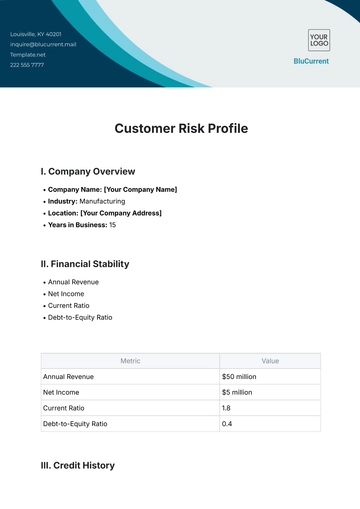

Free Customer Risk Profile

I. Company Overview

Company Name: [Your Company Name]

Industry: Manufacturing

Location: [Your Company Address]

Years in Business: 15

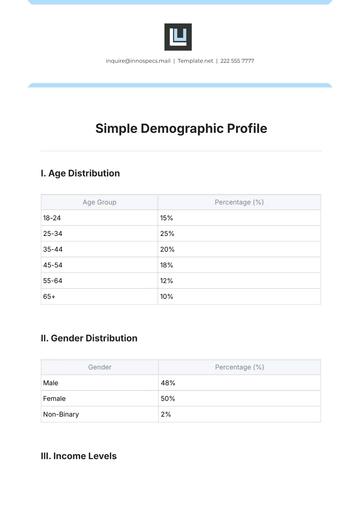

II. Financial Stability

Annual Revenue

Net Income

Current Ratio

Debt-to-Equity Ratio

Metric | Value |

|---|---|

Annual Revenue | $50 million |

Net Income | $5 million |

Current Ratio | 1.8 |

Debt-to-Equity Ratio | 0.4 |

III. Credit History

Credit Rating

Outstanding Loans

Credit Utilization

Metric | Value |

|---|---|

Credit Rating | A |

Outstanding Loans | $10 million |

Credit Utilization | 30% |

IV. Transaction Patterns

Average Monthly Transactions

Transaction Volume

Payment Behavior

Metric | Value |

|---|---|

Average Monthly Transactions | 50 |

Transaction Volume | $1 million |

Payment Behavior | 95% on time; 5% overdue by 10 days |

V. Compliance and Legal Risks

Regulatory Compliance: No known issues with industry regulations

Legal History: No ongoing or past litigation

Compliance Audits: Passed all recent audits with no significant findings

VI. Risk Assessment

Overall Risk Rating: Low

Key Risks Identified:

Economic Downturn: Potential impact on revenue if economic conditions worsen

Supply Chain Disruptions: Possible risk due to reliance on international suppliers

VII. Recommendations

Monitoring: Continue regular monitoring of financial statements and transaction patterns

Credit Terms: Maintain current credit terms with periodic reviews

Risk Mitigation: Develop contingency plans for supply chain disruptions

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

This Customer Risk Profile Template from Template.net can help you recognize and control possible hazards. This fully editable and customisable template aids in the documentation and evaluation of risks associated with customers. To provide a thorough and proactive approach to risk management, customize the template using our AI Editor Tool to meet your unique requirements.