Free Accounting Financial Management

1. Introduction

1.1 Overview

Accounting Financial Management is crucial for the effective operation and sustainability of any organization. This comprehensive approach to managing financial activities ensures accurate recording, reporting, and analysis of financial transactions. At [Your Company Name], we emphasize the importance of robust financial management systems to enhance decision-making, compliance, and financial health.

1.2 Objectives

The primary objectives of Accounting Financial Management include:

Ensuring accurate and timely financial reporting.

Maintaining compliance with regulatory requirements.

Supporting strategic decision-making through detailed financial analysis.

Enhancing operational efficiency through effective budget management.

Identifying and mitigating financial risks.

2. Financial Reporting

2.1 Financial Statements

Financial statements are essential tools for evaluating the financial performance and position of an organization. They provide stakeholders with a clear picture of the company's financial health.

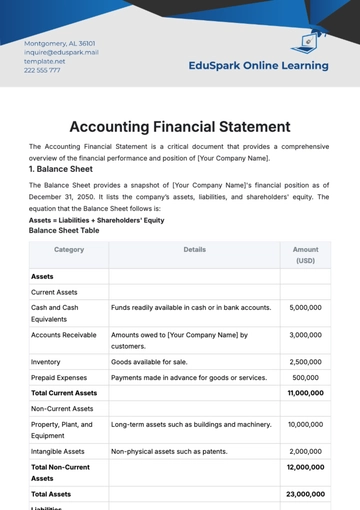

2.1.1 Balance Sheet

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps assess the company's financial stability and liquidity.

Assets: Include current and non-current assets. Current assets are those expected to be converted into cash or used up within one year, such as cash, accounts receivable, and inventory. Non-current assets are long-term investments like property, plant, and equipment.

Liabilities: Include current and non-current liabilities. Current liabilities are obligations expected to be settled within one year, such as accounts payable and short-term debt. Non-current liabilities are long-term obligations like long-term loans and bonds payable.

Equity: Represents the residual interest in the assets of the company after deducting liabilities. It includes common stock, retained earnings, and additional paid-in capital.

2.1.2 Income Statement

The income statement, or profit and loss statement, summarizes revenues, expenses, and profits or losses over a specific period. It provides insight into the company’s operational efficiency and profitability.

Revenue: Includes sales of goods and services, interest income, and other revenue streams.

Expenses: Cover costs of goods sold, operating expenses, interest expenses, and taxes.

Net Income: The difference between total revenues and total expenses, indicating the company's profitability.

2.1.3 Cash Flow Statement

The cash flow statement reports the cash inflows and outflows from operating, investing, and financing activities. It provides insights into the company's liquidity and cash management practices.

Operating Activities: Cash flows from the core business operations, including receipts from sales and payments to suppliers and employees.

Investing Activities: Cash flows related to the acquisition and disposal of long-term assets, such as purchasing equipment or selling investments.

Financing Activities: Cash flows from transactions with the company’s owners and creditors, including issuing stock, borrowing, and repaying debt.

2.2 Financial Analysis

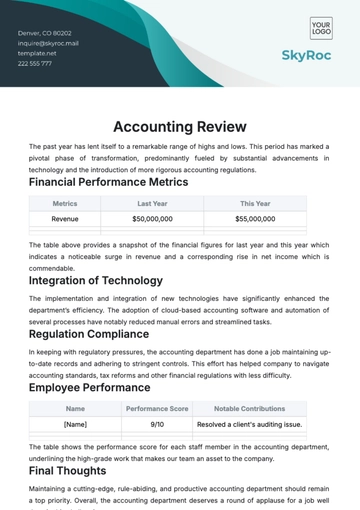

Financial analysis involves evaluating financial statements to assess the company's performance and make informed decisions.

2.2.1 Ratio Analysis

Ratio analysis uses financial ratios to evaluate various aspects of the company's performance.

Liquidity Ratios: Measure the company's ability to meet short-term obligations. Examples include the current ratio and quick ratio.

Profitability Ratios: Assess the company’s ability to generate profit relative to revenue, assets, or equity. Examples include the net profit margin and return on equity (ROE).

Leverage Ratios: Evaluate the company’s debt levels relative to its equity or assets. Examples include the debt-to-equity ratio and interest coverage ratio.

Efficiency Ratios: Measure how effectively the company utilizes its assets. Examples include inventory turnover and accounts receivable turnover.

2.2.2 Trend Analysis

Trend analysis involves comparing financial data over multiple periods to identify patterns and trends. It helps in forecasting future performance based on historical data.

Revenue Trends: Analyzing revenue growth or decline over time.

Expense Trends: Assessing changes in operating expenses and their impact on profitability.

Profitability Trends: Evaluating changes in profit margins and net income.

3. Budgeting and Forecasting

3.1 Budgeting

Budgeting is the process of planning and controlling financial resources to achieve organizational goals. It involves creating detailed financial plans for various departments and activities.

3.1.1 Operating Budget

The operating budget covers the company’s day-to-day operations and includes:

Revenue Projections: Estimations of future sales based on historical data, market trends, and sales forecasts.

Expense Estimates: Budgeting for costs associated with production, marketing, and administrative functions.

Profit Projections: Calculating expected profits based on revenue and expense estimates.

Table 1: Operating Budget Breakdown

Category | Amount (USD) |

|---|---|

Revenue Projections | [$100,000] |

Expense Estimates | [$70,000] |

Profit Projections | [$30,000] |

3.1.2 Capital Budget

The capital budget focuses on long-term investments in assets that will benefit the company over several years.

Capital Expenditures: Budgeting for the purchase of new equipment, property, or technology.

Project Evaluation: Assessing the financial viability of capital projects using methods like net present value (NPV) and internal rate of return (IRR).

Table 2: Capital Budget Allocation

Investment Category | Amount (USD) |

|---|---|

Equipment Purchase | [$50,000] |

Property Acquisition | [$120,000] |

Technology Upgrade | [$30,000] |

3.2 Forecasting

Forecasting involves predicting future financial performance based on historical data, market conditions, and business trends.

3.2.1 Revenue Forecasting

Revenue forecasting estimates future sales based on market analysis, historical performance, and economic conditions.

Historical Data Analysis: Using past sales data to project future revenue.

Market Trends: Evaluating industry trends and consumer behavior.

Economic Indicators: Considering economic factors that may impact sales, such as inflation rates and economic growth.

Table 3: Revenue Forecasting Metrics

Metric | Value (USD) |

|---|---|

Past Year Sales | [$90,000] |

Projected Growth Rate | [10%] |

Forecasted Revenue | [$99,000] |

3.2.2 Expense Forecasting

Expense forecasting predicts future costs based on historical data and anticipated changes in business operations.

Fixed Costs: Estimating costs that remain constant regardless of production levels, such as rent and salaries.

Variable Costs: Predicting costs that fluctuate with production levels, such as raw materials and utilities.

Contingency Planning: Setting aside funds for unexpected expenses or changes in cost structures.

Table 4: Expense Forecasting Details

Expense Type | Amount (USD) |

|---|---|

Fixed Costs | [$40,000] |

Variable Costs | [$20,000] |

Contingency Fund | [$5,000] |

4. Cash Flow Management

4.1 Cash Flow Planning

Cash flow planning involves forecasting and managing cash inflows and outflows to ensure that the company has sufficient liquidity to meet its obligations.

4.1.1 Cash Flow Forecasting

Cash flow forecasting estimates future cash inflows and outflows based on historical data and expected business activities.

Short-Term Forecasting: Planning for daily or weekly cash flow needs.

Long-Term Forecasting: Estimating cash flow for monthly or annual periods.

Table 6: Short-Term Cash Flow Forecast

Category | Amount (USD) |

|---|---|

Daily Cash Inflows | [$5,000] |

Daily Cash Outflows | [$3,000] |

Net Daily Cash Flow | [$2,000] |

Table 7: Long-Term Cash Flow Forecast

Category | Amount (USD) |

|---|---|

Monthly Cash Inflows | [$150,000] |

Monthly Cash Outflows | [$120,000] |

Net Monthly Cash Flow | [$30,000] |

4.1.2 Cash Flow Monitoring

Monitoring cash flow involves tracking actual cash inflows and outflows against forecasts.

Regular Reporting: Generating cash flow reports to compare actual performance with forecasts.

Variance Analysis: Identifying discrepancies between forecasted and actual cash flows and investigating the causes.

Table 8: Cash Flow Monitoring Report

Month | Forecasted Inflows (USD) | Actual Inflows (USD) | Forecasted Outflows (USD) | Actual Outflows (USD) | Variance (USD) |

|---|---|---|---|---|---|

January | [$15,000] | [$14,500] | [$12,000] | [$12,200] | [-$200] |

February | [$16,000] | [$16,500] | [$13,000] | [$12,800] | [+$700] |

March | [$14,500] | [$14,000] | [$12,500] | [$13,000] | [-$500] |

4.2 Working Capital Management

Working capital management focuses on managing short-term assets and liabilities to ensure operational efficiency.

4.2.1 Inventory Management

Effective inventory management ensures that the company maintains optimal inventory levels to meet customer demand without overstocking.

Inventory Turnover: Calculating how quickly inventory is sold and replaced.

Reorder Points: Setting thresholds for reordering inventory to avoid stockouts.

Table 9: Inventory Management Metrics

Metric | Value |

|---|---|

Current Inventory Level | [20,000 units] |

Annual Sales | [240,000 units] |

Inventory Turnover Ratio | [12] |

Reorder Point | [5,000 units] |

4.2.2 Accounts Receivable Management

Managing accounts receivable involves monitoring and collecting outstanding invoices to maintain cash flow.

Credit Policies: Establishing policies for extending credit to customers.

Collection Procedures: Implementing procedures for following up on overdue accounts.

Table 10: Accounts Receivable Management

Metric | Value |

|---|---|

Total Receivables | [$40,000] |

Average Collection Period | [30 days] |

Percentage of Overdue Accounts | [10%] |

Collection Efficiency | [90%] |

4.2.3 Accounts Payable Management

Accounts payable management involves managing the company’s obligations to suppliers and creditors.

Payment Terms: Negotiating favorable payment terms with suppliers.

Cash Discounts: Taking advantage of discounts for early payment.

Table 11: Accounts Payable Management

Metric | Value |

|---|---|

Total Payables | [$25,000] |

Average Payment Terms | [45 days] |

Discounts Utilized | [5%] |

Total Discounts Saved | [$1,250] |

5. Financial Controls and Compliance

5.1 Internal Controls

Internal controls are processes and procedures designed to ensure the accuracy and reliability of financial reporting and safeguard assets.

5.1.1 Control Activities

Control activities include policies and procedures to mitigate risks and ensure compliance with financial regulations.

Segregation of Duties: Separating responsibilities among different employees to prevent fraud and errors.

Authorization and Approval: Requiring authorization for significant financial transactions.

5.1.2 Monitoring and Review

Regular monitoring and review of internal controls help identify and address weaknesses.

Internal Audits: Conducting periodic internal audits to evaluate the effectiveness of controls.

Management Reviews: Reviewing financial reports and control processes to ensure compliance.

5.2 Regulatory Compliance

Compliance with financial regulations ensures that the company adheres to legal and regulatory requirements.

5.2.1 Financial Reporting Standards

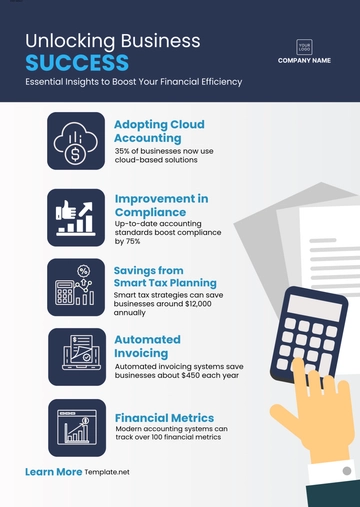

Adhering to financial reporting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) is essential for accurate reporting.

Standard Compliance: Ensuring financial statements are prepared in accordance with applicable standards.

Regulatory Updates: Staying informed about changes in financial reporting regulations.

5.2.2 Tax Compliance

Tax compliance involves fulfilling tax obligations and filing accurate tax returns.

Tax Planning: Strategizing to minimize tax liabilities and optimize tax benefits.

Tax Filings: Preparing and submitting tax returns in accordance with regulatory requirements.

6. Risk Management

6.1 Financial Risk Assessment

Financial risk assessment involves identifying and analyzing risks that could impact the company's financial stability.

6.1.1 Risk Identification

Identifying potential financial risks, including market risk, credit risk, and operational risk.

Market Risk: Risks related to fluctuations in market conditions, such as interest rates and exchange rates.

Credit Risk: Risks associated with the possibility of non-payment by customers or counterparties.

6.1.2 Risk Evaluation

Evaluating the potential impact and likelihood of identified risks.

Risk Impact: Assessing the potential financial impact of each risk.

Risk Probability: Estimating the likelihood of each risk occurring.

6.2 Risk Mitigation Strategies

Implementing strategies to mitigate identified financial risks and minimize their impact.

6.2.1 Hedging

Using financial instruments to hedge against market risks, such as currency and interest rate fluctuations.

Hedging Instruments: Utilizing options, futures, and swaps to manage exposure.

Hedging Strategies: Developing strategies to balance risk and reward.

6.2.2 Diversification

Diversifying investments and revenue sources to reduce dependence on a single source of income.

Investment Diversification: Spreading investments across different asset classes and sectors.

Revenue Diversification: Expanding revenue streams to reduce reliance on a single market or product.

7. Strategic Financial Planning

7.1 Long-Term Financial Goals

Establishing long-term financial goals aligns financial planning with the company’s strategic objectives.

7.1.1 Goal Setting

Setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

Revenue Targets: Defining revenue growth objectives over the long term.

Profitability Goals: Setting targets for improving profit margins and net income.

7.1.2 Strategic Initiatives

Developing initiatives to achieve long-term financial goals.

Investment Plans: Identifying strategic investments to support growth and expansion.

Cost Reduction: Implementing measures to reduce costs and improve efficiency.

7.2 Performance Measurement

Measuring financial performance against established goals and benchmarks.

7.2.1 Key Performance Indicators (KPIs)

Identifying and tracking KPIs to evaluate financial performance.

Revenue Growth: Measuring year-over-year revenue growth.

Return on Investment (ROI): Assessing the return on capital investments.

7.2.2 Benchmarking

Comparing financial performance against industry benchmarks and competitors.

Industry Comparisons: Analyzing financial ratios and performance metrics relative to industry standards.

Competitive Analysis: Evaluating financial performance in the context of competitors.

8. Conclusion

8.1 Summary

Accounting Financial Management is a critical component of organizational success. By implementing effective financial reporting, budgeting, cash flow management, and risk management practices, [Your Company Name] ensures robust financial health and supports strategic decision-making.

8.2 Future Considerations

As [Your Company Name] continues to evolve, it is essential to adapt financial management practices to emerging trends and challenges. Ongoing improvements in financial systems and processes will support long-term growth and sustainability.

8.3 Recommendations

Regular Review: Continuously review and update financial management practices to ensure alignment with organizational goals and regulatory requirements.

Employee Training: Invest in training for financial management staff to enhance their skills and knowledge.

Technology Integration: Leverage advanced financial technologies and software to improve efficiency and accuracy.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage your finances with ease using the Accounting Financial Management Template from Template.net. This customizable template helps you create a comprehensive financial management plan. Editable in our AI Editor Tool, it’s perfect for maintaining financial stability and growth. Download now and enhance your financial management process!