Accounting Expense Forecast

I. Introduction

In today's competitive business environment, maintaining a clear and actionable financial plan is crucial for the success of [Your Company Name]. To support this objective, an accurate accounting expense forecast is indispensable. This forecast outlines anticipated expenses over the upcoming fiscal year, providing a structured approach to financial planning and management. By predicting future costs, [Your Company Name] can make well-informed decisions, optimize resource allocation, and safeguard against potential financial shortfalls.

The process of creating an expense forecast involves a meticulous review of past financial performance, industry benchmarks, and specific organizational needs. This includes detailed projections across various expense categories such as operational costs, administrative overhead, and capital investments. Each category is assessed based on historical data, current economic conditions, and planned business activities. This detailed forecasting allows [Your Company Name] to identify cost-saving opportunities and strategically invest in areas that will drive growth.

Effective expense forecasting not only aids in creating a robust budget but also enhances financial control and transparency. By setting realistic financial targets and regularly monitoring performance against these targets, [Your Company Name] can adapt to changing conditions and achieve its strategic goals. Furthermore, a well-prepared forecast supports clear communication with stakeholders, ensuring that investors, lenders, and other parties have a comprehensive understanding of the company’s financial outlook.

II. Expense Categories

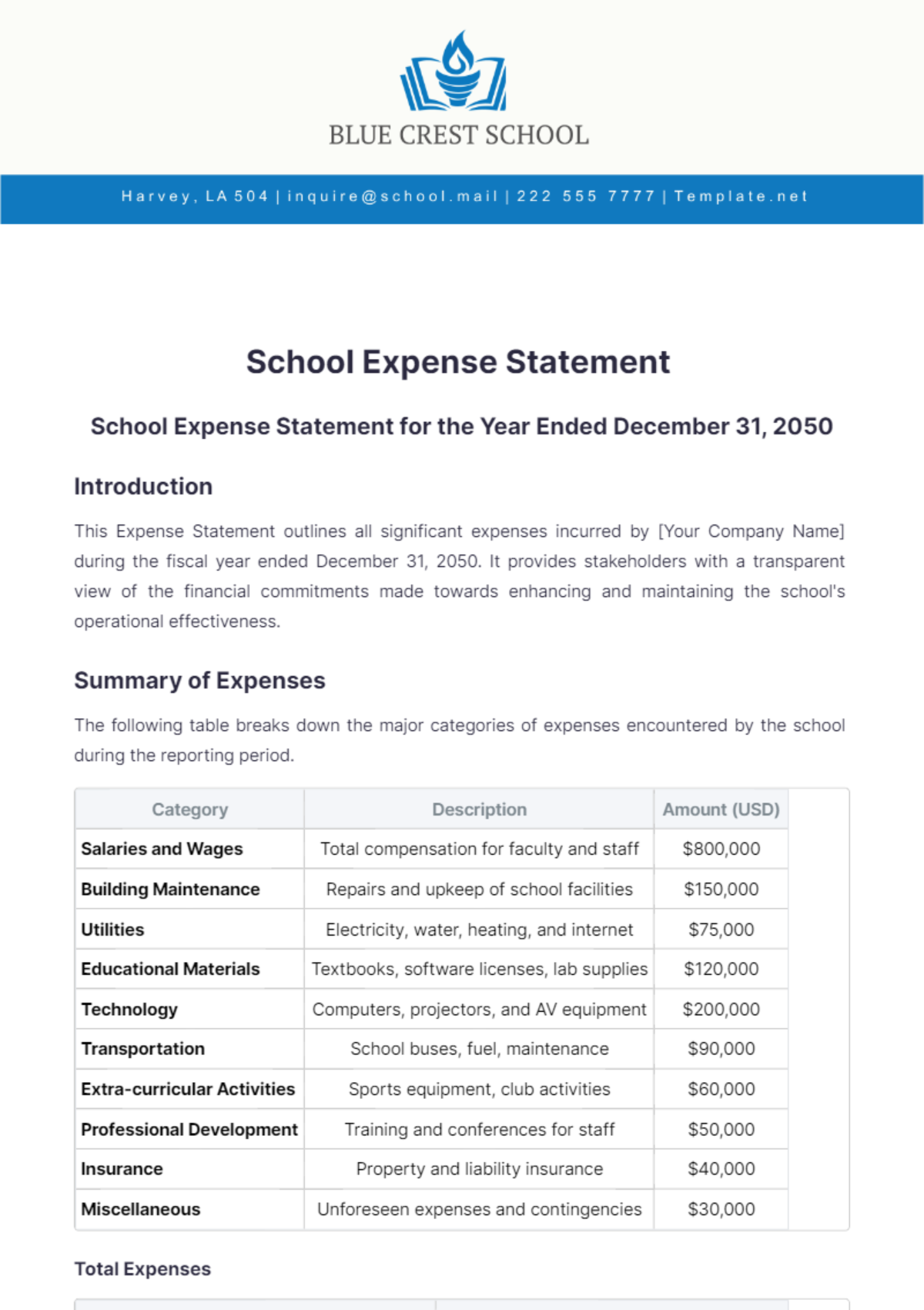

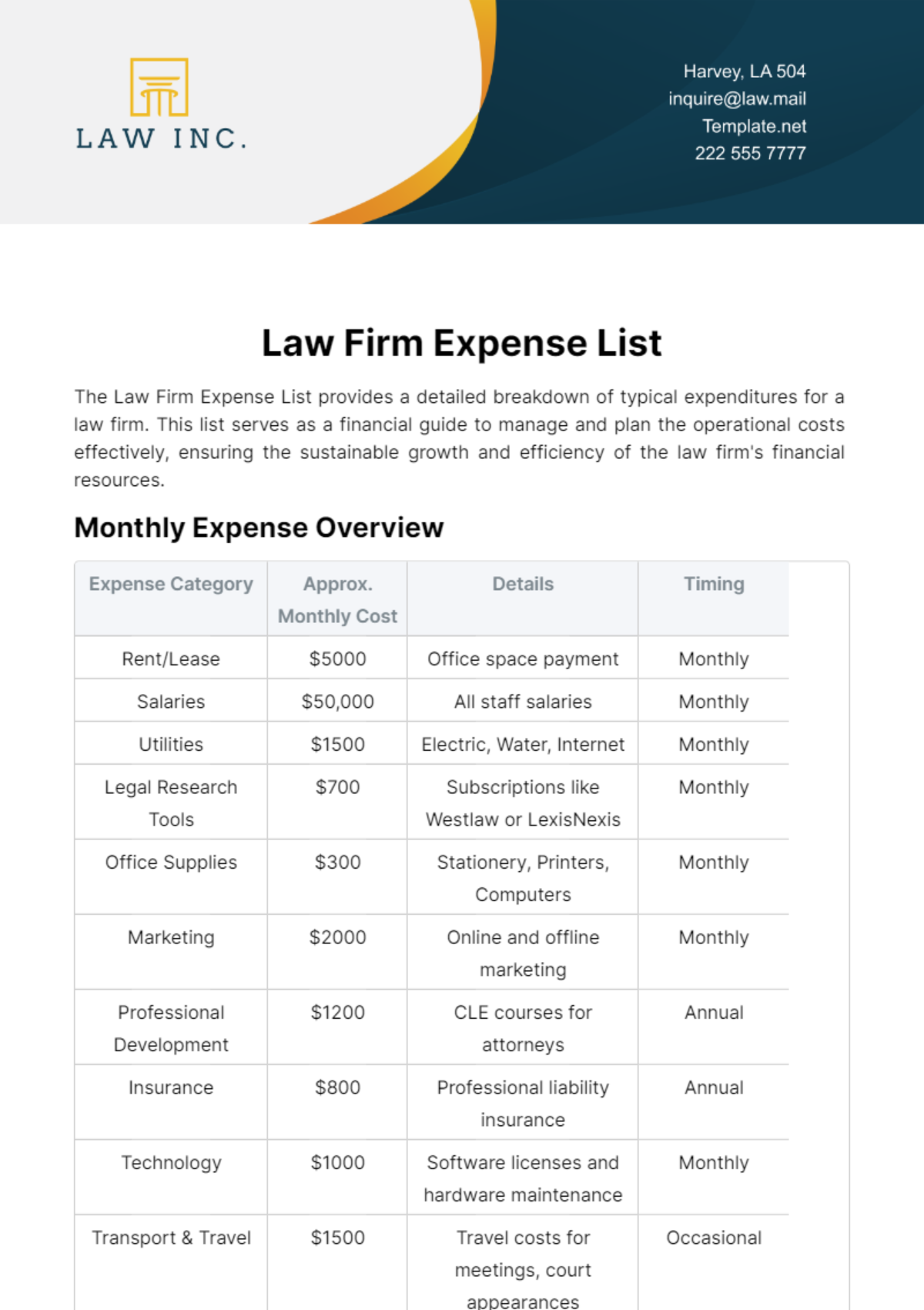

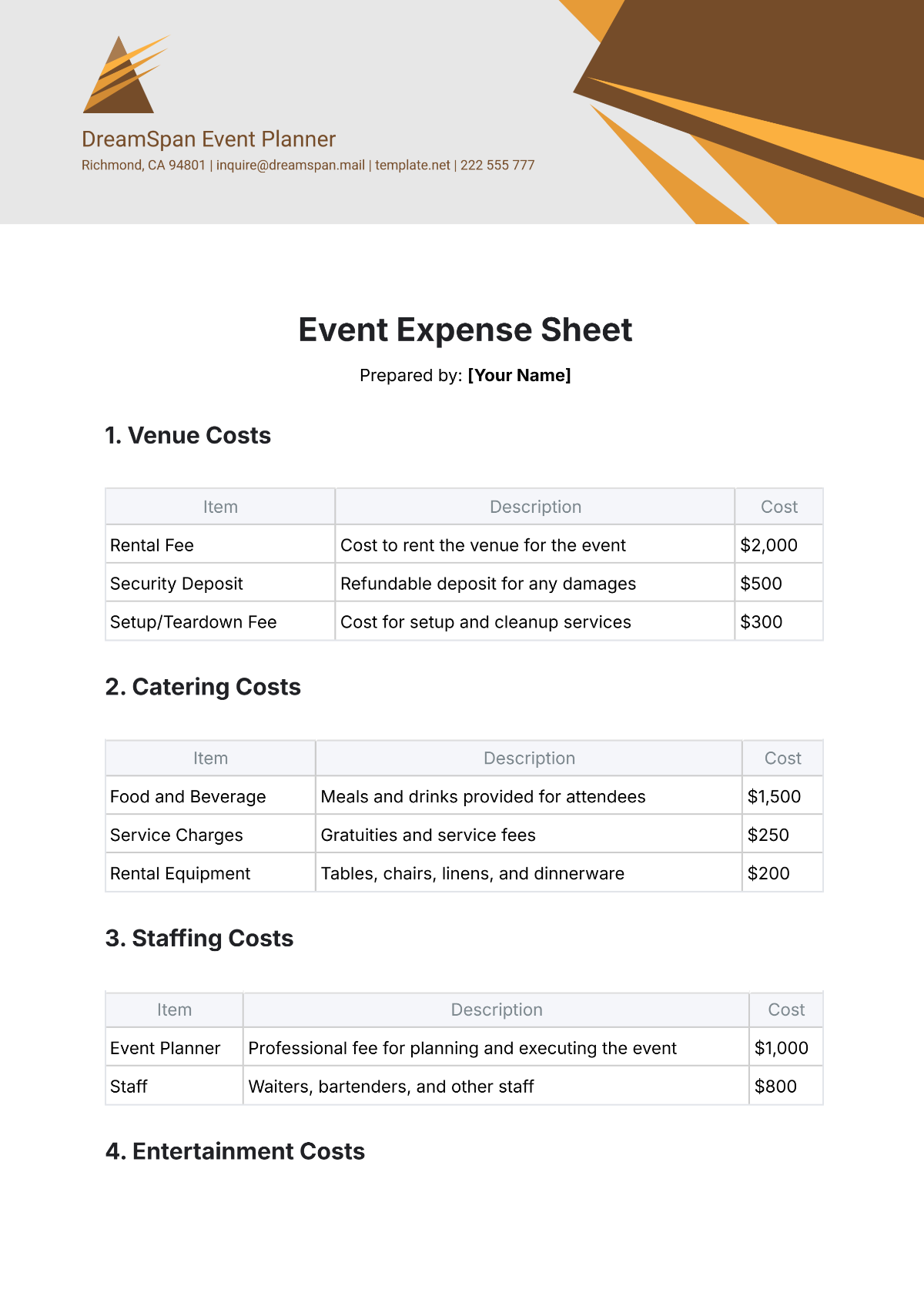

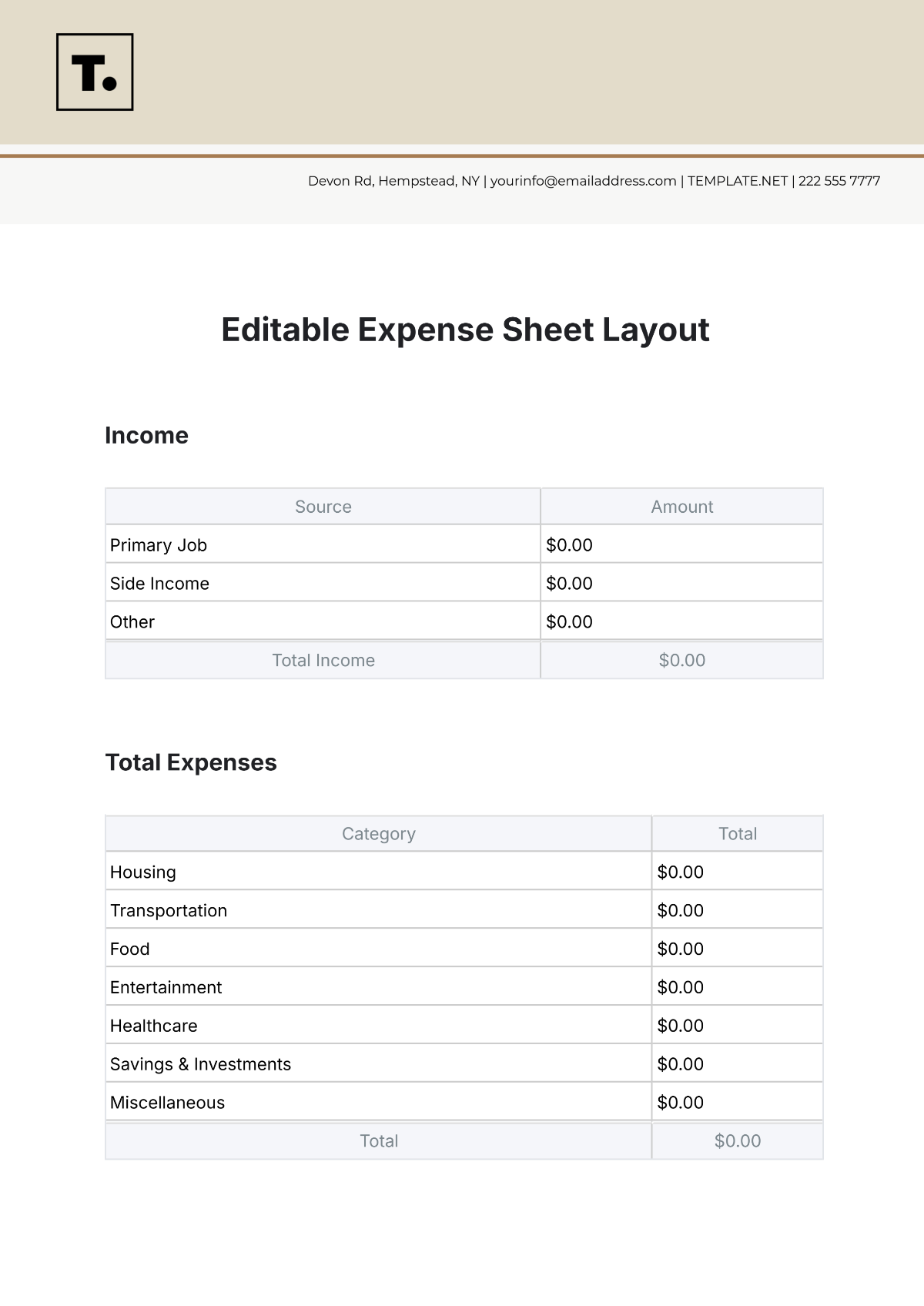

Effective financial management at [Your Company Name] hinges on a clear understanding of expense distribution across various categories. By categorizing expenses, [Your Company Name] can more accurately track and control spending, ensuring that resources are allocated efficiently and strategic goals are met. Each expense category reflects a critical area of business operations, from daily activities to long-term investments.

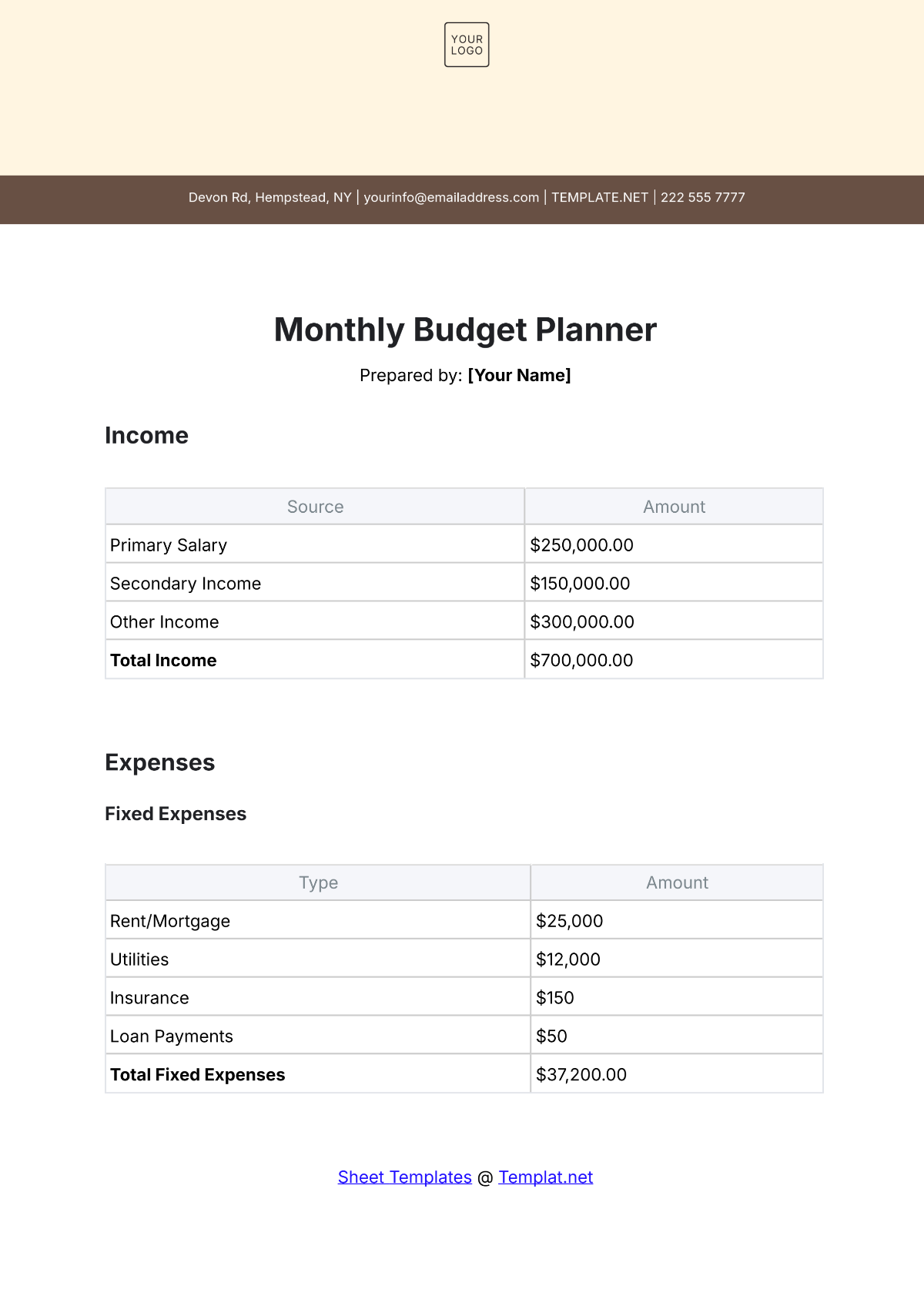

The following table provides a detailed breakdown of the primary expense categories for [Your Company Name]. It offers a structured view of how expenses are distributed, encompassing everything from personnel costs to capital expenditures. This breakdown helps in monitoring expenditures, planning budgets, and making informed financial decisions.

Expense Category | Description |

|---|---|

Personnel Costs | Salaries, wages, benefits, and other compensation for employees. |

Operational Expenses | Day-to-day expenses required to run the business, such as utilities, rent, and supplies. |

Marketing & Promotional Expenses | Costs associated with advertising, promotions, and public relations efforts. |

Research & Development | Investments in developing new products or services and enhancing existing ones. |

Capital Expenditures | Expenditures for purchasing or upgrading long-term assets like equipment, property, or technology. |

Miscellaneous Expenses | Other expenses that do not fall into the above categories, including unforeseen or irregular costs. |

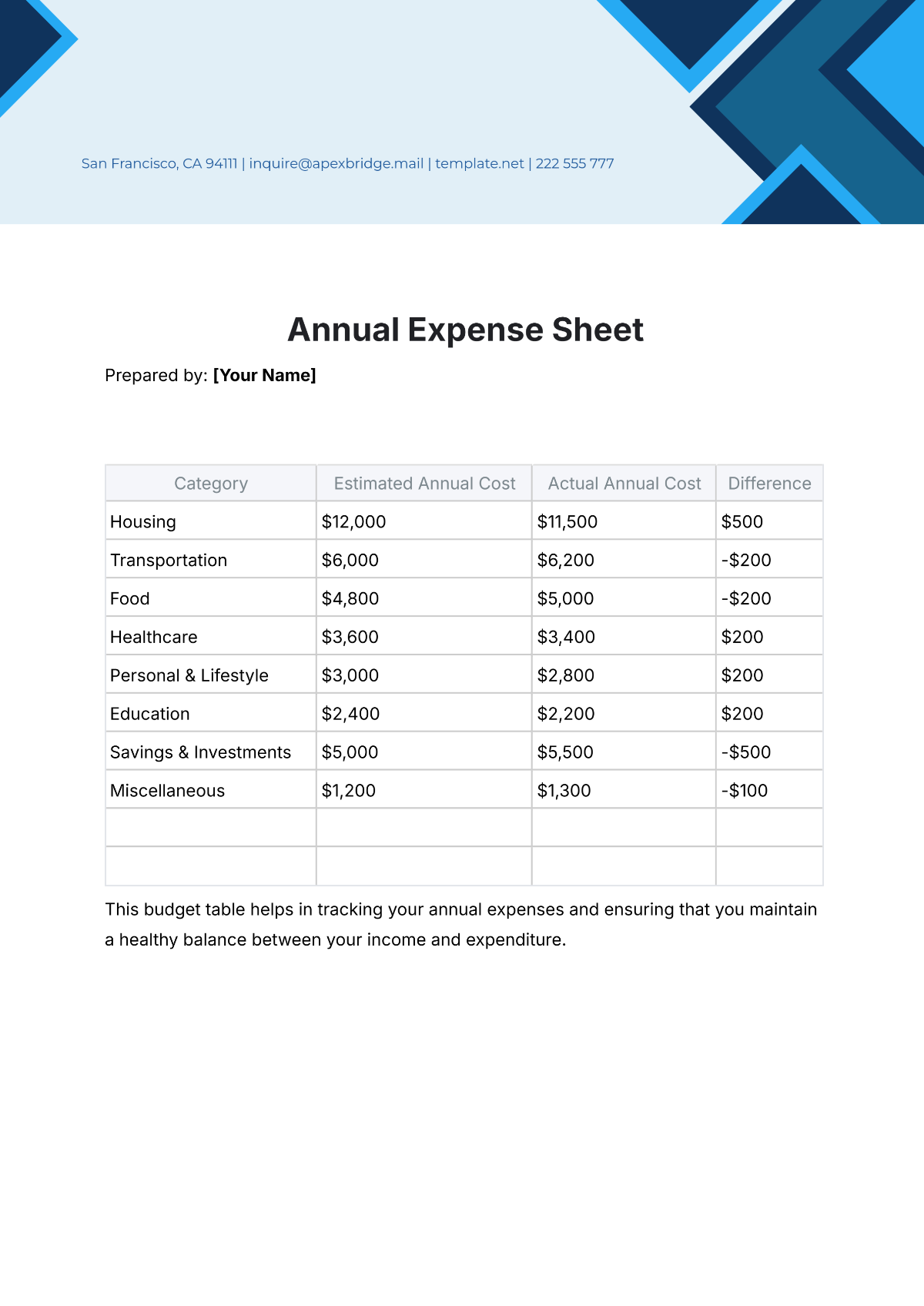

III. Expense Breakdown

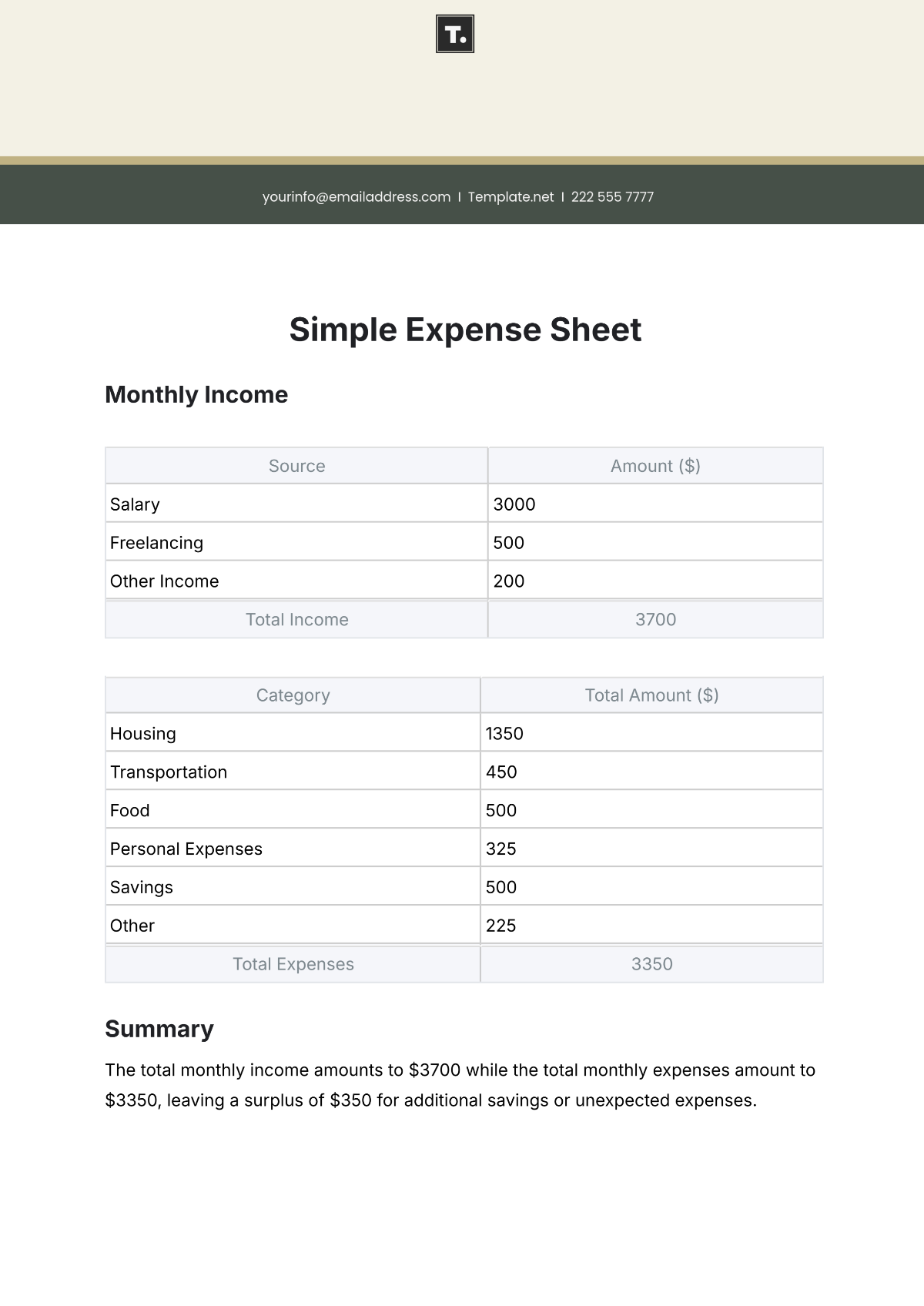

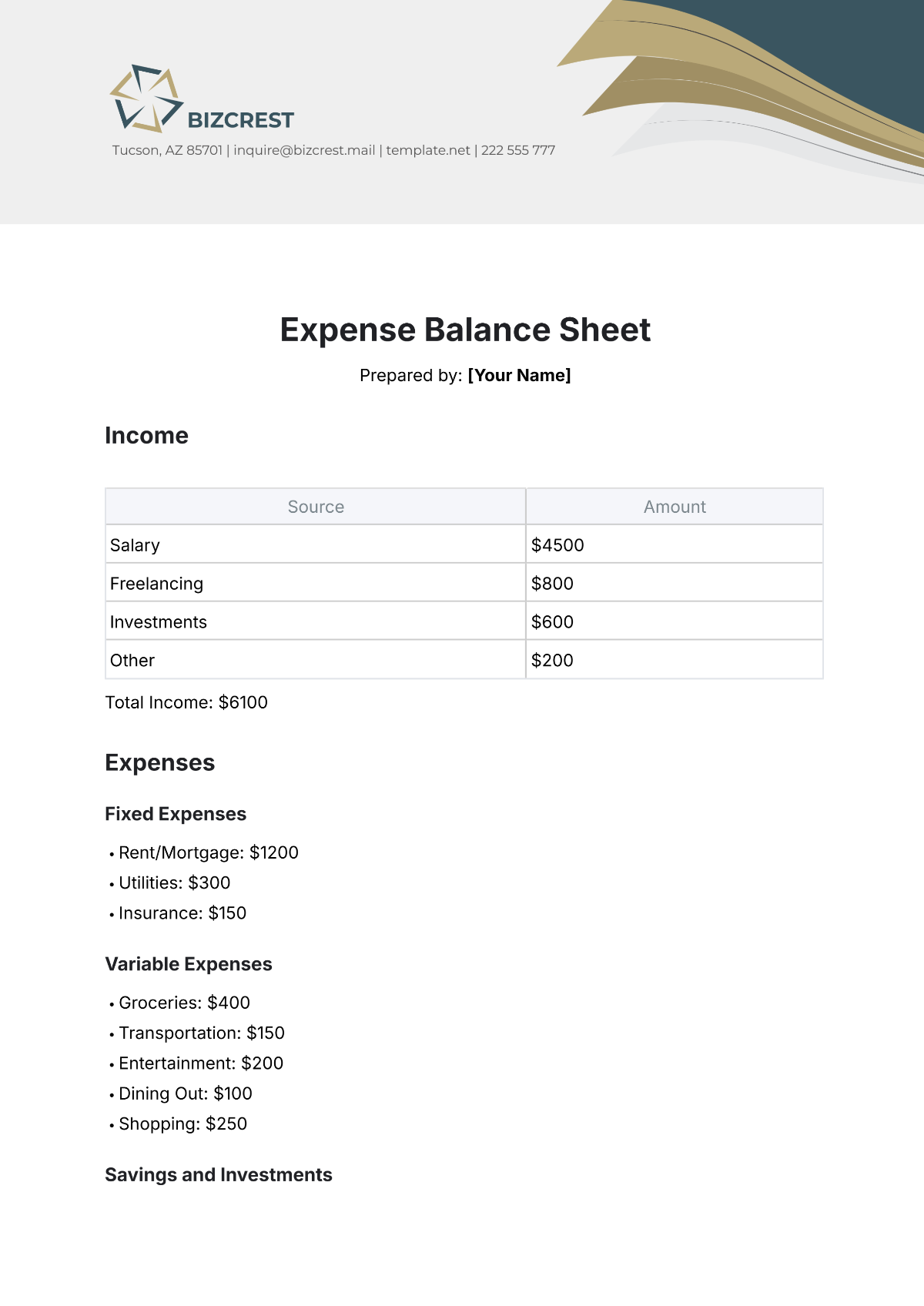

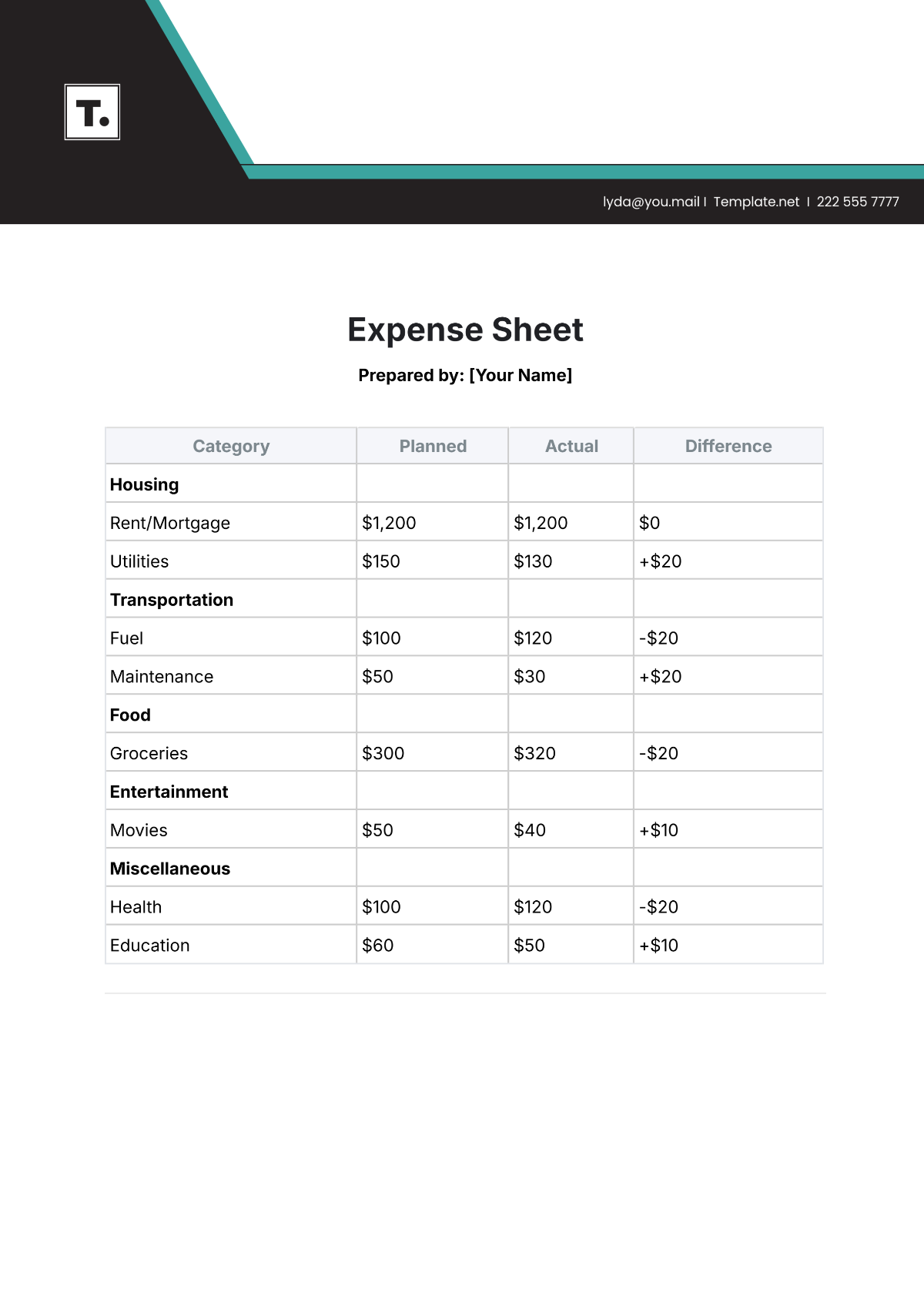

Understanding how expenses are distributed throughout the fiscal year is vital for effective financial management at [Your Company Name]. The Expense Breakdown section provides a detailed quarterly analysis of each expense category, allowing for a clear view of spending trends and financial commitments over time. By examining the expenses across quarters, [Your Company Name] can better manage cash flow, anticipate future financial needs, and adjust strategies as necessary. The following table outlines the forecasted expenditures for each category, offering insights into how funds are allocated and highlighting areas for potential adjustment.

Category | Q1 | Q2 | Q3 | Q4 | Total |

|---|---|---|---|---|---|

Personnel Costs | $150,000 | $160,000 | $170,000 | $180,000 | $660,000 |

Operational Expenses | $100,000 | $110,000 | $120,000 | $130,000 | $460,000 |

Marketing & Promotional Expenses | $50,000 | $60,000 | $70,000 | $80,000 | $260,000 |

Research & Development | $200,000 | $220,000 | $240,000 | $260,000 | $920,000 |

Capital Expenditures | $300,000 | $320,000 | $340,000 | $360,000 | $1,320,000 |

Miscellaneous Expenses | $20,000 | $30,000 | $40,000 | $50,000 | $140,000 |

IV. Conclusion

Based on the comprehensive expense forecast detailed above, the total projected expenditures for [Your Company Name] for the upcoming fiscal year are estimated to be $3,760,000. This forecast encompasses all major expense categories, including personnel costs, operational expenses, marketing and promotional activities, research and development, capital expenditures, and miscellaneous expenses. By providing a clear and detailed breakdown of anticipated costs, this forecast serves as a crucial tool for financial planning and budget allocation. It ensures that [Your Company Name]'s expenditures are strategically aligned with its business objectives and financial goals.

The forecast is intended to guide the company in making informed financial decisions and optimizing resource allocation throughout the year. It is essential to regularly review and adjust the forecast as needed to account for any changes in business conditions or unforeseen expenses. For further details on the methodologies and references used to develop this forecast, or if you have any questions regarding the financial planning process, please reach out to us at [Your Company Email]. Our team is available to provide additional insights and support to ensure that [Your Company Name] remains on track to achieve its financial and strategic objectives.