Accounting Tax Preparation Checklist

Ensure a smooth tax filing process by gathering all necessary documents and information. Use this checklist to stay organized.

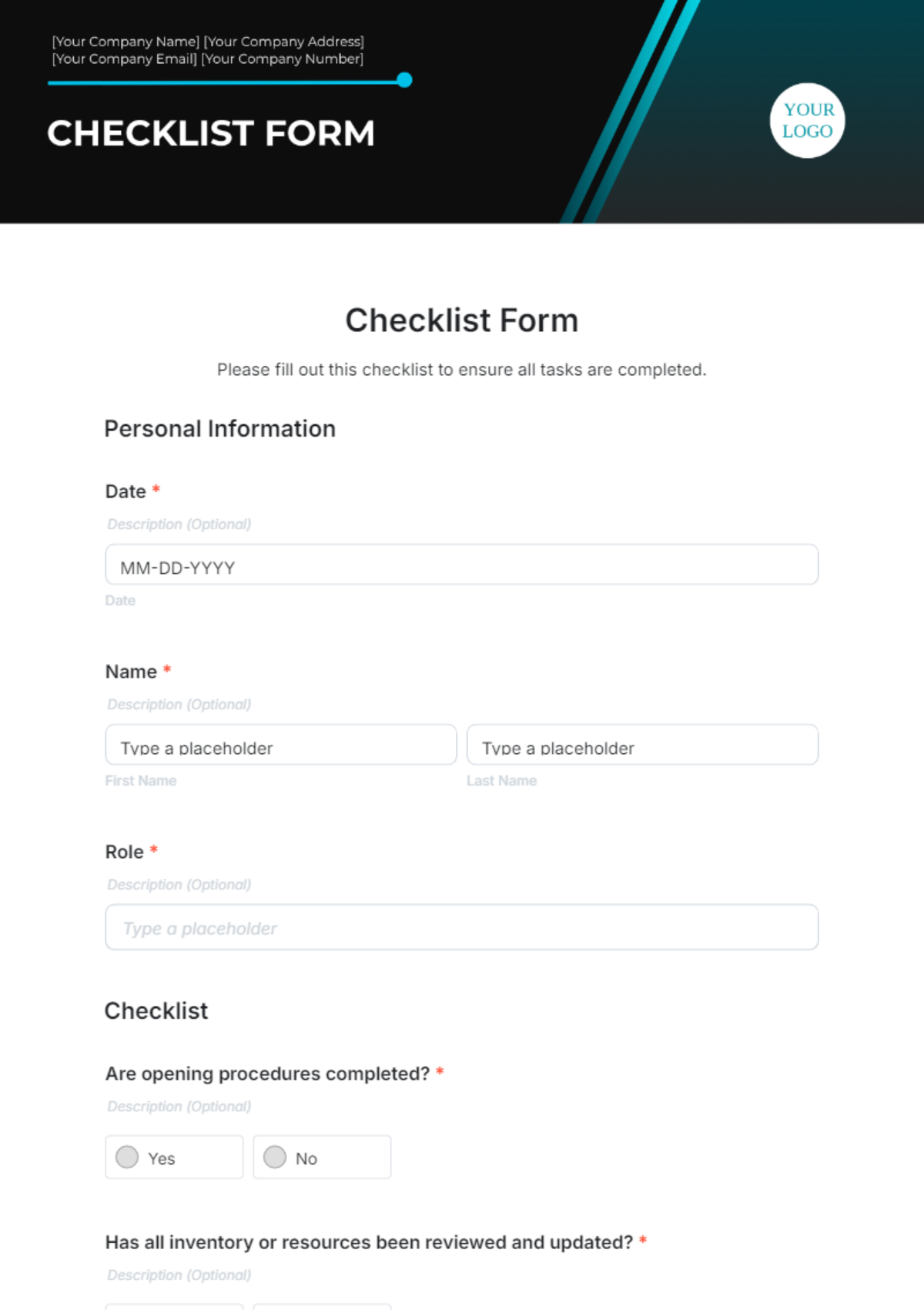

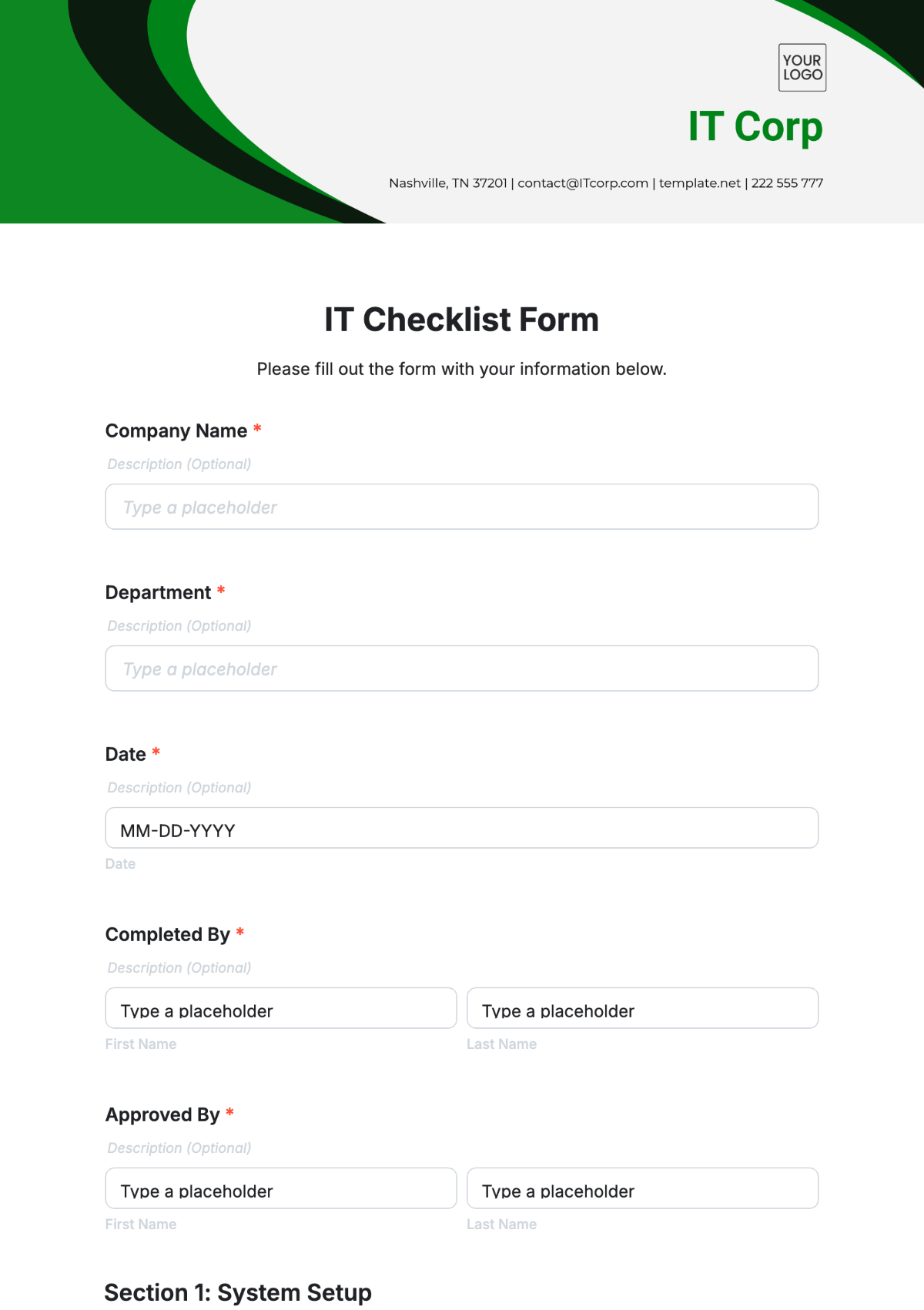

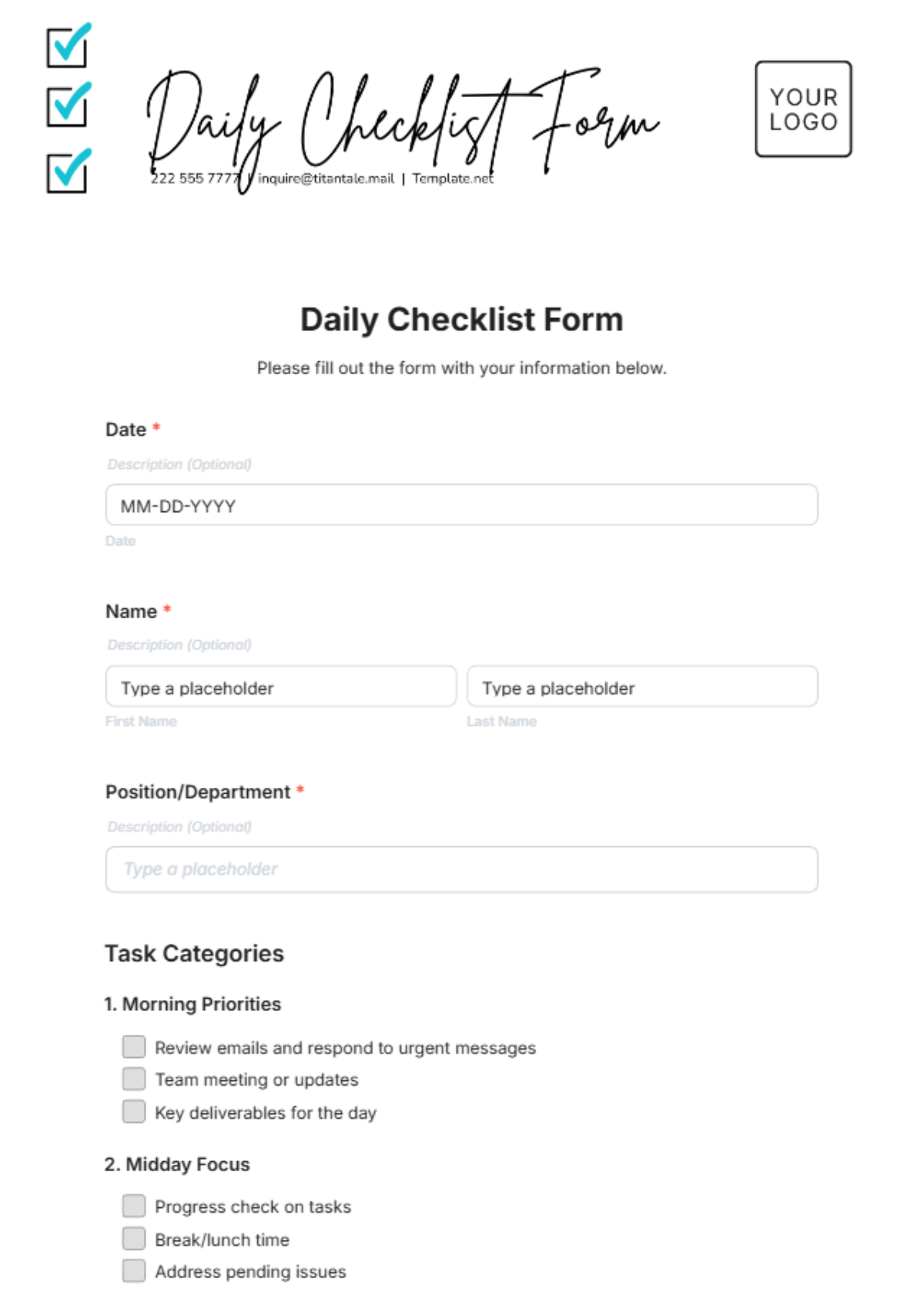

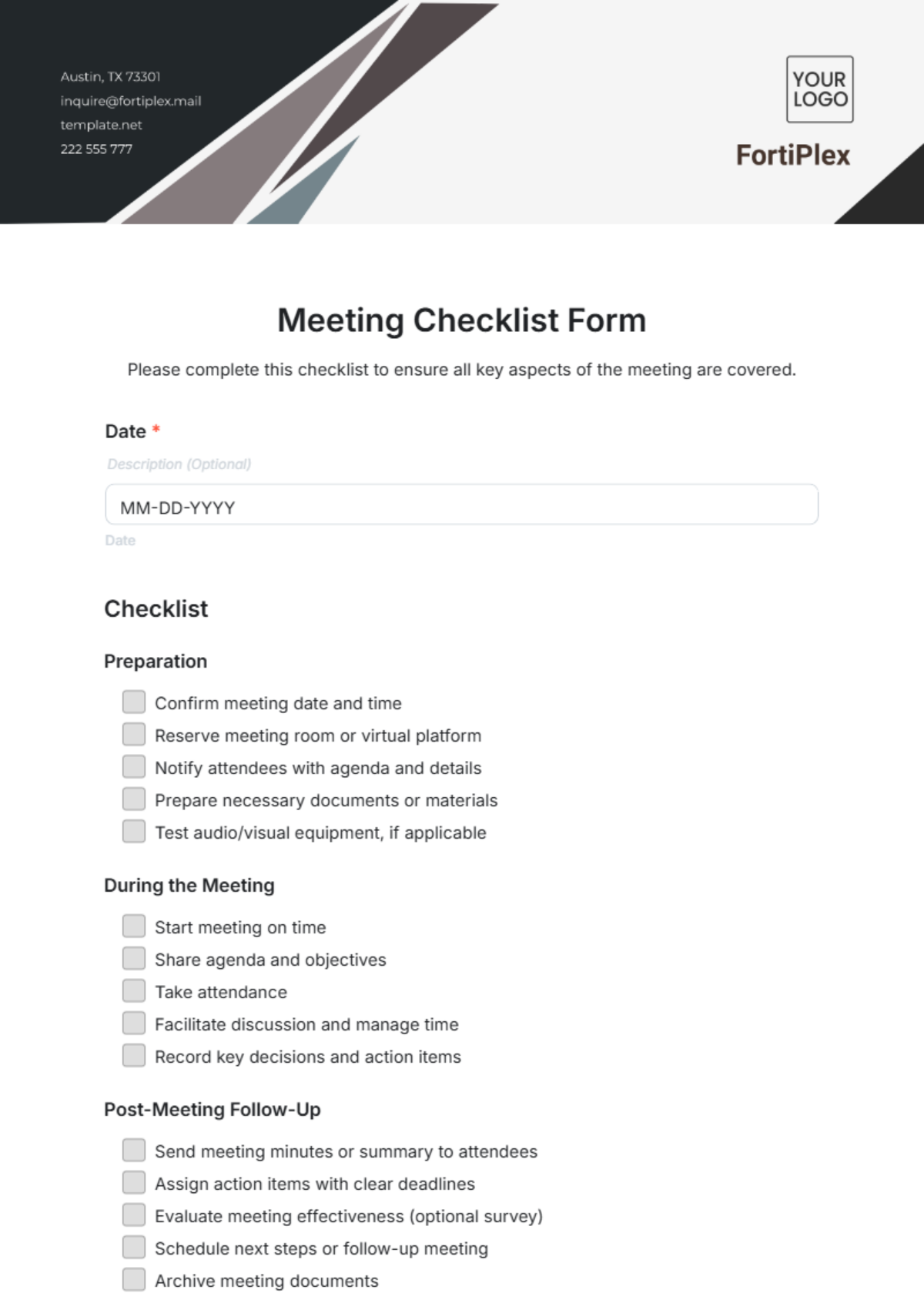

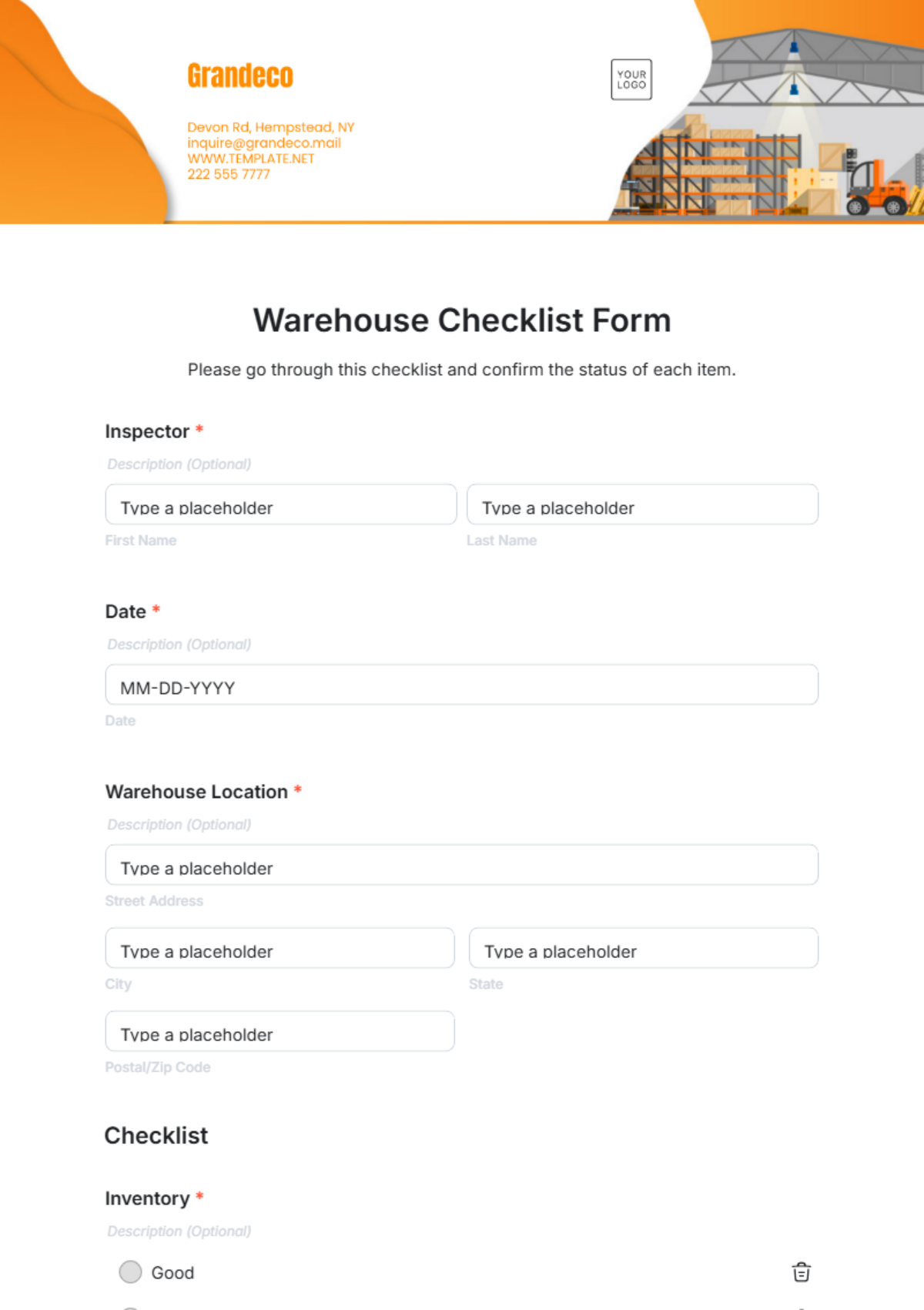

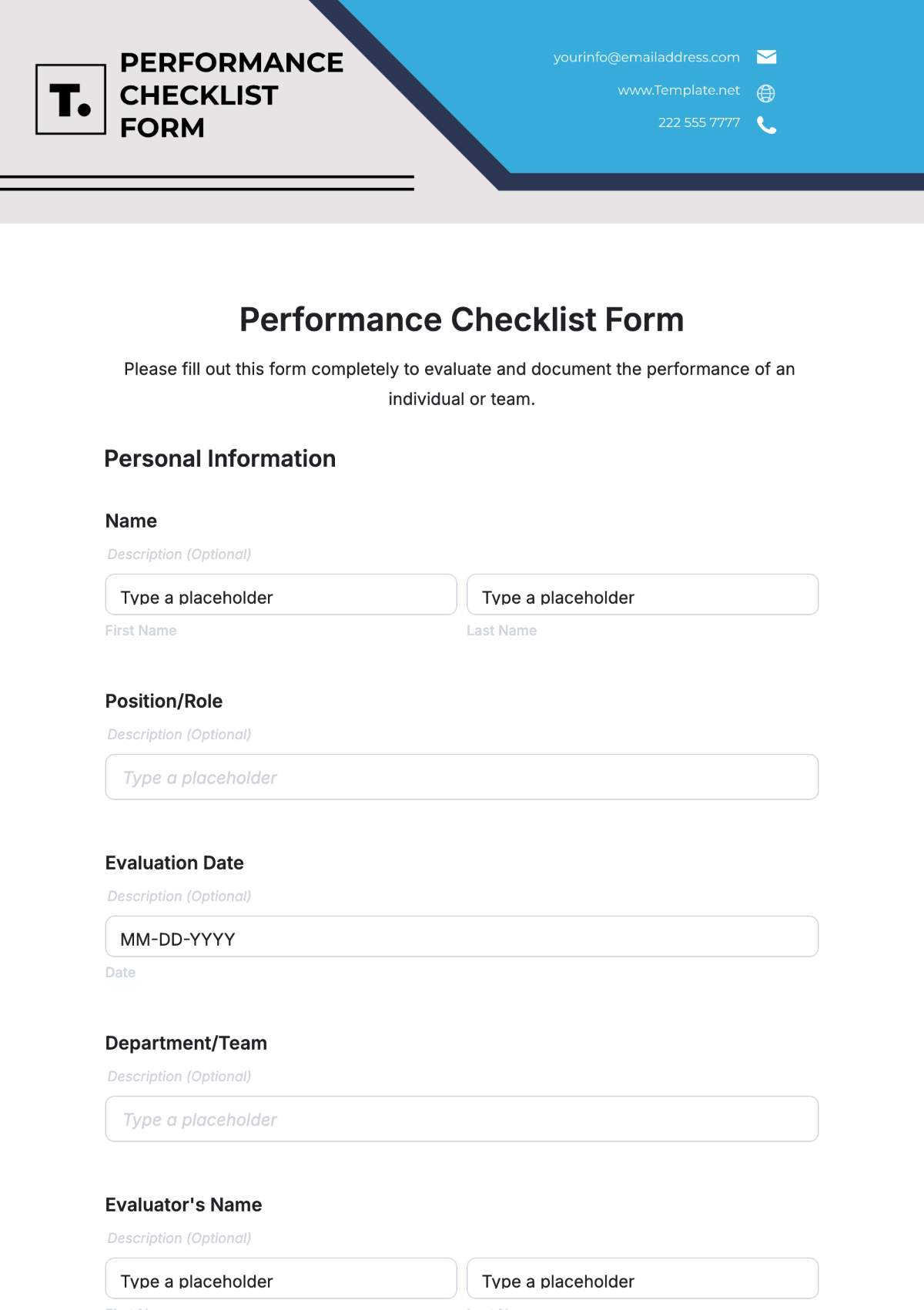

Name

Phone number

Personal Information

Social Security Numbers (for you and dependents)

Previous year’s tax return

Income Documentation

W-2 forms

1099 forms

Self-employment income

Rental income records

Interest and dividend statements

K-1 forms

Deductions and Credits

Receipts for deductible expenses

Mortgage interest statements

Property tax statements

Education expenses (1098-T)

Childcare expenses

Retirement contributions

Business expenses

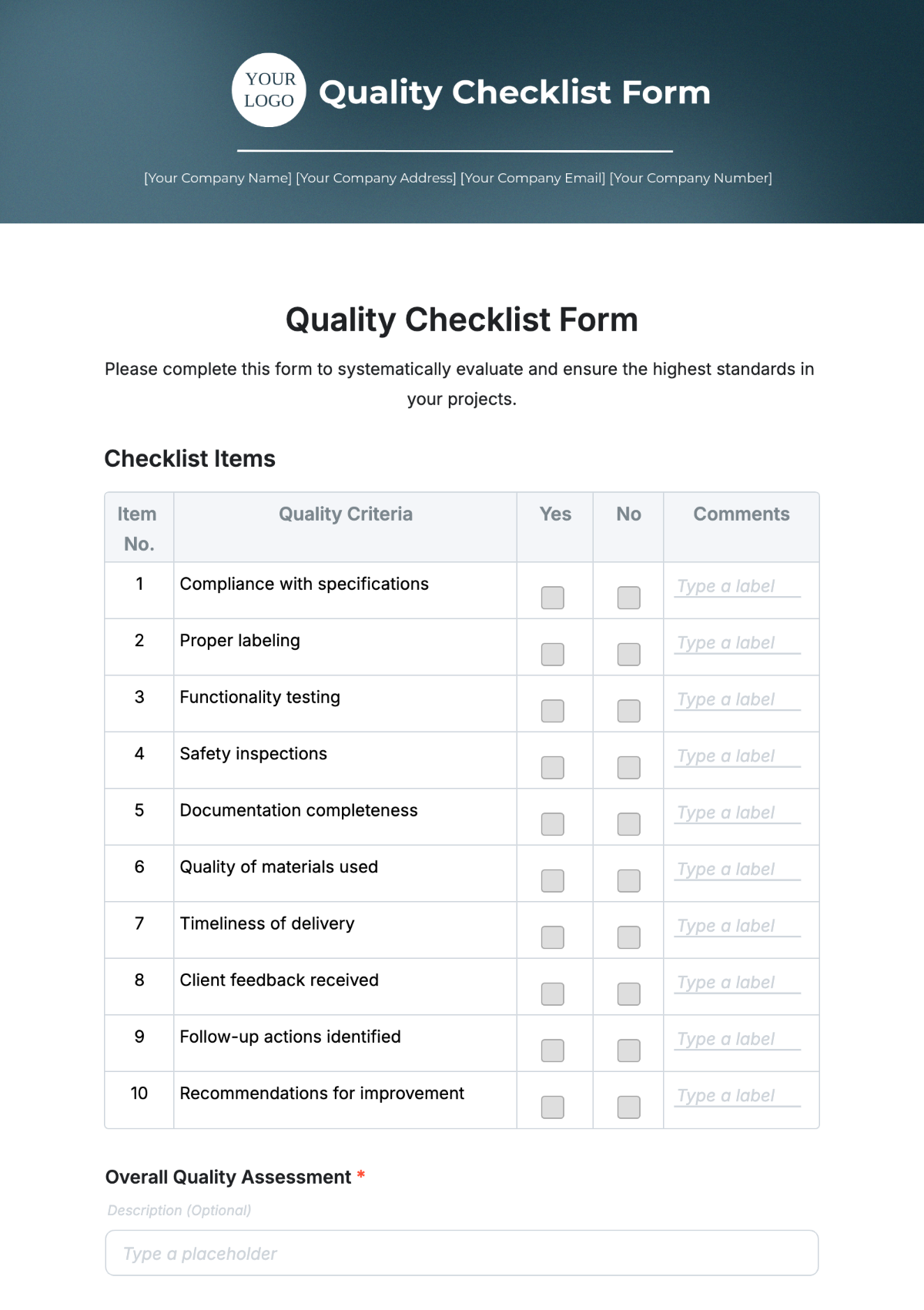

Investment Information

Year-end investment statements

Records of capital gains/losses

Health Insurance Information

Form 1095-A, 1095-B, or 1095-C

HSA contribution records

Business Documentation (if applicable)

Profit and loss statements

Balance sheets

Inventory records

Mileage logs

Business licenses/permits

Other Relevant Documents

Tax credits and deductions

Documentation for tax payments made

Correspondence from the IRS

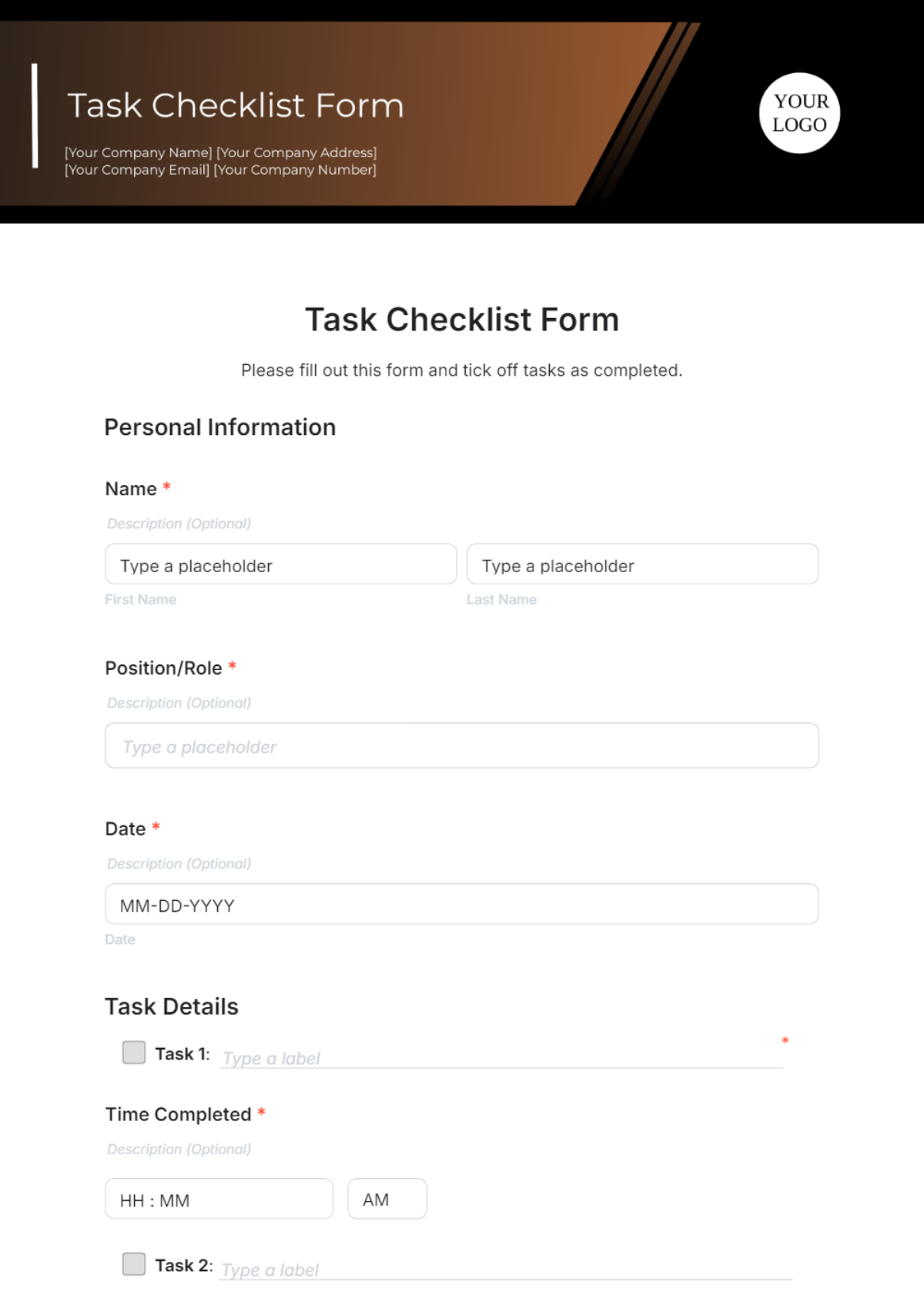

Final Steps

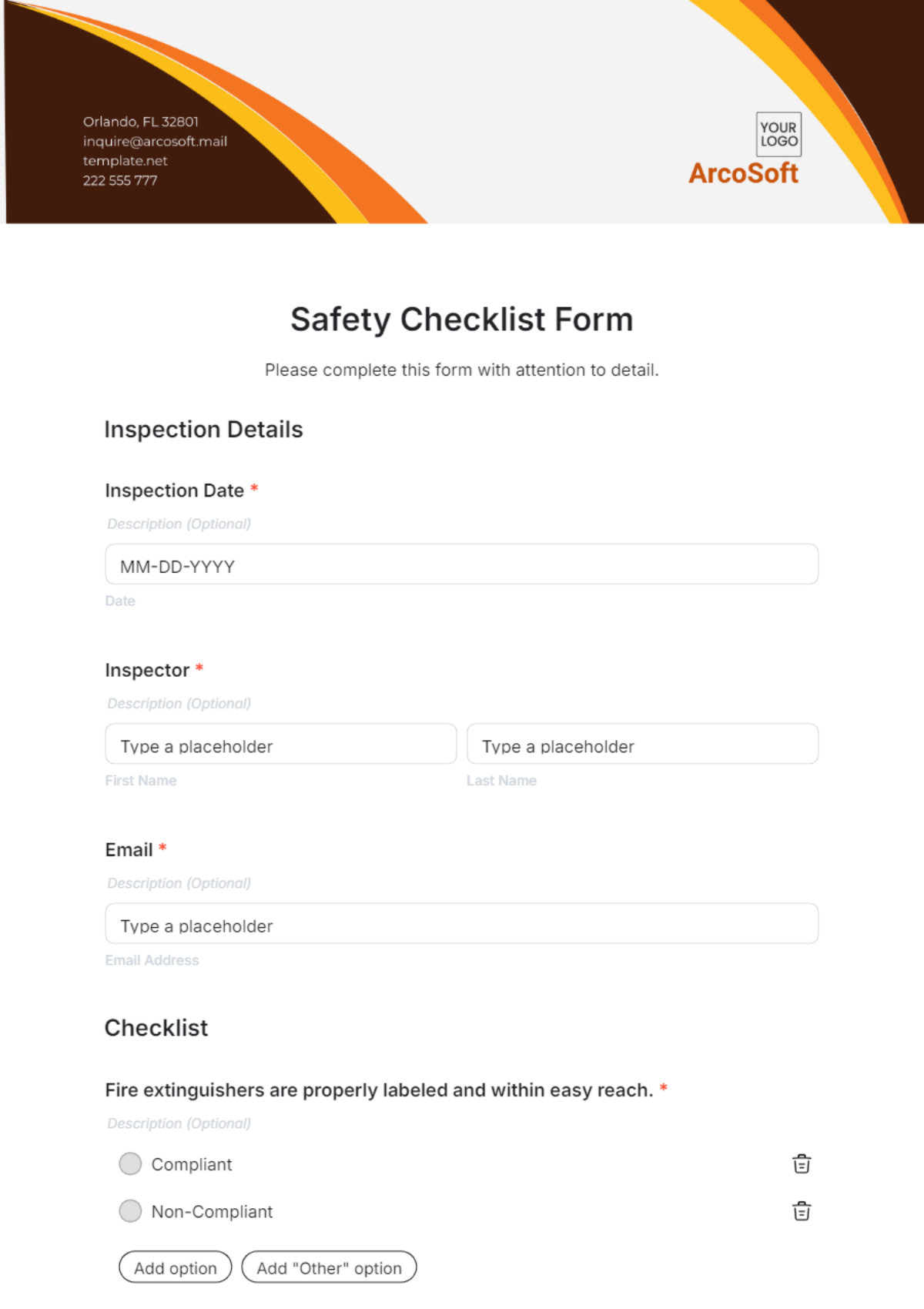

Review documents for accuracy

Organize systematically

Schedule a meeting with a tax professional, if needed