagements.

Audit Fees: Maintained within budget through long-term service agreements with auditing firms.

Other Expenses

Expense Item | 2050 Actual (USD) | 2050 Budget (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Charitable Donations | 200,000 | 200,000 | 0 | 0% |

Insurance Premiums | 150,000 | 200,000 | -50,000 | -25% |

Miscellaneous Supplies | 50,000 | 100,000 | -50,000 | -50% |

Total | 400,000 | 500,000 | -100,000 | -20% |

Observations:

Insurance Premiums: Lowered costs by re-evaluating coverage needs and negotiating better rates with insurance providers.

Miscellaneous Supplies: Decreased expenses through efficient inventory management and minimizing non-essential purchases.

Year-over-Year Comparison

Subcategory | 2050 Actual (USD) | 2050 Actual (USD) | Variance (USD) | Variance (%) |

|---|---|---|---|---|

Legal and Professional Fees | 600,000 | 700,000 | -100,000 | -14.3% |

Other Expenses | 400,000 | 500,000 | -100,000 | -20% |

Total | 1,000,000 | 1,200,000 | -200,000 | -16.7% |

Observations:

Miscellaneous expenses decreased by 16.7% compared to 2050, reflecting effective cost-control measures and strategic financial planning.

Recommendations

Continue leveraging in-house expertise to minimize reliance on external professional services.

Regularly review insurance coverage to ensure optimal protection at competitive rates.

Maintain stringent controls over miscellaneous expenditures to sustain cost efficiencies.

IV. Conclusion

A. Summary of Findings

Overall Performance

The total expenses for [Your Company Name] in 2050 were $12,500,000, slightly exceeding the annual budget by 2%. While certain categories such as Operational Costs and Miscellaneous Expenses were under budget, overspending in Administrative and Travel and Entertainment Expenses contributed to the overall budget variance.Key Drivers of Variance

Administrative Expenses: Increased staffing and facility maintenance costs.

Travel and Entertainment: Extensive business development activities and international engagements.

Positive Outcomes

Effective cost management in Operational and Miscellaneous categories.

Strategic investments in employee development and technology enhancements supporting long-term growth.

B. Recommendations for Future Actions

Enhanced Budgeting Practices

Reassess budget allocations based on actual expenditure trends and future business objectives.

Incorporate more flexible budgeting strategies to accommodate unforeseen expenses.

Cost Optimization Strategies

Implement stricter approval processes for high-cost expenditures.

Explore cost-saving opportunities through process improvements and technology adoption.

Regular Financial Monitoring

Conduct periodic financial reviews to track expense patterns and identify potential issues early.

Utilize advanced financial analytics tools for better forecasting and decision-making.

Policy Development and Compliance

Develop comprehensive expense management policies covering all expenditure categories.

Ensure adherence to financial policies through regular audits and employee training programs.

C. Closing Statement

The fiscal year 2050 presented both challenges and opportunities for [Your Company Name]. Despite minor budget overruns, the company made strategic investments that are expected to yield positive returns in the coming years. By implementing the recommendations outlined in this report, [Your Company Name] can strengthen its financial position, improve operational efficiency, and support sustainable growth.

Prepared by:

[Your Name]

Finance Manager

[Your Company Name]

Reviewed and Approved by:

Jane Smith

Chief Financial Officer

[Your Company Name]

Date: January 15, 2051