Free Personal Finance Datasheet Format

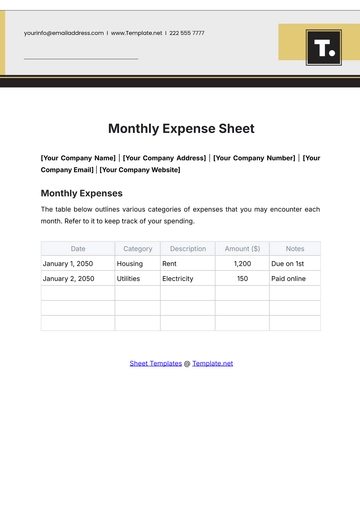

Date Created:

Enter the date this datasheet is created to track the document's timeline.

Prepared By:

Enter your name or the name of the individual responsible for preparing the datasheet.

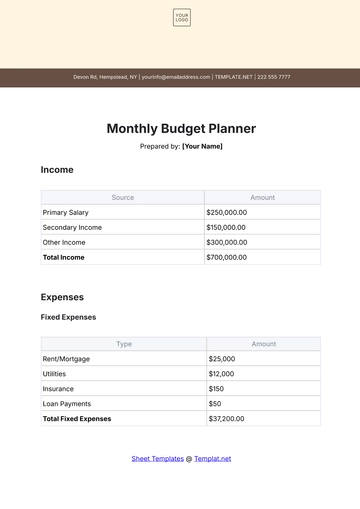

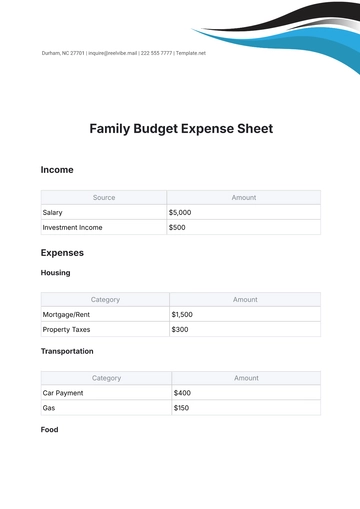

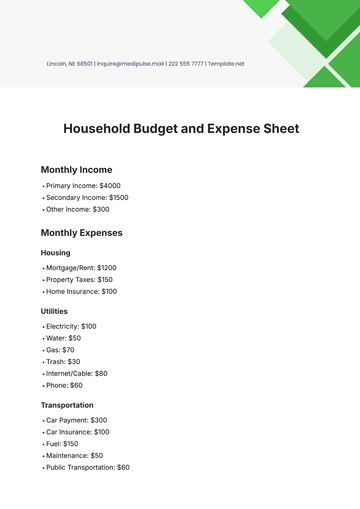

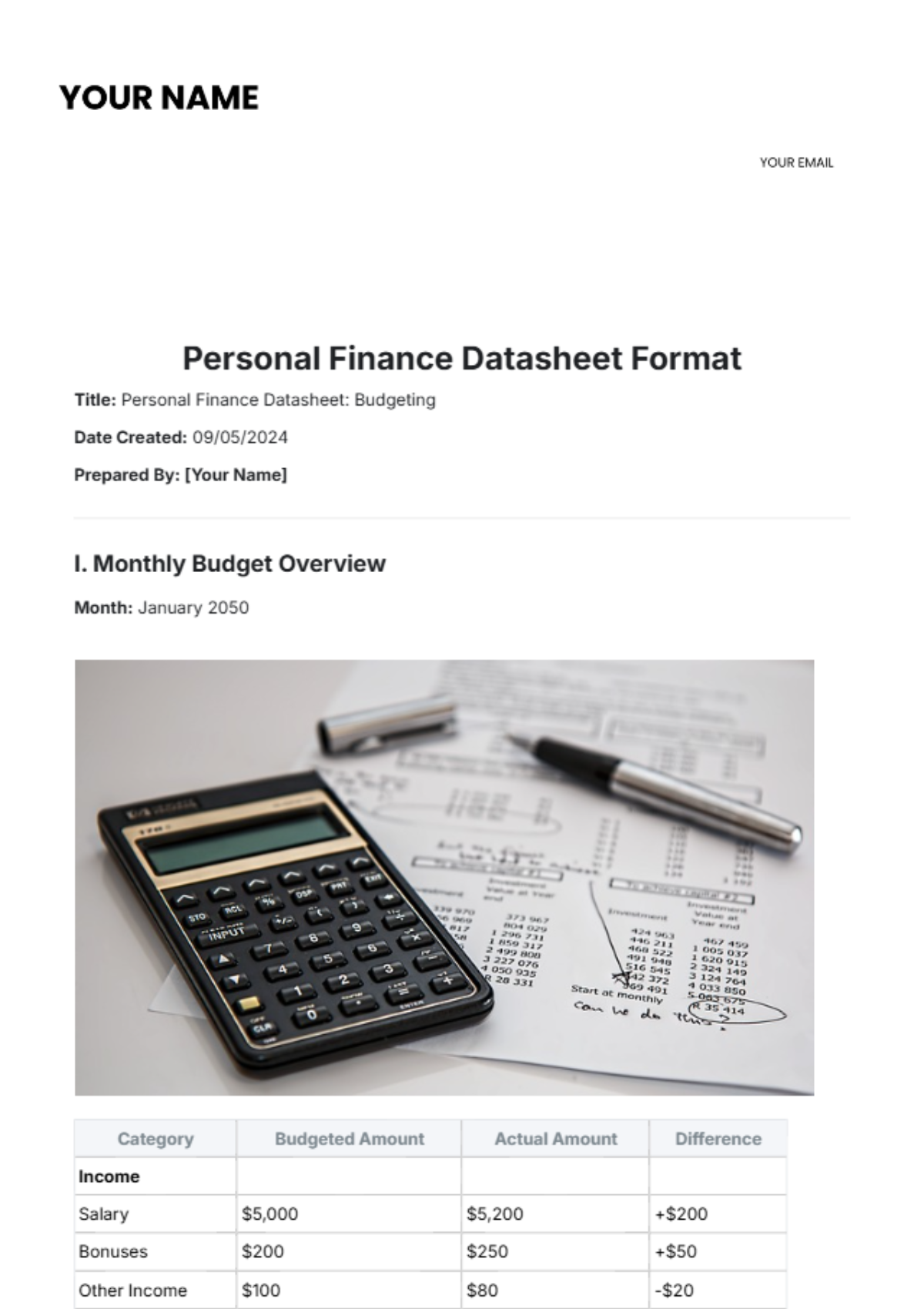

I. Monthly Budget Overview

In this section, select a month and document planned income and expenses by category. Track the budgeted amount, actual amount, and difference for each item (income and expenses) to monitor if spending aligns with goals and if adjustments are needed.

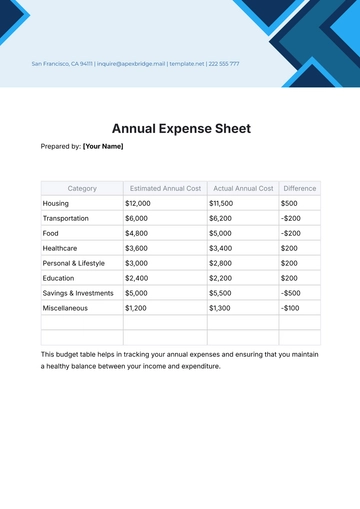

II. Yearly Budget Overview

Set up your yearly financial plan here by defining annual income sources and expense categories. List the budgeted amount and actual amount for each category to monitor annual progress, then calculate the difference to identify overall budget alignment.

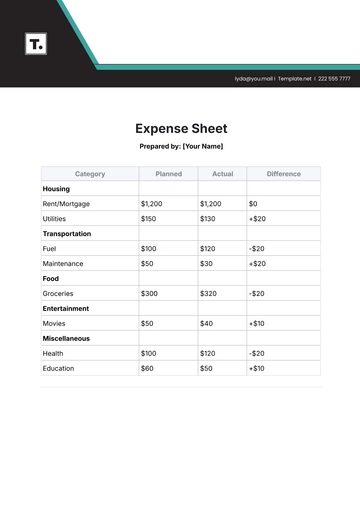

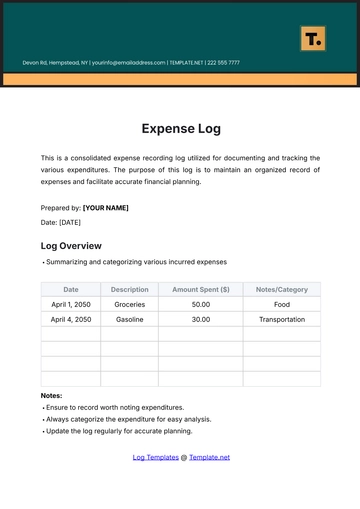

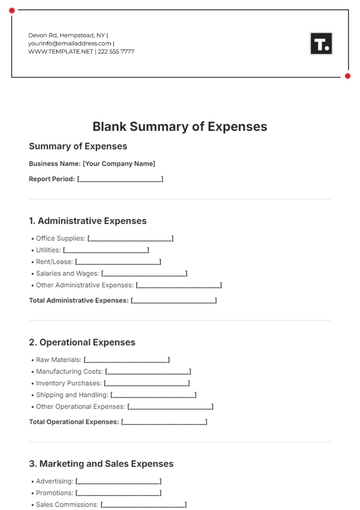

III. Expense Categories Breakdown

Use this section to describe each expense category and set both a monthly and yearly budget for each. Ensure each description covers what is included in the category (e.g., rent, utilities, groceries), helping you set realistic targets and stay organized.

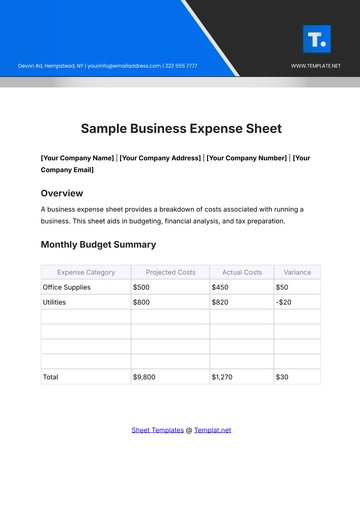

IV. Budget Summary

Summarize income, expenses, and net income for each month and for the year to understand financial performance at a glance. This section helps you evaluate how well you’re staying within your budget over time and spot trends that may require adjustments.

V. Budget Variance Analysis

Each month, use this section to compare your budgeted and actual income and expenses. This monthly check will highlight areas where your budget plan and actual spending diverge, helping you make timely adjustments.

VI. Notes and Observations

Document any observations about spending patterns, such as overspending or savings in particular categories. Use this section to record insights that can help refine your budgeting strategies for future months.

VII. Action Plan for Adjustments

Create actionable steps to address any variances noted. Identify the category, describe the issue, and specify actions to better control spending or enhance savings, like adjusting grocery shopping habits if that category shows over budget.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Transform your financial management with the Personal Finance Datasheet Format Template from Template.net. This editable and customizable tool allows for seamless tracking of income, expenses, and budgets. Featuring an AI Editable Tool for enhanced convenience, it ensures that all your financial data is organized efficiently. Perfect for personal use or professional financial planning.

You may also like

- Attendance Sheet

- Work Sheet

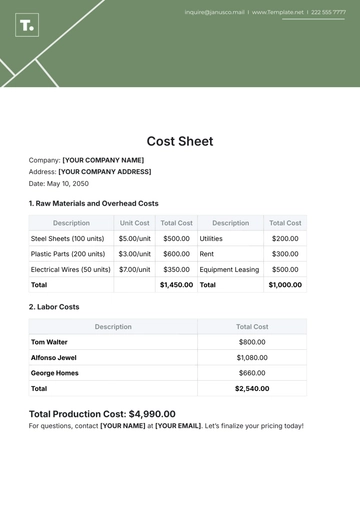

- Sheet Cost

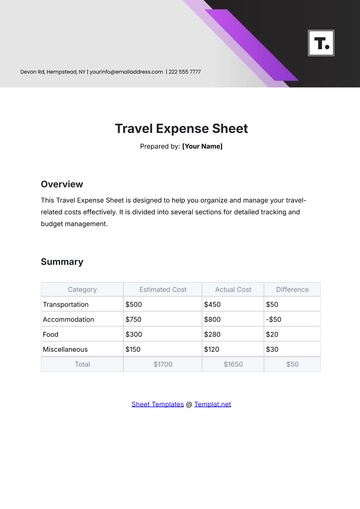

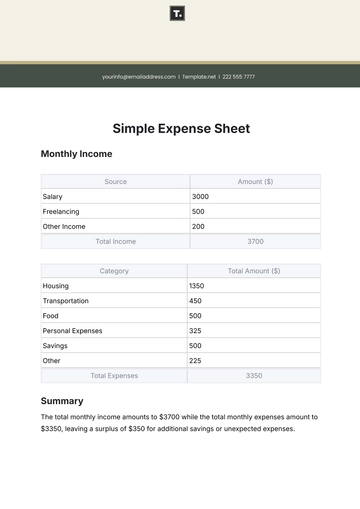

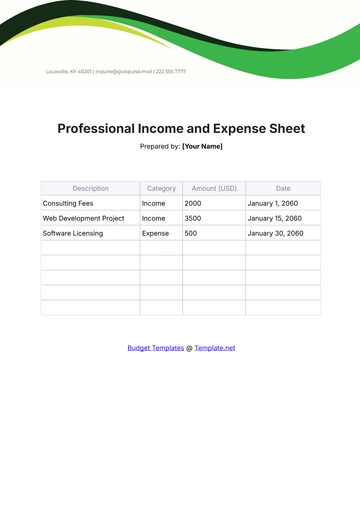

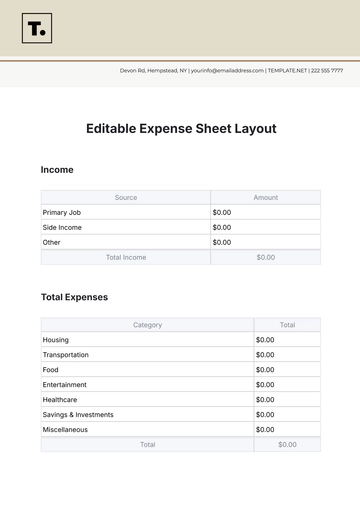

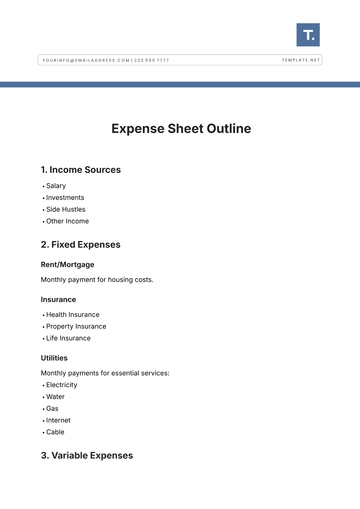

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet