Startup Financial Projection

I. Introduction

A well-structured financial projection is critical for a startup’s success, particularly when forecasting growth, expenses, and profitability. This projection not only helps in planning, but it also assists in attracting investors, securing loans, and guiding financial decision-making. This document provides a detailed financial projection for [Your Company Name] from 2050 onwards, covering essential aspects such as revenue projections, cost analysis, cash flow statements, and profitability estimates. This projection will span a 10-year horizon, starting from the year 2050 and ending in 2060.

II. Objectives of the Financial Projection

A. Revenue Growth Forecast The primary objective is to estimate revenue growth over the next decade. This involves projecting sales, identifying trends, and understanding market potential. [Your Company Name] aims to grow by capturing new market opportunities and enhancing its existing product offerings.

B. Expense Analysis The projection aims to thoroughly evaluate both fixed and variable expenses, including operational costs, salaries, marketing expenses, and cost of goods sold (COGS).

C. Profitability Goals This projection will help [Your Company Name] determine the point of reaching profitability, including gross margins, operating margins, and net income.

D. Capital Requirement Analysis Estimating the necessary capital needed for operations, expansion, and scaling up is crucial. The projection helps determine whether external funding is required and outlines potential sources, such as equity investments or loans.

E. Break-even Analysis Another objective is to calculate the break-even point, i.e., when the company's total revenue will cover its total expenses.

III. Revenue Projections

A. Revenue Assumptions

Initial Year Revenue (2050) In 2050, [Your Company Name] is expected to generate $2,000,000 in revenue. This estimate is based on market analysis, pricing strategies, and the introduction of new products. It assumes that the company will sell 10,000 units of its main product at an average price of $200 per unit.

Growth Rate A conservative growth rate of 10% is assumed for the first five years (2050-2055) as the company establishes its market presence. From 2056-2060, the growth rate is expected to accelerate to 15%, driven by market expansion and product diversification.

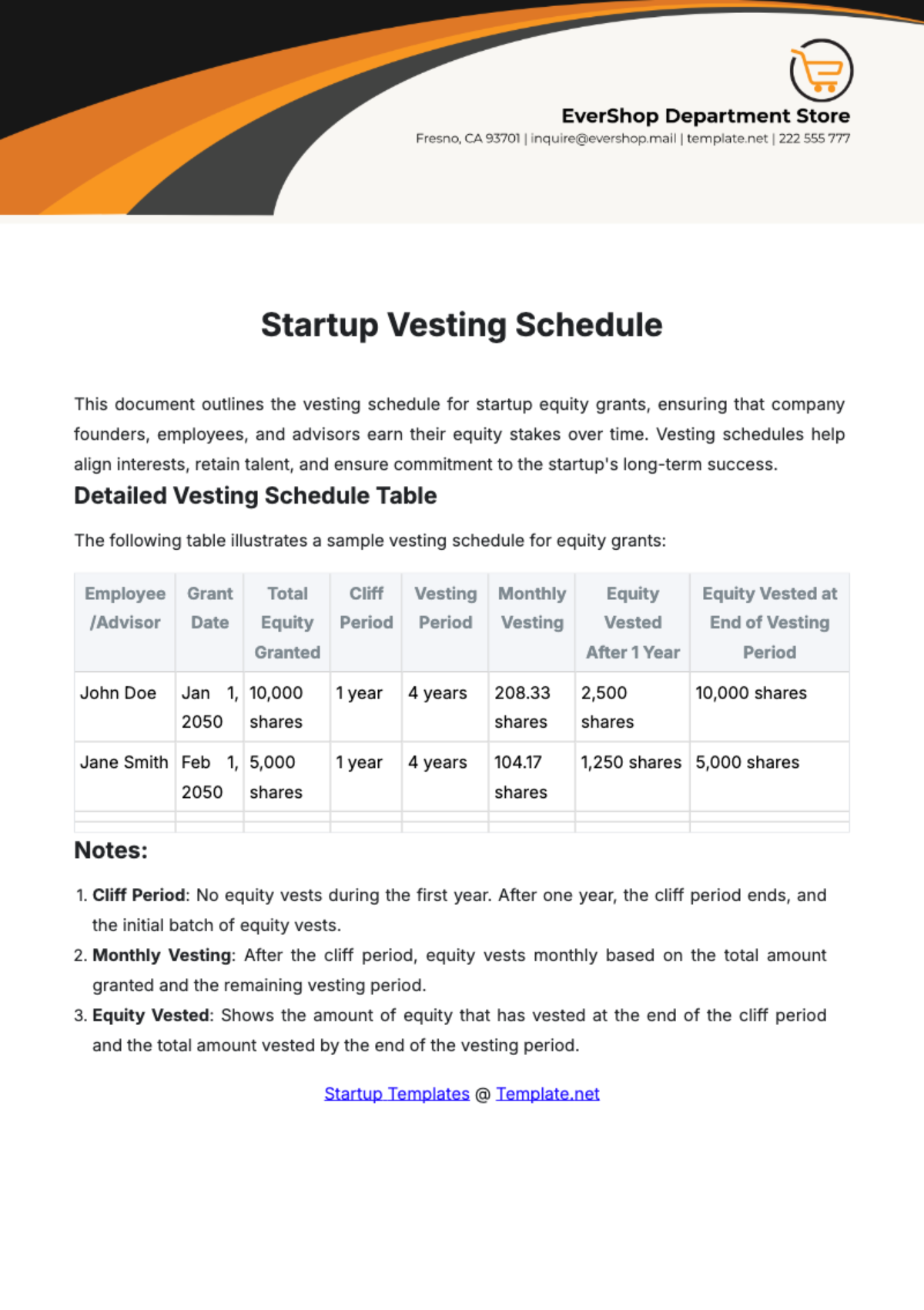

B. Revenue Projection Table (2050-2060)

Year | Revenue Growth Rate | Projected Revenue |

|---|---|---|

2050 | - | $2,000,000 |

2051 | 10% | $2,200,000 |

2052 | 10% | $2,420,000 |

2053 | 10% | $2,662,000 |

2054 | 10% | $2,928,200 |

2055 | 10% | $3,221,020 |

2056 | 15% | $3,704,173 |

2057 | 15% | $4,259,799 |

2058 | 15% | $4,898,768 |

2059 | 15% | $5,633,584 |

2060 | 15% | $6,478,622 |

C. Revenue Breakdown by Product Line

Product A: Main Revenue Generator Product A, the flagship product of [Your Company Name], will continue to be the primary revenue generator, accounting for approximately 70% of the total revenue.

Product B: Supplemental Income Product B, a new product line expected to launch in 2052, will account for 20% of revenue by 2060.

Service Offerings [Your Company Name] will also offer related services, which are projected to account for the remaining 10% of revenue by 2060.

IV. Expense Projections

A. Fixed and Variable Costs

Fixed Costs Fixed costs include rent, utilities, salaries of core staff, and administrative expenses. For 2050, fixed costs are projected to be $800,000. These costs are expected to increase by 5% annually due to inflation and expansion of operations.

Variable Costs Variable costs are closely tied to production levels. The main components include raw materials, production labor, and packaging. Variable costs are projected to be 40% of total revenue.

B. Expense Projection Table (2050-2060)

Year | Fixed Costs | Variable Costs (40% of Revenue) | Total Expenses |

|---|---|---|---|

2050 | $800,000 | $800,000 | $1,600,000 |

2051 | $840,000 | $880,000 | $1,720,000 |

2052 | $882,000 | $968,000 | $1,850,000 |

2053 | $926,100 | $1,064,800 | $1,990,900 |

2054 | $972,405 | $1,171,280 | $2,143,685 |

2055 | $1,021,025 | $1,288,408 | $2,309,433 |

2056 | $1,072,076 | $1,481,669 | $2,553,745 |

2057 | $1,125,680 | $1,703,920 | $2,829,600 |

2058 | $1,181,964 | $1,959,507 | $3,141,471 |

2059 | $1,241,062 | $2,253,433 | $3,494,495 |

2060 | $1,303,115 | $2,593,076 | $3,896,191 |

C. Salaries and Wages

The salaries of key employees will account for a significant portion of fixed costs. By 2050, salaries are projected to reach $500,000, increasing by 5% annually due to expected team expansion and inflation adjustments.

V. Cash Flow Projections

A. Cash Inflows

Operating Cash Inflows Cash inflows from operations will be generated from product sales and service fees. The estimated cash inflow for 2050 is $2,000,000, growing in line with the projected revenue growth rate.

External Funding [Your Company Name] anticipates raising $1,500,000 in equity funding in 2050 to finance early-stage expansion efforts. This will contribute to the initial cash inflows.

B. Cash Outflows

Operating Cash Outflows Outflows will mainly consist of COGS, salaries, marketing expenses, and overheads. Operating cash outflows are expected to mirror the expense projections.

Capital Expenditures Capital expenditures (CapEx) for equipment, technology, and infrastructure will be an essential part of outflows. For 2050, CapEx is projected to be $300,000, with increases anticipated in subsequent years as the company scales.

C. Cash Flow Table (2050-2060)

Year | Cash Inflows | Cash Outflows | Net Cash Flow |

|---|---|---|---|

2050 | $3,500,000 | $1,900,000 | $1,600,000 |

2051 | $2,200,000 | $1,740,000 | $460,000 |

2052 | $2,420,000 | $1,855,000 | $565,000 |

2053 | $2,662,000 | $1,990,900 | $671,100 |

2054 | $2,928,200 | $2,143,685 | $784,515 |

2055 | $3,221,020 | $2,309,433 | $911,587 |

2056 | $3,704,173 | $2,553,745 | $1,150,428 |

2057 | $4,259,799 | $2,829,600 | $1,430,199 |

2058 | $4,898,768 | $3,141,471 | $1,757,297 |

2059 | $5,633,584 | $3,494,495 | $2,139,089 |

2060 | $6,478,622 | $3,896,191 | $2,582,431 |

VI. Profitability Analysis

A. Gross Profit

Gross profit is calculated as the difference between revenue and the cost of goods sold (COGS). For 2050, with revenue at $2,000,000 and COGS at 40% of revenue ($800,000), the gross profit is projected at $1,200,000.

B. Operating Profit

Operating profit is derived by subtracting operating expenses (fixed and variable) from the gross profit. For 2050, operating profit is projected at $400,000.

C. Net Profit

Net profit is the final profit after accounting for taxes, interest, and other non-operating expenses. For 2050, with an estimated tax rate of 20%, the net profit is projected at $320,000.

D. Profitability Projection Table (2050-2060)

Year | Revenue | Gross Profit (60%) | Operating Profit | Net Profit (20% Tax) |

|---|---|---|---|---|

2050 |

|

|

|

|

2051 |

|

|

|

|

2052 |

|

|

|

|

2053 |

|

|

|

|

2054 |

|

|

|

|

2055 |

|

|

|

|

2056 |

|

|

|

|

2057 |

|

|

|

|

2058 |

|

|

|

|

2059 |

|

|

|

|

2060 |

|

|

|

|

E. Profitability Ratios

Gross Profit Margin Gross profit margin is projected to remain steady at 60% throughout the period, reflecting efficient cost management and strong pricing strategies.

Operating Profit Margin Operating profit margin starts at 20% in 2050 and is expected to gradually increase as operational efficiency improves, reaching 25% by 2060.

Net Profit Margin Net profit margin is projected to increase from 16% in 2050 to approximately 20% by 2060, indicating overall financial health and profitability.

VII. Capital Requirements and Funding

A. Initial Capital Requirements

Seed Capital For the initial phase (2050), [Your Company Name] requires $1,500,000 in seed capital. This capital will be used for product development, market research, initial marketing campaigns, and operational setup.

Working Capital An additional $500,000 is required as working capital to cover day-to-day expenses such as salaries, rent, and utilities for the first year of operations.

Capital Expenditures (CapEx) As mentioned earlier, an initial CapEx of $300,000 is needed for purchasing equipment, technology, and infrastructure.

B. Funding Sources

Equity Financing [Your Company Name] plans to raise $1,500,000 through equity financing in 2050. This will involve offering a 25% equity stake to early investors. The valuation of the company at this stage is projected to be $6,000,000.

Debt Financing To complement equity financing, the company plans to secure a $500,000 loan at an interest rate of 6% per annum. This loan will be used primarily for working capital needs and is expected to be repaid over a 10-year period.

C. Use of Funds

Product Development Approximately 40% of the funds will be allocated to product development, including research and development, testing, and initial production.

Marketing and Sales Marketing and sales efforts will receive 30% of the funds, focusing on brand building, digital marketing campaigns, and expanding the sales team.

Operational Costs The remaining 30% will cover operational costs, including salaries, rent, utilities, and administrative expenses.

D. Capital Structure

The capital structure of [Your Company Name] in 2050 will be a mix of equity and debt. With $1,500,000 in equity and $500,000 in debt, the debt-to-equity ratio will be 0.33, indicating a relatively low level of financial risk.

VIII. Break-even Analysis

A. Break-even Point Calculation

The break-even point is the point at which total revenue equals total expenses, resulting in neither profit nor loss.

Fixed Costs for 2050: $800,000

Selling Price per Unit: $200

Variable Cost per Unit: $80

Break-even Point = 200− 800,000 / 80 = 800,000 / 120 ≈ 6,667 units

B. Break-even Analysis Table (2050-2060)

Year | Fixed Costs | Variable Cost per Unit | Selling Price per Unit | Break-even Point (Units) |

|---|---|---|---|---|

2050 | $800,000 | $80 | $200 | 6,667 |

2051 | $840,000 | $82 | $210 | 6,707 |

2052 | $882,000 | $84 | $220 | 6,738 |

2053 | $926,100 | $86 | $230 | 6,748 |

2054 | $972,405 | $88 | $240 | 6,746 |

2055 | $1,021,025 | $90 | $250 | 6,734 |

2056 | $1,072,076 | $92 | $260 | 6,723 |

2057 | $1,125,680 | $94 | $270 | 6,705 |

2058 | $1,181,964 | $96 | $280 | 6,678 |

2059 | $1,241,062 | $98 | $290 | 6,641 |

2060 | $1,303,115 | $100 | $300 | 6,596 |

C. Break-even Analysis Insights

The break-even analysis reveals that [Your Company Name] will need to sell approximately 6,667 units in 2050 to cover all its fixed and variable costs. As the company grows, the break-even point decreases due to increased efficiency, higher selling prices, and better cost management. By 2060, the break-even point is expected to decrease to around 6,596 units, reflecting improved operational efficiency.

IX. Sensitivity Analysis

A. Impact of Revenue Fluctuations

Optimistic Scenario In an optimistic scenario where revenue grows at a rate of 20% per year, [Your Company Name] could achieve higher profitability and a quicker break-even point. The net profit margin could increase to 25% by 2060, and the company could reach profitability by 2052.

Pessimistic Scenario In a pessimistic scenario where revenue growth slows to 5% per year, the break-even point may not be reached until 2053, and net profit margins could remain at around 15%. This would necessitate tighter cost controls and potentially seeking additional funding to sustain operations.

B. Impact of Cost Variations

Increased Fixed Costs If fixed costs rise by 10% annually instead of the projected 5%, the break-even point would be higher, requiring the company to sell more units to cover expenses. This scenario underscores the importance of controlling fixed costs, especially in the early years.

Fluctuations in Variable Costs If variable costs increase due to rising material prices or labor costs, the gross profit margin could shrink, affecting overall profitability. Maintaining strong supplier relationships and exploring cost-saving measures would be critical in such a scenario.

C. Scenario Analysis Table (2050-2060) Continued

Year | Base Revenue | Optimistic Revenue (+20%) | Pessimistic Revenue (+5%) | Base Net Profit | Optimistic Net Profit | Pessimistic Net Profit |

|---|---|---|---|---|---|---|

2050 | $2,000,000 | $2,400,000 | $2,100,000 | $320,000 | $576,000 | $336,000 |

2051 | $2,200,000 | $2,640,000 | $2,310,000 | $368,000 | $633,600 | $352,800 |

2052 | $2,420,000 | $2,904,000 | $2,425,500 | $401,600 | $707,760 | $371,040 |

2053 | $2,662,000 | $3,194,400 | $2,551,775 | $536,880 | $804,288 | $391,566 |

2054 | $2,928,200 | $3,613,840 | $2,679,364 | $627,612 | $925,539 | $413,194 |

2055 | $3,221,020 | $3,865,224 | $2,818,332 | $729,270 | $1,104,136 | $437,050 |

2056 | $3,704,173 | $4,444,948 | $2,968,249 | $920,342 | $1,472,338 | $463,380 |

2057 | $4,259,799 | $5,111,759 | $3,130,661 | $1,144,159 | $1,759,583 | $492,249 |

2058 | $4,898,768 | $6,058,521 | $3,306,194 | $1,405,837 | $2,058,847 | $523,774 |

2059 | $5,633,584 | $7,159,001 | $3,495,504 | $1,711,271 | $2,469,553 | $558,048 |

2060 | $6,478,622 | $8,773,346 | $3,699,279 | $2,065,945 | $2,906,055 | $595,084 |

D. Sensitivity Analysis Insights

Revenue Fluctuations: The sensitivity analysis shows that an optimistic revenue growth scenario can significantly enhance profitability, with net profit potentially reaching $2,906,055 by 2060. Conversely, in a pessimistic scenario with slower revenue growth, net profit might only be $595,084, highlighting the importance of robust revenue growth strategies.

Cost Variations: Increased fixed or variable costs can negatively impact profitability. For instance, a 10% annual increase in fixed costs or a rise in variable costs could significantly elevate the break-even point, necessitating adjustments in pricing strategies or cost control measures to maintain profitability.

X. Financial Risks and Mitigation Strategies

A. Market Risk

Risk Description: Market risk involves fluctuations in market demand, competition, and economic conditions. A downturn in the market or increased competition could affect [Your Company Name]'s revenue and profitability.

Mitigation Strategies:

Diversification: Expand product offerings and enter new markets to reduce dependency on a single revenue stream.

Market Research: Conduct regular market research to anticipate trends and adapt strategies accordingly.

Competitive Analysis: Monitor competitors and adjust pricing, marketing, and product features to stay competitive.

B. Operational Risk

Risk Description: Operational risk includes disruptions in supply chains, production issues, and inefficient processes. These risks can impact the company’s ability to deliver products and services effectively.

Mitigation Strategies:

Supplier Relationships: Develop strong relationships with multiple suppliers to ensure a reliable supply chain.

Process Improvement: Implement continuous improvement practices and invest in technology to enhance operational efficiency.

Contingency Planning: Prepare contingency plans for potential disruptions to minimize operational impact.

C. Financial Risk

Risk Description: Financial risk involves factors such as interest rate fluctuations, currency exchange rate changes, and liquidity issues. These risks can affect financial stability and borrowing costs.

Mitigation Strategies:

Hedging: Use financial instruments to hedge against interest rate and currency fluctuations.

Liquidity Management: Maintain a sufficient cash reserve and monitor cash flow closely to ensure liquidity.

Debt Management: Structure debt carefully and consider refinancing options to manage interest costs.

D. Legal and Regulatory Risk

Risk Description: Legal and regulatory risk involves changes in laws and regulations that could impact [Your Company Name]’s operations and compliance requirements.

Mitigation Strategies:

Compliance: Stay informed about relevant laws and regulations and ensure compliance through regular audits and legal consultations.

Legal Counsel: Engage legal experts to address potential legal issues and navigate complex regulatory environments.

Risk Assessment: Conduct regular risk assessments to identify and address potential legal and regulatory challenges.

XI. Conclusion

A. Summary of Financial Projections

[Your Company Name]'s financial projections for 2050 and beyond indicate a positive growth trajectory, with steady revenue increases, improving profitability, and manageable capital requirements. The detailed projections provide a clear roadmap for the company’s financial strategy, highlighting the importance of effective cost management, revenue growth, and strategic funding.

B. Strategic Recommendations

Focus on Revenue Growth: Implement aggressive marketing and sales strategies to drive revenue growth, ensuring that the company achieves its financial targets and maintains a strong market position.

Cost Management: Continue to optimize operational efficiency and control costs to enhance profitability and manage financial risks effectively.

Funding and Capital Structure: Secure necessary funding through a balanced mix of equity and debt financing, maintaining a manageable debt-to-equity ratio and ensuring financial stability.

Risk Management: Proactively address potential risks through robust mitigation strategies, including market research, operational improvements, and legal compliance.

Long-term Planning: Develop long-term financial plans and projections to guide strategic decisions and ensure sustainable growth and profitability over the coming decades.

C. Future Outlook

Looking ahead to 2060 and beyond, [Your Company Name] is well-positioned for continued growth and success. By adhering to the financial projections and strategic recommendations outlined in this document, the company can navigate challenges, capitalize on opportunities, and achieve its long-term financial goals.

This comprehensive financial projection provides a detailed blueprint for [Your Company Name]'s financial management and growth strategy, ensuring that the company remains on track to achieve its objectives and deliver value to stakeholders.